Technical Analysis & Forecast 21.02.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair formed a structure of a growth wave to 1.0838 and a decline structure to 1.0803 today. Currently, a growth link to 1.0820 is forming. Practically, a new consolidation range might go by these levels. With an escape upwards, the range might expand to 1.0850. With a downward escape, the potential for a new decline wave to 1.0755 could open. This is the first target.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed a growth wave to 1.2660. By now, a decline impulse to 1.2626 has formed. A correction link to 1.2642 might form today. Once the correction is over, a new decline wave to 1.2560 could begin, from where the trend could extend to 1.2535. This is the first target.

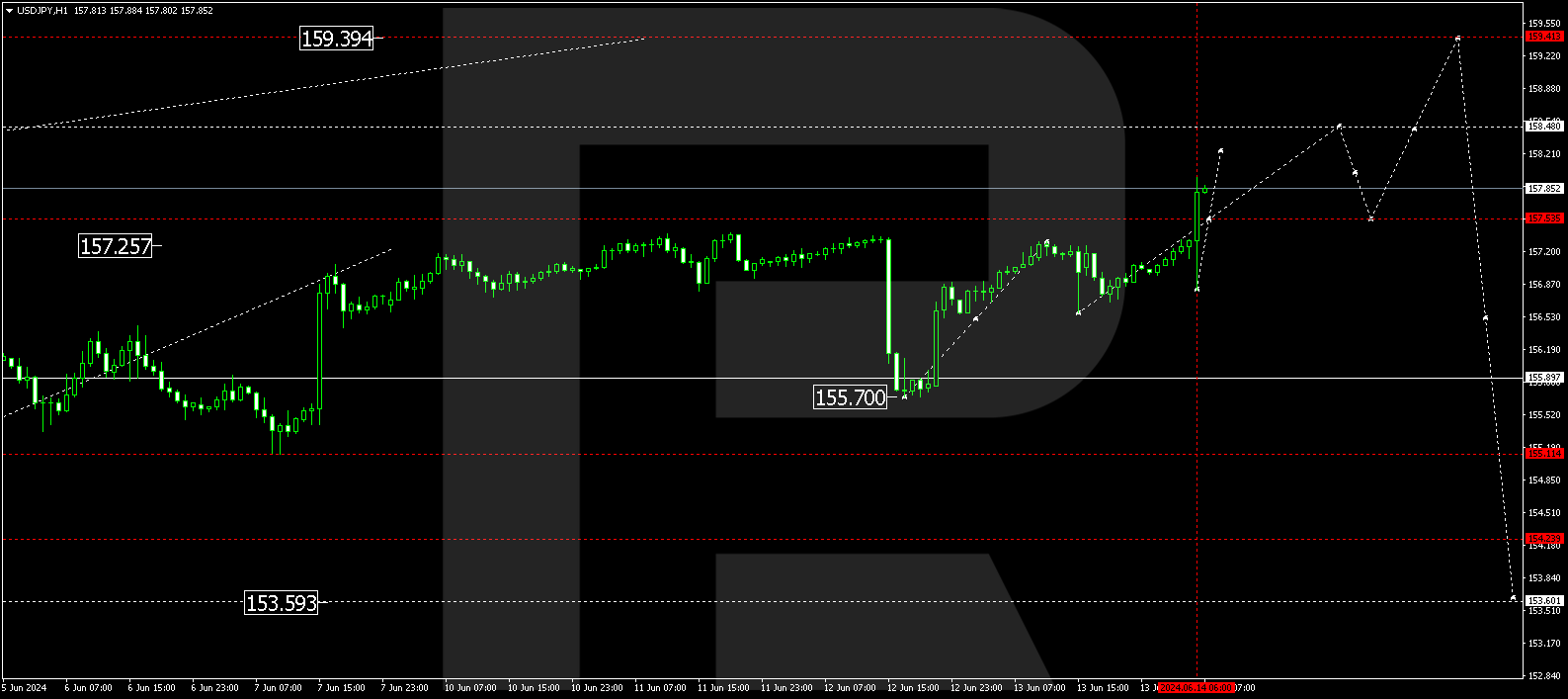

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a decline wave to 149.58. Next, the quotes might correct to 150.05 (a test from below). A decline to 149.37 is expected after that. Once this level is reached, a new growth wave to 151.50 could start.