Technical Analysis & Forecast 01.06.2023

EURUSD, “Euro vs US Dollar”

The currency pair completed a wave of decline to 1.0635. Today the market has performed a correction to 1.0692. At the moment, a consolidation range is forming under this level. A breakout of the range downwards and further development of the wave to 1.0643 are expected. And if this level also breaks, the potential for a decline to 1.0614 could open. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of growth to 1.2447. Today the market is forming a consolidation range under this level. A structure of decline is expected to develop to 1.2385. Next, another structure of growth to 1.2460 is not excluded. After the price reaches this level, the wave could continue to 1.2350, from where the trend could continue to 1.2269.

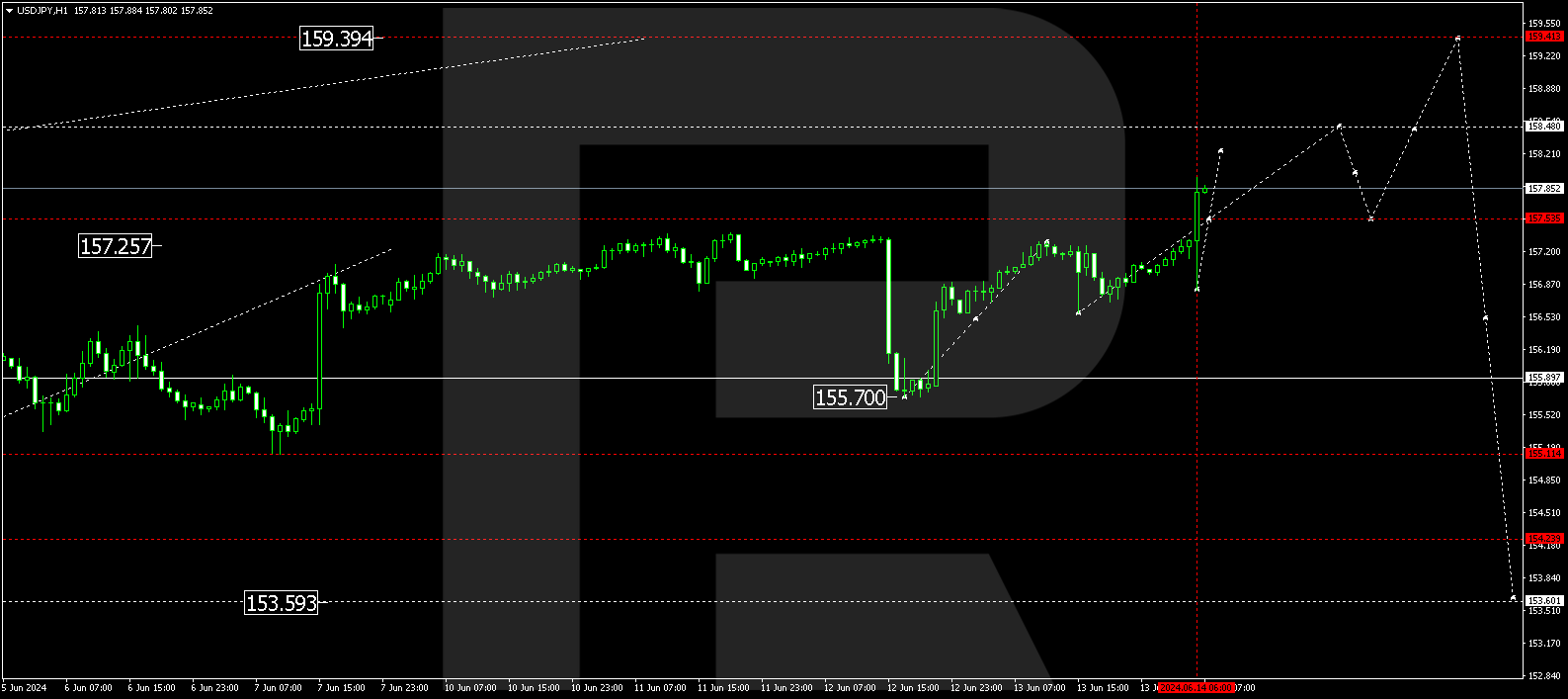

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a structure of a declining link to 139.00. A wave of growth to 140.37 could start today, from where the trend might continue to 141.55.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a structure of growth to 0.9146. Today a correction to 0.9084 is not excluded. Next, growth to 0.9154 might follow. This is a local target.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is forming a consolidation range around 0.6498. The range might extend today to 0.6539. Next, a decline to 0.6444 might follow. This is a local target. And next, growth to 0.6490 and a decline to 0.6432 are expected.

