Technical Analysis & Forecast 04.08.2023

EURUSD, “Euro vs US Dollar”

EURUSD has completed a wave of decline to the 1.0917 level. Today the market is forming a consolidation range above this level. Growth could follow with the range extending to the 1.0964 level. An upward breakout of this range will open the potential for a correction to 1.0997. With a downward breakout, the trend could continue to 1.0869.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a structure of decline to the 1.2620 level. Today the market has corrected to 1.2737 (a test from below). Another structure of decline to 1.2600 is expected to follow. This is a local target. Once the price hits this level, another correction to the 1.2737 level could develop, followed by a decline to the 1.2488 level.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a link of correction to the 142.11 level. Today the market is forming a consolidation range above this level. With a downward breakout, the correction could continue to the 140.20 level. With an upward breakout, a link of growth to 145.45 could follow with the prospect of trend continuation to 146.22.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a wave of correction to the 0.8730 level (a test from above). Another structure of growth to the 0.8800 level is expected to follow. An upward breakout of this level will open the potential for a movement by the trend to 0.8900. This is the first target.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a wave of decline to the 0.6514 level. Today the market has completed a link of correction to the 0.6577 level. One more link of the correction to 0.6613 could follow. Once the correction is completed, a new wave of decline to 0.6500 could start. With a breakout of this level, the trend could continue to the 0.6425 level.

BRENT

Brent has corrected to the 82.25 level. Today the market has completed a structure of growth to 85.40. At the moment, a consolidation range is forming around this level. An upward breakout will open the potential for a wave to 87.40 with the prospect of trend continuation to the 91.50 level.

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of decline to the 1929.14 level. Today the market continues to form a consolidation range above this level. With an upward breakout, a link of correction to the 1951.60 level could follow. A downward breakout will open the potential for trend continuation to 1920.90 with the prospect of extending the wave to 1914.40.

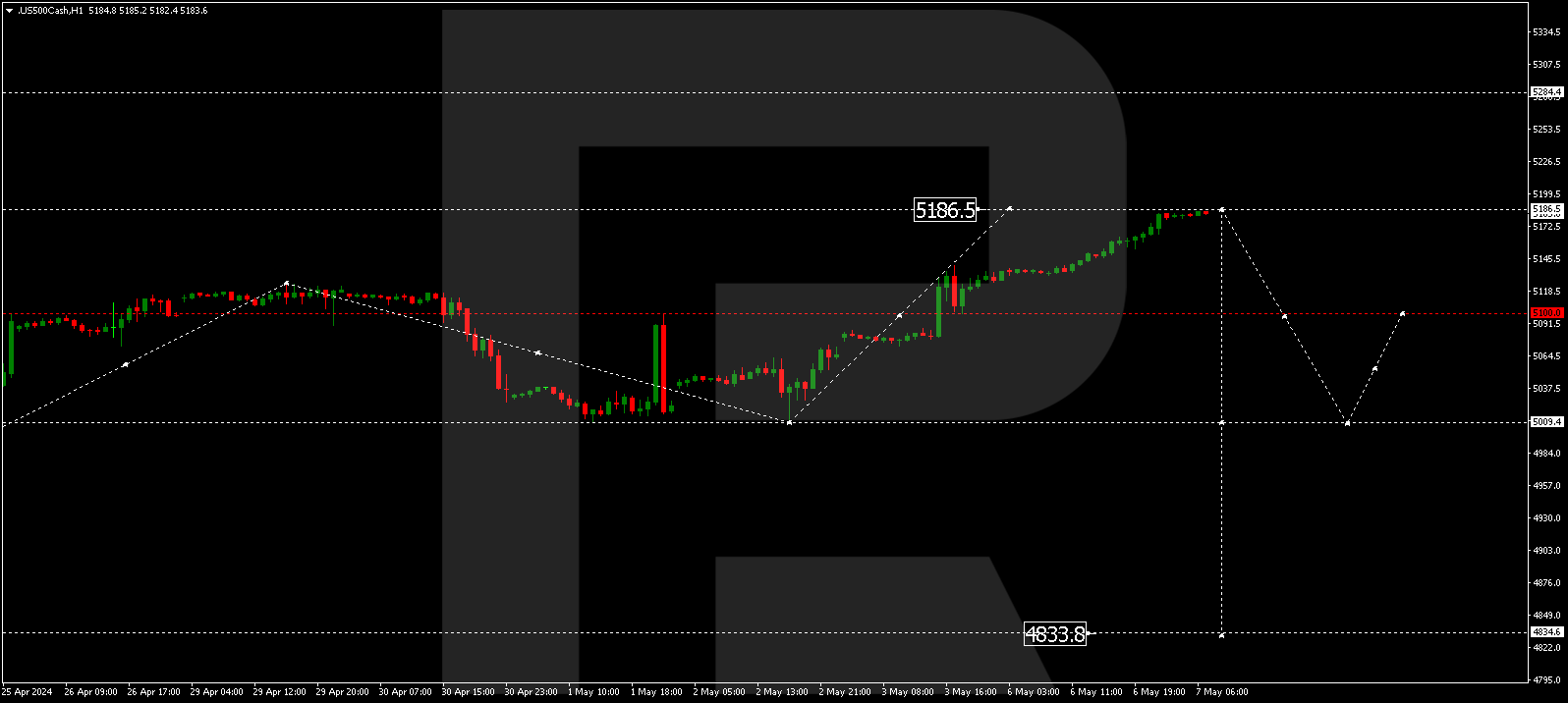

S&P 500

The stock index has completed a wave of decline to the 4486.5 level. Today the market is forming a correction to 4522.2. After the correction is completed, another structure of decline to 4440.4 could develop. This is a local target.