Technical Analysis & Forecast 21.04.2023

EURUSD, “Euro vs US Dollar”

The currency pair has completed a new structure of correction to 1.0988. Today the market is forming a link of a new wave of decline to 1.0935. With a breakout of this level downwards as well, a pathway to 1.0884 could open. After the price reaches this level, a link of correction to 1.0940 is not excluded.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair continues developing a consolidation range around 1.2402. Today the range might extend to 1.2333. Then growth to 1.2402 could follow.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has reached a local target of correction at 133.80. Today growth to 134.37 looks possible. Then a decline to 133.66 is not excluded. After the quotes reach this level, a new wave of growth to 135.30 could start.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues forming a consolidation range around 0.8963. Today the market has extended it downwards to 0.8920. A link of growth to 0.8963 is expected (a test from below). Then a decline to 0.8900 might follow. After the price reaches this level, a structure of growth to 0.9009 could develop.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair extended the consolidation range upwards to 0.6770. Today the market has demonstrated a structure of decline to 0.6717, and upon breaking it goes on developing the wave to 0.6666. After the quotes reach this level, a wave of growth to 0.6717 could start (a test from below).

BRENT

Brent continues developing a wave of decline to 80.00. After the price reaches this level, a consolidation range could develop above this level. The quotes are expected to break the range upwards and start a new wave of growth to 83.55. The target is first.

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 1990.30. At a certain point, the market extended the range upwards to 2012.30. Today a structure of decline to 1990.30 could develop. And with a breakout of this level downwards, a pathway to 1965.45 could open. After the quotes reach the level, growth to 1990.30 could start (a test from below).

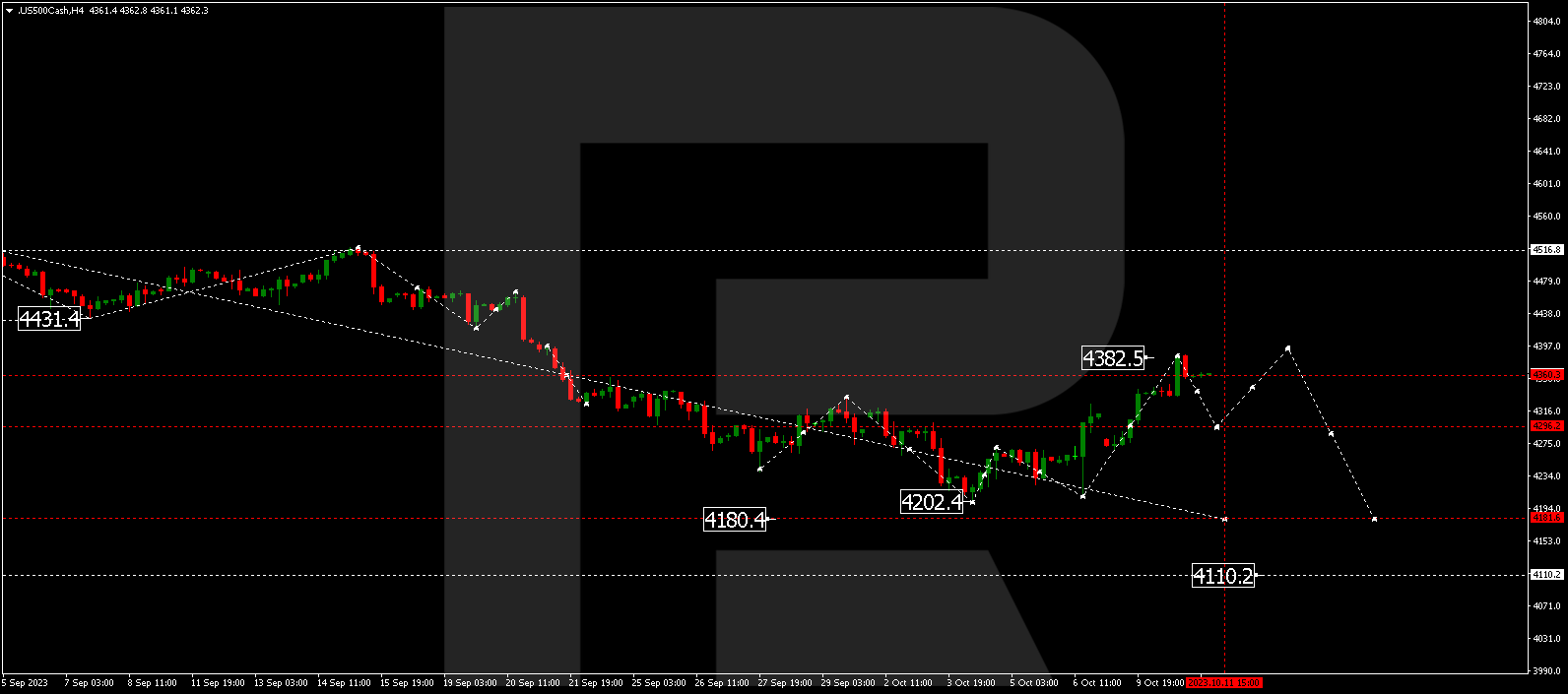

S&P 500

The stock index continues developing a consolidation range around 4140.0 without any expressed trend. At a certain point, the market extended the range down to 4117.5 and returned to 4140.0 (a test from below). Today the market could extend the range to 4110.5. Next, the quotes could grow to 4140.0 and drop to 4100.0.