AUDUSD, “Australian Dollar vs US Dollar”

In the H4 chart, AUDUSD is trading below the 200-day Moving Average, thus indicating a descending tendency. In this case, the price is expected to break 1/8 and then fall to reach the support at 0/8. However, this scenario may no longer be valid if the price breaks 2/8 to the upside. After that, the instrument may grow towards 3/8.

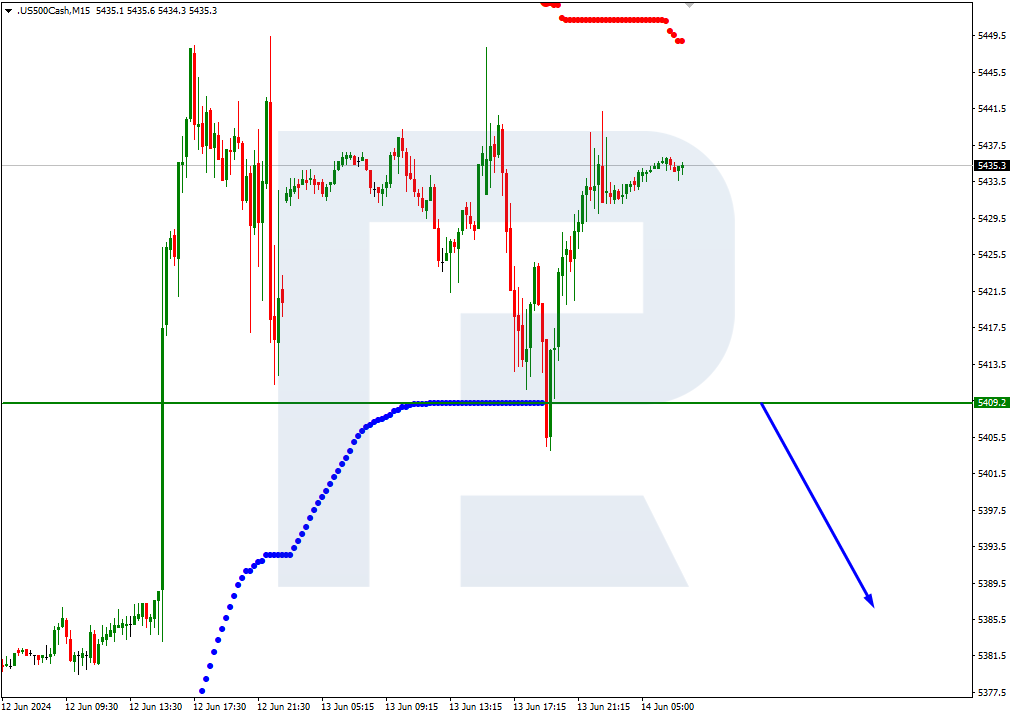

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue trading downwards.

NZDUSD, “New Zealand Dollar vs US Dollar”

As we can see in the H4 chart, NZDUSD is trading within the “oversold area”. In this case, the price is expected to break 0/8 and then continue growing to reach the resistance at 1/8. However, this scenario may no longer be valid if the price breaks -1/8 to the downside. In this case, the instrument may fall towards -2/8.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue its growth.