Technical Analysis & Forecast 28.06.2023

EURUSD, “Euro vs US Dollar”

The currency pair has corrected to 1.0970. A decline to 1.0903 is expected today. And if this level also breaks downwards, the potential for a decline to 1.0855 could open, from where the trend might continue to 1.0750.

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has corrected to 1.2758. The wave of decline is expected to continue to 1.2700 today. And if this level also breaks downwards, the structure might extend to 1.2650.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair continues developing a wave of growth to 144.51. After the price reaches this level, a link of decline to 143.90 is not excluded, followed by a rise to 144.88.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a consolidation range around 0.8946. A link of growth to 0.8989 is expected to form today. And if this level also breaks upwards, the potential for a wave of growth to 0.9055 could open.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has broken the level of 0.6666 downwards, completing a wave of decline to 0.6620. A link of correction to 0.6666 is not excluded today (a test from below). Next, the trend might continue downwards to 0.6610, from where the trend could continue to 0.6588.

BRENT

Brent continues developing a consolidation range around 74.74. The range might extend downwards to 72.15. With an escape from the range upwards, the potential for a structure of growth to 76.60 could open. And if this level also breaks upwards, a wave to 81.00 might develop from there.

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 1924.94. At the moment, the market has escaped it downwards, completing a structure of decline to 1910.94. A link of growth to 1921.77 is not excluded (a test from below). Next, a decline to 1908.66 could follow, from where the trend might continue to 1905.55.

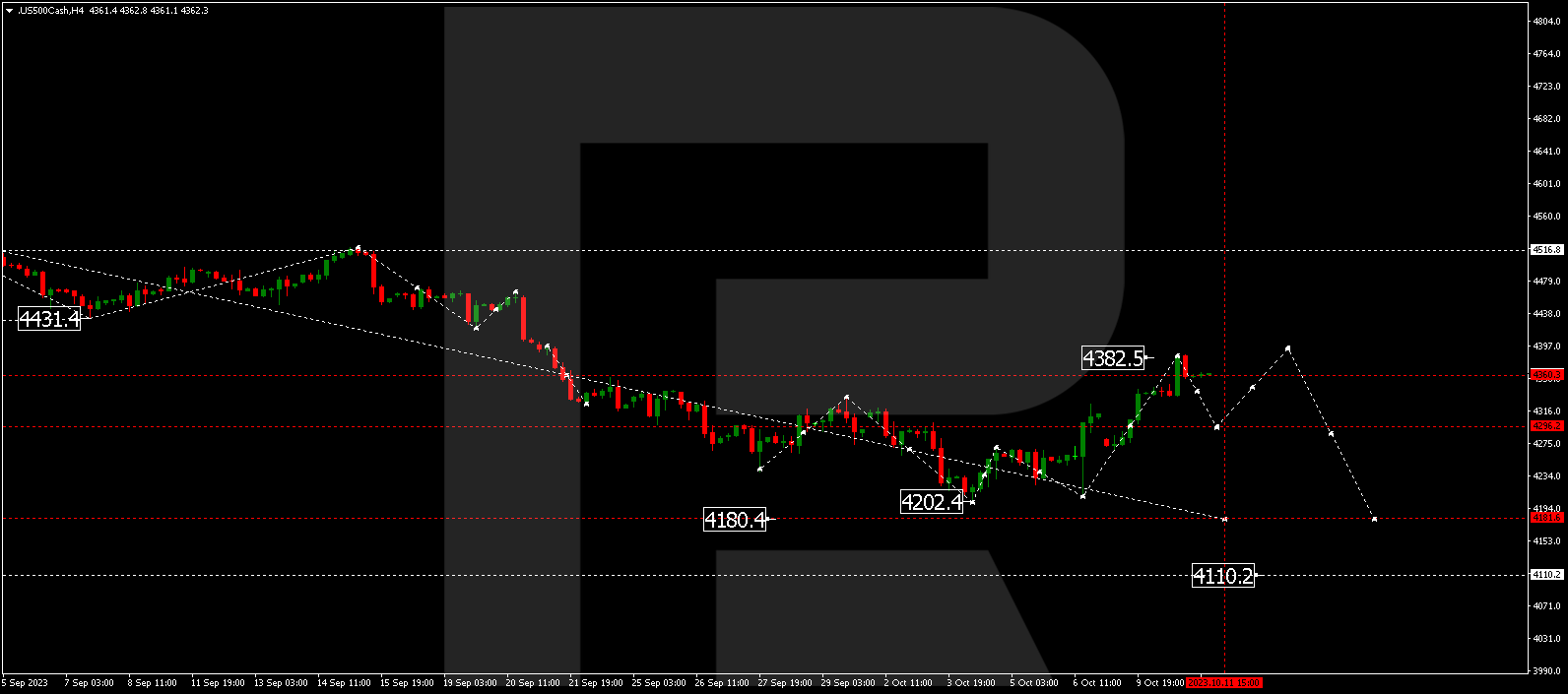

S&P 500

The stock index has completed a structure of a wave of decline to 4333.3. A correction might develop today to 4395.5, followed by a decline to 4282.0 (a test from above).