Technical Analysis & Forecast 15.05.2023

EURUSD, “Euro vs US Dollar”

The currency pair has completed a wave of decline to 1.0844. Today the market is forming a consolidation range above this level. A structure of growth could develop to 1.0920, followed by a decline to 1.0833. If the price breaks the range upwards, the potential for a rise to 1.0950 could open. With an escape downwards, a decline to 1.0793 might be expected.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to 1.2444. Today the market is forming a consolidation range above this level. A link of growth to 1.2515 is not excluded, followed by a decline to 1.2416. If the price breaks the range upwards, the potential for a corrective wave to 1.2599 could follow. With an escape downwards, a decline to 1.2355 might be expected.

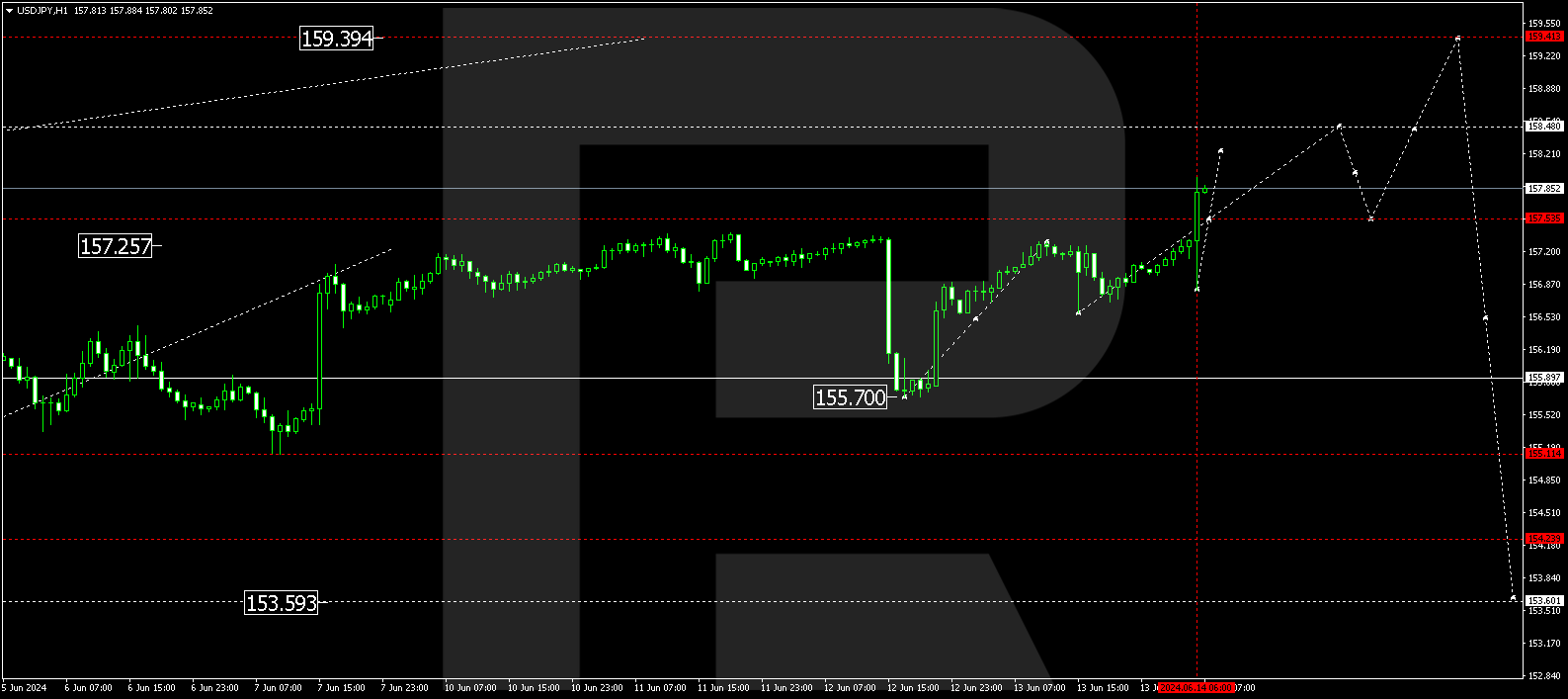

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of growth to 135.81. Today the market is forming a consolidation range above this level. If the price breaks the