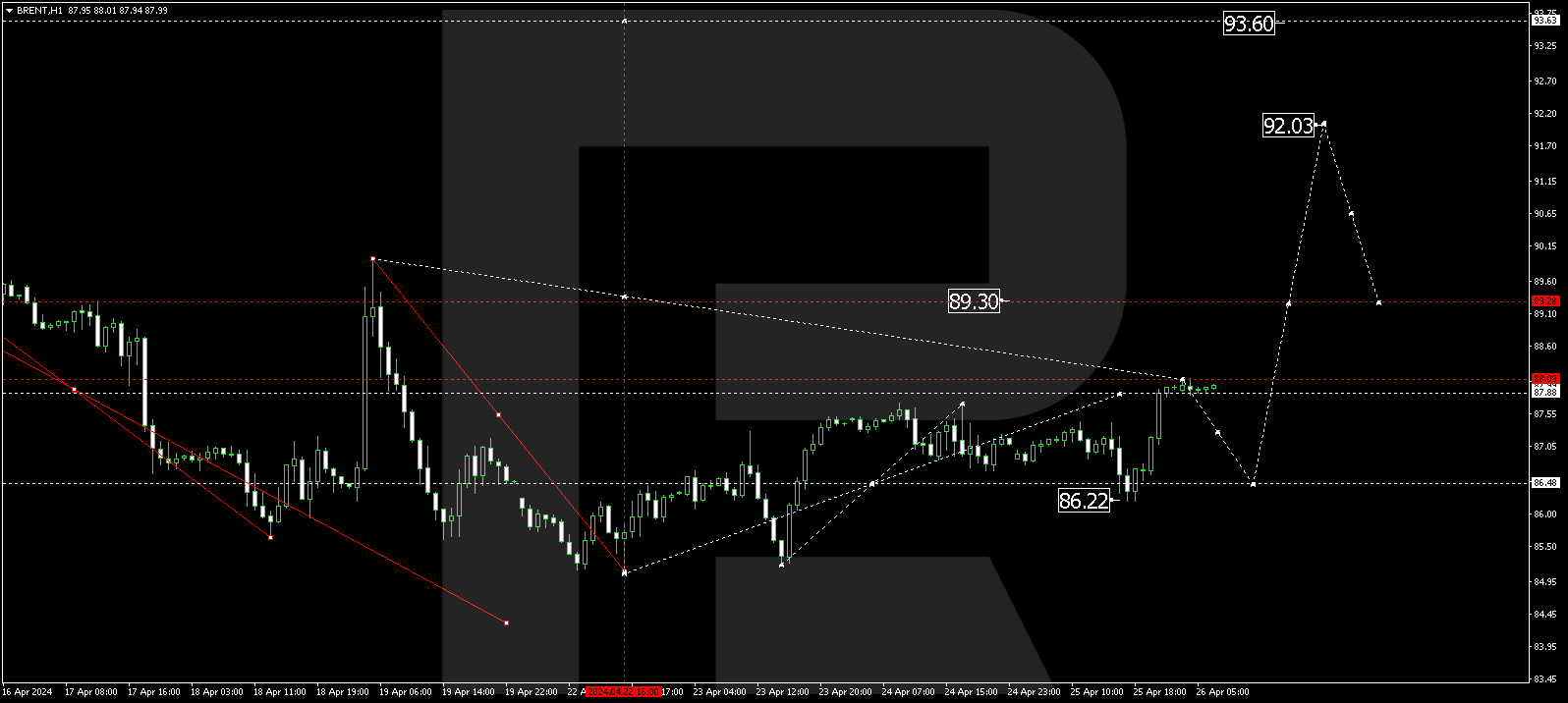

BRENT

Brent completed a wave of correction to 71.50 and a link of growth to 73.77. A link of decline to 72.10 has formed today. At the moment, another impulse of growth to 73.77 is forming. And if this level also breaks, the potential for a rise to 75.55 could open, from where the wave could develop to 76.15. This is the first target.