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has formed a decline link to 0.8785 by now. Today the market has returned to the consolidation range around 0.8818. With an escape from the range upwards, the potential for a rise to 0.8880 might open. And with a downward escape, the correction could continue to 0.8757.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair has completed a growth wave to 0.6577. A consolidation range is currently forming under this level. With a downward escape, the decline wave could continue to 0.6455. With an escape upwards, the correction might extend to 0.6630. Next, a decline by the trend to 0.6455 could follow. This is the first target.

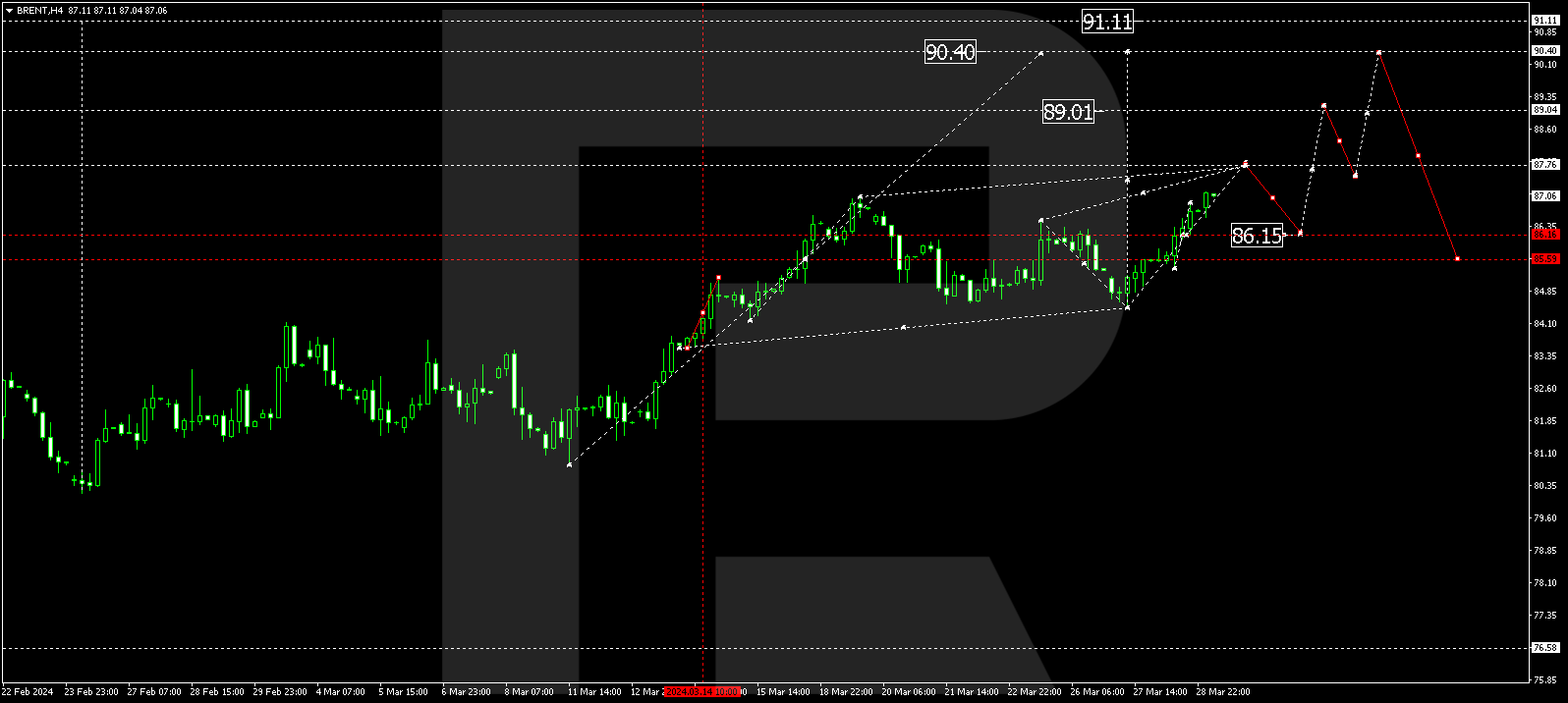

BRENT

Brent continues developing a consolidation range around 81.52 without any obvious trend. With an escape upwards, the growth wave is expected to continue to 84.64, from where the trend might continue to 86.50. This is the first target.

