EURUSD, “Euro vs US Dollar”

EURUSD has completed a wave of decline to 1.0582. A link of correction to 1.0636 might follow today. Practically, a consolidation range is developing. With an escape from the range downwards, the potential for a declining wave to 1.0520 could open. With an escape upwards, the wave of growth might extend to 1.0712. Next, a decline to 1.0466 could follow.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a declining wave to 1.2153. The pair could correct to 1.2178 today. Next, the trend is expected to continue to 1.2072.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed an impulse of growth to 149.92. It could correct to 149.64 today. Next, the wave of growth might extend to 150.40, from where the trend could continue to 150.75.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed an impulse of growth to 0.8950. A link of correction to 0.8916 is expected today. Next, the wave of growth could extend to 0.8987, from where the trend might extend to 0.9016.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has extended a wave of growth to 0.6389. A decline to 0.6327 is expected today, followed by a link of growth to 0.6363. Next, a decline to 0.6272 is expected.

BRENT

Brent has formed a consolidation range around 88.98 and continues correcting to 85.50, escaping the range downwards. After the correction is over, a new wave of growth to 93.25 might start, from where the trend could continue to 95.00.

XAUUSD, “Gold vs US Dollar”

Gold has completed an impulse of decline to 1953.15 and a correction to 1977.50. A new impulse of decline to 1939.95 is expected. This is the first target. After the price reaches this level, a correction to 1968.00 could follow.

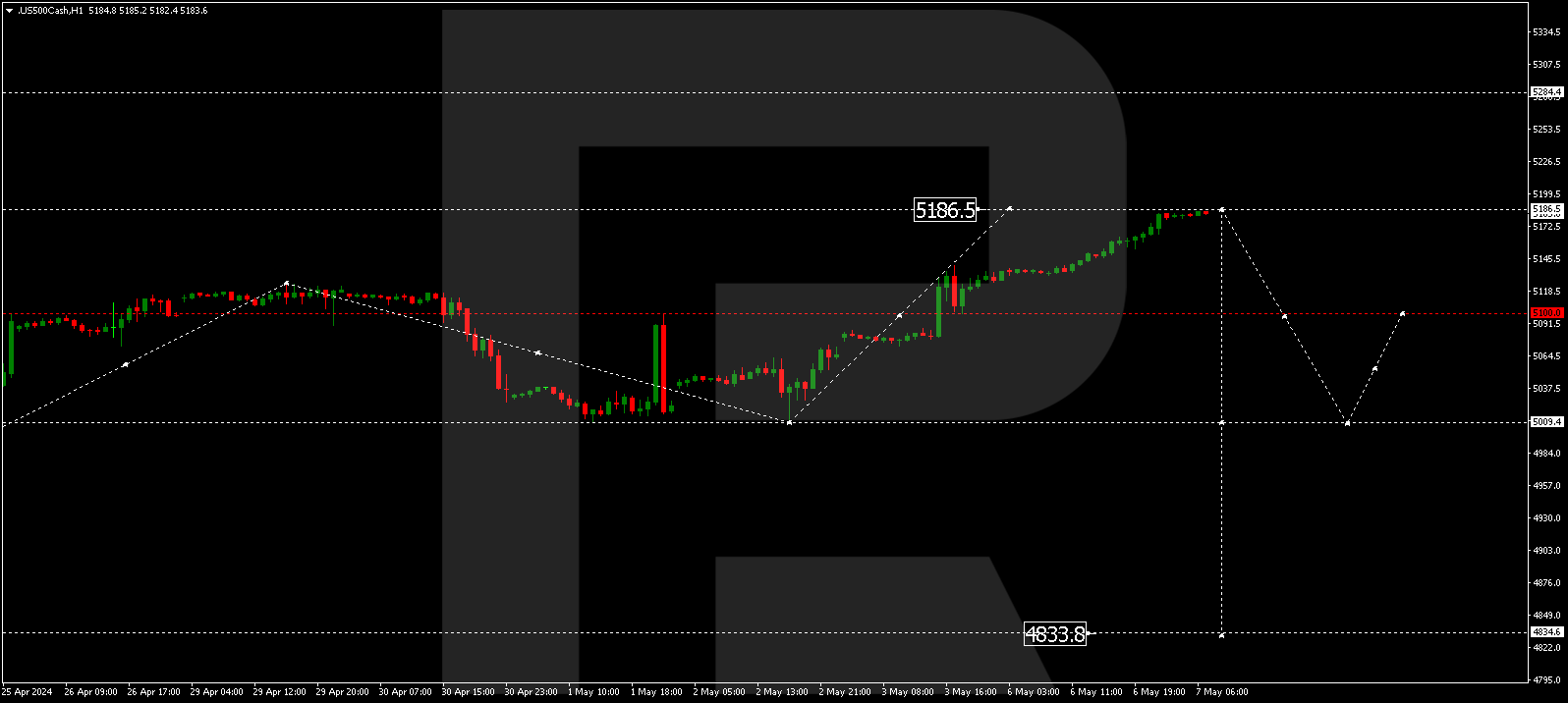

S&P 500

The stock index continues consolidating around 4251.0. The pair might drop to 4166.1 today. A link of correction to 4251.0 is not excluded, followed by a decline to 4111.1.