Technical Analysis & Forecast 20.02.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair is forming a consolidation range around 1.0760. A decline link to 1.0755 is not excluded today. The quotes might escape the range upwards, aiming at 1.0823. Once this level is reached, a new decline wave to 1.0717 is expected. This is the first target of a new decline wave.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair is forming a consolidation range around 1.2600. A decline structure to 1.2575 might form today. Once this level is reached, a growth link to 1.2639 could form, followed by a decline to 1.2570. And if this level also breaks, the potential for a decline wave to 1.2500 could open.

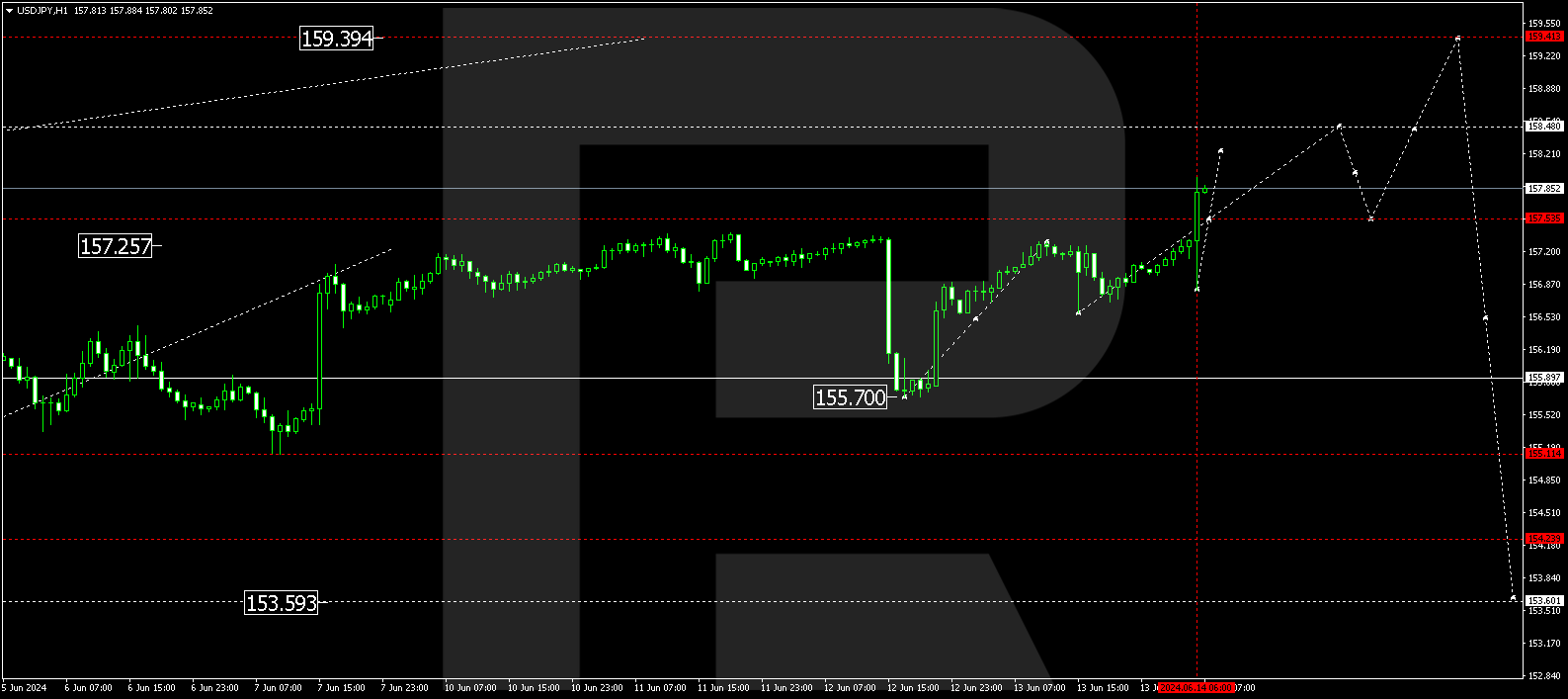

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has concluded a growth wave to 150.35. A consolidation range is currently forming around this level. With a downward escape from the range, the potential for a decline to 149.37 might open. And with an escape upwards the growth wave could extend to 150.80.