NZDUSD under pressure: consumer confidence in New Zealand decreases

The NZDUSD rate is declining within a descending channel, attempting to secure a position below the support level. Find out more in our analysis for 25 October 2024.

NZDUSD forecast: key trading points

- RBNZ Governor Adrian Orr confirmed that the low inflation target is attainable, adding to arguments for an interest rate cut in November

- New Zealand’s Consumer Confidence Index fell from 95.1 in September to 91.2 in October

- NZDUSD forecast for 25 October 2024: 0.5984 and 0.6052

Fundamental analysis

The NZDUSD rate declined to 0.5987 on Friday, marking its fourth consecutive week of losses. The pressure on the New Zealand dollar is mounting amid rising expectations of a moderate Federal Reserve rate cut and uncertainty about the upcoming US presidential election.

Domestically, Reserve Bank of New Zealand Governor Adrian Orr noted that attaining low and stable inflation has become a realistic target. This adds to arguments supporting another substantial RBNZ rate cut in November. The markets have already priced in a 50-basis-point cut and are also assessing the likelihood of a 75-basis-point reduction. As part of today’s NZDUSD forecast, these factors exert pressure on the currency pair.

The significant economic news from New Zealand includes a decrease in consumer confidence in October after three consecutive months of growth. The ANZ-Roy Morgan Consumer Confidence Index fell to 91.2 points in October from 95.1 in September, indicating the end of the recovery period. Employment figures remain extremely weak, with 22% of respondents reporting a weaker financial position than last year and only 14% expecting improvements next year. This is significantly lower than the September indicator of 25%.

NZDUSD technical analysis

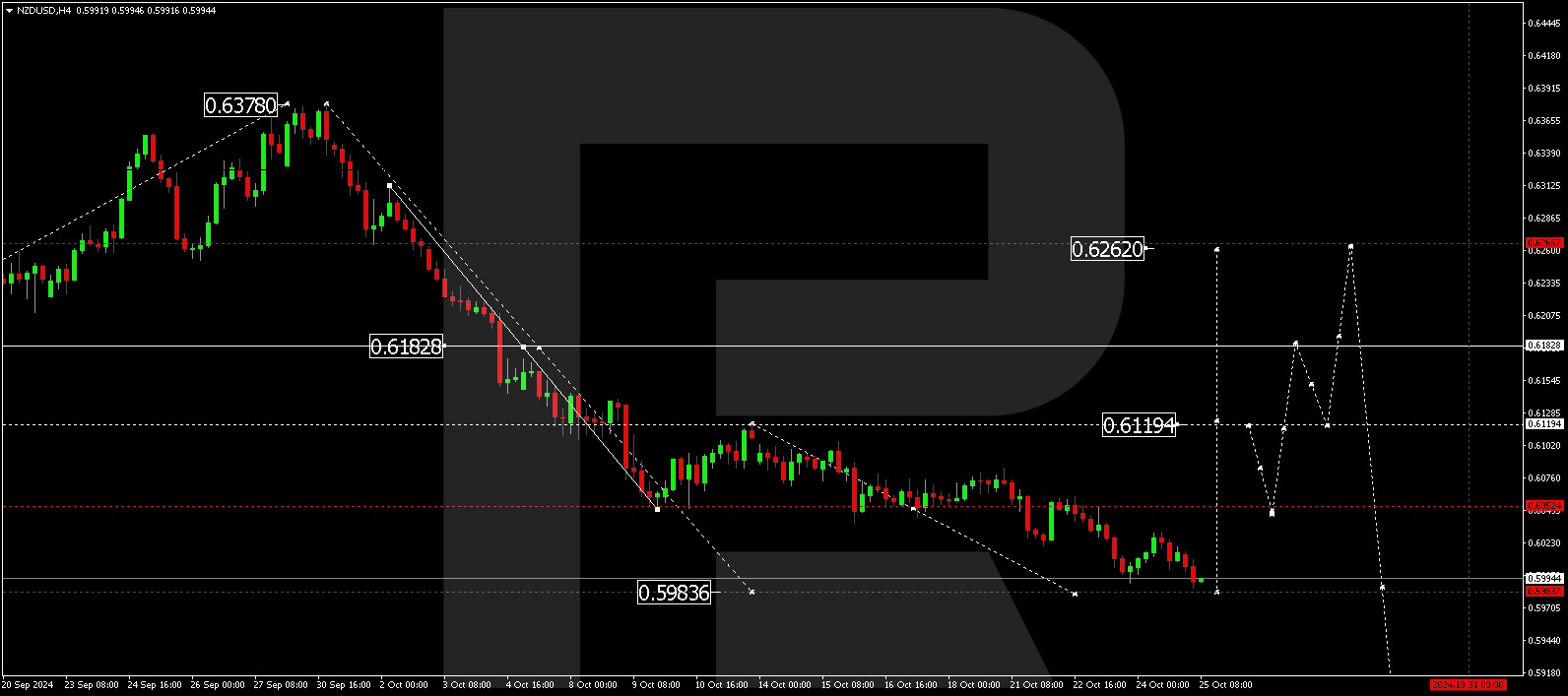

The NZDUSD H4 chart shows that the market continues its downward trajectory towards 0.5984. Today, 25 October 2024, it is worth considering the possibility that the price could reach this target level before a growth wave begins, aiming for 0.6052. Once the price hits this level, the NZDUSD rate could fall to 0.6020 (testing from above). Subsequently, a new growth wave is expected to develop, aiming for 0.6119 as the first target.

Summary

The NZDUSD rate continues to decline amid expectations of Federal Reserve policy easing and uncertainty around the US election. The decrease in consumer confidence and the weak employment market in New Zealand exert additional pressure on the New Zealand dollar. Technical indicators in today’s NZDUSD forecast suggest that the wave could continue towards 0.5984, followed by growth to 0.6052.