Technical Analysis & Forecast 24.07.2023

EURUSD, “Euro vs US Dollar”

EURUSD has performed the second declining impulse to 1.1107. Today the market is forming a consolidation range above this level. An escape from the range downwards and an extension of this wave to 1.1025 are expected. This is a local target. After the price reaches this level, a correction to 1.1125 might follow (with a test from below). Next, the quote could drop to 1.0977.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a structure of a wave of decline to 1.2815. Today the market is forming a consolidation range above this level. An escape from the range downwards and an extension of this wave to 1.2771 are expected. This is a local target. After the price hits this level, a correction to 1.2868 could follow.

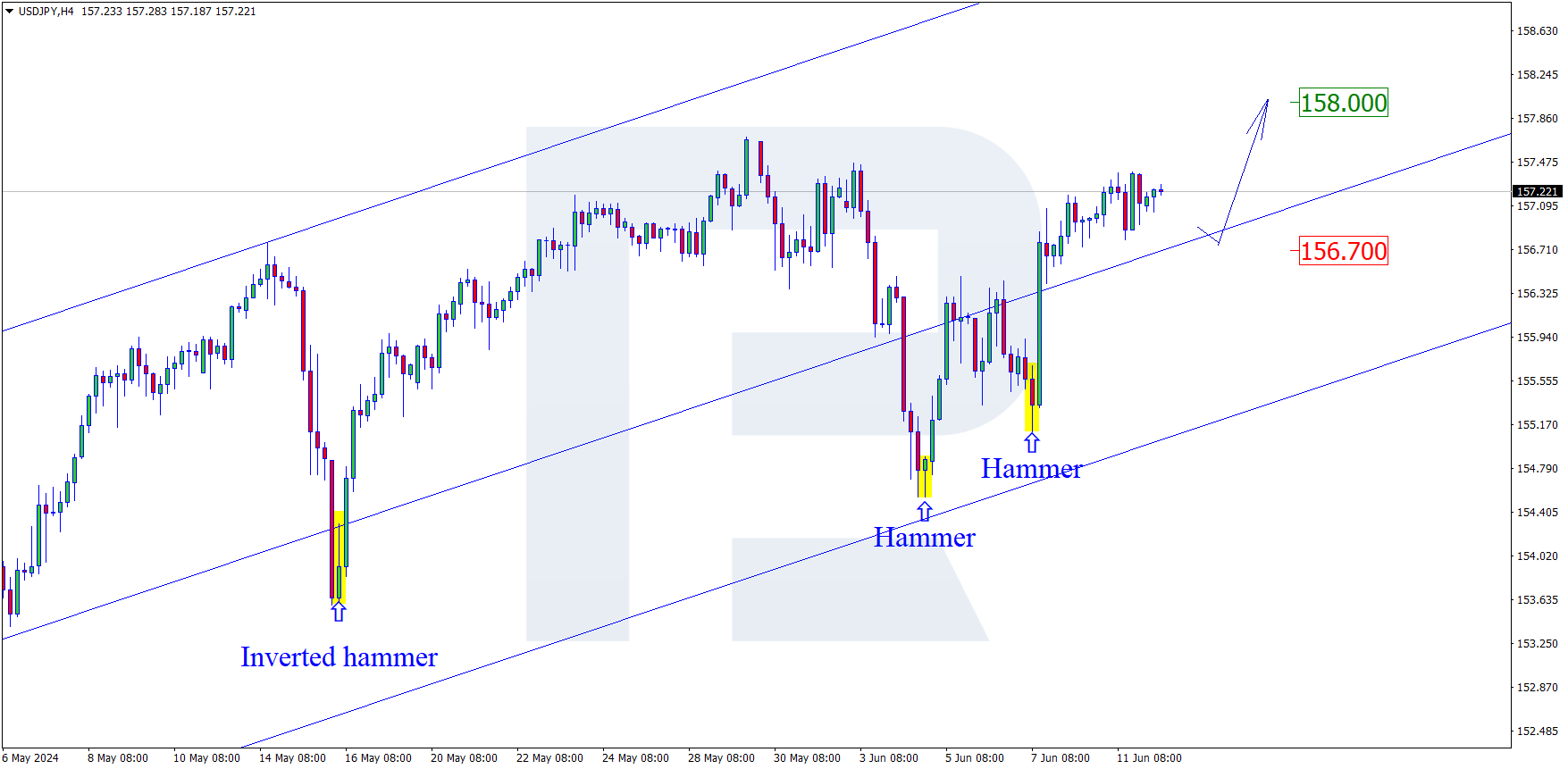

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a wave of growth to 141.92. Today the market is forming a consolidation range under this level. A link of correction to 139.80 is not excluded. After it is over, a new wave of growth to 142.33 is expected.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a wave of growth to 0.8683. Today the market is forming a consolidation range around this level. An escape from this range upwards might open the potential for a rise to 0.8750. With an escape downwards, a link of correction to 0.8625 is not excluded. Next, an increase to 0.8800 could follow.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has reached the target of a declining wave at 0.6715. A consolidation range could develop above this level today. The price is expected to break the range downwards and extend the wave to 0.6699. After the price reaches this level, a correction to 0.6740 might develop, followed by a decline to 0.6638.