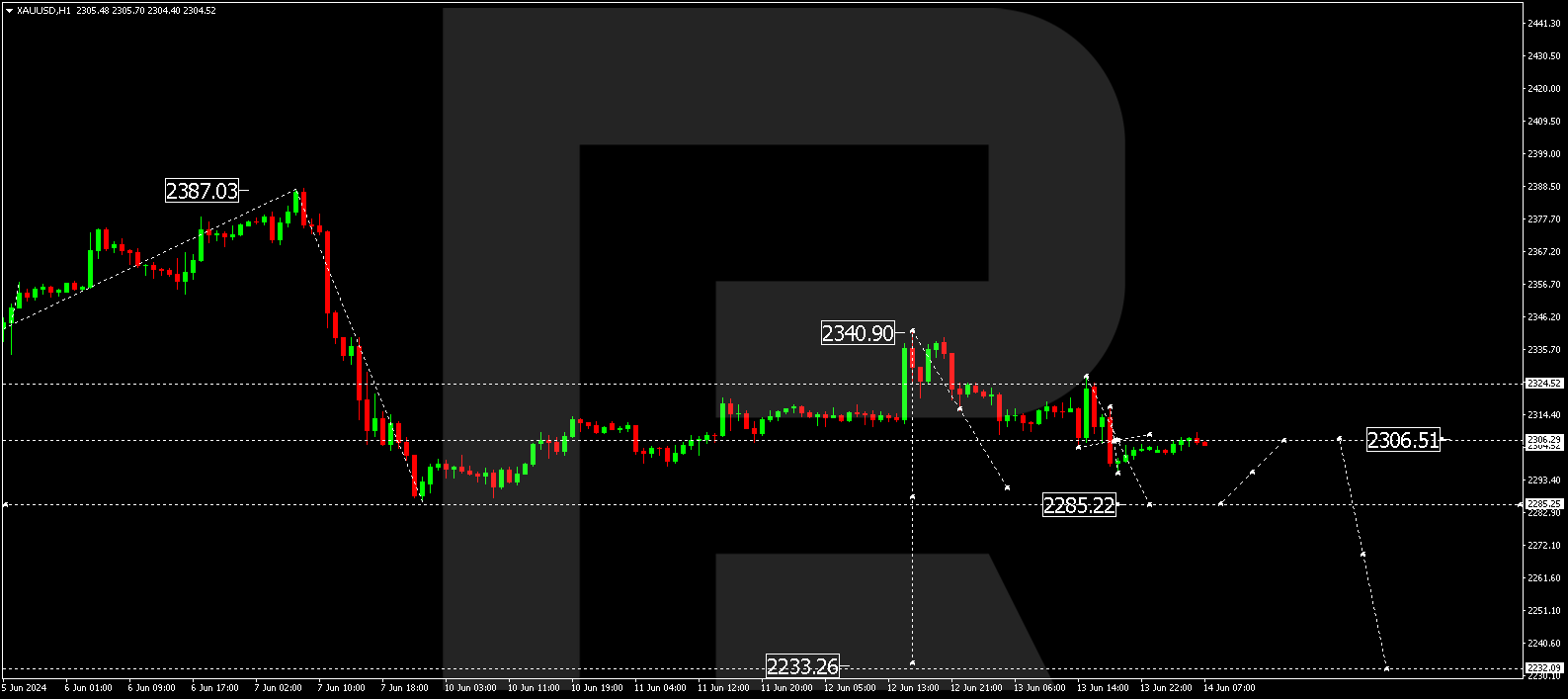

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of growth to 1974.70. Today the market is developing a structure of decline to 1950.50. And if this level also breaks, the potential for a decline by the trend to 1916.15 could also open.

