Technical Analysis & Forecast 26.03.2024

EURUSD, “Euro vs US Dollar”

EURUSD has broken above the 1.0829 level and continues to develop a correction, with the correction target at 1.0861. Once the correction is over, the price could start a new downward movement, aiming for 1.0780. A downward breakout of this level will open the potential for trend expansion to the local target of 1.0690.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has breached the 1.2623 level, continuing to develop a correction towards 1.2672. After the correction, the price is expected to decline to 1.2544. With a breakout of this level, the trend will have the potential to continue to the local target of 1.2467.

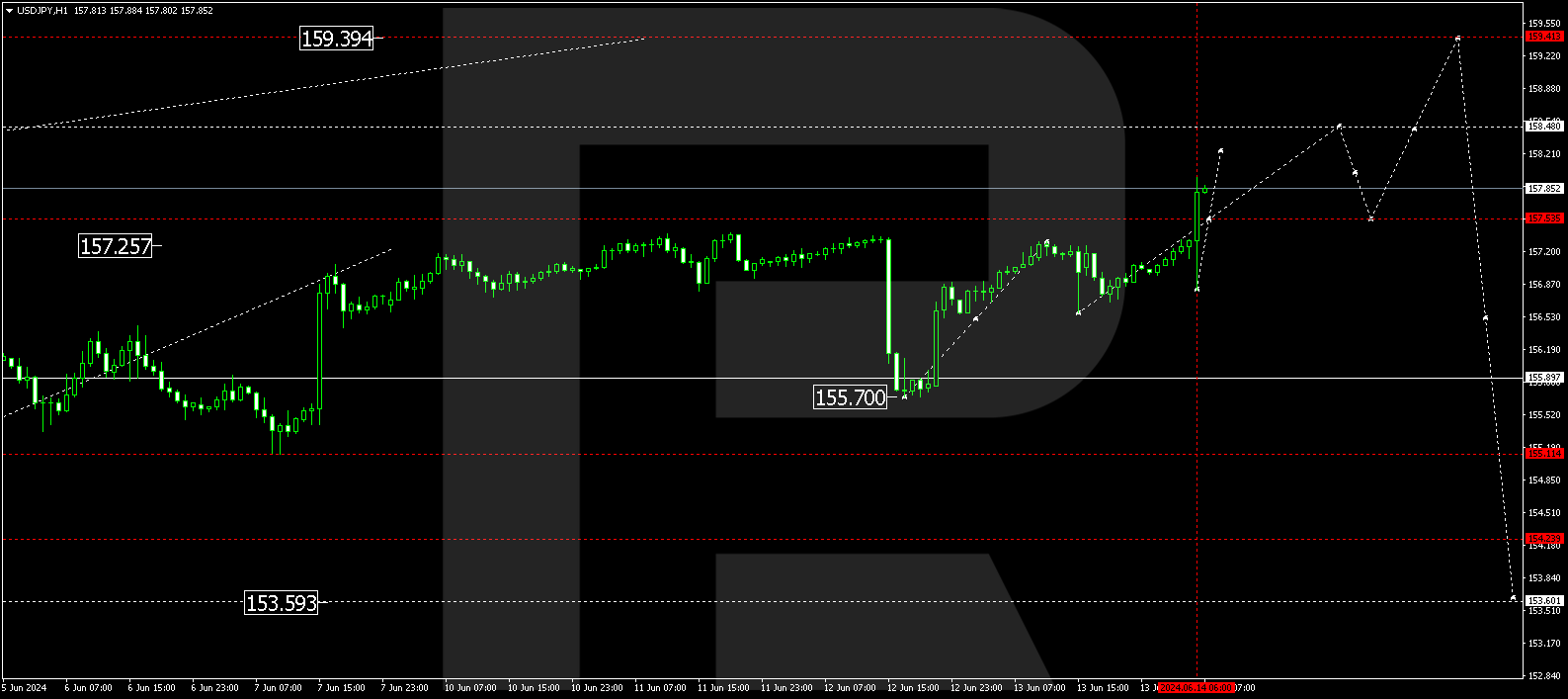

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is currently in a consolidation phase around 151.44, without any strong trend. A decline towards 150.77 is not ruled out today, followed by a growth wave to 151.85, from where the trend might continue to 152.60. This is the first target.