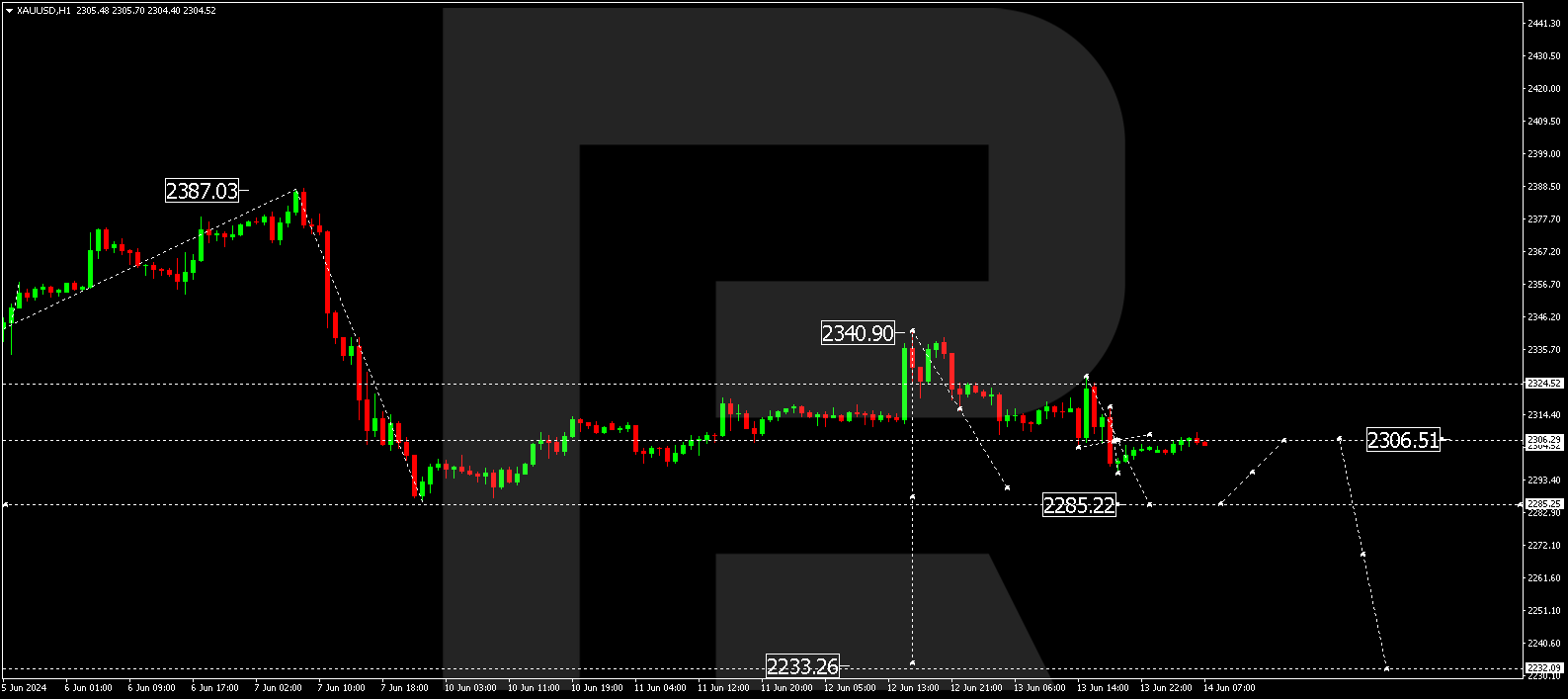

XAUUSD, “Gold vs US Dollar”

Gold extends a growth wave to 2033.00. Once this level is reached, a new decline wave to 2009.00 is expected to start. This is the first target.

