Swiss franc: will the interest rate change?

Today, 20 June 2024, the Swiss National Bank will announce its decision on the interest rate change and hold a press conference.

Swiss franc awaits interest rate decision

Today, the Swiss National Bank (SNB) will announce its decision regarding the interest rate change, which is expected to remain at 1.50%. On 21 March, the interest rate was reduced by 0.25%. In the current situation, maintaining the interest rate at the same level could positively impact the USDCHF exchange rate.

Following the announcement of the interest rate, the Swiss National Bank will hold a press conference and release data on the assessment of monetary policy. This data may reveal some directions for the development of the banking sector, achieved results, and plans for the near future. Historically, the USDCHF exchange rate tends to fluctuate during the press conference due to investor expectations and comments from SNB representatives.

If the press conference is framed positively, it could potentially strengthen the USDCHF exchange rate significantly.

USDCHF technical analysis

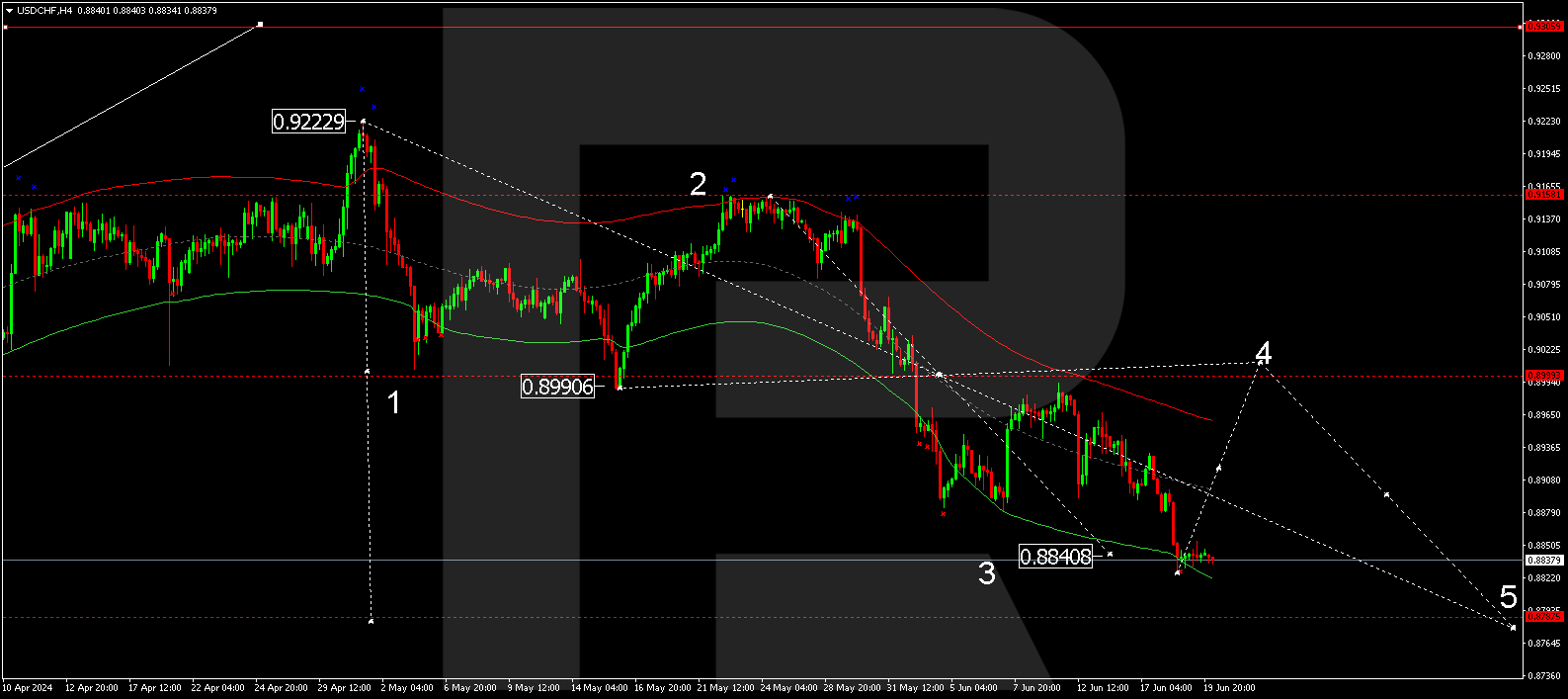

The USDCHF Н4 chart analysis for 20 June 2024 shows a corrective wave towards the local target of 0.8840. A rise to 0.9000 (testing from below) is expected today. After reaching this level, the price might decline to 0.8787, representing the main target for correction. Once the correction is complete, a new growth wave could start, aiming for 0.9300 as a target of the first upward wave.

USDCHF technical analysis 20.06.2024

This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 0.9000. This level is considered crucial for a corrective wave in the USDCHF pair. The market has received a downward rebound from the Envelope’s upper boundary at 0.9155. Today, the quotes are hovering near its lower boundary at 0.8840. A consolidation range is expected to develop. An upward breakout of this range might enable a growth structure, aiming for the Envelope’s upper boundary. Subsequently, the USDCHF rate might fall further to its lower boundary.

Summary

The interest rate decision may help USDCHF implement the scenario with a corrective wave towards 0.8787 and an onward rise to the targets of 0.9015 and 0.9300.