range upwards, the potential for a rise to 137.85 could open. This is a local target. After the price reaches this level, a correction to 135.80 could develop.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a structure of growth to 0.8986. A link of correction to 0.8930 is expected today, followed by growth to 0.9050. And if this level also breaks, the trend might continue to 0.9101.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of decline to 0.6636. Today the market is forming a consolidation range above this level. If the price breaks the range upwards, a correction to 0.6700 could follow. With an escape downwards, the potential for a wave of decline to 0.6595 could open.

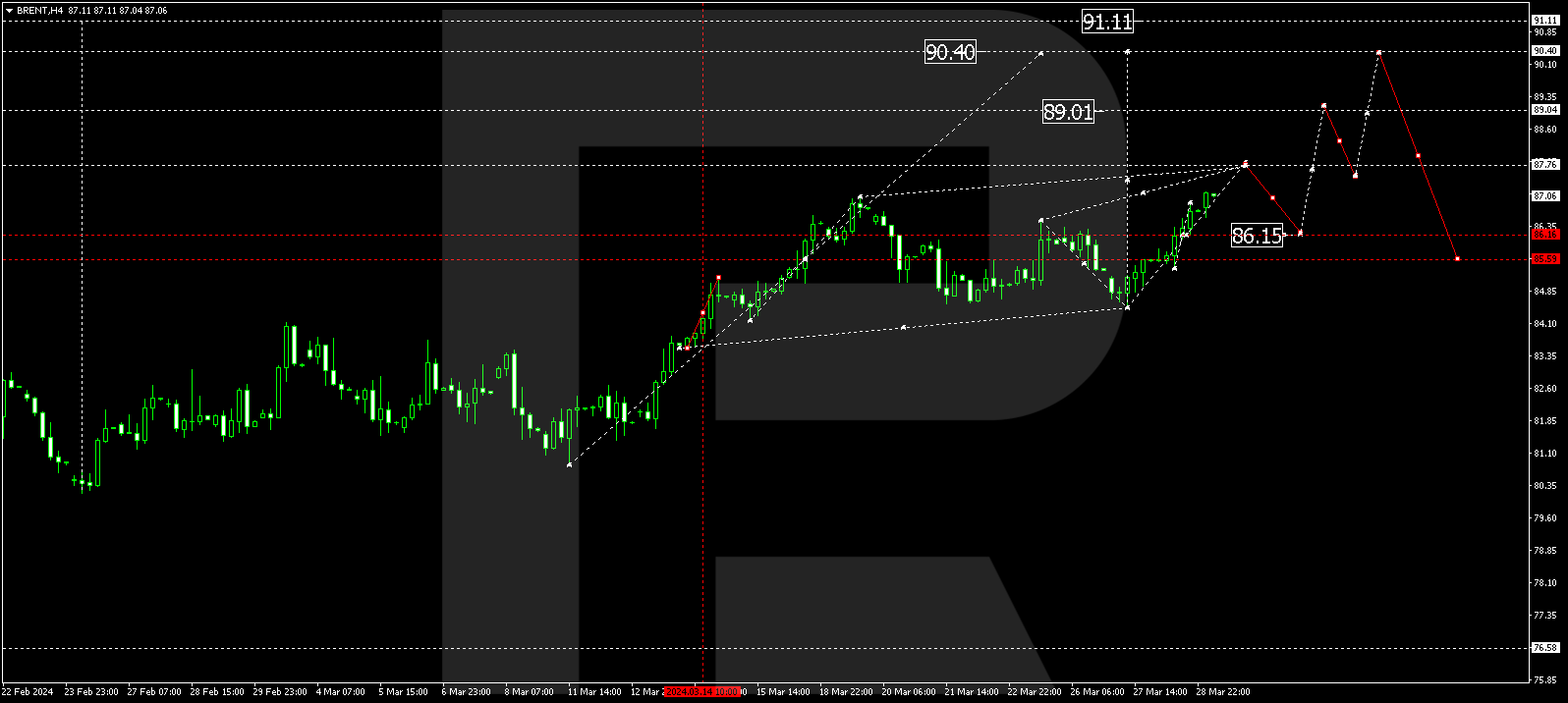

BRENT

In Brent, further correction to 72.33 is not excluded. After it is over, a wave of growth to 79.20 could begin. And if this level also breaks upwards, the potential for growth to 82.60 could open, from where the trend could continue to 86.06. This is a local goal.