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has escaped a consolidation range upwards and might form a correction link to 0.8841. Once this level is reached, a decline link to 0.8787 is not excluded. And with a breakout of this level, the potential for a decline to 0.8740 might open.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair is forming a consolidation range around 0.6537. A growth link to 0.6565 might follow. Next, a new decline wave to 0.6500 is expected. And if this level also breaks, a decline to 0.6535 could form.

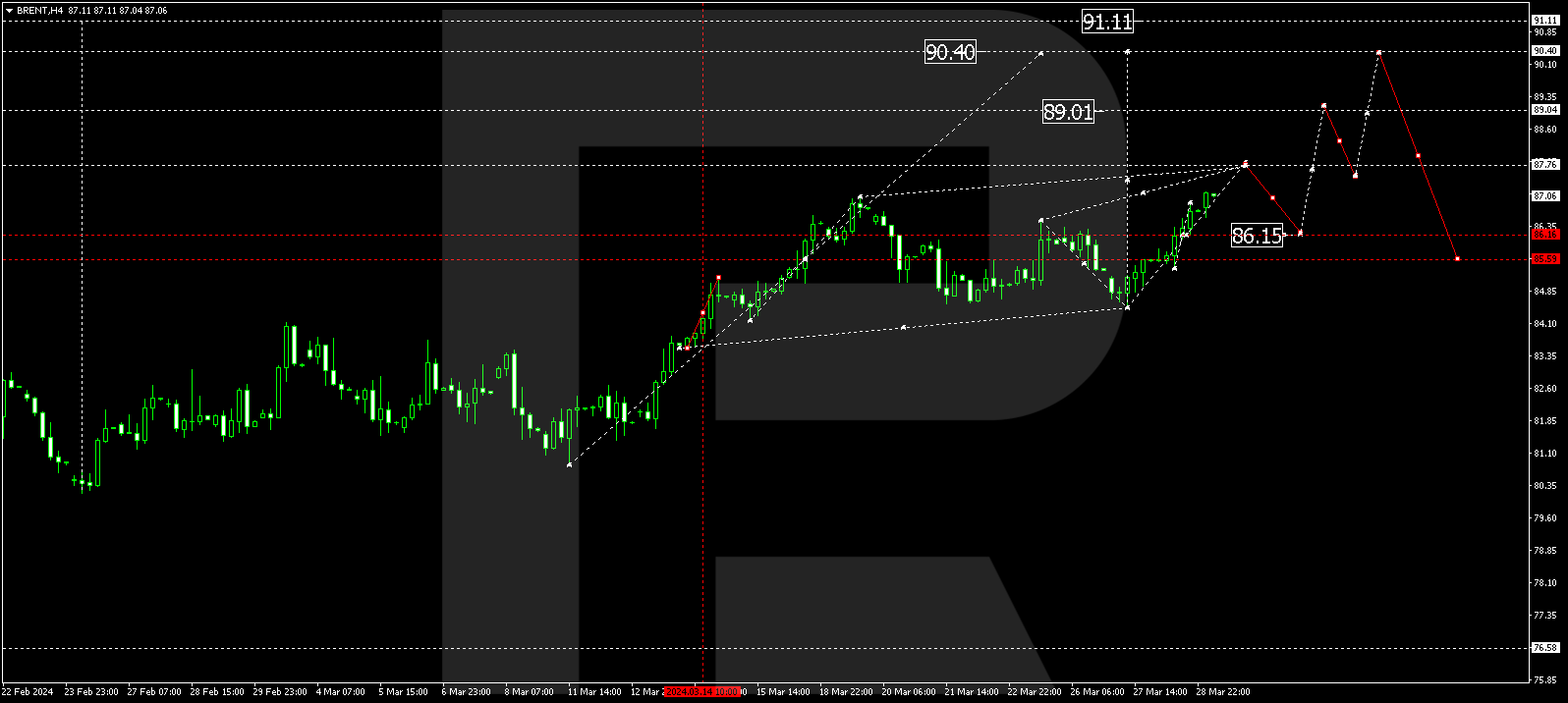

BRENT

Brent continues developing a growth wave to 84.50. Once this level is reached, a correction link to 82.35 might follow. Once this correction is over, a growth wave to 86.55 could start. This is the first target.