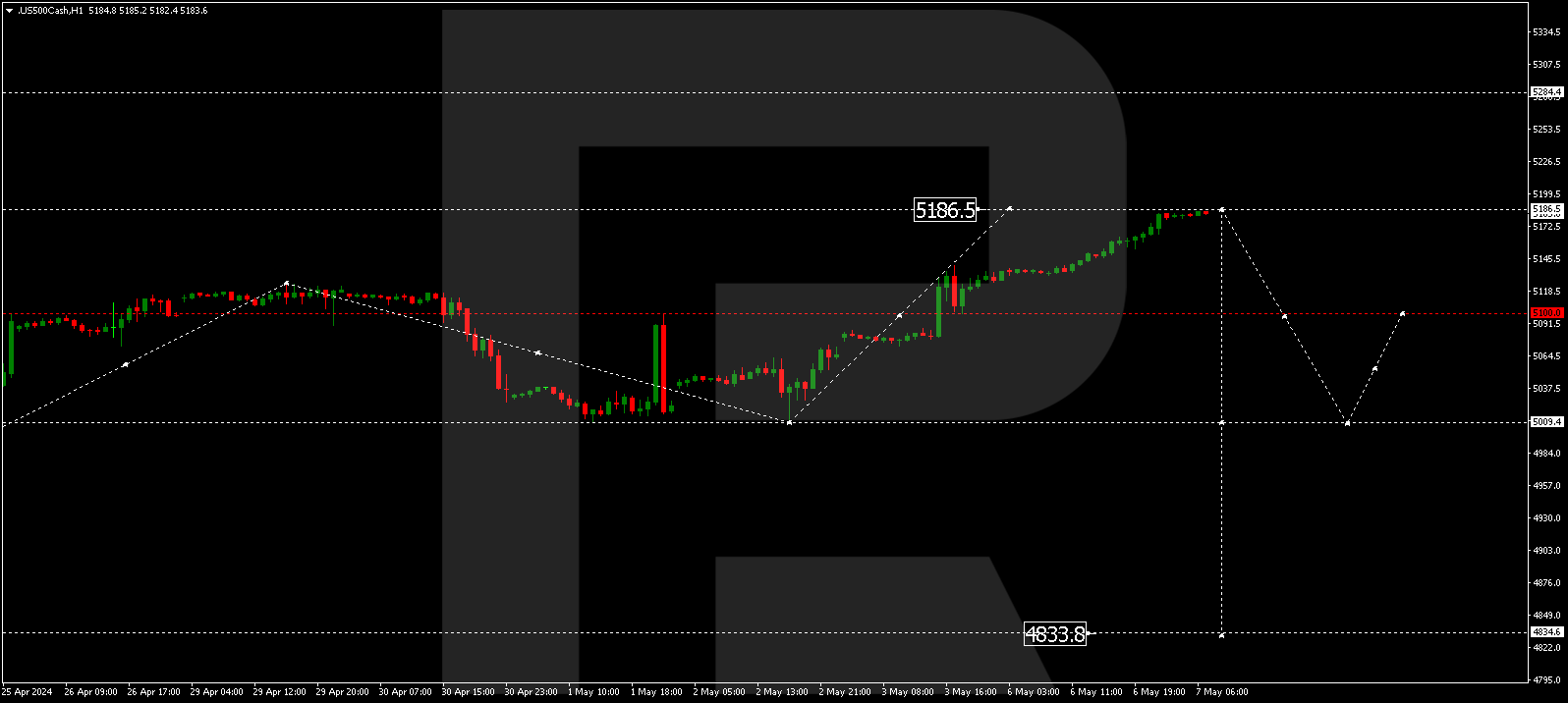

S&P 500

The stock index has completed a decline wave structure to 4956.1. A correction link to 4990.0 is not excluded today (a test from below). Next, a decline to 4942.5 could form. This is a local target.