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has broken above the consolidation range around 0.8984. Practically, upward momentum could continue towards 0.9018 today, with the trend potentially developing to the first target of 0.9027.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is currently in a consolidation phase around 0.6530. Today the consolidation range might expand to 0.6555. Practically, this growth is considered a correction. Once the correction is over, a decline wave towards 0.6500 could start. A breakout of this level will open the potential for a decline by the trend towards the local target of 0.6470.

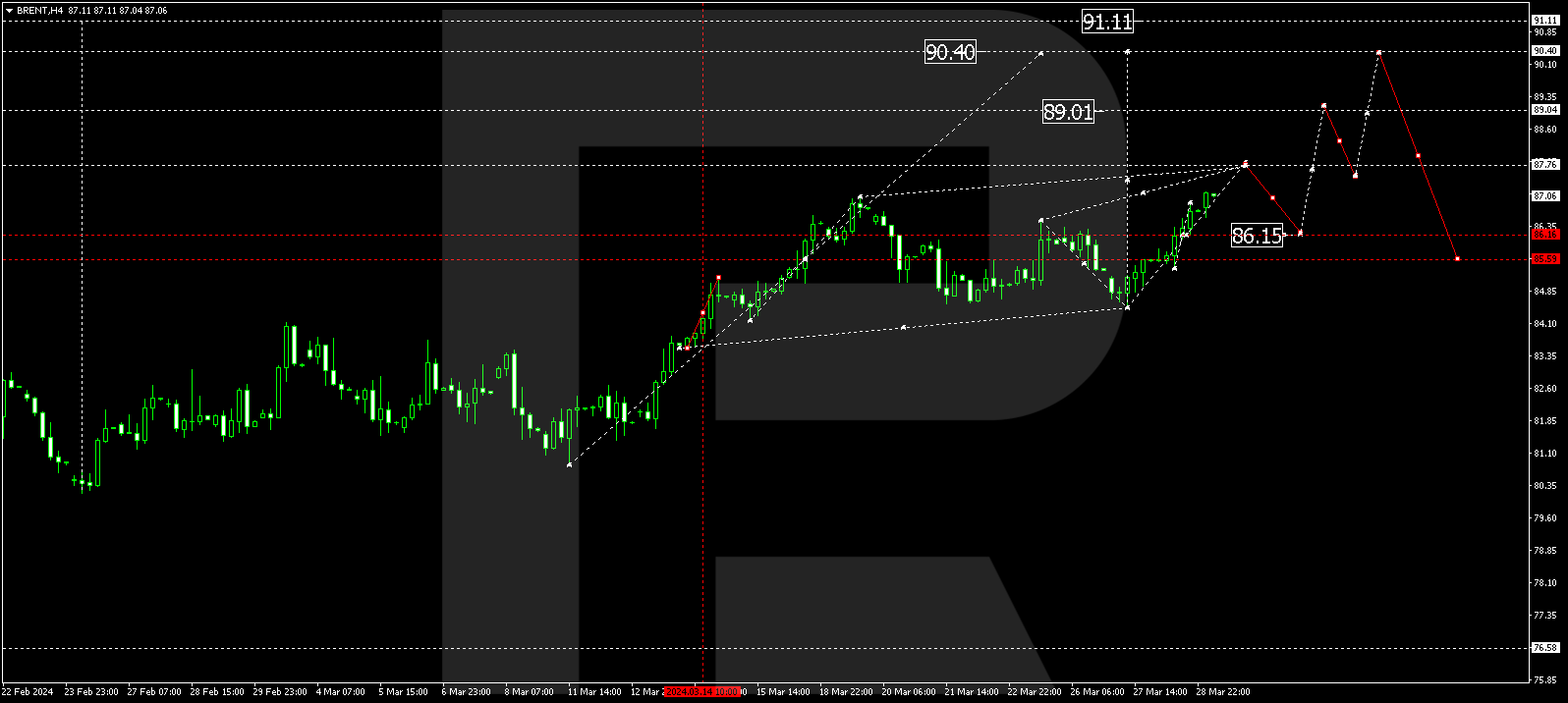

BRENT

Brent has broken above the 85.70 level, maintaining its momentum towards 86.86. With a breakout of this level, the trend might expand towards the local target of 89.20. After the price reaches this level, a correction phase towards 85.00 is not ruled out. Next, the trend is expected to continue to 89.90.

