NZDUSD: rising expectations of an aggressive Fed interest rate cut drive growth in the pair

The NZDUSD rate is correcting after rising by 0.9% yesterday, with buyers attempting to gain a foothold above the resistance level. Find out more in our analysis for 13 September 2024.

NZDUSD forecast: key trading points

- Annual inflation in New Zealand eases to 0.4% as fruit and vegetable prices fall by 12.2%

- BusinessNZ PMI increased to 45.8 points from the revised 44.4, but the sector remains in recession for the 18th consecutive month

- Electronic card transactions in New Zealand rose by 0.2% in August from July, reaching 6.382 billion NZD

- NZDUSD forecast for 13 September 2024: 0.6130 and 0.6060

Fundamental analysis

The NZDUSD rate continues to test the 0.6180 level on Friday. The US dollar remains under pressure amid investors’ expectations regarding the upcoming Federal Reserve meeting. The likelihood of an aggressive 50-basis-point Fed interest rate cut increased to 47% from only 13% yesterday. At the same time, the odds of a 25-basis-point interest rate cut reduced to 57% from the previous 87%. Growing expectations for a significant tightening of the Federal Reserve monetary policy support the current rise in the pair as part of the NZDUSD forecast for today.

New Zealand’s domestic market expects the Reserve Bank of New Zealand to lower interest rates at the two remaining meetings this year. There is a possibility that one of the decisions could be more significant, with a 50-basis-point cut.

Meanwhile, annual food inflation in New Zealand eased to 0.4% from 0.6% a month ago primarily due to a 12.2% year-over-year fall in fruit and vegetable prices, while food prices overall continue to rise. At the same time, the manufacturing sector remains in recession, although the BusinessNZ PMI increased to 45.8 points from the revised July reading of 44.4, indicating an 18-month continued decline. Electronic card transactions in New Zealand increased by 0.2% in August from July, reaching 6.382 billion NZD.

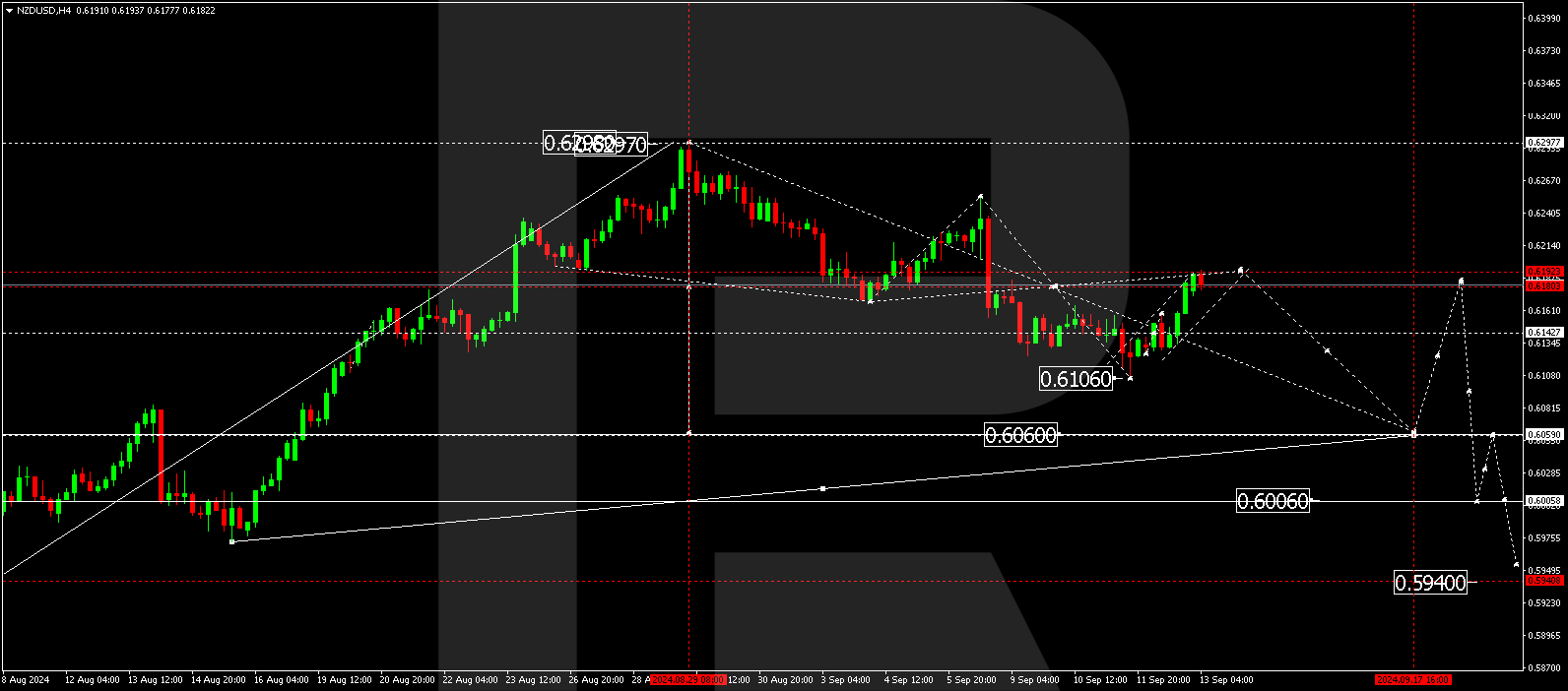

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market has formed a consolidation range around 0.6140 and broken above its upper boundary. The pair has completed a growth wave, reaching 0.6193 (testing from below) today, 13 September 2024. The market has outlined a wide consolidation range around 0.6180. It will be relevant to consider the beginning of a new downward wave, targeting 0.6130. A breakout below this level will open the potential for a decline to 0.6060. Breaking below the 0.6130 level may be considered a signal for a continuation of the downtrend.

Summary

Despite easing inflation in New Zealand and ongoing recession in the country’s manufacturing sector, the NZDUSD rate is experiencing upward momentum amid growing expectations of an aggressive Federal Reserve interest rate cut. Technical indicators in today’s NZDUSD forecast suggest that the downtrend could begin, aiming for the 0.6130 and 0.6060 levels.