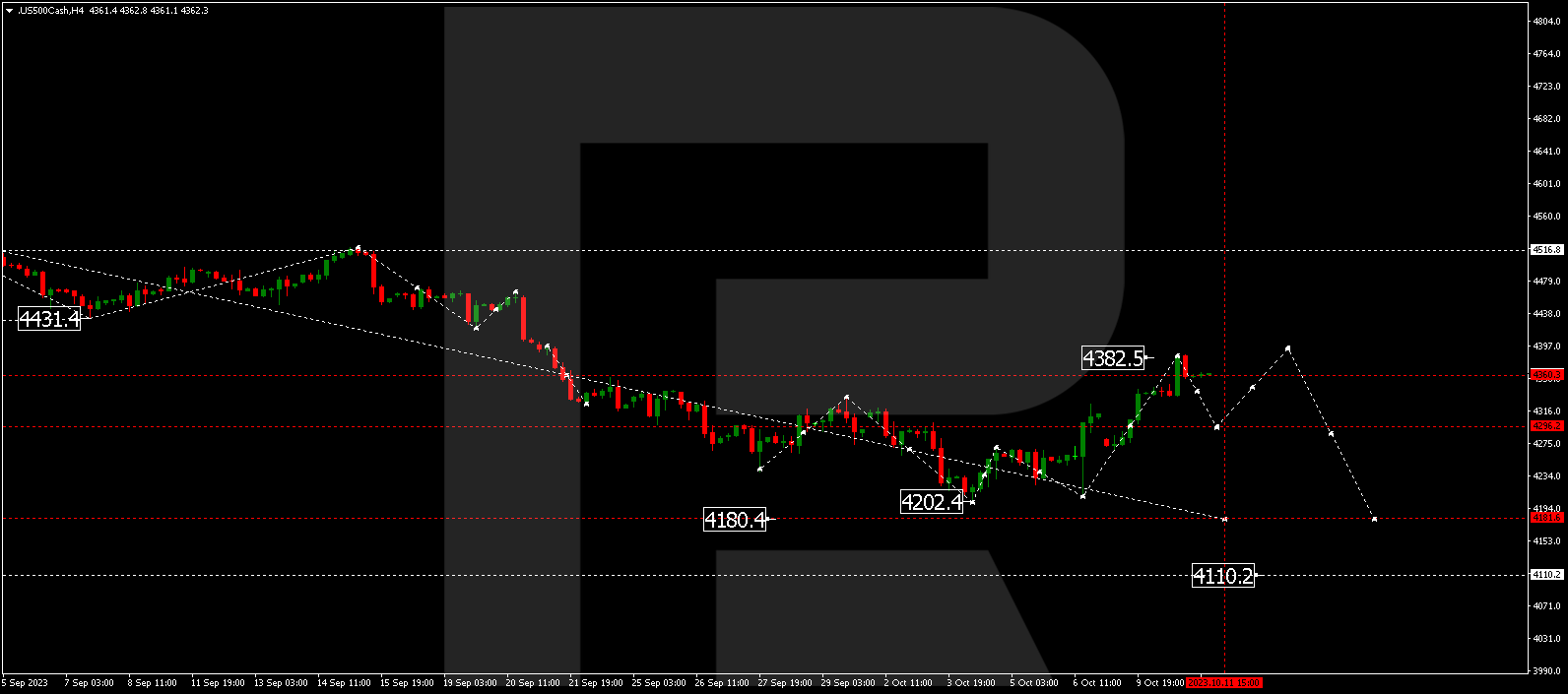

S&P 500

The stock index goes on declining to 4161.8. After the price reaches this level, a link of growth to 4267.5 is not excluded, followed by a decline to 4049.0. The target is first.