Technical Analysis & Forecast 11.08.2023

EURUSD, “Euro vs US Dollar”

EURUSD has broken the consolidation range upwards and completed another link of correction to the 1.1063 level. Once the price hit this level, the market started to develop a new wave of decline to the 1.0955 level. A link of growth to 1.1000 (a test from below) could begin next, followed by a decline to 1.0888.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD received support at the 1.2708 level and completed another link of correction to the 1.2817 level. Once the price hit this level, the market started to develop another wave of decline to 1.2626. A link of growth to 1.2720 could develop next, followed by a decline to 1.2586. This is a local target.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues to develop a wave of growth to the 145.10 level. After the price reaches this level, a correction to 143.43 could start. Once the correction is over, a new wave of growth to 146.30 could follow. This is a local target.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed another corrective wave to the 0.8690 level. Today the market is forming a new wave of growth to the 0.8810 level. After the price hits this level, a link of correction to 0.8750 could develop, followed by growth to 0.8870. This is a local target.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed another structure of growth to the 0.6614 level. After the price reached this level, the market started to develop a structure of decline to the 0.6464 level. A link of correction to 0.6525 is not excluded, followed by a decline to 0.6433. This is the first target.

BRENT

Brent continues to form a consolidation range below the 87.51 level. A downward correction to the 82.75 level is not excluded, followed by growth to 90.82 with the prospect of trend continuation to 93.53. This is a local target.

XAUUSD, “Gold vs US Dollar”

Gold has completed another corrective structure to the 1929.90 level and began to develop a new wave of decline. The price has completed its movement to 1912.00 and corrected to 1921.60. Today a link of decline to the 1910.70 level has been performed. A consolidation range is expected to form above this level. With an upward breakout, a link of correction to 1920.00 could follow. A downward breakout will open the potential for a decline to 1903.85. This is a local target.

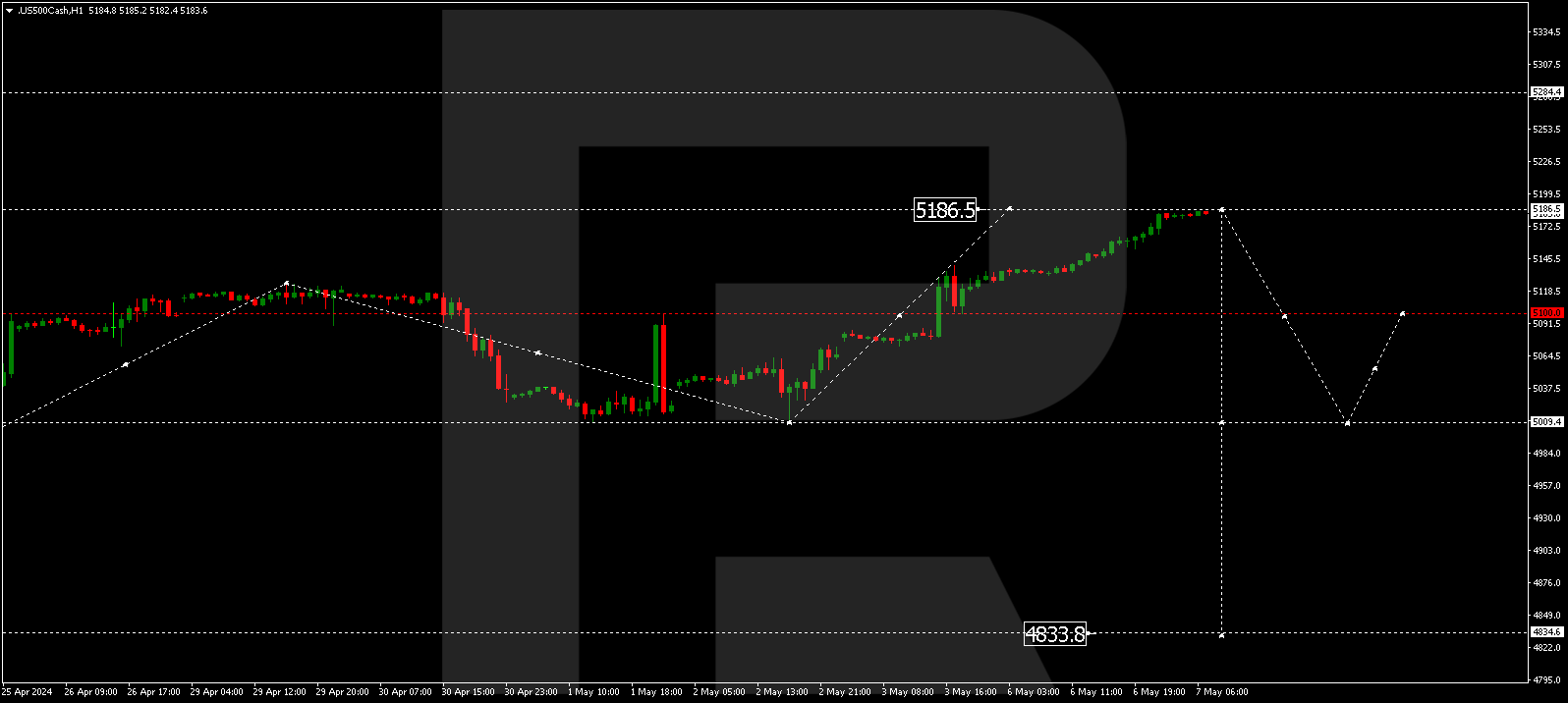

S&P 500

The stock index has completed a corrective wave to the 4520.0 level. Then the market started to develop a new structure of decline to the 4435.2 level. Once the price hits this level, a link of growth to 4470.0 (a test from below) could form, followed by a decline to 4360.0. This is the first target.