Technical Analysis & Forecast 11.04.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair practically finished a correction wave at 1.0884 and started developing a decline wave because of the news. By now, the quotes have finished the wave at 1.0728. A consolidation range is expected to form above this level today. With an escape upwards, a growth link towards 1.0773 (testing from below) is not excluded. Next, a decline to 1.0682 might follow. With a downward escape from the range, the wave could extend to 1.0682, from which level the trend might continue to 1.0662.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair finished correcting at 1.2708 and continued developing a new decline wave on the news. By now, a wave towards 1.2520 has formed. A consolidation range might form around this level today. With an escape upwards, a growth link towards 1.2570 is not excluded (testing from below). Next, a decline by the trend to 1.2450 might follow. With a downward escape from the range, the potential for a wave targeting 1.2450 could open, from which level the trend might continue to 1.2355.

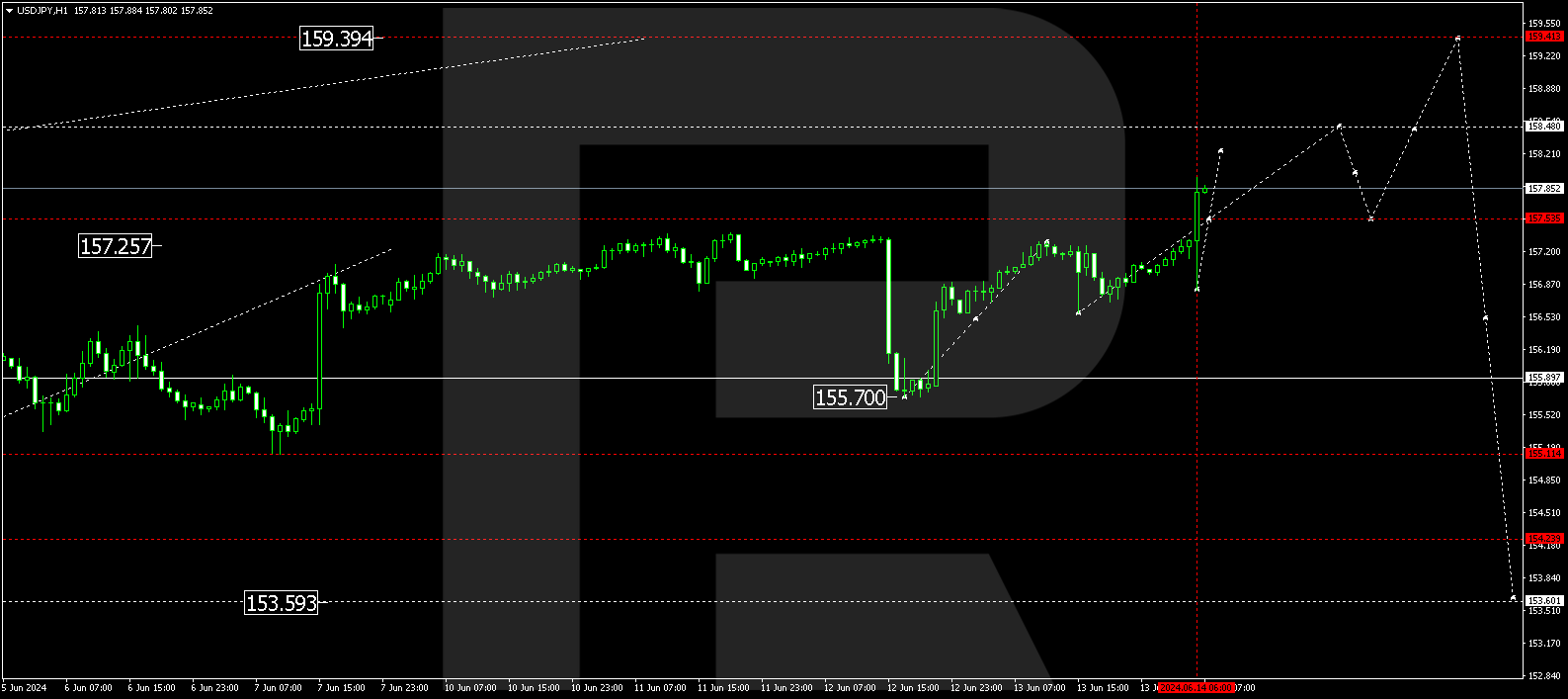

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair escaped a consolidation range upwards on the news and formed a growth wave towards 153.22. A consolidation range might form under this level today. With a downward escape, a decline link to 152.55 is not excluded. With an upward escape, the potential for a wave to 154.00 might open. This is a local target.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has corrected to 0.9012. On the news, the market continued developing a growth wave towards 0.9146. A consolidation range might form under this level today. An escape downwards to 0.9090 is not excluded (testing from above). Next, a rise to 0.9165 could follow. With an upward escape from the range, the potential for a wave towards 0.9165 might open, from where the trend could extend to 0.9185.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair formed a correction wave targeting 0.6643. On the news, the market started a decline wave again. By now, a decline link to 0.6498 has formed. The market is completing a consolidation range above this level today. With an upward escape, a growth link towards 0.6537 is not excluded (testing from below). Next, a decline to 0.6435 could follow. With a downward escape from the range, the potential for a decline wave towards 0.6411 might open, from where the trend could extend to 0.6395.