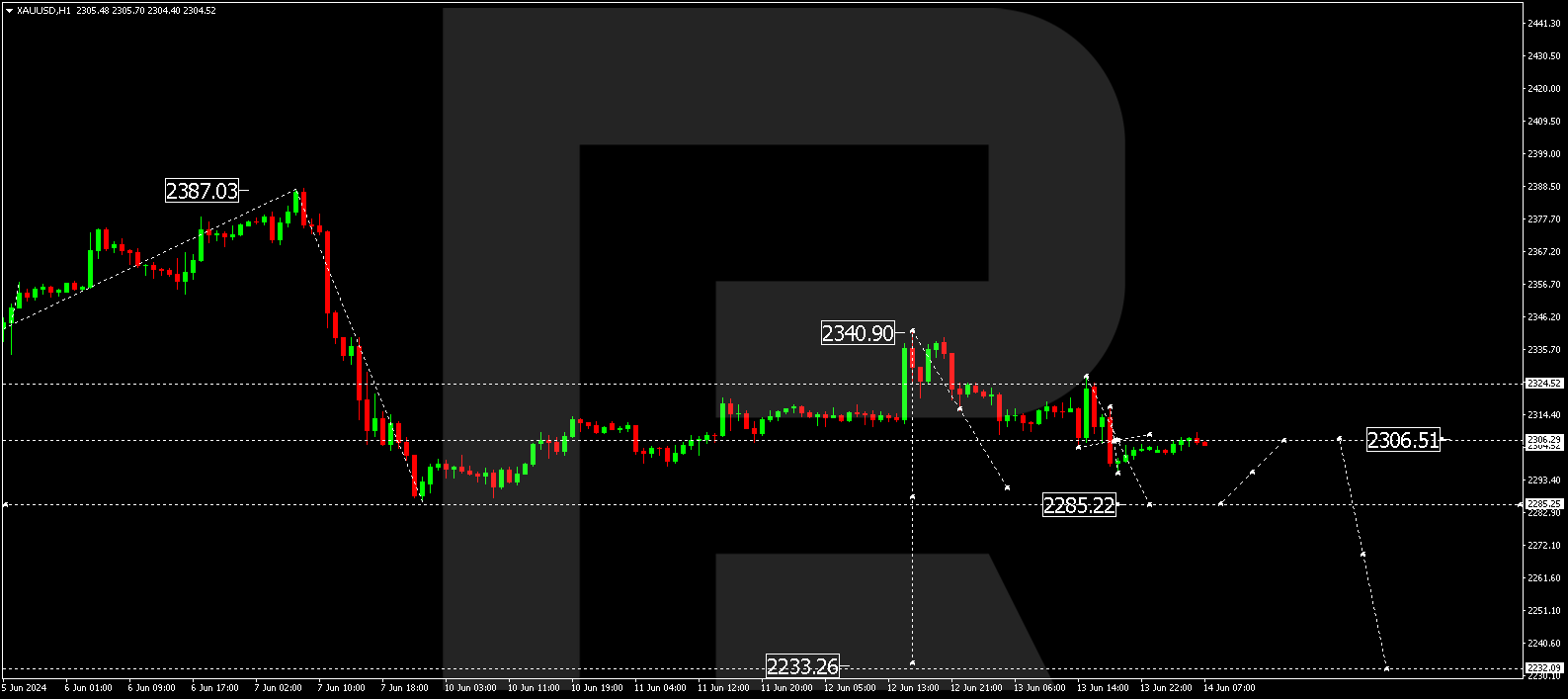

XAUUSD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2170.96. Today the consolidation range could expand to 2184.90. Next, a decline wave towards the first target of 2155.20 could develop. After the price reaches this level, a correction could start, aiming for 2188.88.

