Technical Analysis & Forecast 16.01.2024

EURUSD, “Euro vs US Dollar”

EURUSD has broken the 1.0950 level downwards and continues extending the range to the lower boundary. The target is 1.0913. Once this level is reached, a new consolidation range might form under it. With an escape from the range upwards, a growth structure to 1.0950 might form. In case the price breaks the level downwards, the potential for a decline wave to 1.0877 could open. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has broken the 1.2727 level downwards and continues declining to the lower boundary of the consolidation range. The target is 1.2667. Once this level is reached, a new consolidation range could form. If the price escapes it upwards, a growth structure to 1.2727 could develop. With an escape downwards, the decline wave might continue to 1.2608. This is a local target.

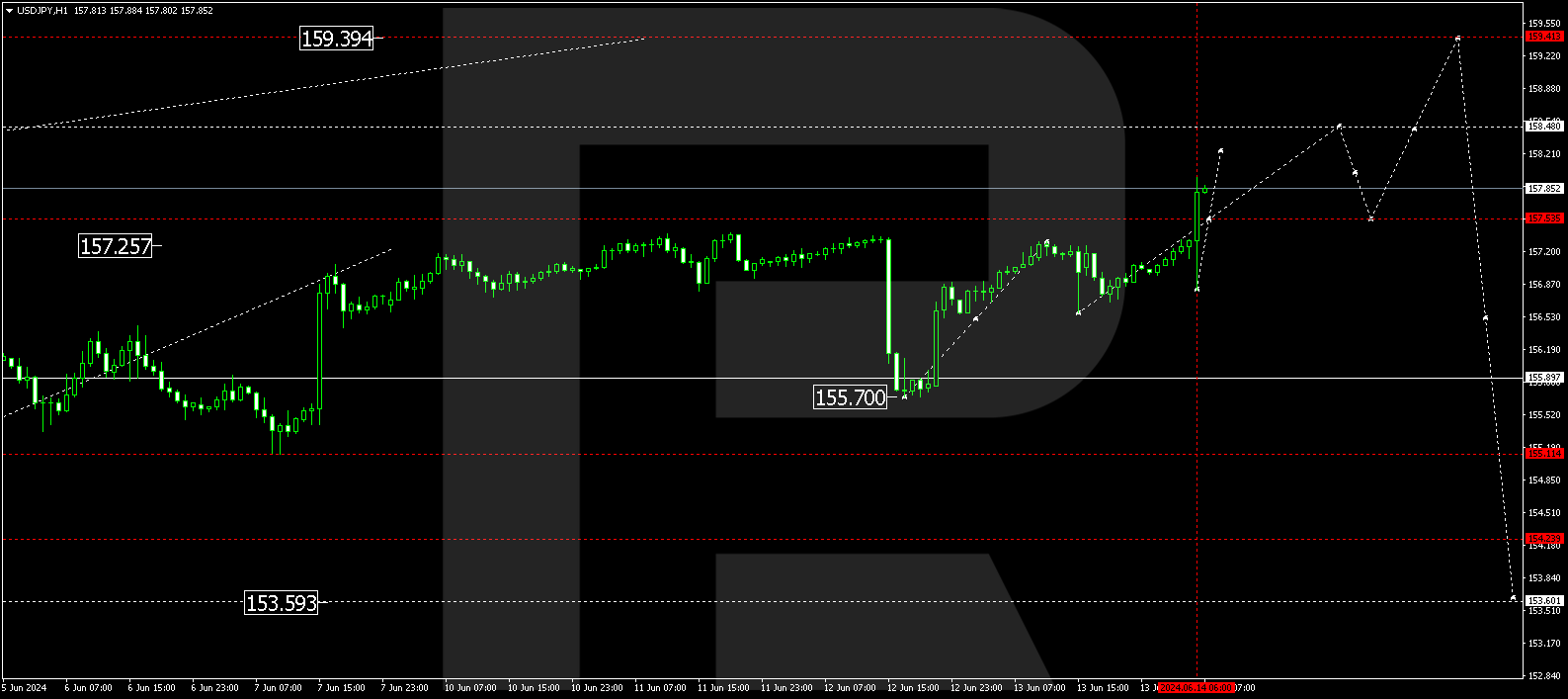