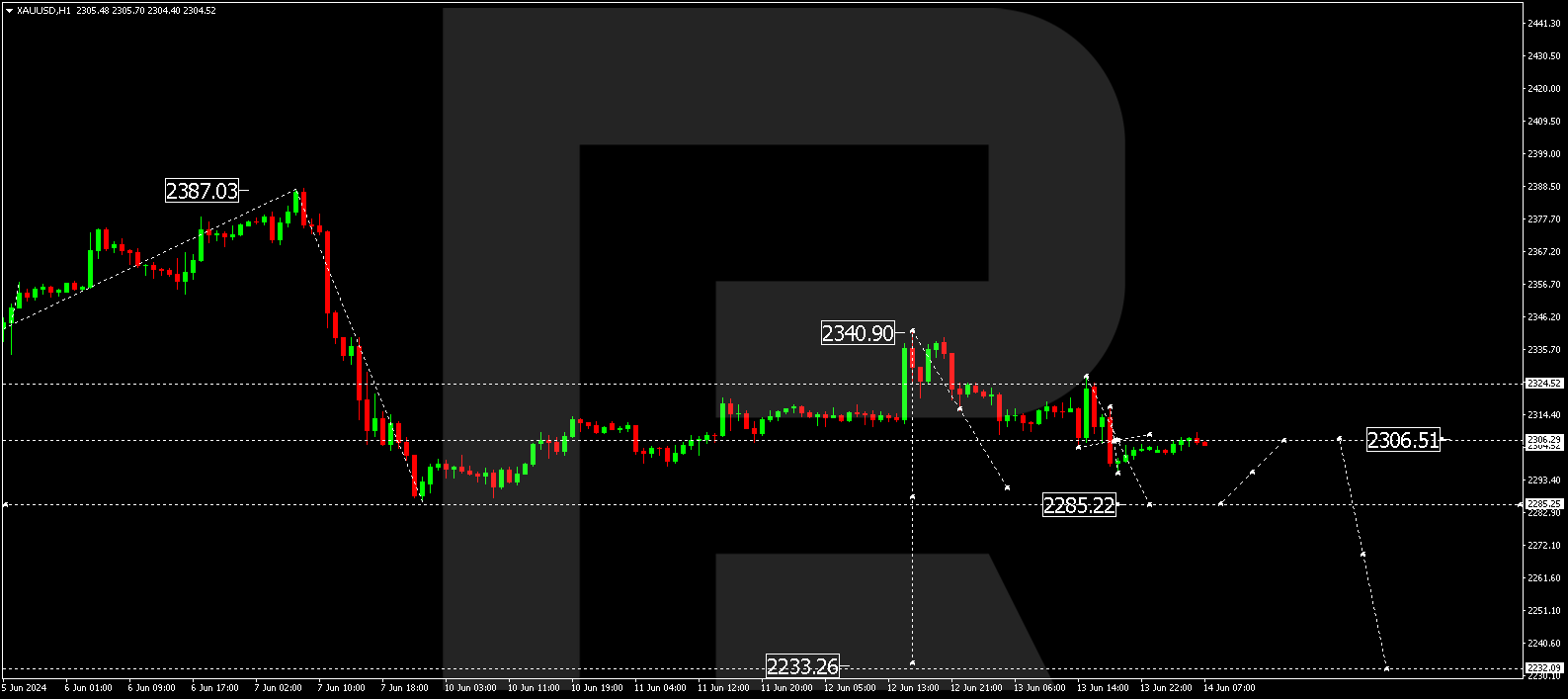

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave to 2022.85. Today the quotes could correct to 2013.13 (a test from above). Next, another growth structure to 2033.00 might follow. Upon reaching this level, the quotes could begin a decline to 2009.25.