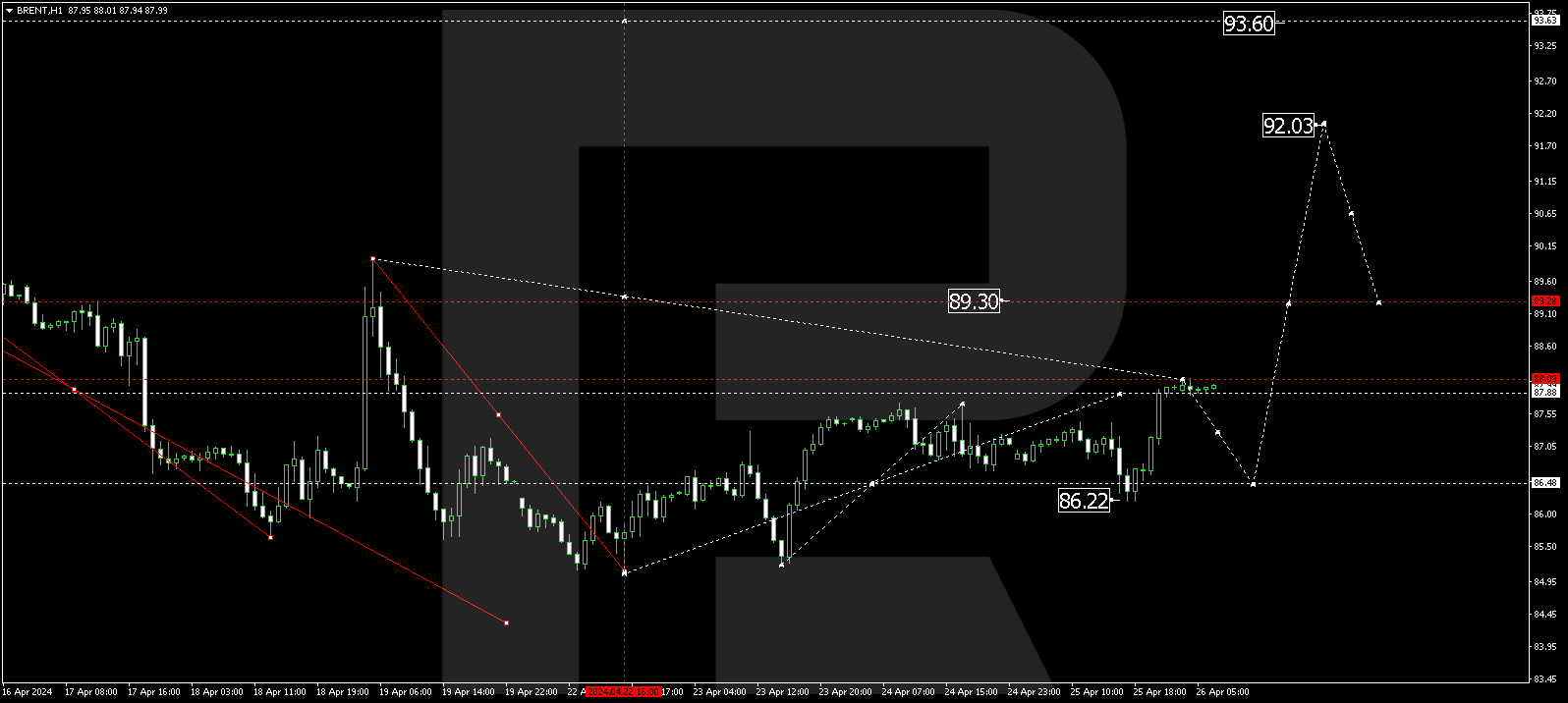

BRENT

Brent has finished correcting at 88.38. A growth impulse to 90.20 has formed today. A consolidation range is now forming under this level. With an upward escape from the range, the potential for a rise to 91.16 might open. Once this level is reached, a correction link to 89.90 is not excluded (testing from above). Next, a rise to 91.47 might follow. This is a local target.