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues developing a growth wave to 146.30. Next, a decline link to 145.30 is expected. And if this level also breaks downwards, the potential for a decline to 144.08 might open. This is a local target.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues developing a growth structure to 0.8580. Once this level is reached, the price could drop to 0.8530. Practically, a new consolidation range is forming at these levels. With an escape from the range upwards, the wave could continue to 0.8700. This is a local target. With an escape downwards, the correction might continue to 0.8455, followed by a rise to 0.8700.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a decline wave to 0.6612. A consolidation range is forming around this level today. With an escape from the range upwards, a correction to 0.6657 is expected. With an escape downwards, the decline wave might continue to 0.6588.

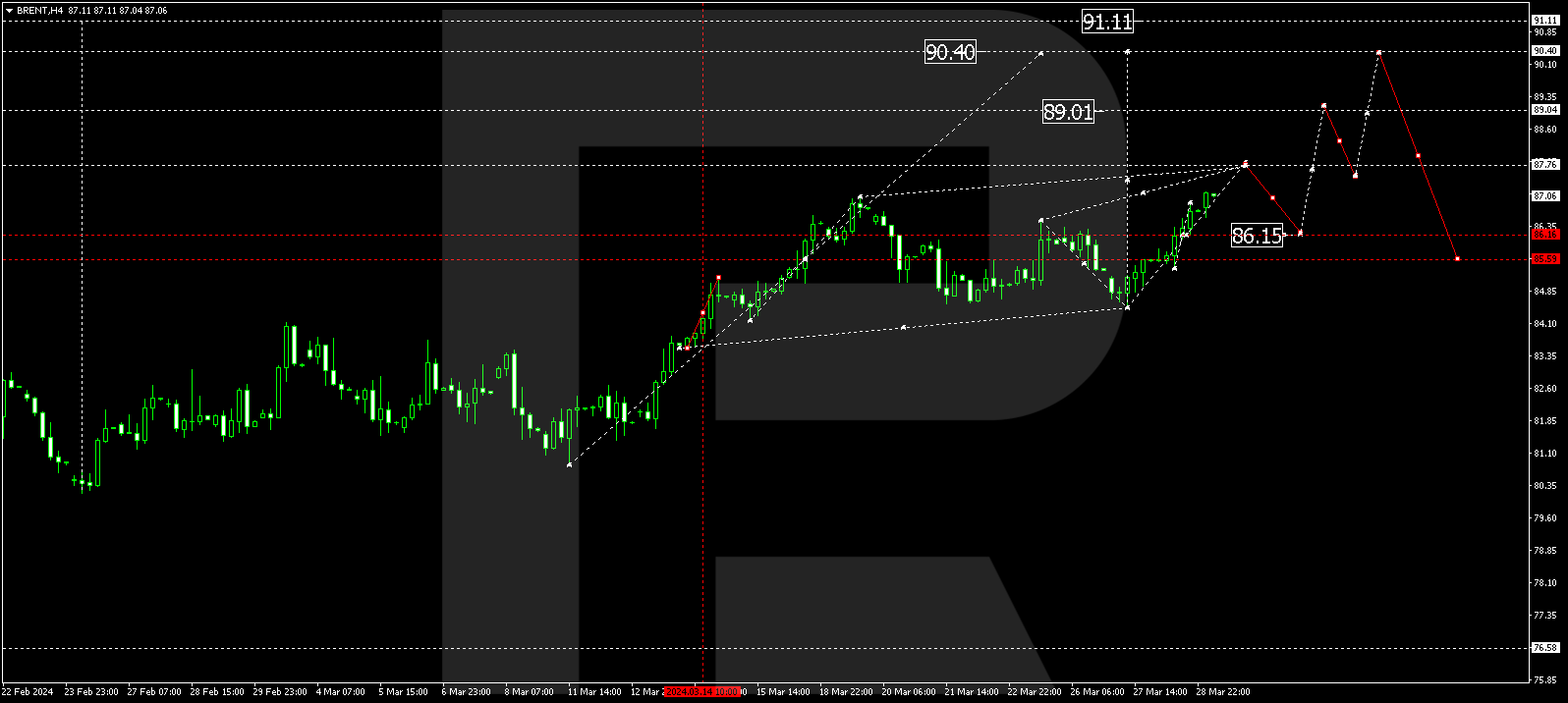

BRENT

Brent has completed a correction link to 76.88. The growth wave might extend to 79.30, from where the trend could continue to 82.00. This is a local target. Next, a decline to 79.30 (a test from above) and a rise to 82.82 might follow.

