Technical Analysis & Forecast 22.08.2023

EURUSD, “Euro vs US Dollar”

EURUSD has received support at 1.0875 and could extend the correction to 1.0933. Practically, a wide consolidation range continues developing around 1.0900. With the price exiting the range downwards, the wave of decline could continue to 1.0817, from where the trend might extend to 1.0733. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD continues forming a wide consolidation range around 1.2700. A link of growth to 1.2786 might follow today. After the price reaches this level, it might drop to 1.2676. And a downward breakout of this level could open the potential for a decline to 1.2650, from where the trend could continue to 1.2565.

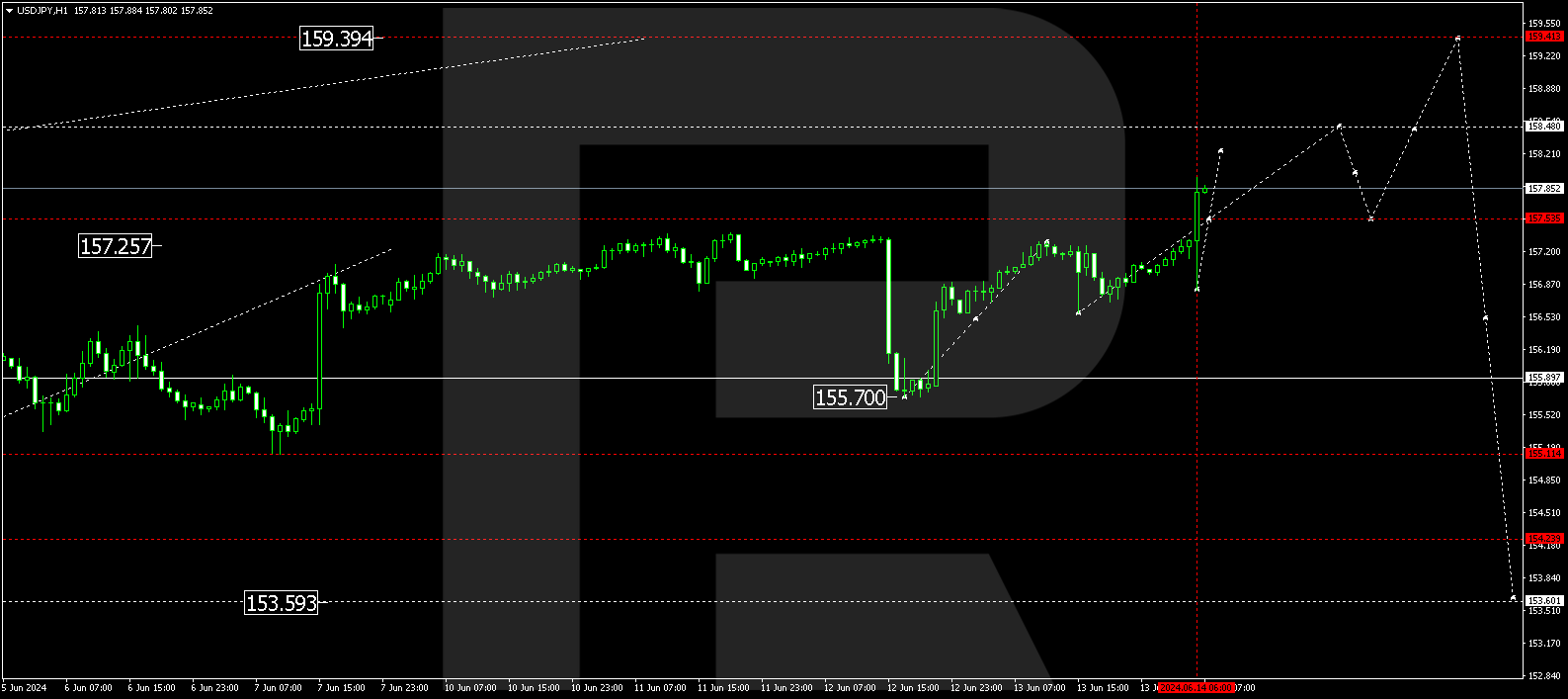

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a wave of growth to 146.38. Today the market is forming a consolidation range under this level. A link of decline to 145.75 is not excluded. After the price reaches this level, a new wave of growth to 146.75 might start. This is a local target.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues developing a consolidation range around 0.8795. The quotes exiting the range upwards might open the potential for continuing the wave to 0.8844 and extending the trend to 0.8888.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues developing a consolidation range around 0.6404. The latter might expand to 0.6444. Next, a decline to 0.6363 could follow, from where the trend might continue to 0.6277.

