Despite a reduction in NZD speculative net positions, the NZDUSD pair continues to strengthen. The New Zealand dollar is gaining against the US dollar. Find out more in our analysis for today, 9 August 2024.

NZDUSD trading key points

- CFTC Gold speculative net positions: previously at 246.6 thousand

- CFTC NZD speculative net positions: previously at -11.4 thousand

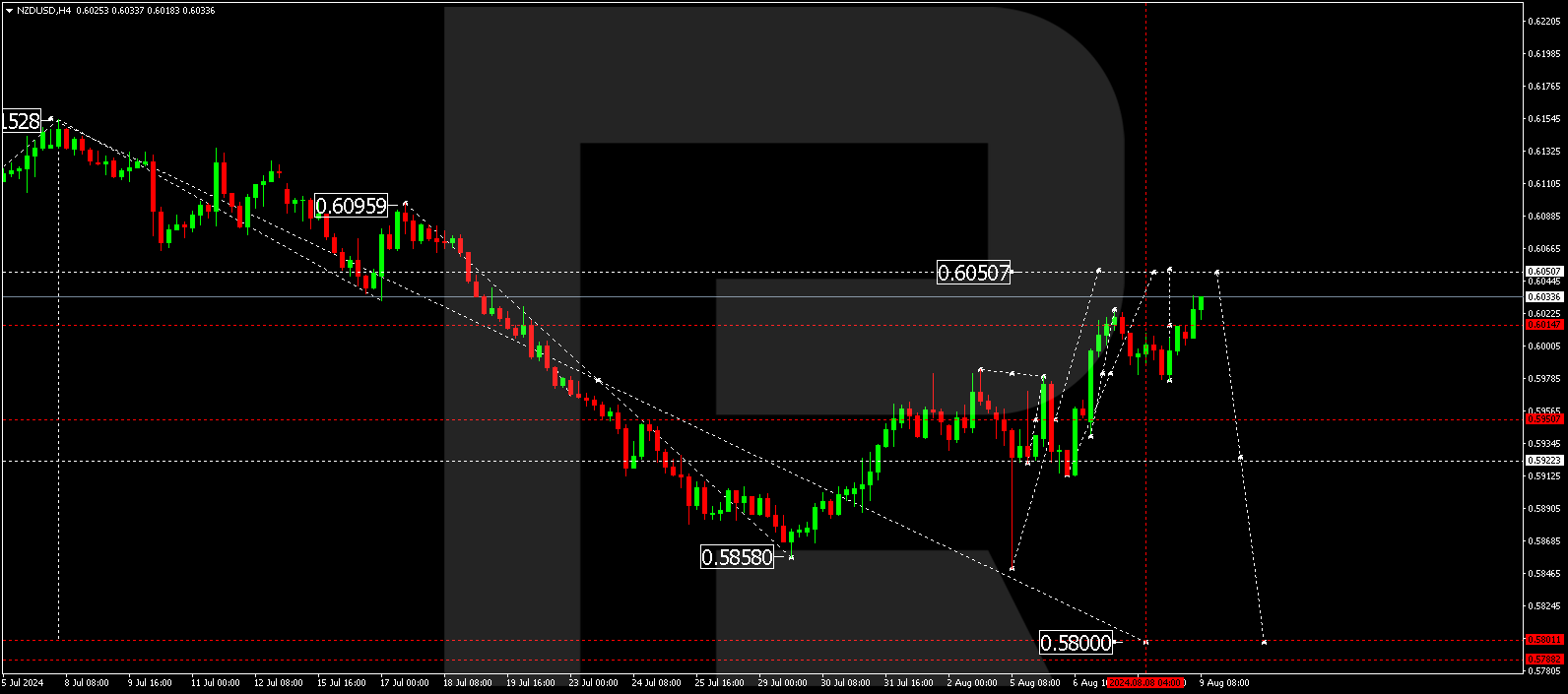

- NZDUSD forecast for 9 August 2024: 0.6050 and 0.5800

Fundamental analysis

The Commodity Futures Trading Commission (CFTC) weekly report analyses non-commercial traders’ (speculators’) speculative positions in the US futures markets. The information is presented as the difference between traders’ long and short positions on Chicago’s and New York’s futures platforms. The CFTC report is published every Friday at 3:30 pm EST and covers data up to the previous Tuesday.

According to recent data, the number of speculative long positions in the New Zealand dollar has decreased for two consecutive weeks, suggesting that bearish sentiment dominates the market.

Although CFTC Gold’s speculative net positions decreased according to the previous report, long positions continue to increase overall.

Fundamental analysis for 9 August 2024 suggests that the NZDUSD rate may continue its short-term growth before correcting.

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market has formed a consolidation range around 0.5950. The price broke above this range today, 9 August 2024. A growth wave is expected to continue towards 0.6050. This upward movement is considered a correction of the previous downward trend. Once the correction is complete, a new downward phase could begin, aiming for 0.5800.

Summary

Limited fundamental data, combined with the NZDUSD technical analysis in today’s NZDUSD forecast, suggests that the pair may continue to correct towards 0.6050. After testing this level, a downward movement could start, targeting 0.5800.