Technical Analysis & Forecast 26.02.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair continues developing a consolidation range around the 1.0823 level. A decline link to 1.0808 is expected today. Next, a rise to 1.0823 might follow (a test from below). With an escape from this range downwards, a decline to 1.0790 could form, from where the trend might extend to 1.0726. With an upward escape, it is not excluded that the correction wave might continue to 1.0854. Once this level is reached, a new decline wave to 1.0726 could begin. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has extended its consolidation range to 1.2700, and today the market is forming a decline wave to 1.2653. Practically, a wide consolidation range around 1.2653 continues forming. With a downward escape from the range, the potential for a decline wave to 1.2609 might follow. This is a local target.

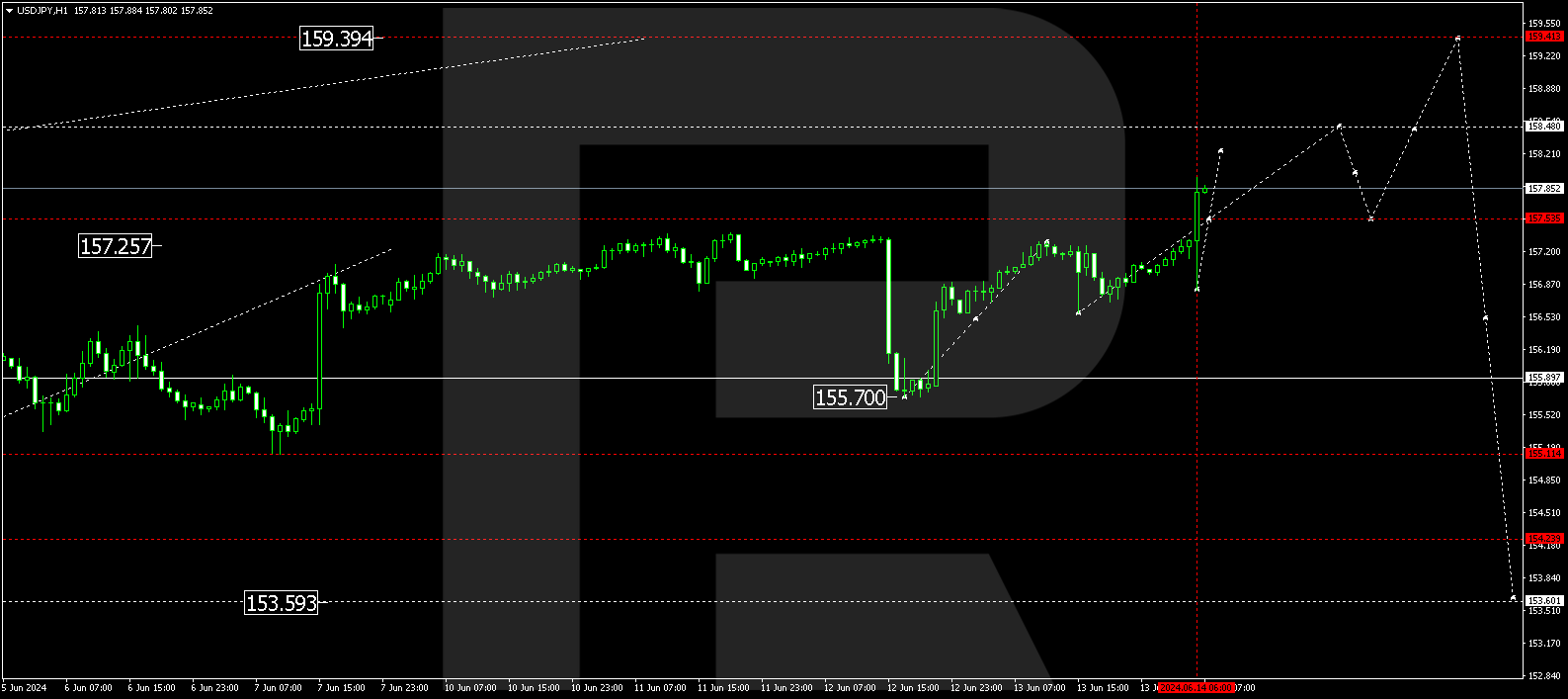

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues forming a consolidation range around the 150.44 level. A decline link to 150.15 is expected today, with a growth link to 150.44 forming next (a test from below). After that, a