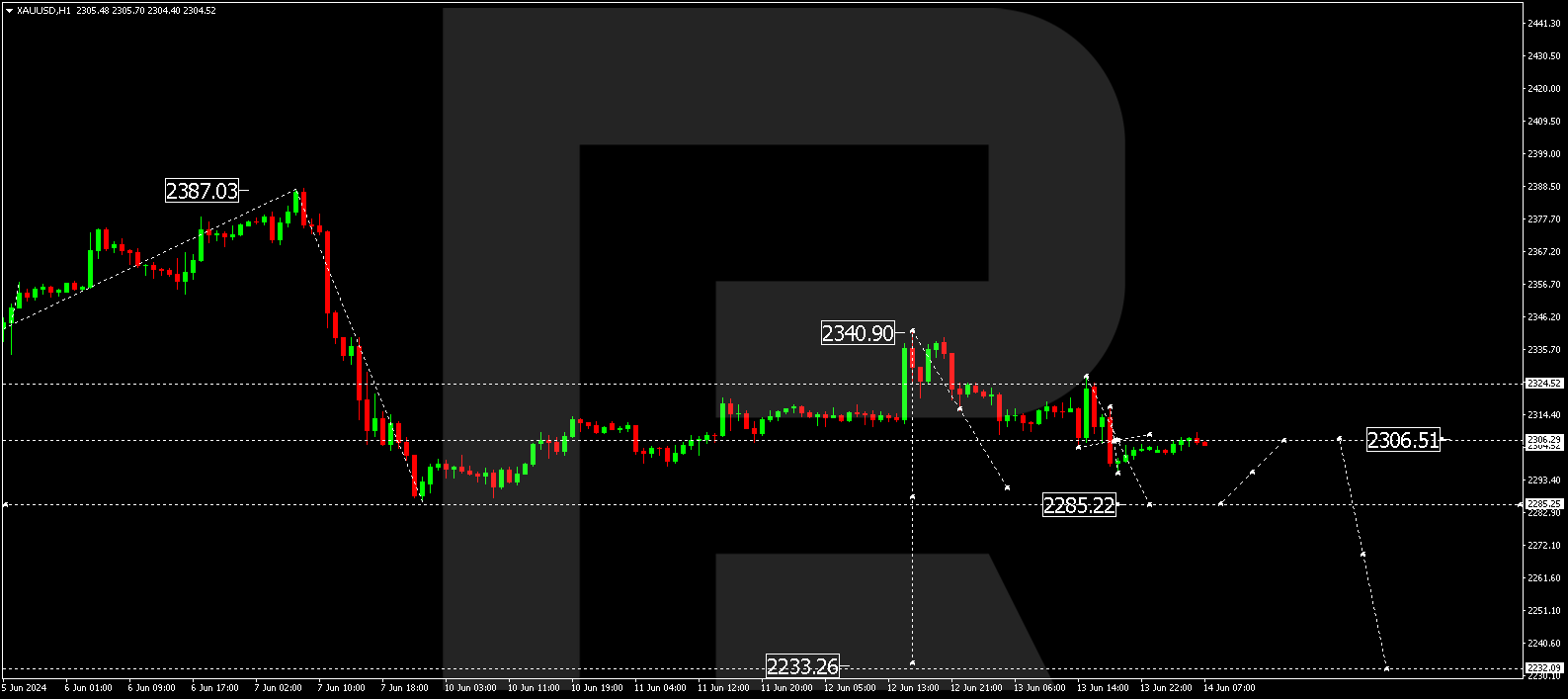

XAUUSD, “Gold vs US Dollar”

Gold has formed a correction wave towards 2320.00. By now, the market has made a growth impulse to 2352.33. A consolidation range is expected to form under this level today. With an upward escape, the wave could extend to 2370.70, from where the trend might continue to 2377.77. This is a local target.

