PepsiCo, Inc. stock forecast: buyback may support the company’s stock

PepsiCo, Inc.’s (NYSE: PEP) Q4 2024 report showed a decline in sales in its North American Frito-Lay and Quaker Foods divisions, with the latter affected by product recalls due to salmonella. The company’s management also highlighted a shift in consumer demand towards healthier eating. Following the report’s release, PepsiCo’s stock fell, reflecting investor concerns over the shortfall in revenue and changing consumer preferences.

This article examines PepsiCo, Inc.’s business, detailing its income sources, presenting its quarterly reports, and providing a fundamental analysis of PEP. Expert forecasts for PepsiCo’s stock in 2025 are also provided, alongside an analysis of PepsiCo’s stock performance, which serves as the basis for the PepsiCo 2025 stock forecast.

About PepsiCo, Inc.

PepsiCo, Inc. is an American multinational corporation that produces and sells food, soft drinks, and snacks. Its portfolio includes well-known brands such as Cheetos, Gatorade, Lay’s, Mountain Dew, Pepsi, Quaker, and Tropicana. The company was founded in 1965 by merging Thе Pepsi-Сola Company and Frito-Lay. On 13 November 1972, PepsiCo, Inc. went public on the NYSE, and its shares have since traded under the PEP ticker symbol.

PepsiCo, Inc.’s main revenue streams

PepsiCo divides its operations into three major segments and publishes information on each separately in its quarterly reports. Below are the segments in which the company operates:

- Frito-Lay: this segment focuses on producing and selling a variety of snacks. The range includes products from many well-known brands, such as Cheetos, Doritos, Lay’s, Ruffles, and Tostitos. These high-margin products support PepsiCo’s leading position in the US salty snack market

- Quaker Foods: this includes Quaker products, one of the pioneering brands in PepsiCo’s portfolio, which specialises in healthy eating. Quaker offers cereal bars, cereals, muesli, oatmeal, and other products. This sector focuses on breakfast and healthy eating products

- PepsiCo Beverages: this segment represents the entire range of PepsiCo’s drinks, including soft drinks (Mountain Dew, Pepsi), sports and energy drinks (Gatorade), purified drinking water (Aquafina), tea, and juices (Lipton, Tropicana). Drinks are the company’s core business and generate the majority of revenue

In its reports, PepsiCo provides detailed information for each segment only in North America, while revenues from other regions are presented as a consolidated total. PepsiCo’s business model demonstrates that it operates across three markets simultaneously, enabling it to diversify its revenues.

PepsiCo, Inc. Q3 2024 report

On 8 October, PepsiCo reported its financial results for Q3 2024. Below are the key figures from the report:

- Revenue: 23.32 billion USD (-0.6%)

- Net income: 2.93 billion USD (-5.0%)

- Earnings per Share: 2.13 USD (-4.9%)

- Operating profit: 3.87 billion USD (-3.6%)

Revenue by segment:

- Frito-Lay North America: 5.89 billion USD (-1.2%)

- PepsiCo Beverages North America: 7.17 billion USD (+0.1%)

- Quaker Foods North America: 648.00 million USD (-13.2%)

Revenue by region:

- Latin America: 2.91 billion USD (-4.6%)

- Europe: 3.94 billion USD (+6.4%)

- Africa, Middle East, and East Asia: 1.55 billion USD (-6.2%)

- Asia-Pacific: 1.19 billion USD (-1.4%)

PepsiCo’s management noted that the company demonstrates resilience despite challenging conditions. The crucial issues in Q3 were the recall of Quaker products over potential Salmonella contamination and geopolitical tensions in some international markets.

CEO Ramon Laguarta emphasised that the company has remained profitable thanks to strict cost control and continued investment in its competitiveness. However, in light of these challenges, PepsiCo has revised its Q4 and full-year 2024 revenue outlook. Revenue growth is now expected to fall below the previous projection of 4%, while the forecast for EPS growth remains at a minimum of 8%. Nonetheless, PepsiCo retains a positive outlook for the full year 2024.

Although its financial performance declined year-on-year, its stock price rose following the earnings release.