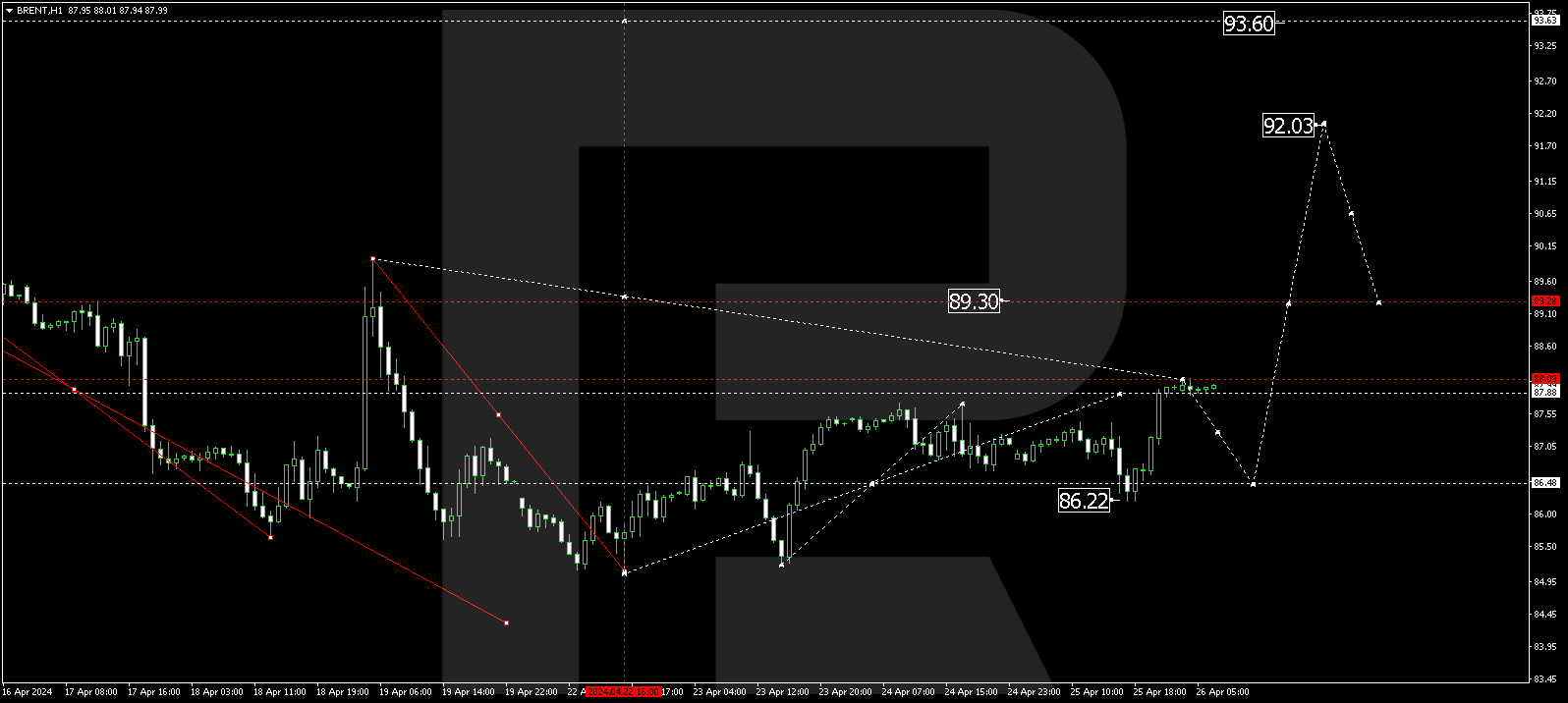

BRENT

Brent continues developing a link of decline to 83.55. After the price reaches this level, a link of growth to 85.77 is not excluded. The whole growth structure is interpreted as a corrective one. After the correction is over, a new wave of decline to 82.00 might develop, followed by a rise to 87.77. This is a local target.