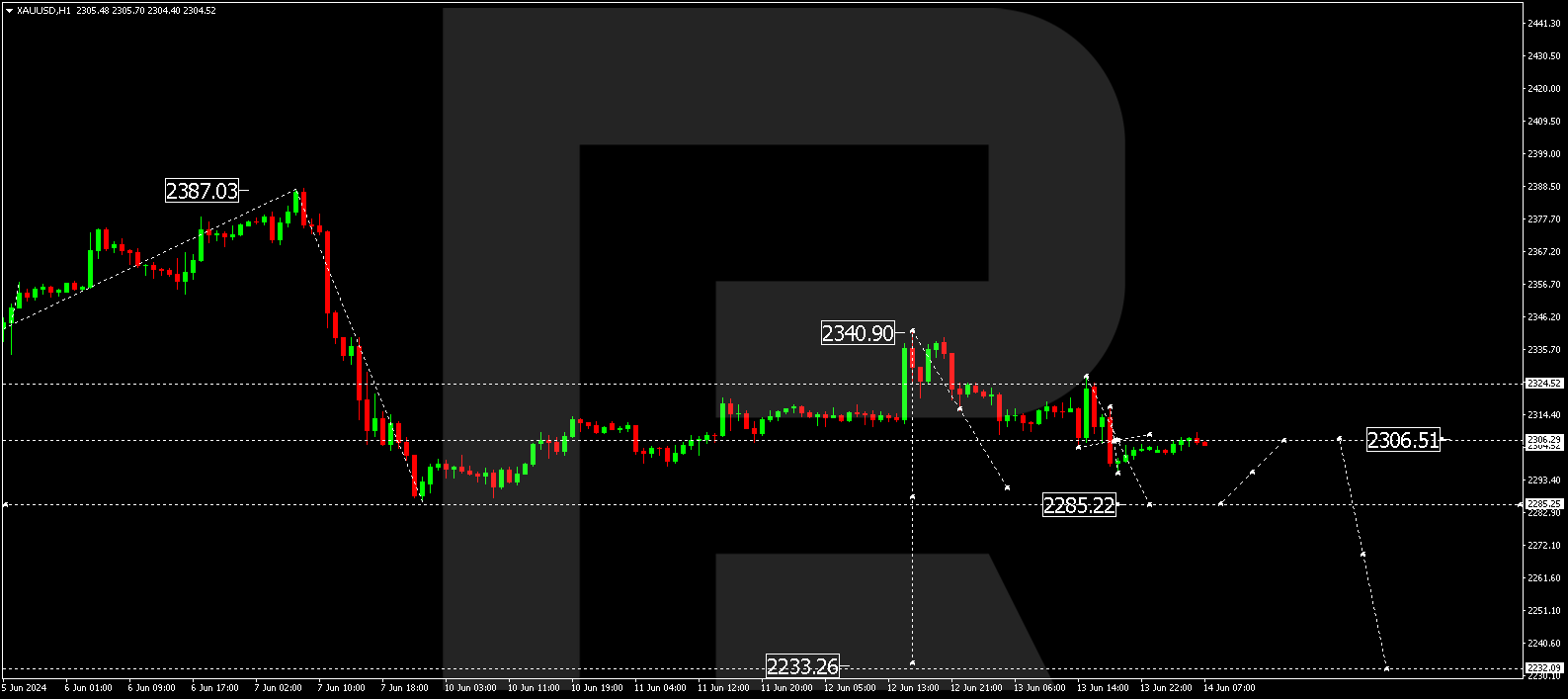

XAUUSD, “Gold vs US Dollar”

Gold goes on developing a consolidation range around 2012.85. A link of growth to 2025.10 is not excluded. Then a structure of decline to 1984.45 might start developing, from where the trend could continue to 1978.45.

