A drop in US crude oil inventories may trigger a rise in Brent prices towards 66.50 USD. Find out more in our analysis for 3 June 2025.

Brent forecast: key trading points

- Brent crude oil is forming a correction

- Weekly US crude oil stockpiles (API): previously at -4.236 million barrels

- Brent forecast for 3 June 2025: 63.50 and 66.50

Fundamental analysis

Fundamental analysis of Brent for today, 3 June 2025, takes into account that oil prices are moderately rising, reaching 65.00 USD per barrel. Key support factors include the weakening US dollar and geopolitical risks, such as tensions around Iran and supply disruptions from Canada due to wildfires.

Although OPEC+ decided to maintain the July output increase at 411,000 barrels per day, below market expectations, Brent quotes hit the 65.00 USD resistance level and are now entering a correction.

According to the American Petroleum Institute (API), US crude oil inventories fell by 4.236 million barrels last week. A further drop in stocks in the current reporting period could propel Brent prices towards 66.50 USD.

Brent technical analysis

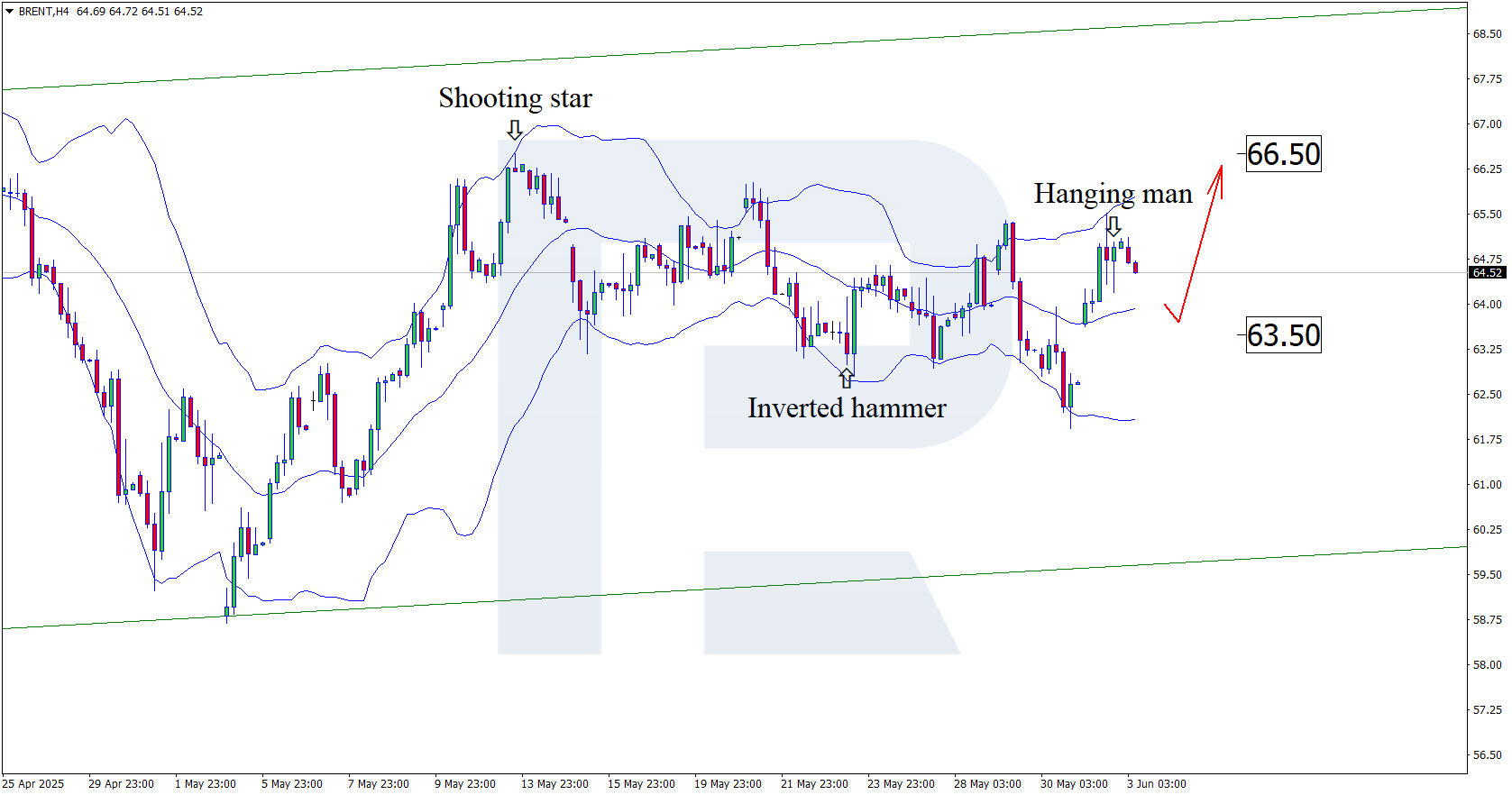

Having tested the upper Bollinger Band, Brent quotes formed a Hanging Man reversal pattern on the H4 chart. The market may now continue a corrective wave, following a signal from the pattern.

The Brent price forecast for 3 June 2025 suggests a corrective move to 63.50 USD. If the price bounces from the support level, it could open the way for a more substantial upward wave.

However, an alternative scenario suggests Brent pieces may continue their ascent towards 66.50 USD without testing the support level.

Summary

Today’s Brent forecast for 3 June points to a possible corrective move down to 63.50 USD, followed by continued upward momentum.