Technical Analysis & Forecast 03.04.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair has completed a decline wave to 1.0724. A correction to 1.0793 (testing from below) could develop today. Once this correction is over, the decline wave is expected to extend to 1.0720. And with a breakout of this level the potential for a movement by the trend towards 1.0650 might open. The local target is an estimated target.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a decline wave towards 1.2539. A correction to 1.2590 (testing from below) is expected today. Once this correction is over, the decline wave could continue towards 1.2526, from which level the trend might extend to 1.2500. This is a local target.

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a consolidation range around the 151.45 level without any obvious trend. By now, the market has technically tested the level from above. A new growth structure towards 151.89 is expected to develop today. This is a local target. Once this level is reached, a correction link to 151.55 is not excluded, followed by a rise to 152.10.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has technically tested the 0.9055 level from above. Today the market is forming a growth wave to 0.9102. Once this level is reached, a correction link to 0.9080 is not excluded. Next, a growth wave to 0.9114 might begin. This is the first target.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a decline wave to 0.6480. A correction to 0.6527 is forming today. Once this level is reached, a new decline wave to 0.6464 might start, from which level the trend could continue to 0.6390.

BRENT

Brent continues developing a growth wave to 89.18. Once this level is reached, a decline wave to 87.77 is not excluded (testing from above). Next, a rise to 89.90 could follow, from which level the trend might extend to 90.80. This is a local target.

XAUUSD, “Gold vs US Dollar”

Gold has performed a technical test of 2253.12 from above. By now, the market has formed a growth link to 2288.00. A narrow consolidation range is expected to form under this level today. With an upward escape from the range, the potential for a wave towards 2301.50 could open, from which level the trend could extend to 2327.30. This is a local target. Once this level is reached, a correction link to 2288.00 is not excluded, after which a rise towards 2350.00 is expected.

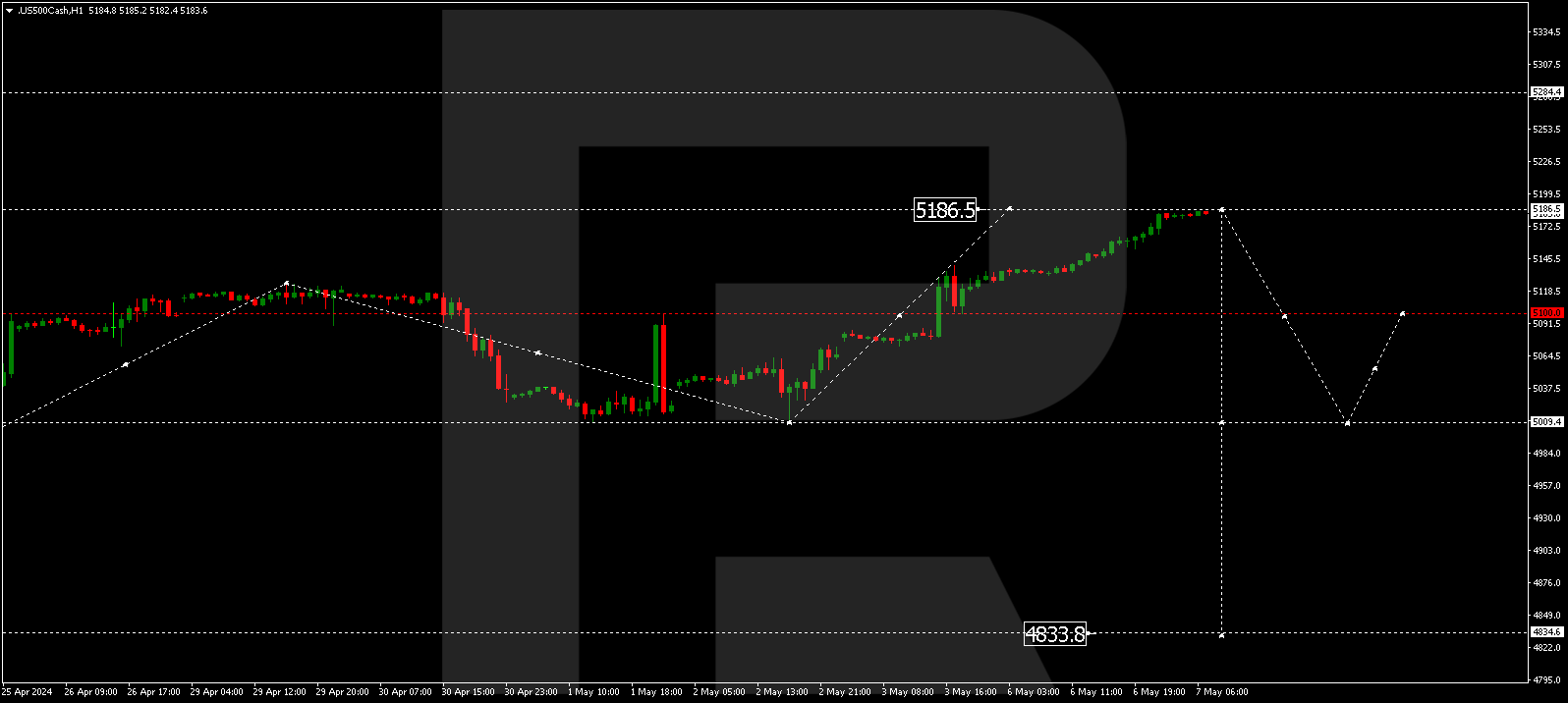

S&P 500

The stock index has performed a decline wave to 5188.6. A correction link towards 5219.0 is not excluded today. Once this correction is over, a decline to 5186.0 might form. This is a local target. Next, a rise to 5220.0 (testing from below) is expected, followed by a decline to 5154.5. This is the first target.