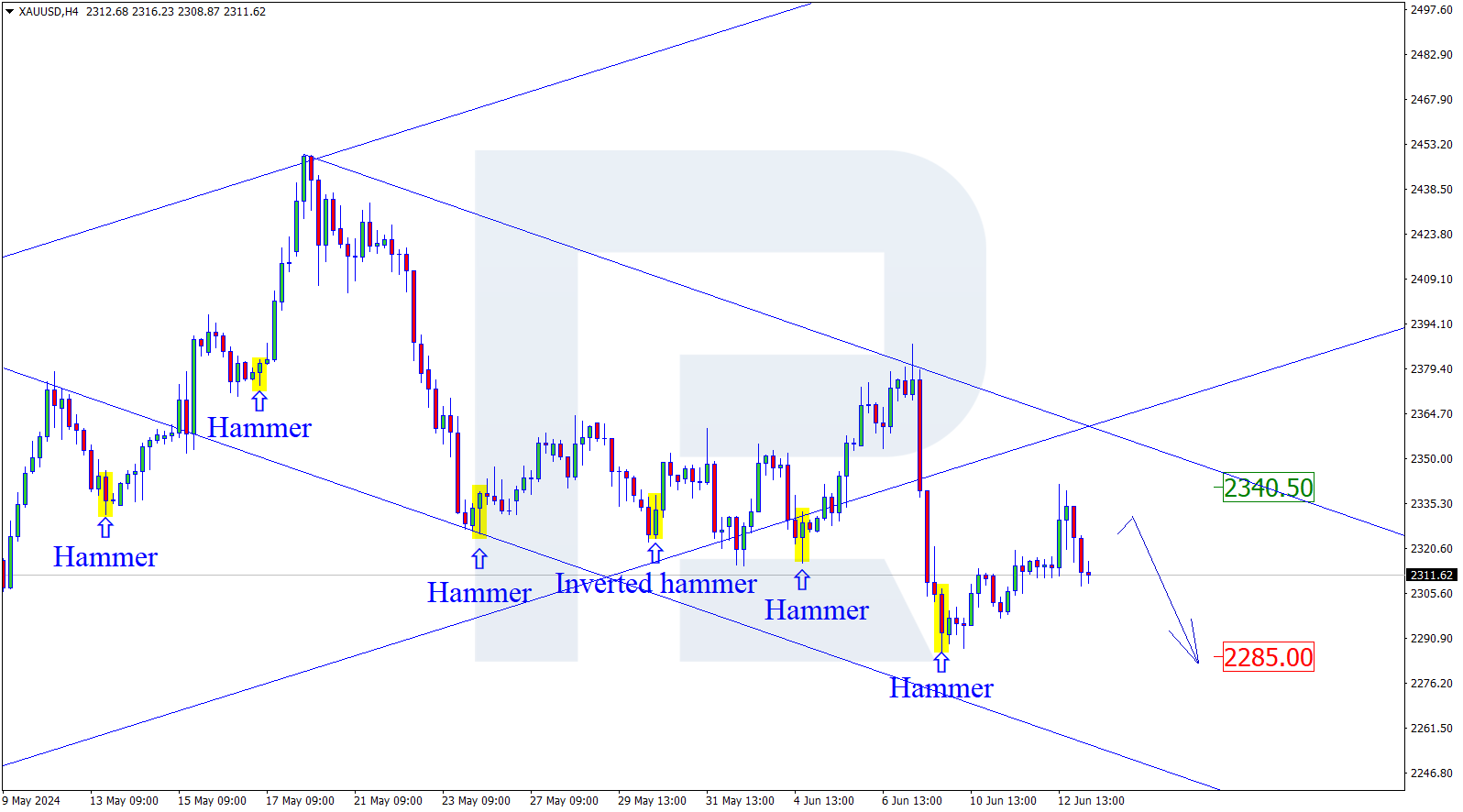

XAUUSD, “Gold vs US Dollar”

Gold continues developing a correction to 2042.77. Once this level is reached, a growth link to 2073.00 is not excluded, followed by a new correction link to 2042.77 and a rise to 2131.77. This is the first target.

