Technical Analysis & Forecast 04.04.2023

EURUSD, “Euro vs US Dollar”

The currency pair completed a link of growth to 1.0862. The market has formed a consolidation range around it. If the price breaks the range upwards, it could be extended to 1.0915. A link of correction to 1.0862 (a test from above) could develop today. Then growth to 1.0938 is likely to start. After the price reaches the level, we expect a wave of decline to 1.0790 to start.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair completed a wave of growth to 1.2363. A consolidation range formed around this level. The price broke it upwards and extended the range to 1.2424. A link of correction to 1.2363 (a test from above) is expected today. Then the pair could grow to 1.2455 and drop to 1.2323.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a link of correction to 132.20. A link of growth to 133.93 is expected to form today, followed by a decline to 132.20. Then growth to 134.50 is not excluded. And after the price reaches this level, a decline to 130.40 could start.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a consolidation range around 0.9168. At the moment, the market has extended the range downwards to 0.9115. A link of growth to 0.9168 is expected today. If the price breaks the range upwards, a new wave of growth to 0.9260 might start.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has extended the consolidation range upwards to 0.6792. A new consolidation range is likely to form under this level. We expect the price to break it downwards and drop to 0.6722. The target is first.

BRENT

Brent goes on developing a consolidation range around 84.44. If the price breaks it downwards, a link of correction to 80.00 is not excluded. And if the price breaks the range upwards, it may reach the level of 87.07. The target is first. And after the quotes reach the level, we expect a link of correction to 80.00.

XAUUSD, “Gold vs US Dollar”

Gold completed a wave of growth to 1972.20. A consolidation range formed around this level, the price broke it upwards, and the range got extended to 1990.45. Today the market may perform a link of correction to 1972.20 (a test from above). Then growth to 1995.80 could follow. And after the price reaches this level, a wave of decline to 1944.00 could begin.

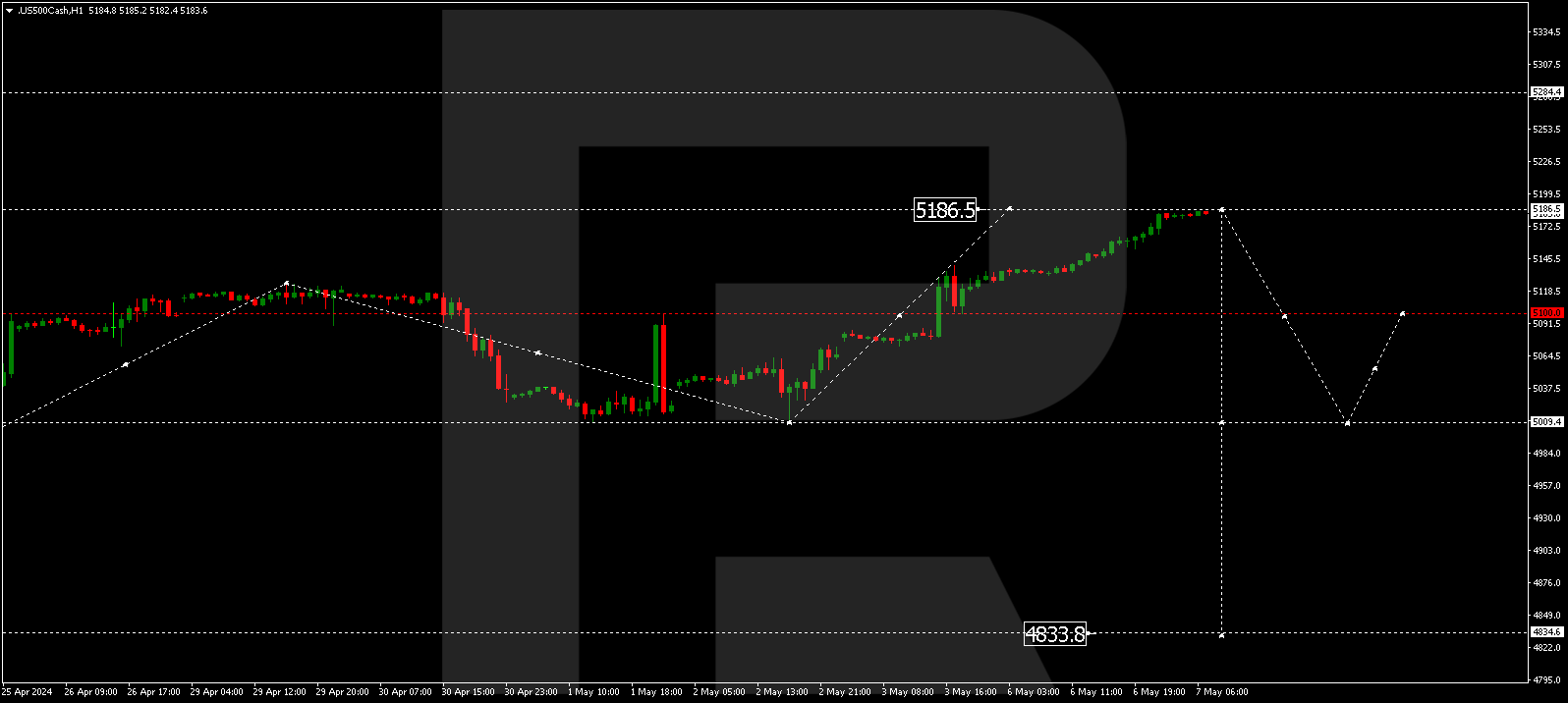

S&P 500

The stock index goes on forming a consolidation range around 4119.0. It may get extended to 4153.3 today, followed by a decline to 4080.0. And after the price breaks this level, a pathway to 4013.3 could open. The target is first. After the price reaches this level, a correction to 4070.0 could start.