PepsiCo, Inc. Q4 2024 report

On 3 February 2025, PepsiCo released its Q4 2024 report. Its key financial highlights are outlined below:

- Revenue: 27.78 billion USD (-0.2%)

- Net income: 1.52 billion USD (+15.4%)

- Earnings per share: 1.11 USD (+18.1%)

- Operating profit: 2.25 billion USD (+33.7%)

Revenue by segment:

- Frito-Lay North America: 7.31 billion USD (-2.1%)

- PepsiCo Beverages North America: 7.91 billion USD (-2.1%)

- Quaker Foods North America: 874.00 million USD (-0.1%)

Revenue by region:

- Latin America: 3.69 billion USD (-6.9%)

- Europe: 4.47 billion USD (+6.2%)

- Africa, Middle East, and East Asia: 2.03 billion USD (+4.9%)

- Asia-Pacific: 1.48 billion USD (+2.1%)

In its commentary on the report, PepsiCo’s management highlighted the company’s current challenges and outlined its future plans. One of the key factors affecting financial performance was a shift in consumer preferences, particularly in North America. Declining demand for salty snacks and beverages impacted revenue in these segments. However, management emphasised that the company is actively adapting its products to evolving trends, including the growing interest in healthier food. In this context, they underscored PepsiCo’s success in launching products such as Pepsi Zero Sugar and SunChips, which cater to changing consumer preferences.

The 2025 forecast projects low-single-digit growth in organic revenue and a mid-single-digit increase in adjusted EPS. Despite the current challenges, this reflects moderate optimism regarding the company’s continued expansion. The company also announced a 5% dividend increase and a share buyback program, with a total budget of approximately 8.6 billion USD.

Additionally, PepsiCo reiterated its commitment to innovations, product diversification, and marketing initiatives to sustain future growth. Management expressed confidence that these measures would drive improved performance in North America throughout the year.

Expert forecasts for PepsiCo, Inc. stock for 2025

- Barchart: 10 of 20 analysts rated PepsiCo stock as a Strong Buy, nine as Hold, and one as Strong Sell. The target price for the upside is 185 USD, and for the downside is 148 USD

- MarketBeat: eight out of 20 specialists assigned a Buy rating to the stock, 11 recommended Hold, and 1 Sell. The target price for the upside is 200 USD, and for the downside is 150 USD

- TipRanks: Nine out of 16 surveyed gave the stock a Buy rating, and seven recommended Hold. The target price for the upside is 185 USD, and for the downside is 150 USD

- Stock Analysis: Five out of 16 experts assigned a Strong Buy rating to the stock, three as Buy, and eight as Hold. The target price for the upside is 200 USD, and for the downside is 150 USD

It is worth noting that the price of PepsiCo stock as of 11 February was 144 USD, meaning the downside targets predicted by the experts have already been reached. As a result, only the upside targets remain.

