The AUDUSD rate is rising for the second consecutive day, with the price currently at 0.6331. Discover more in our analysis for 14 February 2025.

AUDUSD forecast: key trading points

- Consumer inflation expectations in Australia rose to 4.6% in February 2025

- Markets expect the RBA to lower the interest rate next week

- AUDUSD forecast for 14 February 2025: 0.6345 and 0.6385

Fundamental analysis

The AUDUSD rate approached the 0.6330 resistance level, with buying pressure persisting. The US dollar is losing ground after Donald Trump postponed reciprocal tariffs, reducing the risks of escalating global trade tensions.

Meanwhile, consumer inflation expectations in Australia rose to 4.6% in February 2025 from 4.0% a month earlier, marking the highest level in 10 months.

However, markets are still expecting the RBA to lower the interest rate next week, suggesting an overall easing of 75 basis points over the year. According to today’s AUDUSD forecast, such expectations may restrain the pair’s growth.

AUDUSD technical analysis

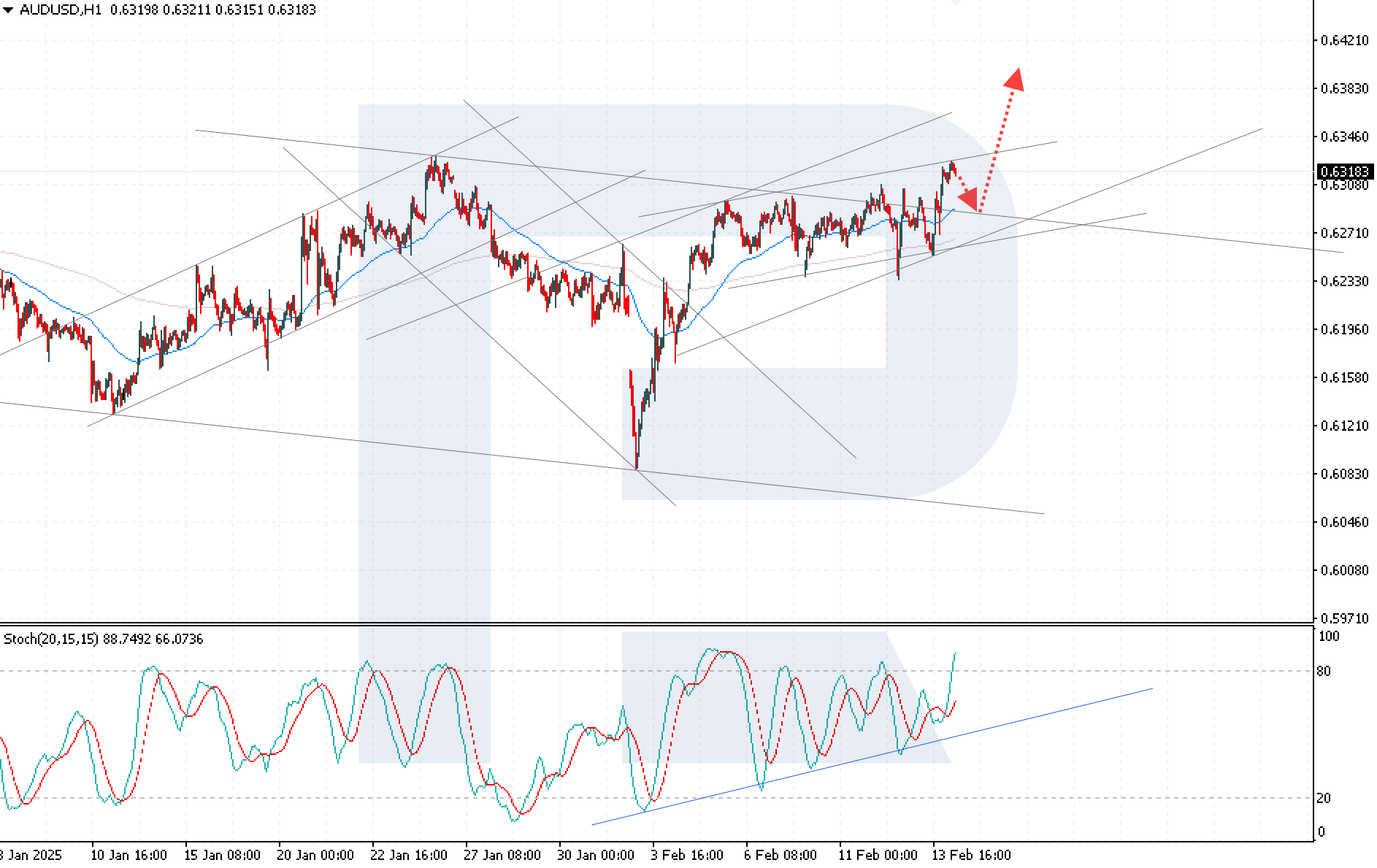

The AUDUSD rate is moving above the EMA-65 line, reinforcing the bullish scenario. The Stochastic Oscillator has reached the overbought area. However, a rebound from the bullish trendline indicates the potential for further growth.

The AUDUSD forecast suggests a correction towards 0.6280, followed by an upward momentum, with a target at 0.6385. To confirm this scenario, buyers need to gain a foothold above the 0.6330 resistance level.

An alternative scenario implies a breakout below the 0.6270 level, which may add to pressure from the sellers and lead to a test of the 0.6230 mark.

Summary

Despite the weakening of the US dollar amid Trump’s decisions, the expected RBA rate cut increases the chances of further strengthening of the Australian dollar. The AUDUSD technical analysis indicates that the growth potential remains. However, it is necessary to firmly secure above the 0.6330 resistance level to confirm further growth to 0.6385, while a breakout below 0.6270 will increase selling pressure.