Strong US data creates bearish momentum for AUDUSD

The AUDUSD rate is recovering, but the US dollar is supported by fresh labour market data. The rate currently stands at 0.6538. Discover more in our analysis for 26 September 2025.

AUDUSD forecast: key trading points

- The number of Americans filing for jobless benefits for the first time fell by 14 thousand to 218 thousand for the week

- The market adjusted expectations of a Fed rate cut in October, with the probability now at 87.7%, down from 92% a day earlier

- The US economy grew at an annualised rate of 3.8% in Q2 2025, marking the fastest pace in seven quarters

- AUDUSD forecast for 26 September 2025: 0.6485

Fundamental analysis

The AUDUSD rate is strengthening today after dipping more than 1% yesterday. The US dollar received support from fresh labour market data. US initial jobless claims fell by 14 thousand to 218 thousand for the week. The consensus forecast had expected an increase to 235 thousand from the revised level of the previous week.

Against this backdrop, the market adjusted expectations of a Federal Reserve rate cut in October by 25 basis points. The likelihood of a cut is now estimated at 87.7%, down from 92% a day earlier. Additional support for the dollar came from strong macroeconomic data. The US economy grew by 3.8% annualized in Q2 2025, according to the Commerce Department’s final estimate. This is the fastest growth in seven quarters, compared to the previously reported 3.3%.

In addition, durable goods orders in August increased by 2.9% from the previous month, marking the first positive result in the last three months. The growth was unexpected, as analysts had forecast a decline of 0.5%.

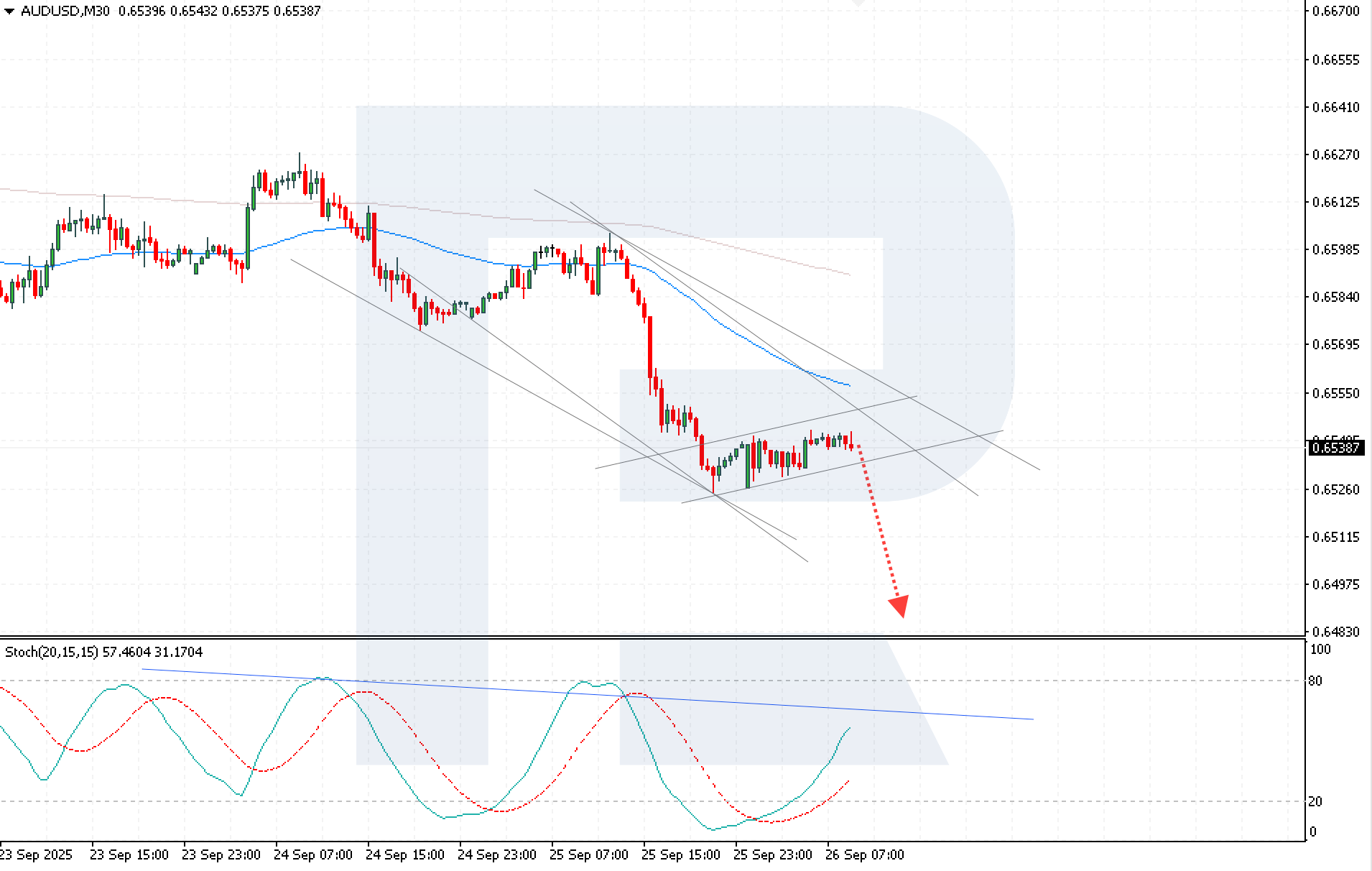

AUDUSD technical analysis

The AUDUSD rate continues to move within a descending channel. On the chart, the price rebounded from the 0.6545 resistance level and formed a consolidation. The scenario points to selling pressure and risks of further decline.

The AUDUSD forecast for today suggests a bearish scenario, with the price breaking below a local support level and falling to 0.6485. The Stochastic Oscillator has exited upwards from oversold territory and is approaching the resistance line, confirming the likelihood of continued downward movement if the price rebounds from this trendline.

Consolidation below 0.6525 will further confirm the bearish scenario and indicate that quotes are moving out of the bullish correction channel.

Summary

Strong US macroeconomic indicators, together with reduced expectations of Fed policy easing, support the dollar and increase pressure on the pair. AUDUSD technical analysis indicates a high probability of a decline towards the target of 0.6485.