Technical Analysis & Forecast 28.03.2024

EURUSD, “Euro vs US Dollar”

The EURUSD pair continues developing a consolidation range around 1.0823. By now, it has expanded the range downwards to 1.0808. Today the market has performed a technical test of 1.0823 from below. With an upward escape from the range, a further correction towards 1.0860 is not excluded. With a downward escape, the wave might extend to 1.0780. Once this level is reached, a correction towards 1.0890 could begin.

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD continues developing a consolidation range around 1.2621. With an upward escape from the range, a correction to 1.2666 could follow. With a downward escape, the potential for a wave towards 1.2545 might open. Once this level is reached, a correction wave to 1.2740 could begin.

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a consolidation range around 151.45. A decline link towards 150.95 is not excluded today, after which the quotes could rise to 151.50. A breakout of this level might open the potential for growth towards 152.00, from which level the trend could extend to 152.80.

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues developing a consolidation range around 0.9044. With a downward escape from the range, a correction link towards 0.8972 is not excluded. With an upward escape, the potential for a wave to 0.9100 might open, from which level the trend could continue to 0.9125.

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues developing a consolidation range around 0.6525. With an upward escape from the range, the potential for a correction towards 0.6555 might open. With a downward escape, the potential for a wave towards 0.6486 might open, from which level the trend could continue to 0.6433. This is a local target.

BRENT

Brent continues developing a consolidation range around 85.65 without any obvious trend. By now, the market has expanded the range towards 84.47. Today the market is at the 85.77 level. With a downward escape from the range, the potential for a correction to 83.55 might open. With an upward escape, the potential for a wave to 89.00 could open, from which level the trend might extend to 91.11.

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 2173.80. A growth link to 2200.00 might form today. Next, a decline to 2173.80 is expected. With a downward escape from this range, the potential for a wave to 2151.00 might open. With an upward escape, a growth link to 2225.00 is not excluded.

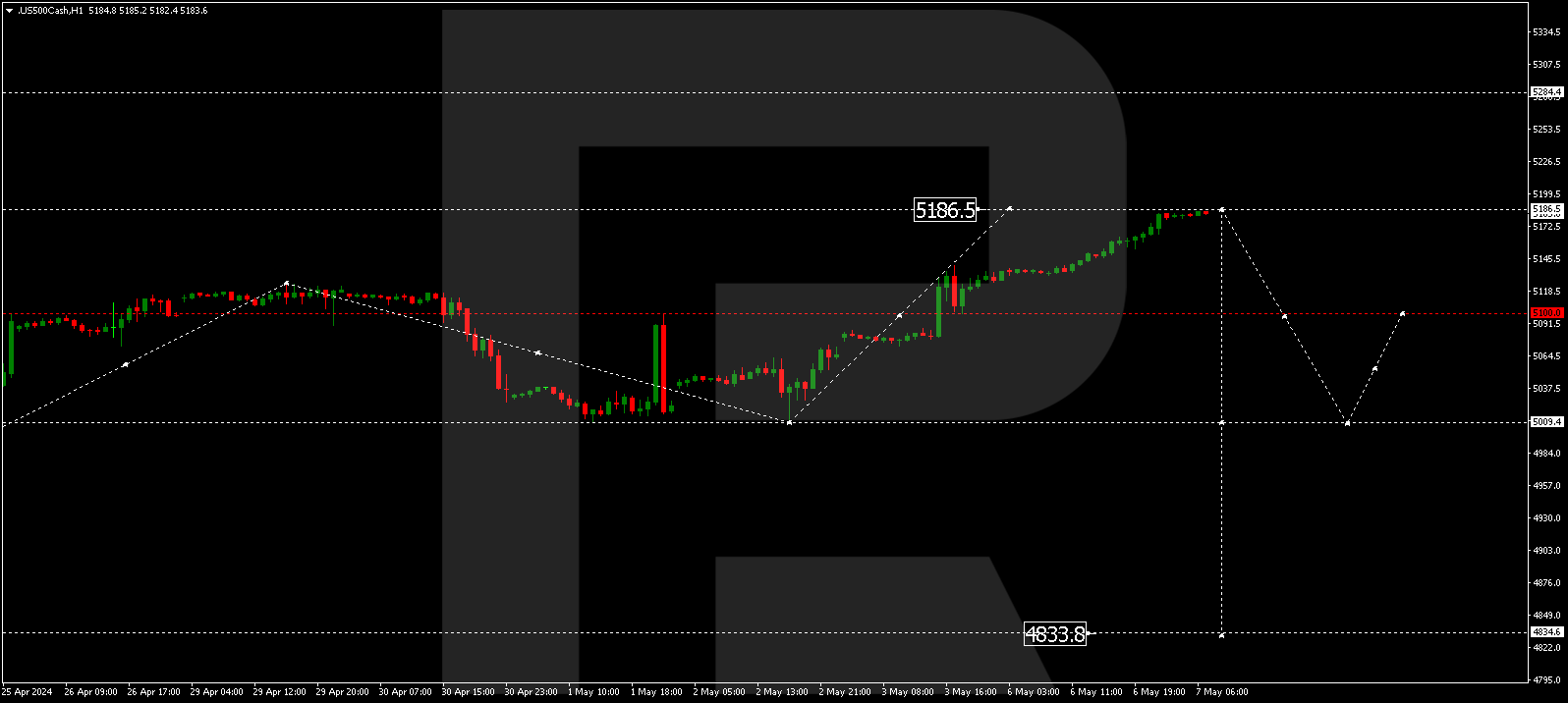

S&P 500

The stock index continues developing a consolidation range around 5244.0. By now, the market has expanded the range upwards to 5263.0. The growth link could extend to 5268.0, from which level the trend might continue to 5278.0. The market is at the highs of a growth wave and might crash by the trend towards 5146.4 at any moment. This is the first target.