The NZDUSD pair remains in a strong position. The market continues to disfavour the US dollar. Find out more in our analysis dated 23 August 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair is rising for the fourth consecutive week

- Investors anticipate RBNZ interest rate cuts in October and November

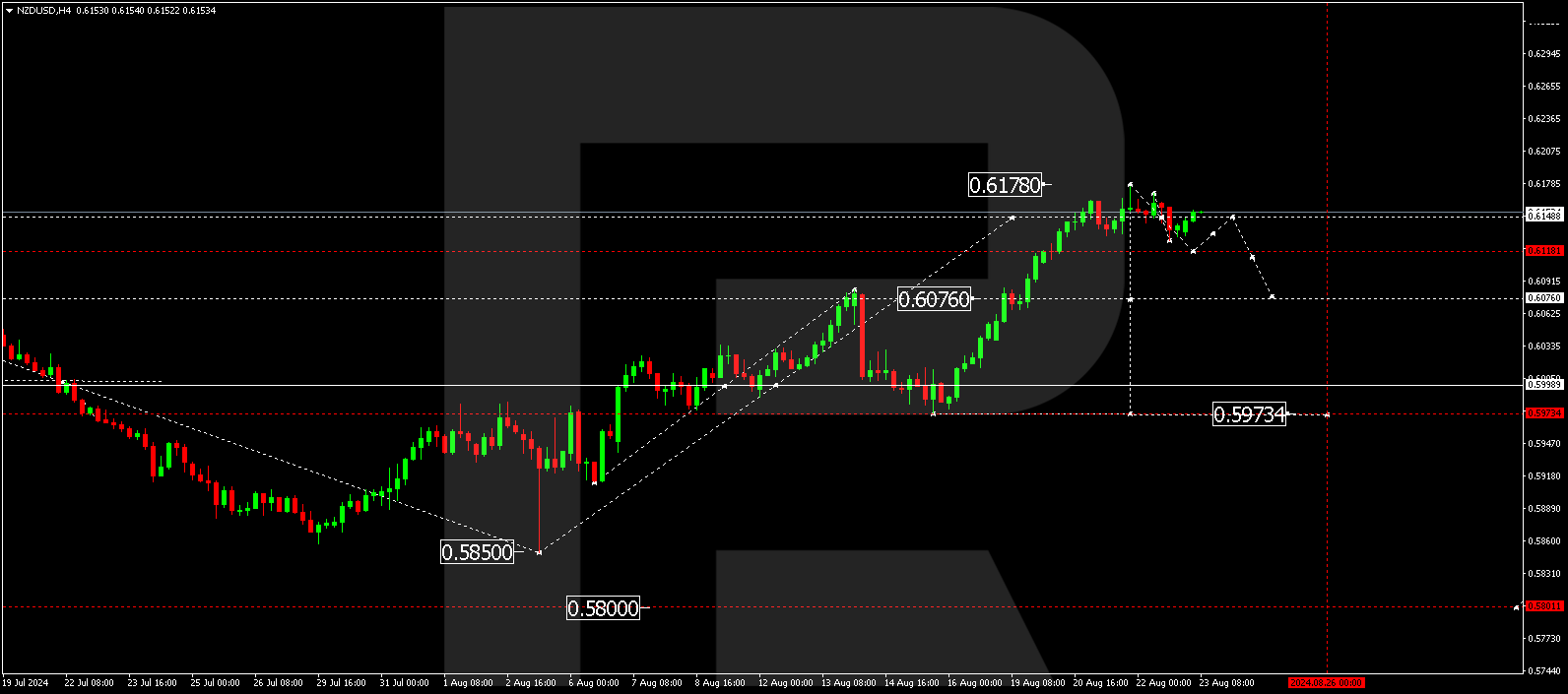

- NZDUSD forecast for 23 August 2024: 0.6076 and 0.5973

Fundamental analysis

The NZDUSD rate rose to 0.6152 on Friday. After brief pauses, the instrument continues to increase amid the US currency’s weakness.

The US dollar remains under intense market pressure ahead of today’s speech by Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium. Powell is expected to clarify the regulator’s future actions and announce an interest rate cut in September.

The Reserve Bank of New Zealand has already begun an easing cycle, reducing the official cash rate this month and signalling further cuts. Investors have already factored in the likelihood of a 25-basis-point interest rate cut after the October and November meetings.

Q2 retail sales in New Zealand fell by 1.2% from the start of the year, exceeding market expectations.

Nevertheless, the NZD continues its ascent. The NZDUSD forecast indicates the pair may close the fourth consecutive week with gains.

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market has formed a growth wave towards 0.6178. The price is expected to decline to 0.6118 before rising to 0.6150 today, 23 August 2024. The market will practically define the boundaries of a consolidation range. A breakout below this range could lead to a downward wave towards 0.6076, with a potential extension to 0.5973.

Summary

The NZDUSD pair continues to rise against the backdrop of a weak US dollar. According to technical indicators, the growth wave appears fully formed and completed. In today’s NZDUSD forecast, it will be relevant to consider the potential for a downward wave towards the 0.6076 and 0.5973 levels.