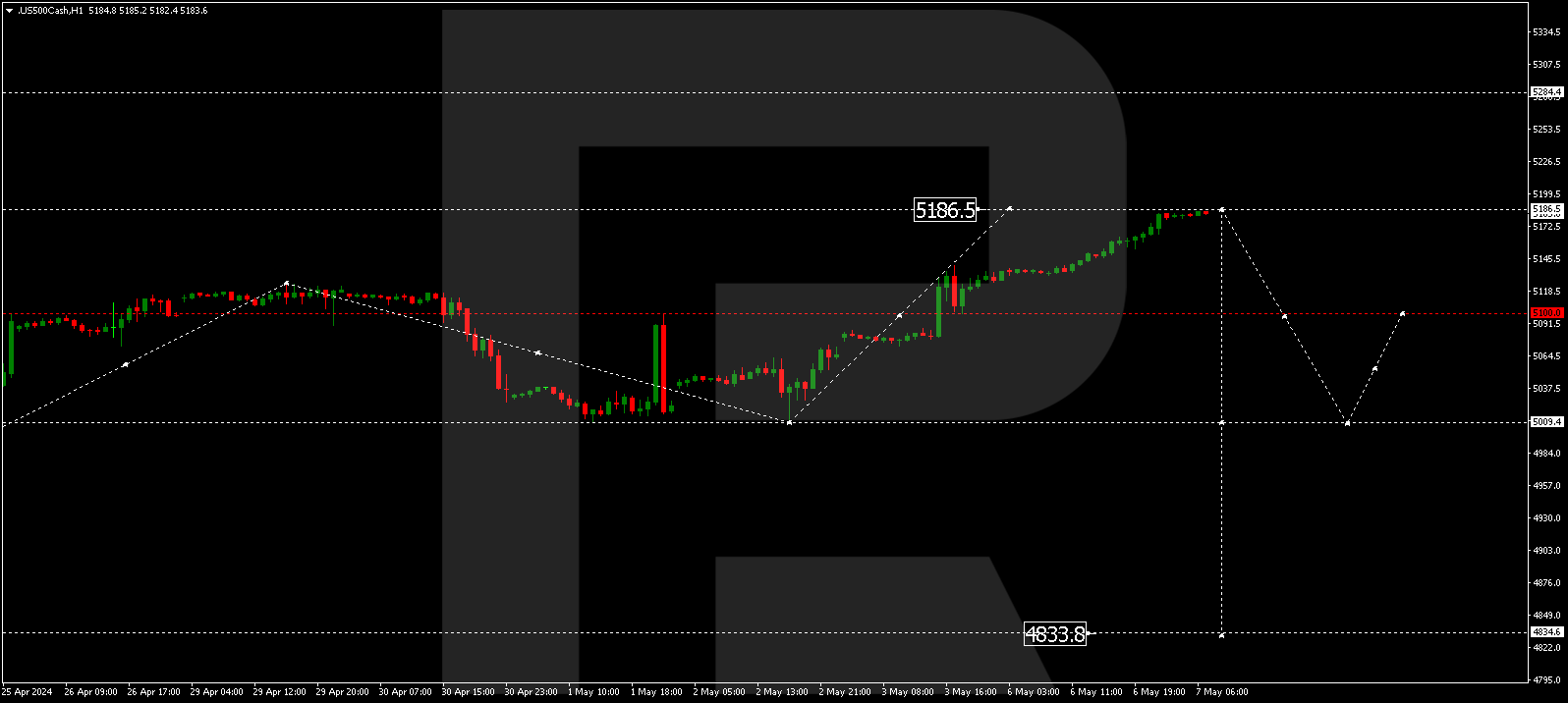

S&P 500

The stock index has broken the 4770.0 level downwards. The decline wave is expected to continue to the lower boundary of the consolidation range. The target is 4737.7. Once this level is reached, a correction link to 4770.0 is not excluded, followed by a decline to 4705.0. This is a local target.