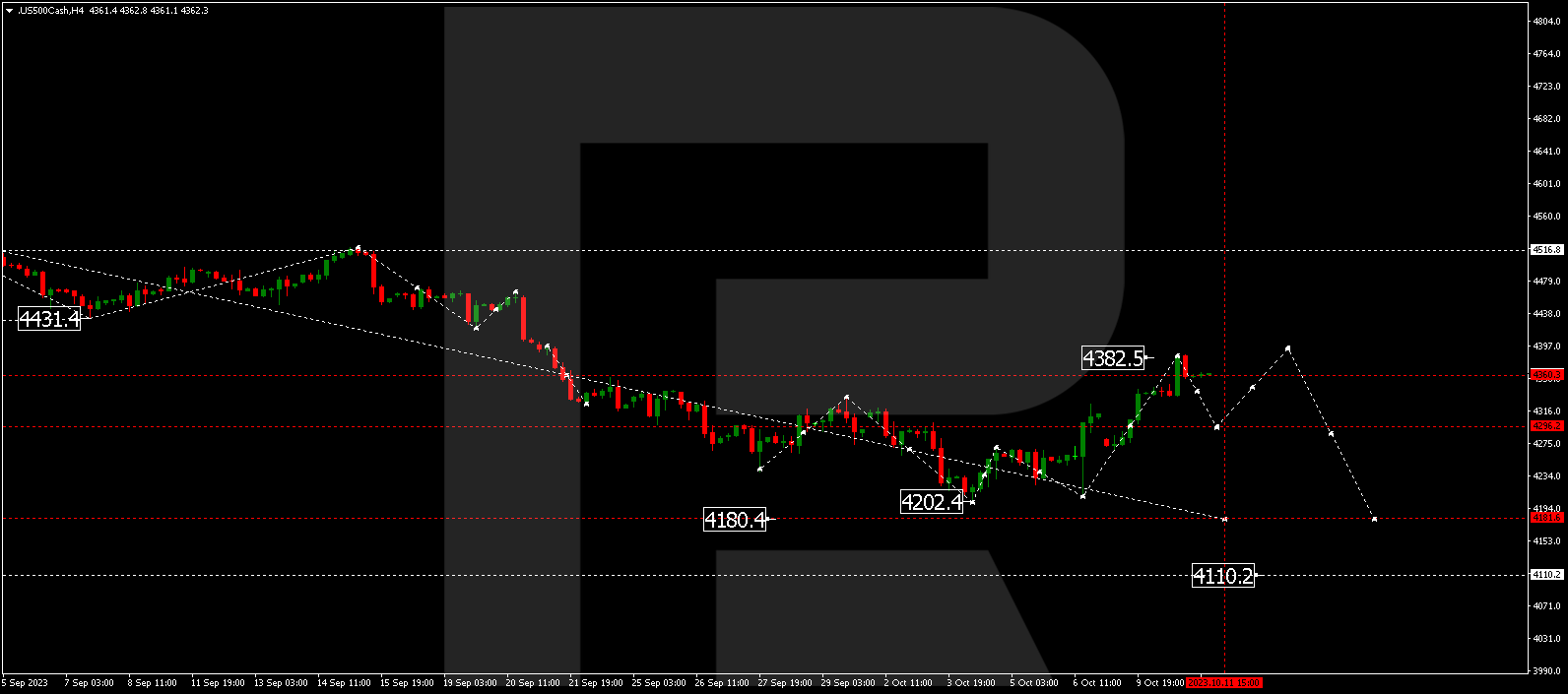

S&P 500

The stock index continues developing a consolidation range around 4133.0 without any bright trend. With an escape upwards, a link of growth to 4215.0 is not excluded. And if the price breaks the range downwards, the potential for a wave of decline to 3945.0 could start, from where the trend could continue to 3900.0.