NZDUSD analysis: the market demonstrates risk appetite

The NZDUSD pair continues to rise for the third consecutive day, driven by a weaker US dollar and positive risk sentiment. Below is our detailed NZDUSD forecast and analysis for 20 September 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair is developing an upward trajectory

- Investors expect the Reserve Bank of New Zealand (RBNZ) to make another rate cut in October

- NZDUSD forecast for 20 September 2024: 0.6288 and 0.6299

Fundamental analysis

As of Friday, the NZDUSD pair strengthened to 0.6242, reflecting positive movement for the New Zealand dollar. The US Dollar's relative weakness has underpinned the outlook for the NZDUSD. Over the week, the New Zealand Dollar strengthened by 1.3%, a notable shift as the US Federal Reserve began its first rate cut cycle in four years, starting with a 50-basis point cut. The decision signals confidence in curbing inflation, further putting pressure on the US currency.

Economic data showed that New Zealand's economy contracted by 0.2% in Q2 2024, slightly better than the 0.4% decline expected. However, a 0.5% year-on-year drop maintains the possibility of a recession. The RBNZ has already started to cut rates, and the market expects another 25bp cut in October with a 41% probability. Given these factors, the forecast for NZDUSD remains cautiously optimistic.

NZDUSD technical analysis

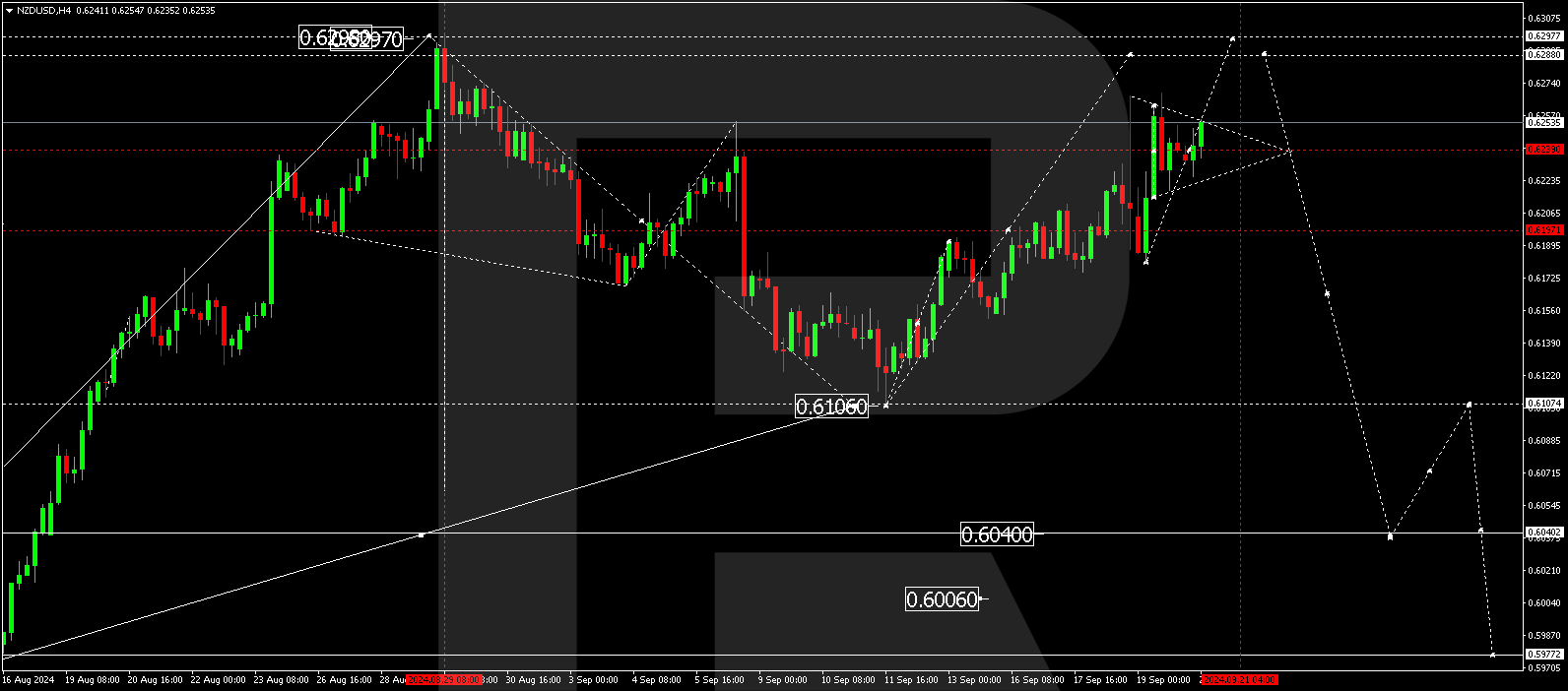

From a technical perspective, the NZDUSD pair is forming a consolidation range around the 0.6239 level on the H4 chart. Today's outlook for NZDUSD suggests the potential for an upside extension towards the 0.6262 level. A break above this range will likely signal further upside with targets at 0.6288 and 0.6299.

Conversely, if the NZDUSD fails to hold at 0.6239 and breaks below, the downside potential to 0.6200 will open up. A drop below 0.6200 could trigger a deepening bearish trend with the next target at 0.6106, offering traders critical levels to watch for possible reversal signals.

Summary

The NZDUSD pair continues steadily climbing as investors show growing interest in risk. Technical indicators suggest the likelihood of continued upward momentum, making today's NZDUSD forecast bullish. Potential targets are 0.6288 and 0.6299. Traders should monitor the key levels, as a breakout or reversal could provide significant near-term trading signals.