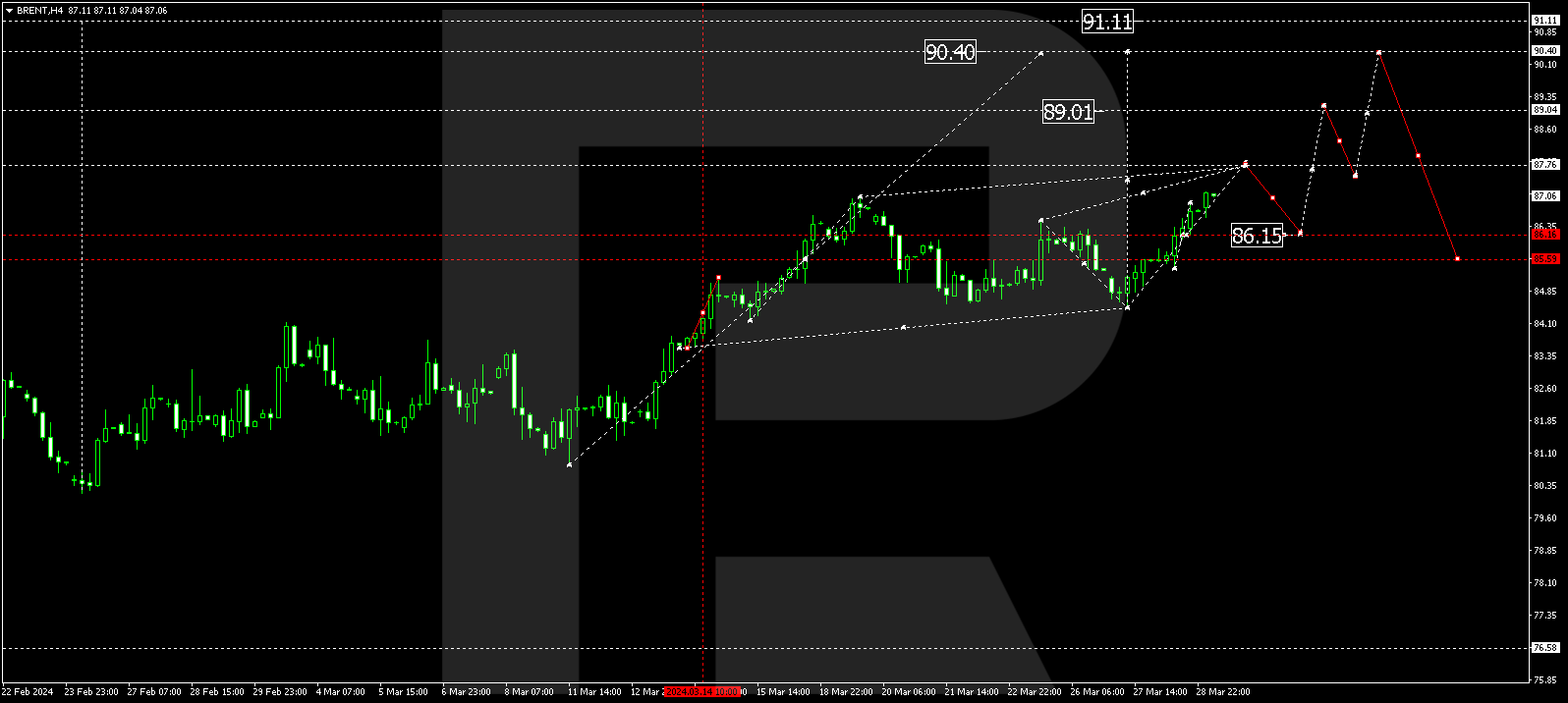

BRENT

Brent has completed a structure of growth to 81.05. A consolidation range is forming under this level. A breakout of the range upwards and a rise to 81.81 are expected. After the price reaches this level, a link of correction to 80.80 is not excluded (with a test from above). Next, a rise to 83.00 might follow, from where the trend could continue to 84.00. This is a local target.