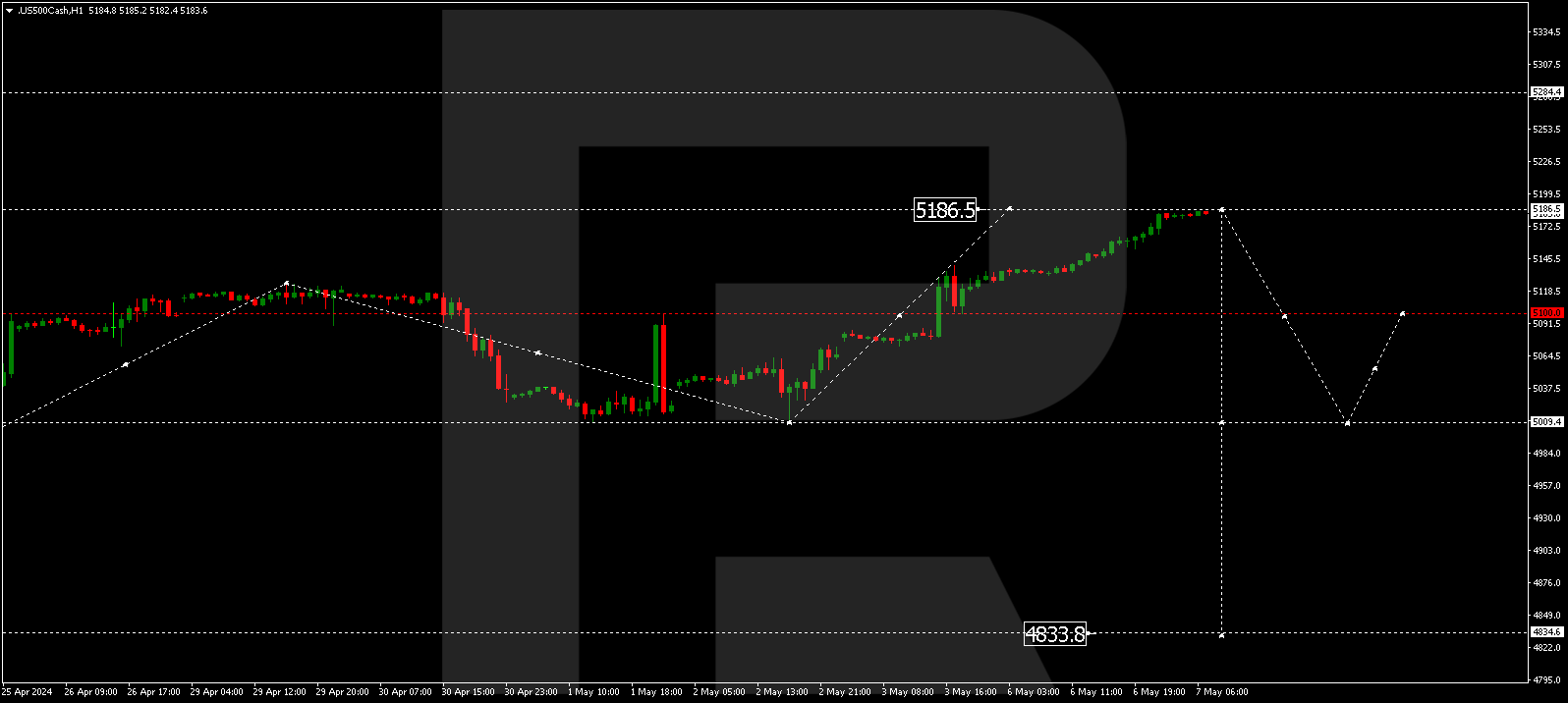

S&P 500

The stock index is forming a consolidation range around 4997.3. A decline link to 4979.0 is expected, followed by a rise to 4997.0 (a test from below) and a decline to 4952.0. This is a local target.