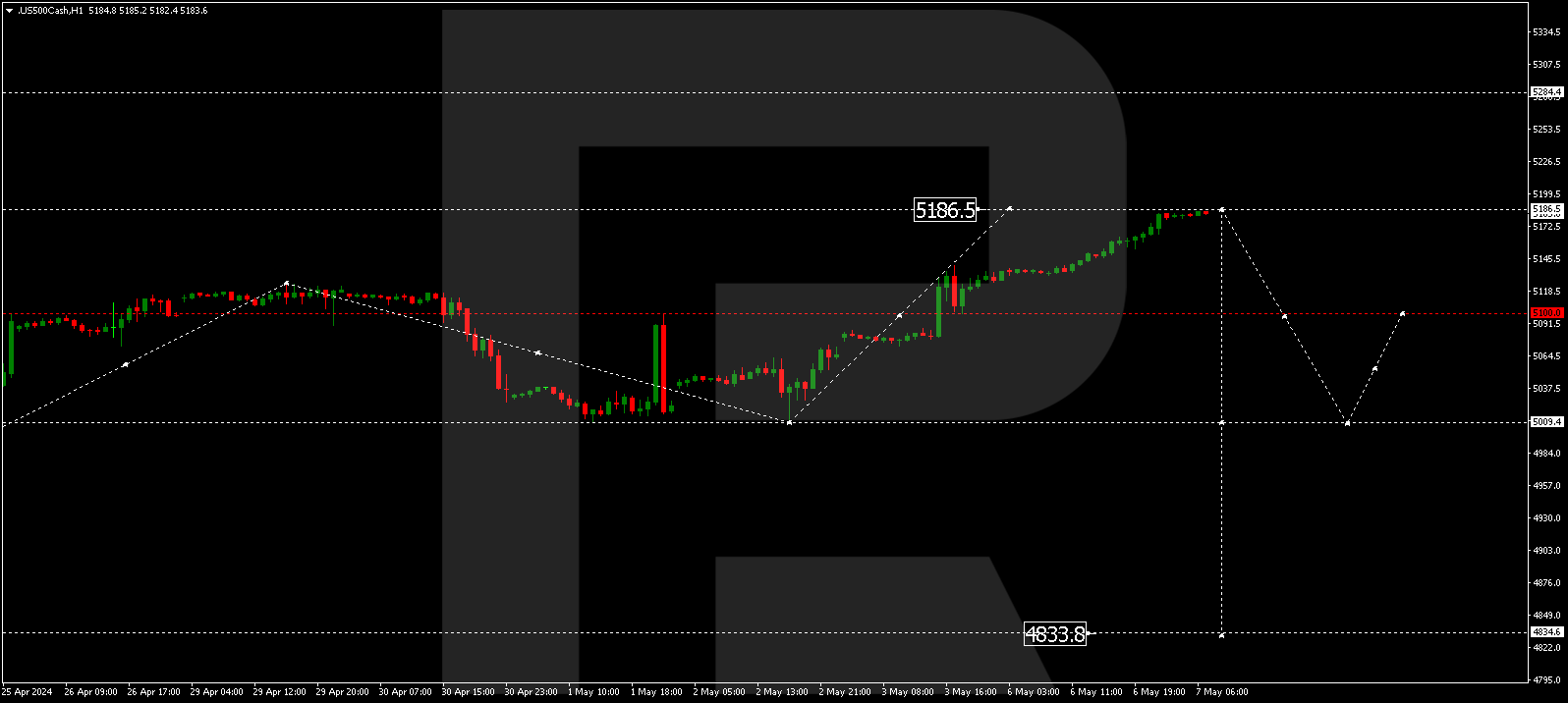

S&P 500

The stock index has completed a decline wave towards 5220.5. Today, a correction phase towards 5244.5 (testing from below) is expected. Once the correction is over, a decline wave could start, aiming for 5193.0. A breakout of this level will open the potential for a downward movement by the trend towards the local target of 5142.0.