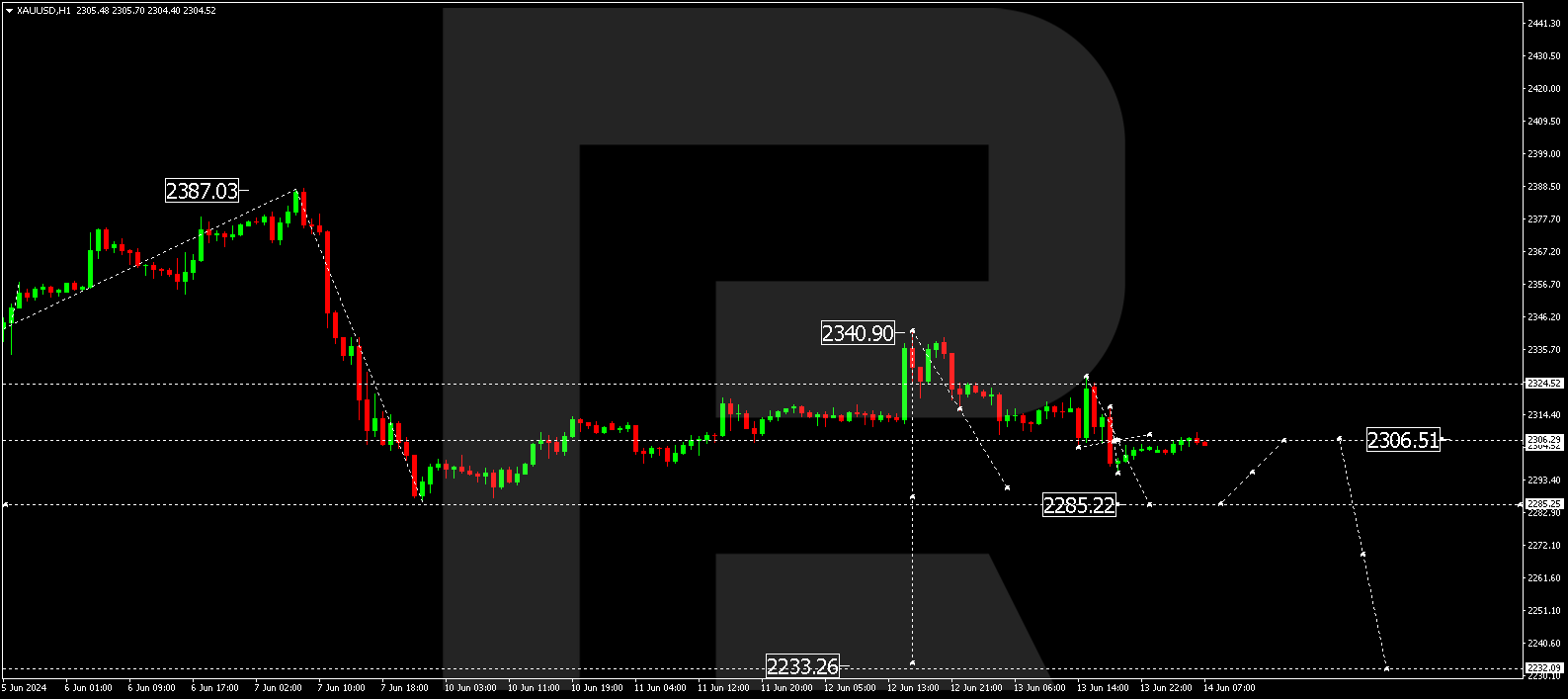

XAUUSD, “Gold vs US Dollar”

Gold has completed a structure of decline to 1956.70. A consolidation range could form above this level today. An escape from the range downwards might let the trend continue to 1950.40. After the price hits this level, a link of correction to 1960.30 is not excluded, followed by a decline to 1937.20.

