EURUSD, “Euro vs US Dollar”

EURUSD has completed a decline wave to 1.0555. A consolidation range could develop above this level today. A link of growth to 1.0612 (a test from below) is not excluded, followed by a decline to 1.0494, potentially extending to 1.0450. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is maintaining its downward trajectory towards 1.2130. After the price hits this level, a correction to 1.2220 (a test from below) could start, followed by a decline to 1.2020.

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues its upward movement to 149.29. After reaching this level, the price could correct to 148.62 and then rise to 149.94.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF continues a growth wave to 0.9200. Once the price hits this level, a correction to 0.9109 could develop, followed by a rise to 0.9284. This is a local target.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues its downward movement to 0.6323. After reaching this level, the price could correct to 0.6393 (a test from below). Following this, it could drop to 0.6276, from where the trend could develop to 0.6200.

BRENT

Brent has corrected to 90.42. Today the market is expanding a growth wave to 93.73. A breakout of this level will open the way for a movement to 97.07. After this level is reached, a link of correction to 93.75 could form, followed by growth to 104.40.

XAUUSD, “Gold vs US Dollar”

Gold is maintaining its downward trajectory to 1891.44. After hitting this level, the price could rise to 1910.40 (a test from below) and then fall to 1877.20, from where the trend could continue to 1864.00.

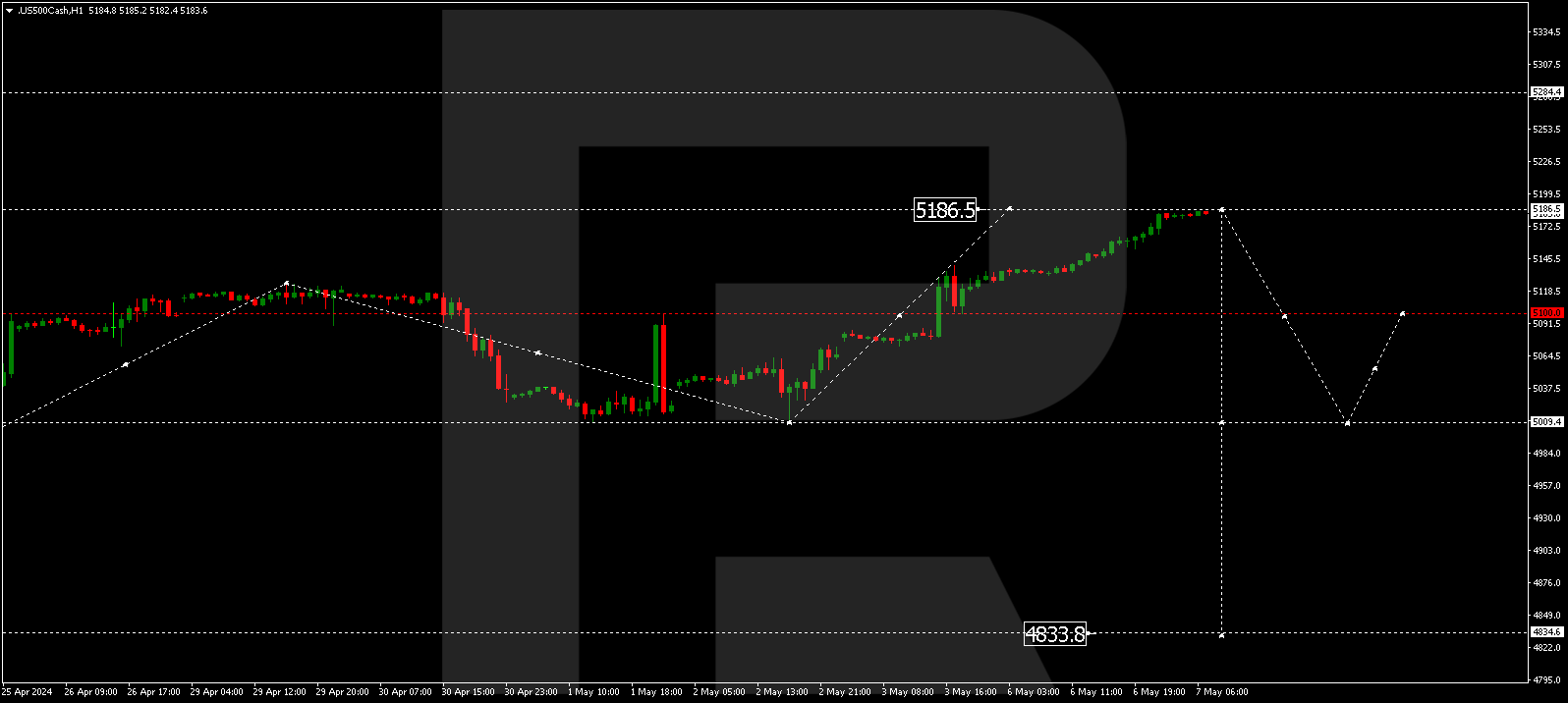

S&P 500

The stock index has formed a consolidation range around 4328.5 and, breaking it downwards, reached 4267.3. A link of correction to 4300.0 could develop today, followed by a decline to 4193.3 with the trend potentially expanding to 4137.0. This is a local target.