Technical Analysis & Forecast 15.05.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair has received support at the 1.0766 level and completed a growth structure, reaching 1.0805. A narrow consolidation range has formed around this level. Today, with an upward breakout, a rise to 1.0827 is expected, followed by a potential decline to 1.0805 (testing from above). Subsequently, the price could rise to the corrective wave target of 1.0844. Once the correction is complete, a new decline wave might start, aiming for 1.0725 as the first target of another decline wave.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has received support at the 1.2509 level and completed a growth structure, reaching 1.2575. A narrow consolidation range has formed around this level. Today, a rise to 1.2599 is expected, followed by a potential decline to 1.2575 (testing from above). Subsequently, the price could rise at least to 1.2630, practically extending a corrective wave. Once the correction is complete, a new decline wave is expected to start, aiming for 1.2444 as the first target.

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a growth wave, reaching 156.77. Today, the market has formed a correction towards 156.22. A consolidation range is expected to develop above this level, possibly extending to 157.09, with another potential growth structure targeting 157.33. At this point, the growth wave will exhaust its potential. Next, a new decline wave could start, aiming for 154.50 as the first target.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is currently in a consolidation phase around 0.9066. The consolidation range has extended upwards to 0.9101 and today could expand downwards to 0.9039. An upward breakout will open the potential for a growth wave towards 0.9220. With a downward breakout, a decline to 0.9009 is not ruled out, followed by a rise to 0.9222.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has received support at the 0.6577 level and risen to 0.6620. The market has formed a consolidation range around this level. Today, a rise to 0.6650 is expected, followed by a potential decline to 0.6622 (testing from above). Subsequently, the price could rise to 0.6666. At this point, the corrective wave will exhaust its potential. A new decline wave could start, aiming for 0.6444 as the first target.

BRENT

Brent is currently in a consolidation phase around 82.75. The consolidation range has extended downwards to 81.85 and today could expand upwards to 83.80. With an upward breakout of the range, a new growth wave could start, aiming for 85.55 as the local target.

XAUUSD, “Gold vs US Dollar”

Gold has received support at the 2336.46 level and risen to 2361.00. Today, a decline to 2347.07 (testing from above) could follow. Next, another corrective link might develop, targeting 2362.44. Once the correction is complete, a new decline wave might start, aiming for 2273.11 as the local target.

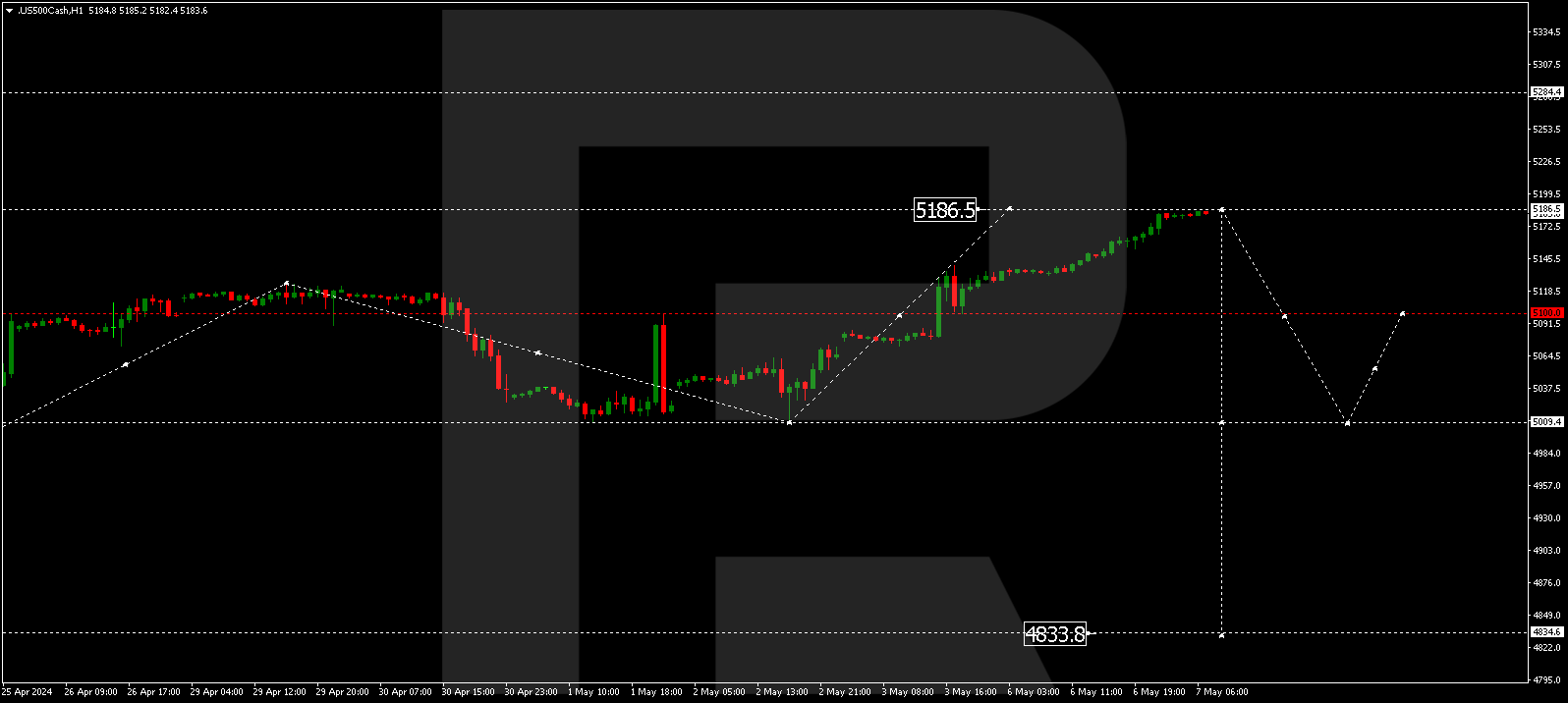

S&P 500

The stock index has received support at 5196.0. The market has completed a growth link, reaching 5250.5. Today, a consolidation range is forming around this level, potentially extending to 5262.2. Next, a new decline wave could start, aiming for 5200.0 as the first target of the decline wave.