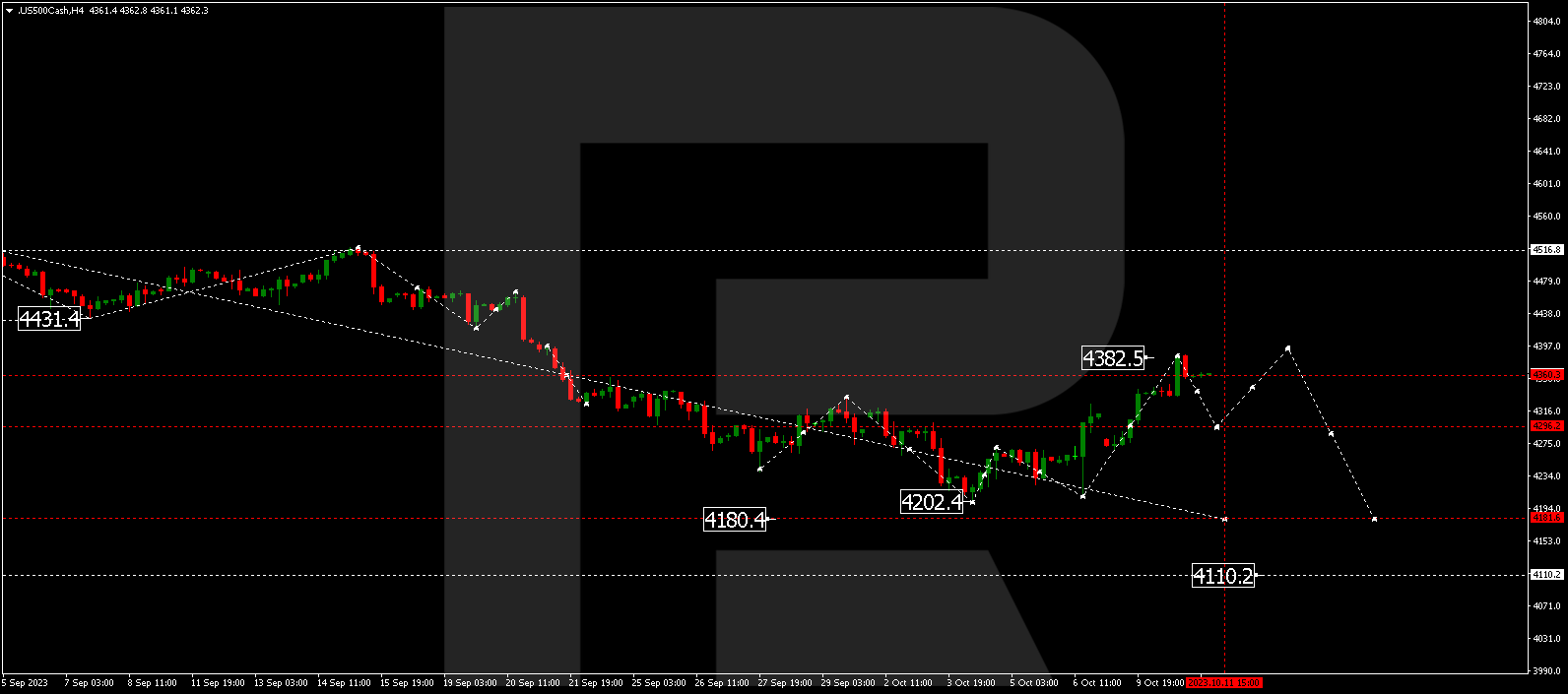

S&P 500

The stock index continues developing a wave of decline. Today the 4534.4 level could break downwards. The estimated decline target is 4504.0. After the price reaches this level, a link of correction to 4530.0 is not excluded, followed by a decline to 4486.6. This is the first target.