XAGUSD continues to trade within a downward correction. The pair is under pressure due to the strengthening of the US dollar after the US election. More details in our XAGUSD analysis for today, 14 November 2024.

XAGUSD forecast: key trading points

- Market focus: market participants are awaiting US inflation data today, with the Producer Price Index (PPI) scheduled for release

- Current trend: a downward movement is underway

- XAGUSD forecast for 14 November 2024: 31.00 and 29.00

Silver fundamental analysis

XAGUSD prices have entered a deep correction, driven by the significant strengthening of the US dollar, a trend supported by Donald Trump’s confident victory in the US presidential election. The CPI data released yesterday showed a 2.6% rise in annual US inflation, which aligned with expectations.

Today, the market will focus on US producer inflation data, particularly the PPI, which is expected to increase by 2.3% year-on-year. Weaker-than-expected PPI results could exert pressure on the USD and help strengthen Silver. Conversely, a higher-than-expected PPI would support the US dollar and could drive XAGUSD prices further down.

XAGUSD technical analysis

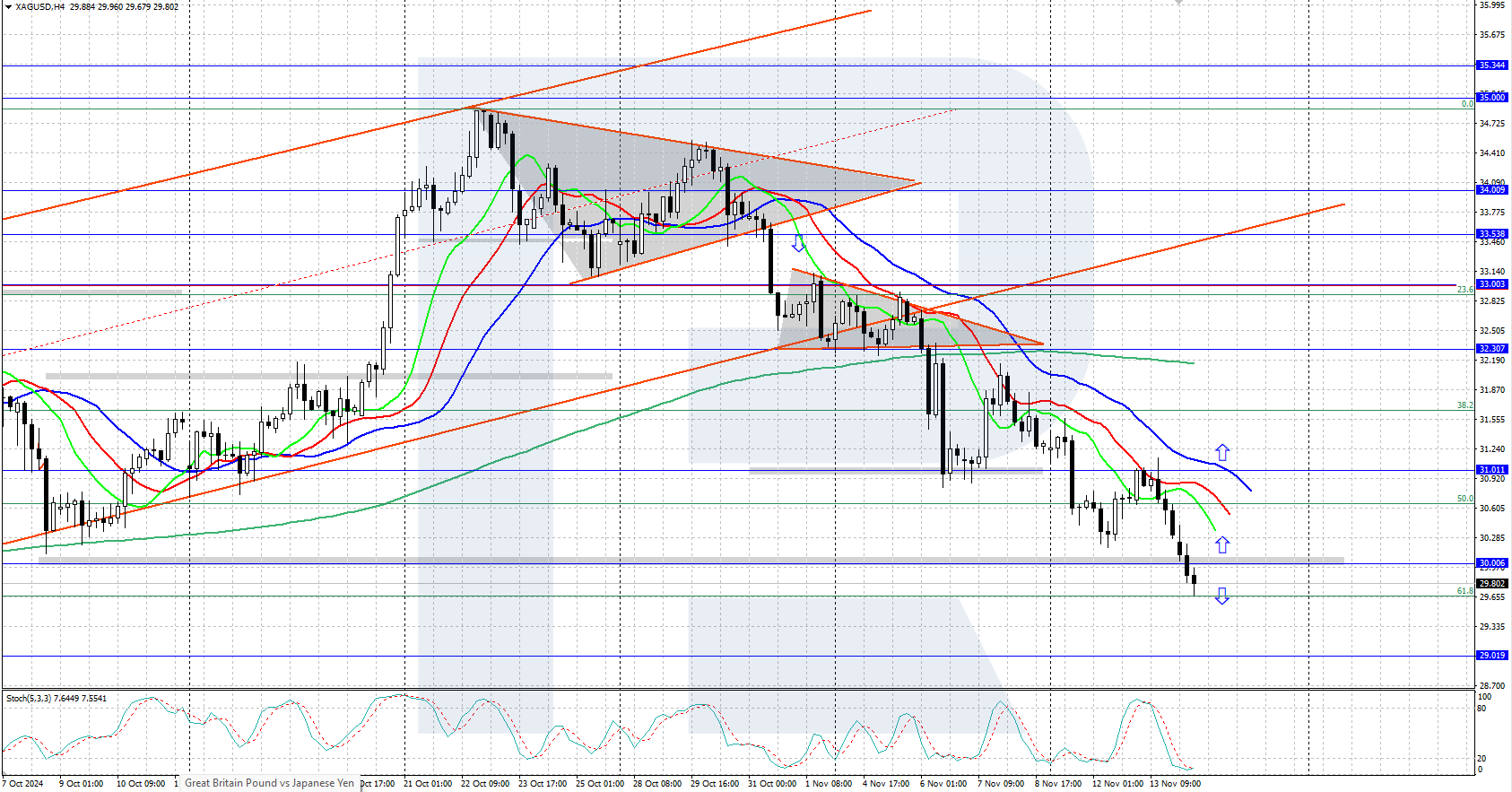

On the H4 chart, Silver prices are experiencing solid downward momentum caused by the strengthening of the US dollar following Trump’s victory. The quotes fell below the psychologically important support level at 30.00 USD. Whether XAGUSD can secure a position below this level remains to be seen.

The short-term Silver price forecast suggests that prices could rise to around 31.00 USD if bulls manage to hold above 30.00 USD and reverse prices upwards. Conversely, if bears gain a foothold below 30.00 USD, the decline could continue to 29.00 USD.

Summary

XAGUSD continues its decline amid the significant strengthening of the US dollar following the US election. Today, market participants will focus on the upcoming US inflation statistics, particularly the PPI.