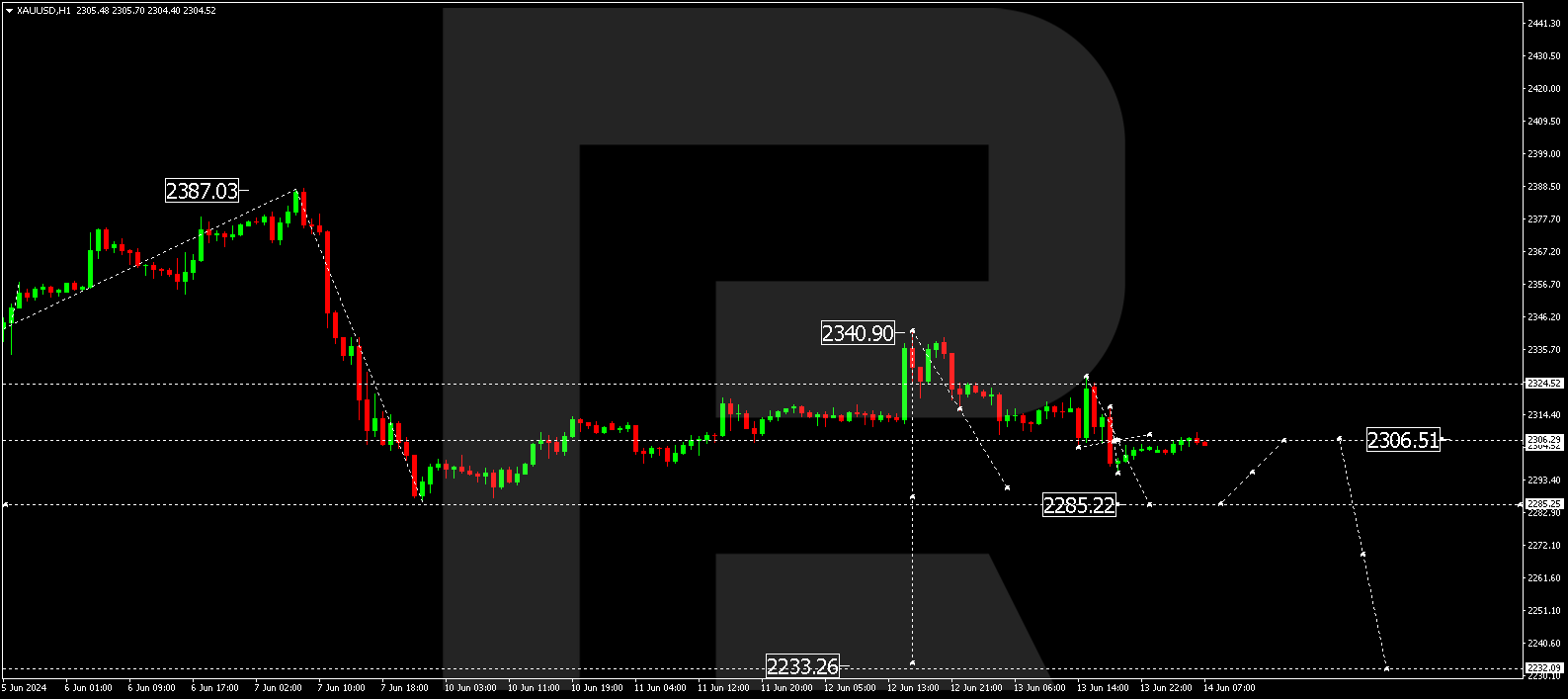

XAUUSD, “Gold vs US Dollar”

Gold has completed a structure of decline to 1884.81. Today the market continues forming a consolidation range under this level. A link of growth to 1900.50 is expected. Next, a decline to 1868.50 could follow. This is a local target.

