The outlook for Brent appears bullish, with prices gaining momentum amid US dollar weakness and likely to reach the 67.70 USD resistance level. Find more details in our analysis for 17 April 2025.

Brent forecast: key trading points

- Brent crude oil continues its upward move

- Philadelphia Fed Manufacturing Index (US): previously at 12.5, projected at 2.2

- Brent forecast for 17 April 2025: 67.70 USD

Fundamental analysis

Today’s fundamental analysis for Brent takes into account that prices are rising steadily, trading near 66.85 USD per barrel, its highest level since the start of the month.

The recent rally is driven by new US sanctions targeting Iran’s oil exports, including penalties on a Chinese refinery. Prices are also supported by additional voluntary oil output cuts announced by some OPEC members, such as Iraq and Kazakhstan.

According to the forecast for 17 April 2025, the Philadelphia Fed Manufacturing Index is expected to drop sharply to 2.2 from the previous 12.5. Such a decline would signal weakening US industrial activity, likely weighing on the US dollar.

Brent technical analysis

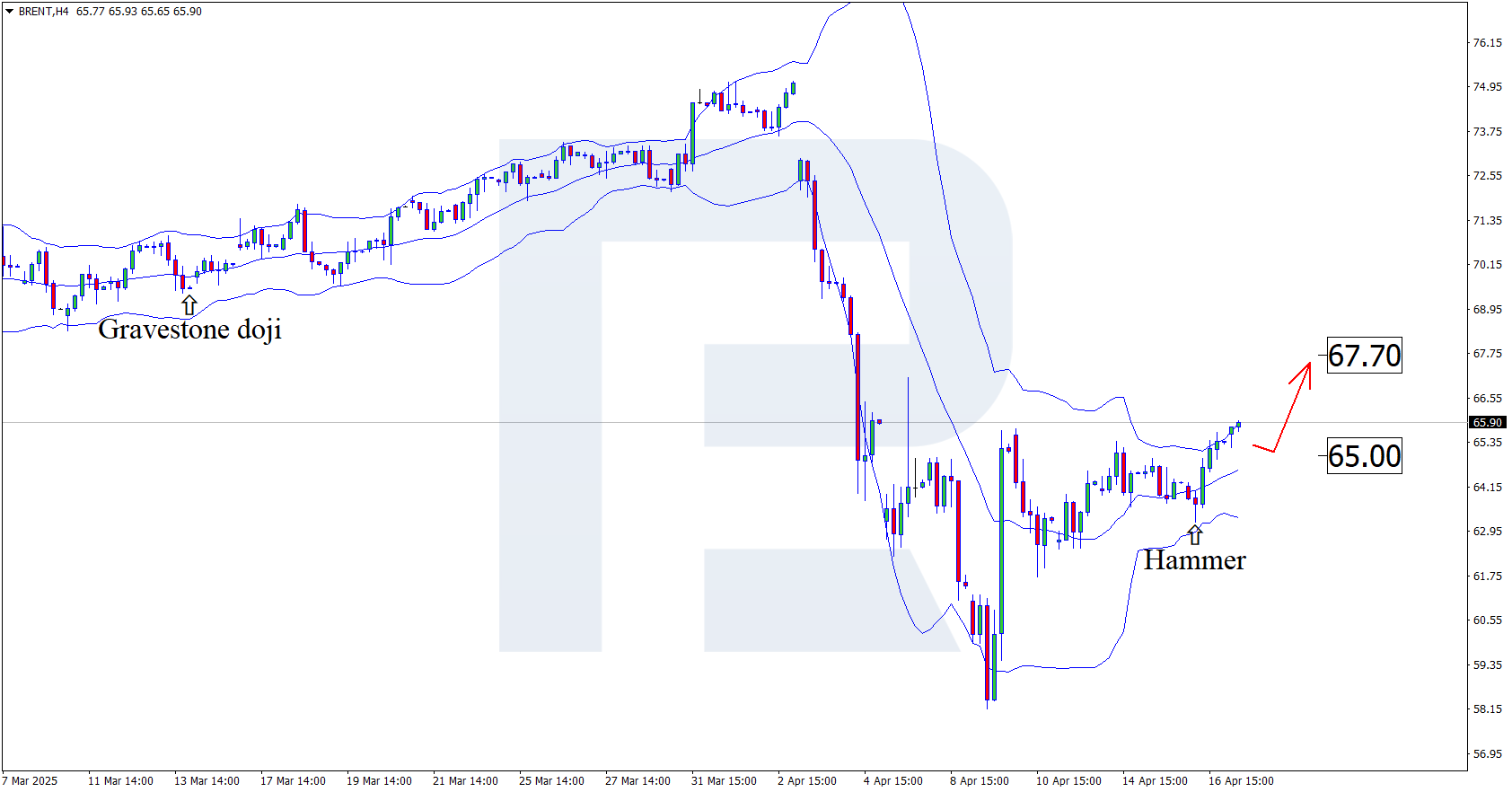

Having tested the lower Bollinger band, Brent prices formed a Hammer reversal pattern on the H4 chart. Quotes currently continue their upward momentum following the pattern signal.

Brent forecast for 17 April 2025 suggests that the upside target could be the next resistance level at 67.70 USD. A breakout above this level would reinforce bullish sentiment and potentially extend the rally.

However, an alternative scenario would see Brent correcting to the 65.00 USD support level before resuming upward movement.

Summary

Brent price forecast takes into account output cuts by some OPEC members. Combined with technical analysis, it supports an upward move towards the 67.70 USD resistance level.