decline to 149.37 is expected. Once this level is reached, a new growth wave to 151.18 is not excluded. And with an escape from the range upwards, the potential for a growth wave to 151.18 could open. This is the first target.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair has corrected to 0.8782, and a growth wave to 0.8825 could develop today. Next, a consolidation range might form around this level. An escape from this range upwards is expected, with the trend extending to 0.8865. This is a local target.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair today continues developing a decline link to 0.6535, with a consolidation range probably forming around this level later. With a downward escape from the range, a decline wave to 0.6500 is expected, from where the trend could continue to 0.6478. This is the first target.

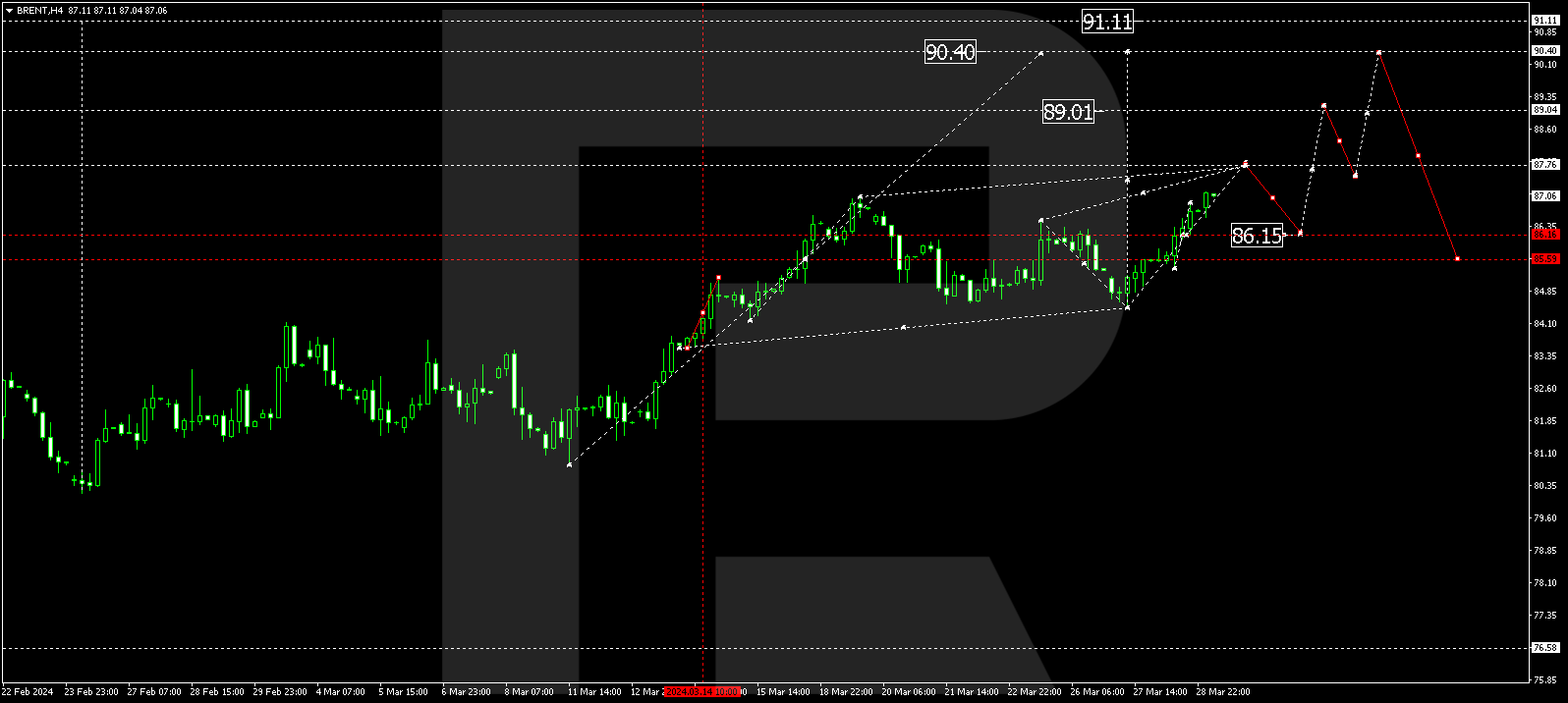

BRENT

Brent has formed a consolidation range around 81.66, and today with an escape downwards the pair might continue a correction to 80.33. Once this level is reached, a new growth wave to 83.00 could start, from where the trend might extend to 84.88. This is a local target.

