Technical Analysis & Forecast 06.03.2023

EURUSD, “Euro vs US Dollar”

The currency pair has completed a wave of correction to 1.0648. Today a new structure of decline to 1.0570 should start. After this level is reached, a consolidation range should form. With an escape downwards, a pathway for a wave down to 1.0490 should open.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a structure of correction to 1.2048. Today the next structure of decline to 1.1895 should start developing. After this level is reached, a consolidation range is likely to form. With an escape downwards, a pathway for a wave of decline to 1.1800 should open.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of correction to 135.37. Today a structure of growth might develop to 136.50. After this level is reached, a consolidation range is likely to develop. With an escape upwards, a pathway to 137.55 should open.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues forming a consolidation range around 0.9418. The range might expand down to 0.9320, from where the quotes might grow to 0.9512. The target is local.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a structure of correction to 0.6773. Today the market is forming a structure of decline to 0.6690. After this level is reached, a consolidation range should form. With an escape downwards, a pathway for a wave of decline to 0.6600 should form.

BRENT

Brent has completed a wave of growth to 85.80. Today the market is forming a consolidation range under this level. With an escape downwards, a link of correction to 82.82 might follow. With an escape upwards, a pathway to 88.60 should open. The target is local.

XAUUSD, “Gold vs US Dollar”

Gold has completed a structure of growth to 1856.33. Today a consolidation range is forming under this level. With an escape upwards, the range might extend to 1862.00. With an escape downwards, a pathway to 1830.46 should open.

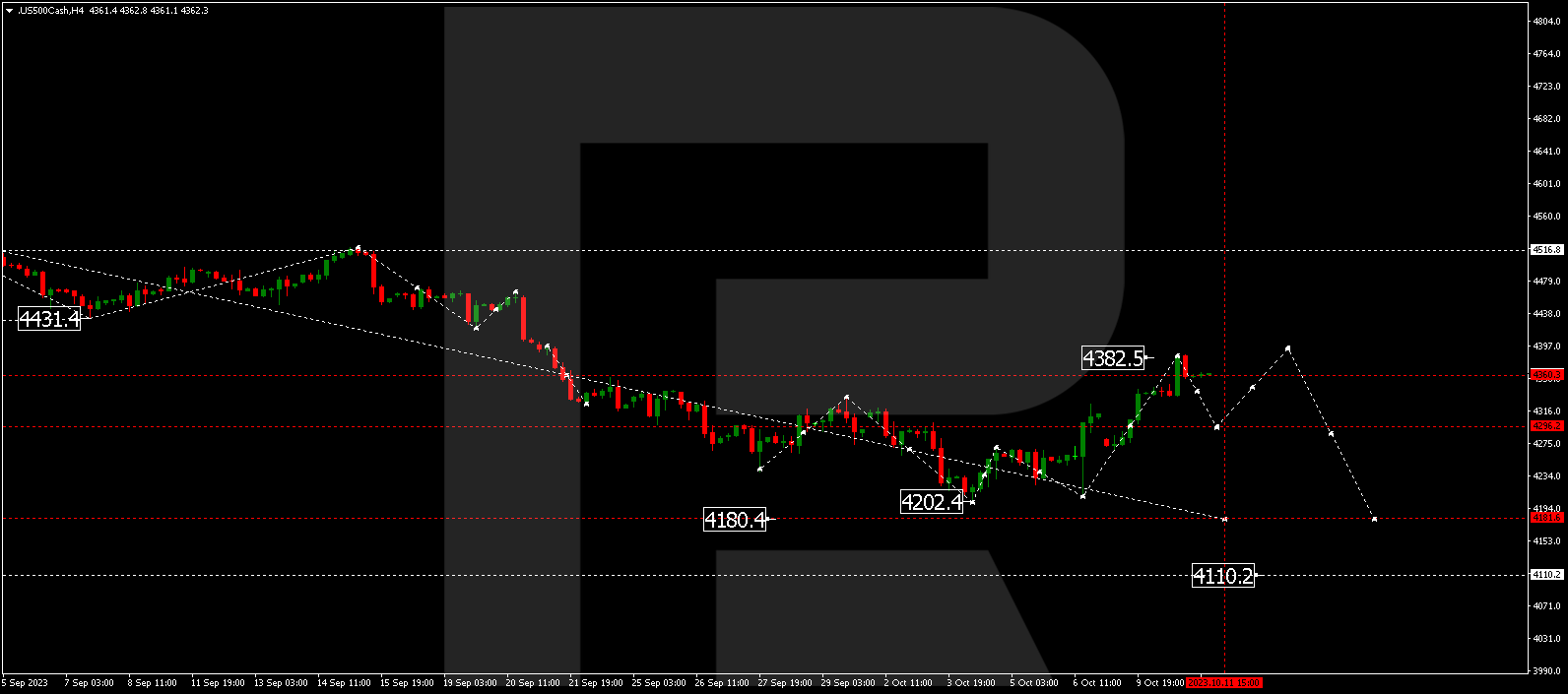

S&P 500

The stock index has completed a link of correction to 4050.5. Today we expect a decline to 3930.0. After this level is reached, a correction to 3992.0 and a decline to 3805.0 should follow.