The XAGUSD price failed to overcome the resistance at 32.30 USD yesterday and entered a downward correction. Tomorrow, market participants will focus on US labour market data. Read about it in our XAGUSD analysis for today, 3 October 2024.

Silver forecast: key trading points

- Market focus: market participants are awaiting tomorrow’s US labour market statistics

- Current trend: a local correction is underway within the uptrend

- XAGUSD forecast for 3 October 2024: 32.30 and 31.00

Silver fundamental analysis

Silver (XAGUSD) remains in a strong daily uptrend, fuelled by the US Federal Reserve’s recent decision to cut interest rates by 0.50% during the September meeting. This cycle of rate cuts is weakening the US dollar, supporting both gold and silver prices.

Market participants are closely watching US employment data for insights. The ADP report on Wednesday showed an increase of 143,000 jobs. However, Friday’s upcoming Nonfarm Payrolls and Unemployment Rate figures will be crucial. A decline in employment could weigh on the USD and provide bullish momentum for silver. At the same time, stronger-than-expected job growth could support the USD, potentially triggering a deeper correction in XAGUSD.

XAGUSD technical analysis

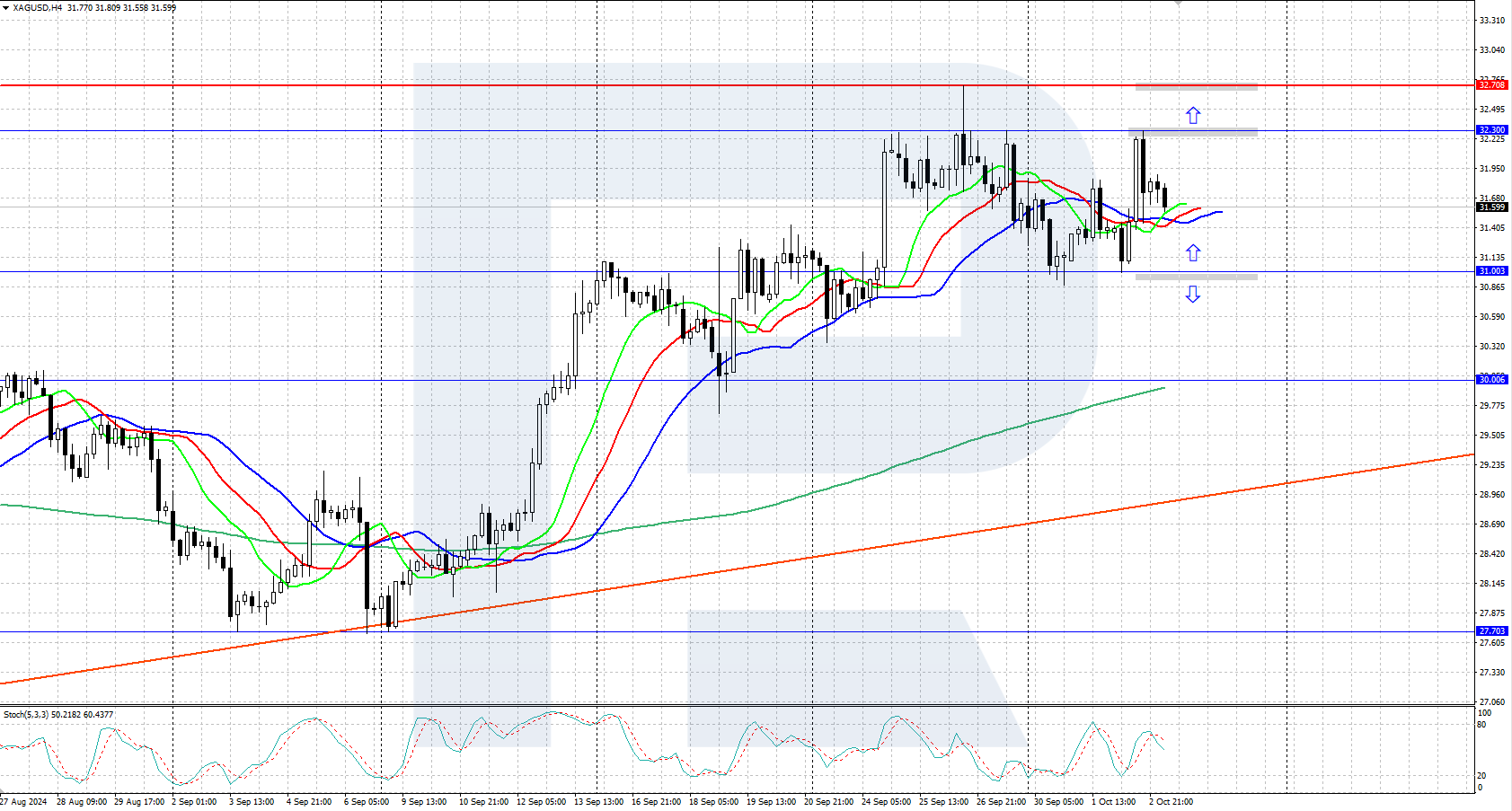

On the H4 chart, silver is trading in a strong uptrend. A local downward correction from the yearly high of 32.70 USD has taken the price down to the support level at 31.00 USD, where demand from buyers was encountered.

As part of the short-term forecast for the XAGUSD price, we can assume that if the bulls continue the upward movement and push the price above 32.30 USD, further growth towards the annual maximum of 32.70 USD will follow. If the bears bring the price below the 31.00 USD support level, the decline may continue to 30.00 USD.

Summary

Silver prices are moderately declining from resistance at 32.30 USD within the correction, but the daily trend remains upward, and the growth may continue. Tomorrow, market participants will focus on US employment statistics.