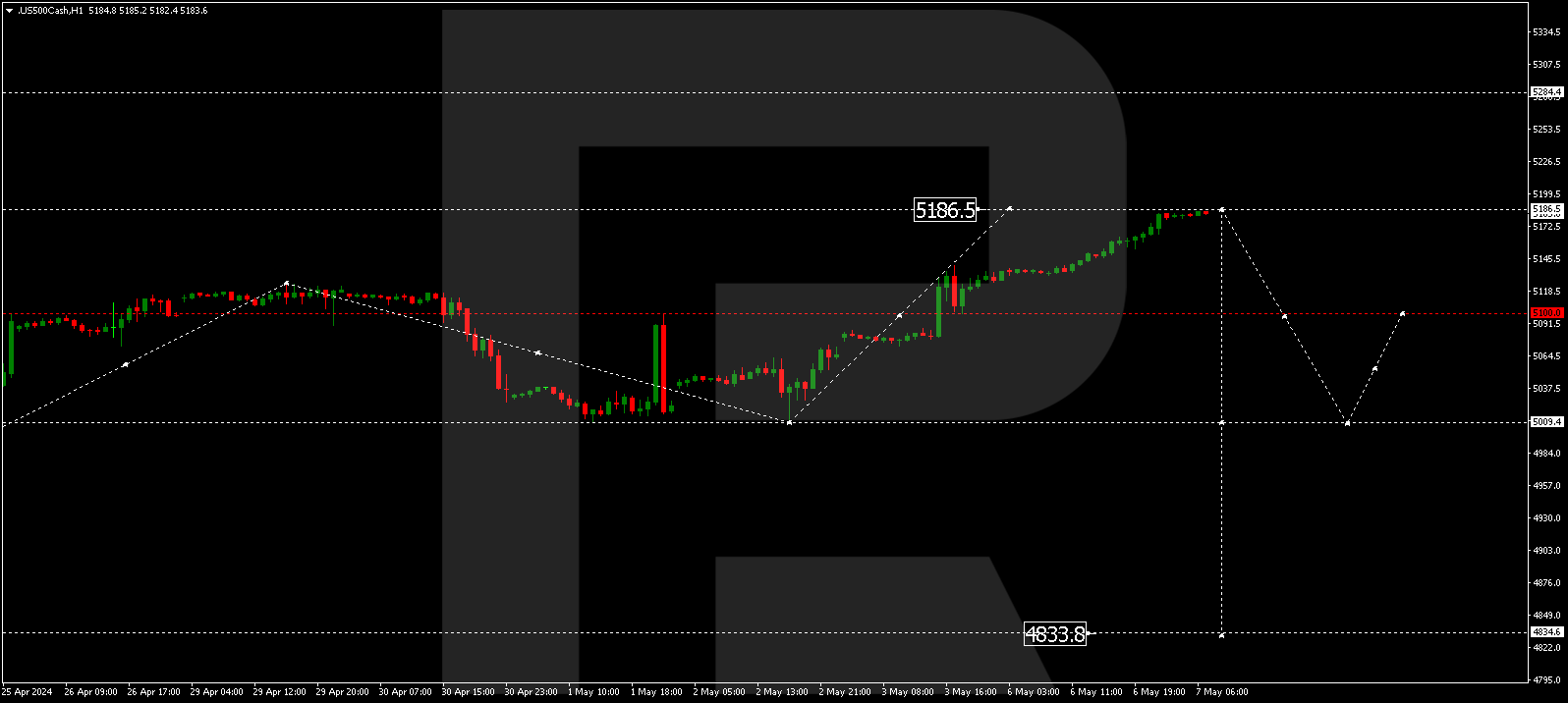

S&P 500

The stock index has completed a decline wave towards 5135.0. A correction link to 5182.0 has formed today. A consolidation range is expected to develop under this level. With a downward escape from the range, the potential for a decline wave to 5125.0 might open. This is the first target. Once this level is reached, a correction towards 5205.0 might start.