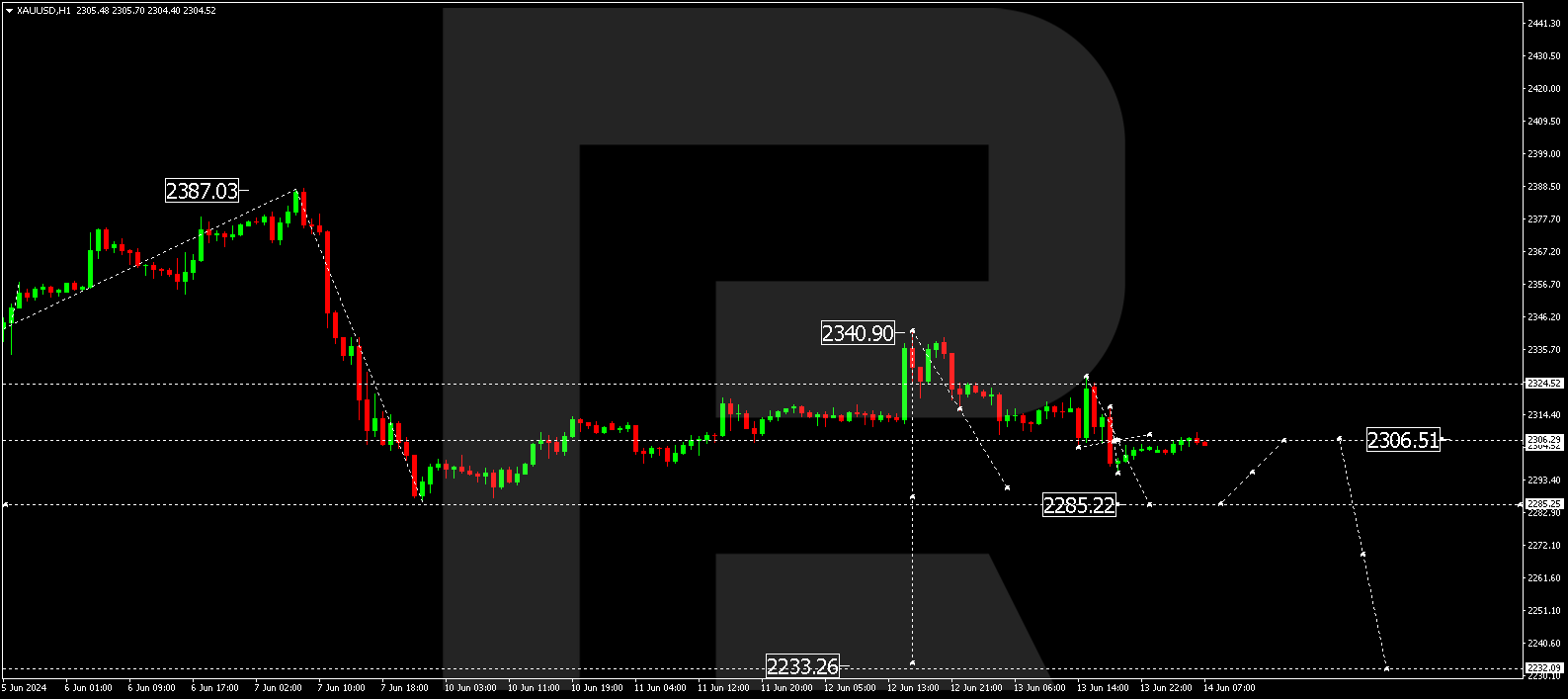

XAUUSD, “Gold vs US Dollar”

Gold continues forming a wide consolidation range around 2026.34. By now, the market has extended it to 2040.90. A decline to the lower range boundary at the 2011.11 level is expected today. Next, a growth link to 2026.34 might follow. With an escape from this range downwards, the potential for a decline wave to 1994.44 might open. This is a local target.

