NZDUSD is under pressure: the market awaits US employment data

The NZDUSD rate is declining, with sellers poised to test the 0.5845 support level. More details in our analysis for 6 December 2024.

NZDUSD forecast: key trading points

- The markets await the US employment report, which could shape the Federal Reserve’s further actions

- The likelihood of a 25-basis-point interest rate reduction by the US regulator has increased to 71.8%

- The US employment forecast for November suggests gains of 200 thousand jobs

- NZDUSD forecast for 6 December 2024: 0.5898

Fundamental analysis

The NZDUSD rate is falling on Friday, remaining within a sideways range. The markets await the US employment report, which may provide insight into further Federal Reserve actions. The likelihood of a 25-basis-point Fed interest rate cut has risen to 71.8%, up from 66.5% a week ago.

Meanwhile, the NZDUSD rate remains under pressure as the Reserve Bank of New Zealand has already lowered the cash rate by 125 basis points to 4.25% this year. An additional 50-basis-point reduction is expected at a meeting in February 2025.

Expectations for US nonfarm employment suggest gains of 200 thousand jobs in November. Weaker data could increase the chance of a Federal Reserve rate cut, which, according to today’s NZDUSD forecast, may temporarily support the New Zealand dollar, pushing the pair away from the current lows. On Thursday, the statistics showed an increase in initial jobless claims to 224 thousand, which is above forecasts and indicates a weaker US labour market.

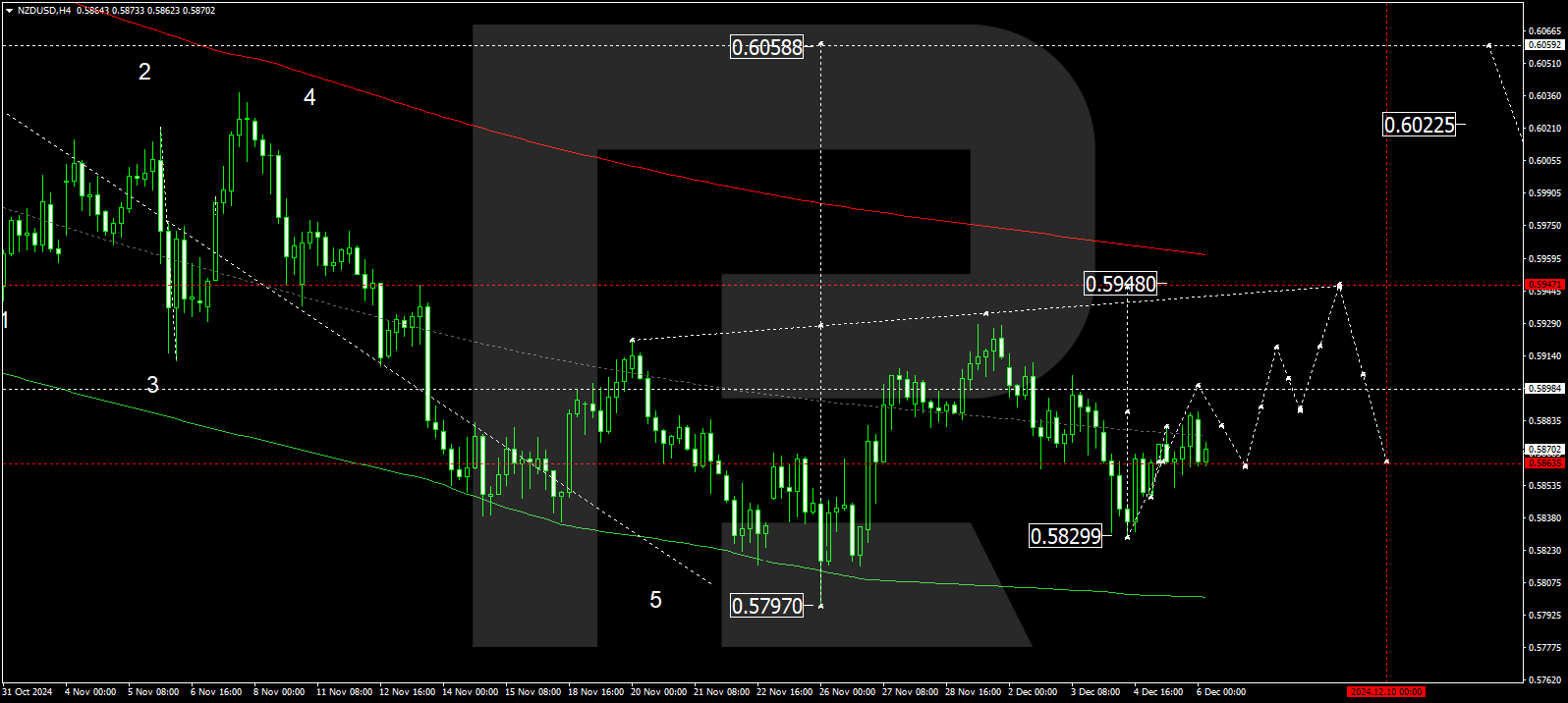

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market is forming a growth wave towards the local target of 0.5898. This level could be reached today, 6 December 2024, before a potential decline to 0.5860 (testing from above). Subsequently, a new growth wave may start, aiming for 0.5920 and potentially continuing the trend to 0.5948 as the first target.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.5860, support this scenario. The market is forming a consolidation range around this level, and a breakout is expected towards the upper boundary of a price envelope at 0.5948. A correction may follow, targeting its central line at 0.5860.

Summary

The NZDUSD rate remains under pressure amid expectations of a further Reserve Bank of New Zealand interest rate cut. However, if the US employment data turns out to be weak, this will temporarily support the currency pair. The technical indicators for today’s NZDUSD forecast suggest that the growth wave will likely continue towards the 0.5898 level.