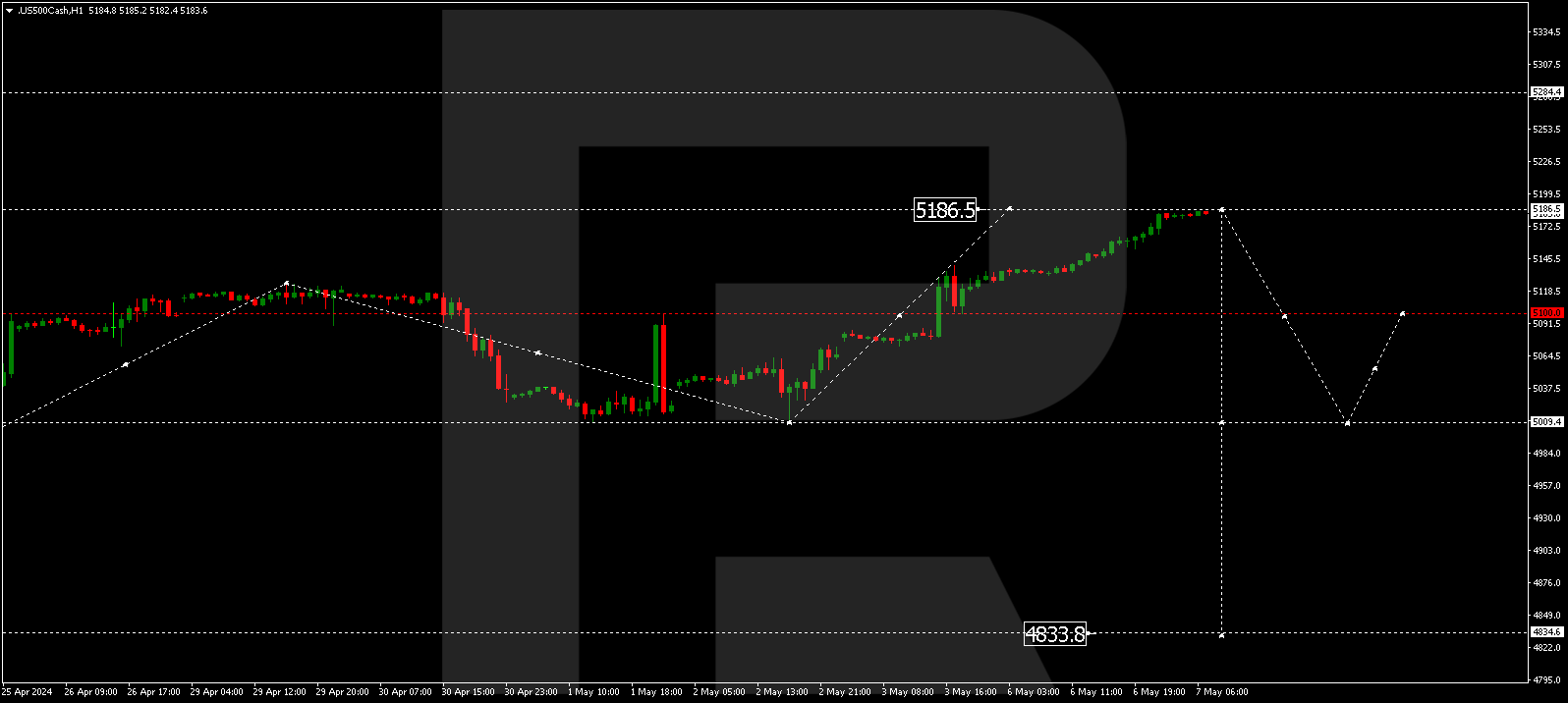

S&P 500

The stock index has performed a link of correction to 4404.4. A consolidation range might develop under this level today. With the price escaping it downwards, the wave of decline could continue to 4317.0. After the price reaches this level, a correction to 4418.0 might start.