The forecast for 6 June 2025 favours the Australian dollar, with the pair potentially extending a correction towards 0.6475. Find more details in our analysis for 6 June 2025.

AUDUSD forecast: key trading points

- The AUDUSD pair is forming a corrective wave

- US Nonfarm Payrolls: previously at 177 thousand, projected at 127 thousand

- AUDUSD forecast for 6 June 2025: 0.6475 and 0.6530

Fundamental analysis

According to the forecast for 6 June 2025, US Nonfarm Payrolls may drop to 127 thousand, down from the previous 177 thousand. If the actual figure aligns with expectations, the market may experience increased volatility and a temporary weakening of the US dollar.

The release of Nonfarm Payrolls nearly always triggers a stir in financial markets and can either support or undermine the US dollar’s position.

Given that the AUDUSD rate is in a corrective phase, today’s forecast favours the Australian dollar. Ahead of the NFP release, the US currency may continue to lose ground.

AUDUSD technical analysis

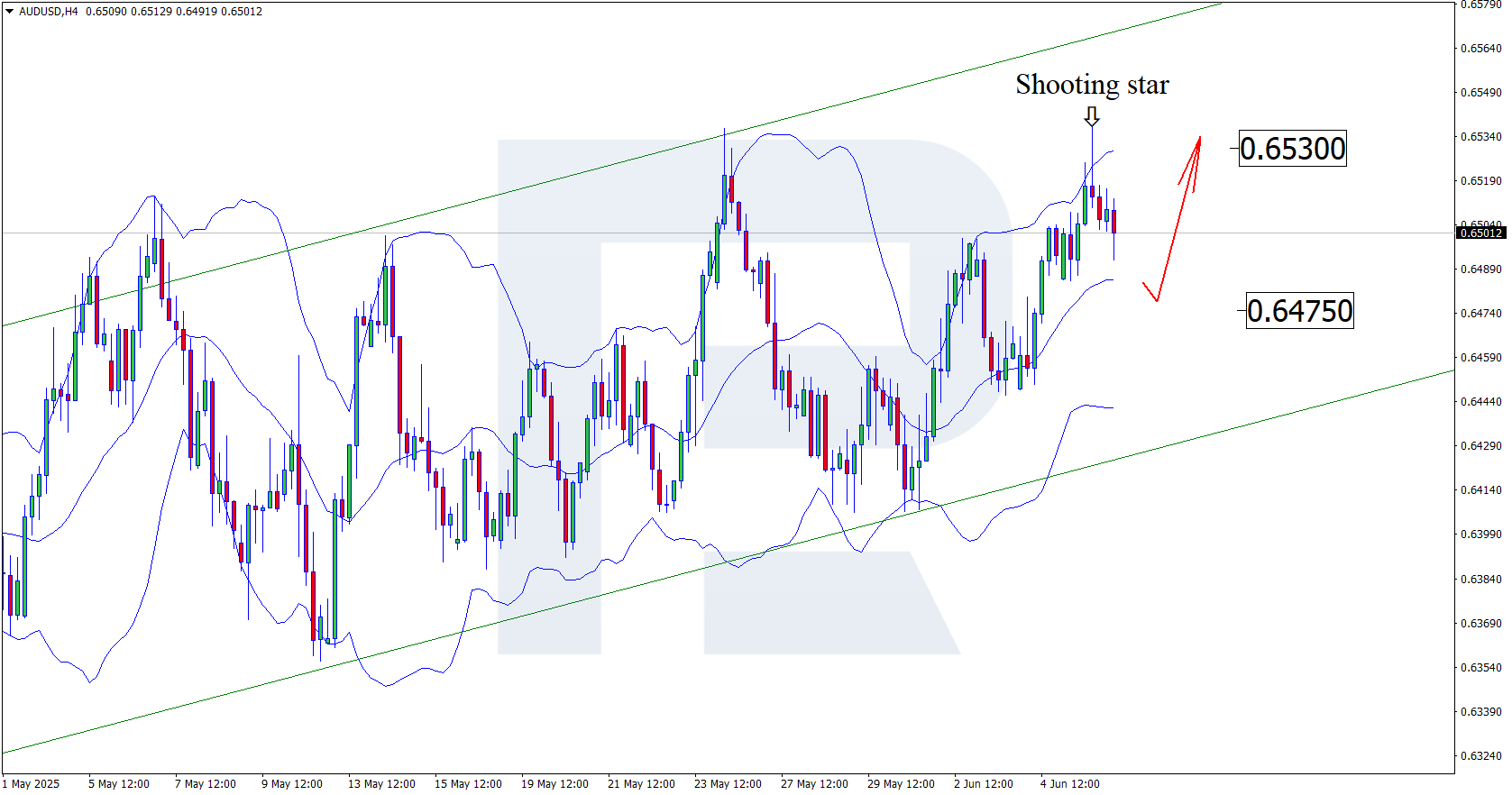

Having tested the upper Bollinger Band, the AUDUSD pair formed a Shooting Star reversal pattern on the H4 chart. The pair is currently undergoing a corrective wave in response to this signal, with a downside target at the 0.6475 support level.

The AUDUSD forecast also takes into account an alternative scenario. Given the notable price increase in recent sessions, further growth towards the nearest resistance at 0.6530 appears likely. A breakout above this level could open the way for the continuation of the uptrend.

Summary

If today’s NFP data disappoints, the AUDUSD pair may continue its correction. AUDUSD technical analysis supports the fundamentals and suggests a pullback towards the 0.6475 support level before growth.