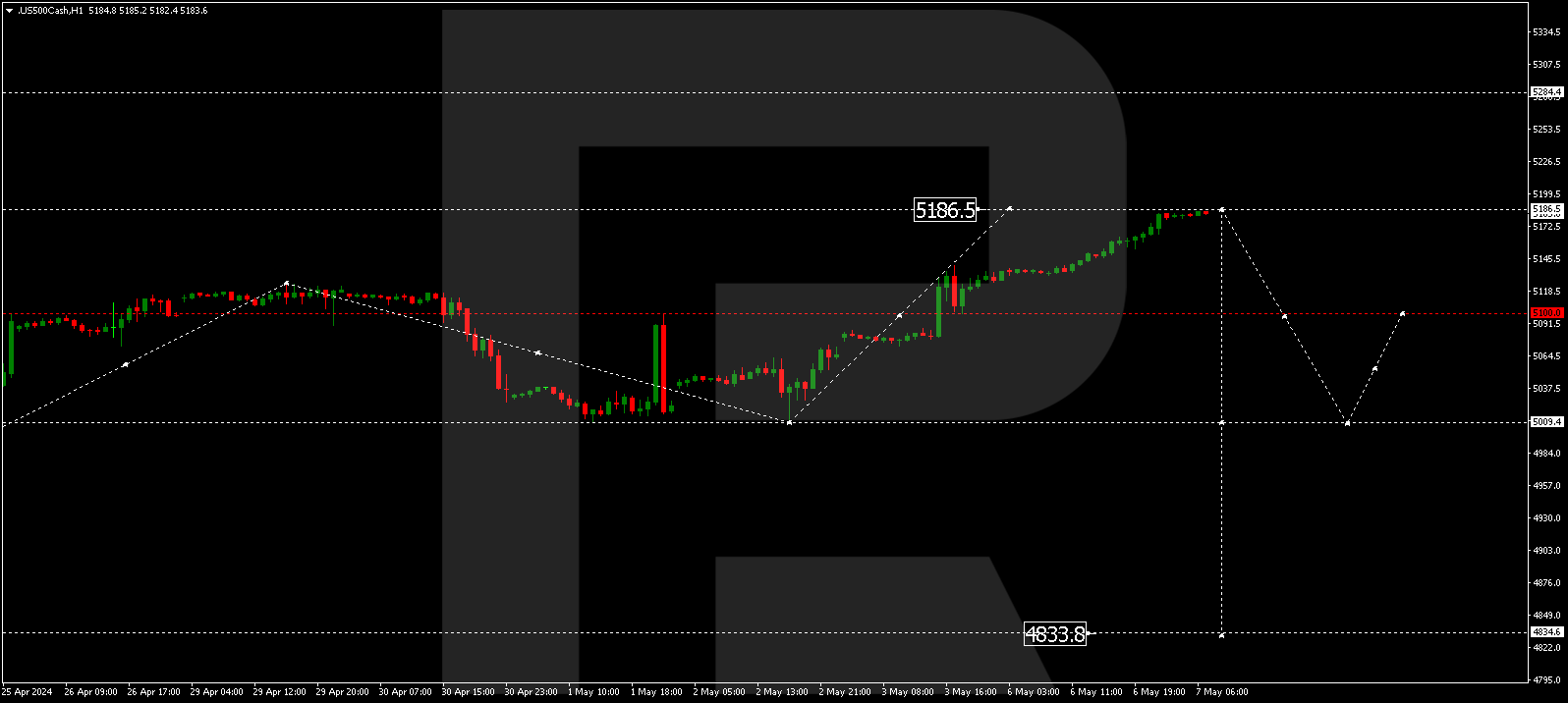

S&P 500

The stock index has completed a growth wave structure to 5110.0. A decline structure to 5046.2 is forming now (a test from above). Next, a rise to 5143.0 might form, and once this level is reached, a new decline wave to 4921.0 could begin. This is the first target.