PepsiCo, Inc. stock price forecast for 2025

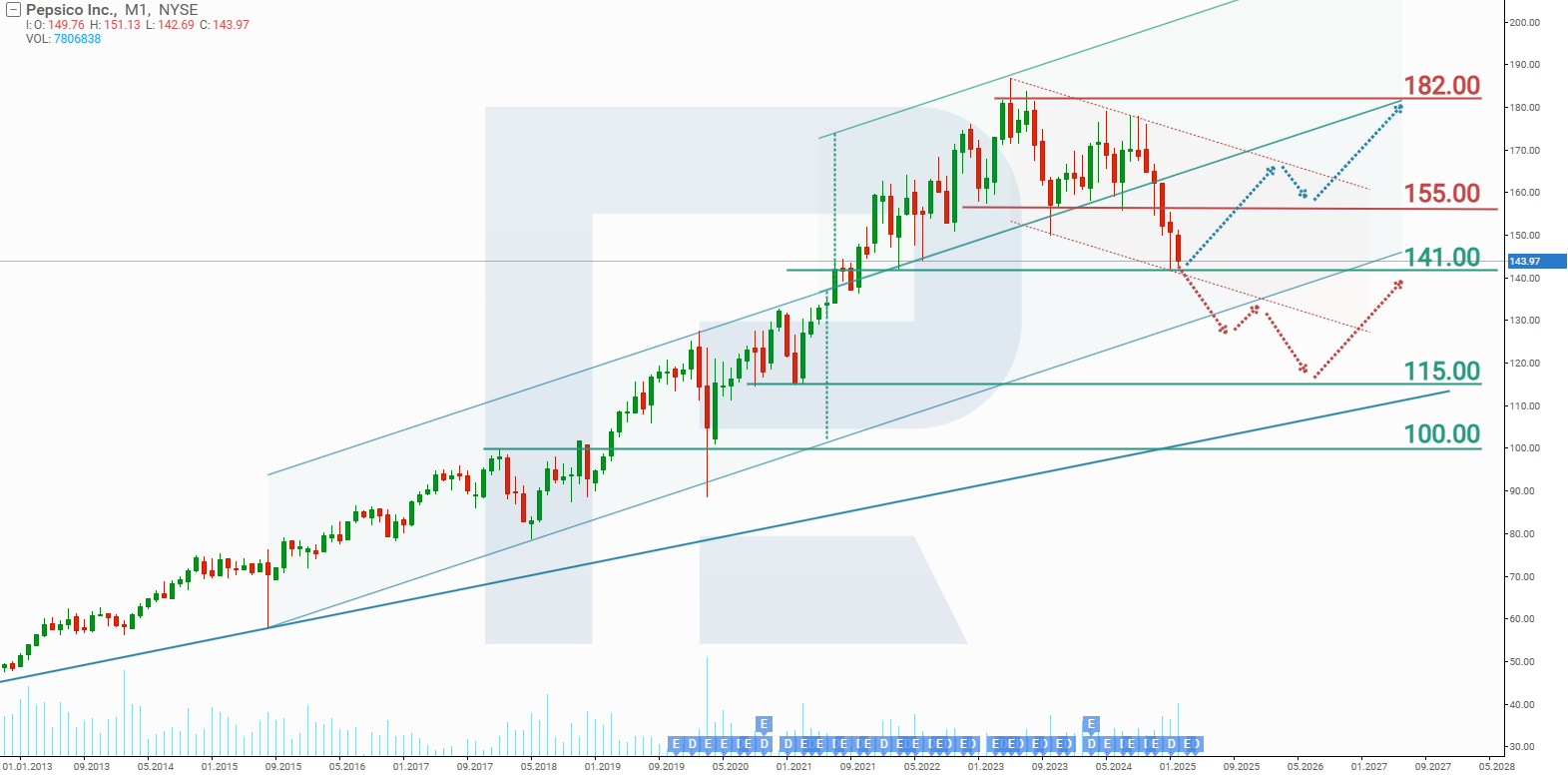

The salmonella incident with PepsiCo products negatively impacted the share price. Since October 2024, the stock has ended each month with losses, ultimately dropping by 15% to the 141 USD support level. Based on PepsiCo’s stock performance, possible price movements for 2025 are as follows.

The optimistic PepsiCo stock forecast suggests a rebound from the 141 USD support level, followed by growth towards an all-time high of 182 USD. This scenario is supported by an increase in dividends and a share buyback, creating more demand for the stock.

The negative PepsiCo stock forecast predicts a breakout below

the 141 USD support level, potentially pushing the share price down to the next support at 115 USD. A rebound from this level will indicate the beginning of another growth wave in PepsiCo’s share price.

PepsiCo, Inc. stock analysis and outlook for 2025Risks of investing in PepsiCo, Inc. stock

Investing in PepsiCo, Inc. stock carries several risks, outlined below:

- Declining consumer demand: there is a risk of reduced demand for key product categories, particularly in the Frito-Lay North America and Quaker Foods segments. Consumers are increasingly choosing healthier alternatives, which may negatively impact the sales of traditional snacks

- Inflationary pressure and rising costs: increasing prices for raw materials, transportation, and labour could reduce PepsiCo’s profitability. Despite efforts to raise prices and cut costs, further inflation could weaken consumers’ purchasing power and limit the company’s ability to pass on costs to buyers

- Currency fluctuations: most of the company’s revenue comes from international markets. Therefore, a stronger US dollar could reduce profitability when converting foreign income

- Regulatory and operational risks: major product recalls could result in significant financial losses and reputational damage. In Q4 2024, Quaker Foods faced a recall due to salmonella contamination. Such incidents could undermine consumer trust and increase costs

- Restructuring and automation risks: PepsiCo is closing four bottling plants in the US and is actively implementing automation, which requires significant investment. If these measures do not lead to the expected improvements in efficiency and cost reductions, they could pressure the company’s profitability

- Competitive pressure: PepsiCo faces tough competition from traditional rivals such as Coca-Cola (NYSE: KO) and new health-focused brands. The success of its portfolio expansion strategy with products like Pepsi Zero Sugar and SunChips is still uncertain

Summary

PepsiCo faces challenges such as shifts in consumer preferences towards healthier eating, geopolitical risks, and inflation, which will be harder to pass on to consumers as their interest may significantly decline. To navigate these upcoming difficulties, PepsiCo must actively drive innovation and develop new products by reducing sugar content and using natural ingredients. It is also essential to balance quality and price to remain competitive, which can be achieved through optimising production processes.

In its 2025 forecasts, PepsiCo’s management focuses on cost reduction and innovation, suggesting that the company is on the right track, with execution now being the key challenge. Investors initially reacted negatively to the report’s results on the day of publication, but the low established on 4 February has yet to be breached. This indicates that interest in the shares is returning as market participants continue to believe in the company’s strategy and expect it to meet its targets.