Technical Analysis & Forecast 29.01.2024

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction wave to 1.0884. Today the market is forming a structure of a decline wave to 1.0839. Once this level is reached, a narrow consolidation range is expected to form around this level. With an escape from the range upwards, a growth link to 1.0860 is not excluded. With a downward escape, the potential for a decline wave to 1.0817 might open, from where the trend could continue to 1.0791. This is a local target.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a correction wave to 1.2757. Today the pair has performed a decline wave to 1.2690. Currently, a consolidation range is forming above this level. A correction link to 1.2707 is not excluded, followed by a decline wave to 1.2655. With a breakout of this level, the potential for a wave to 1.2590 could open. This is a local target.

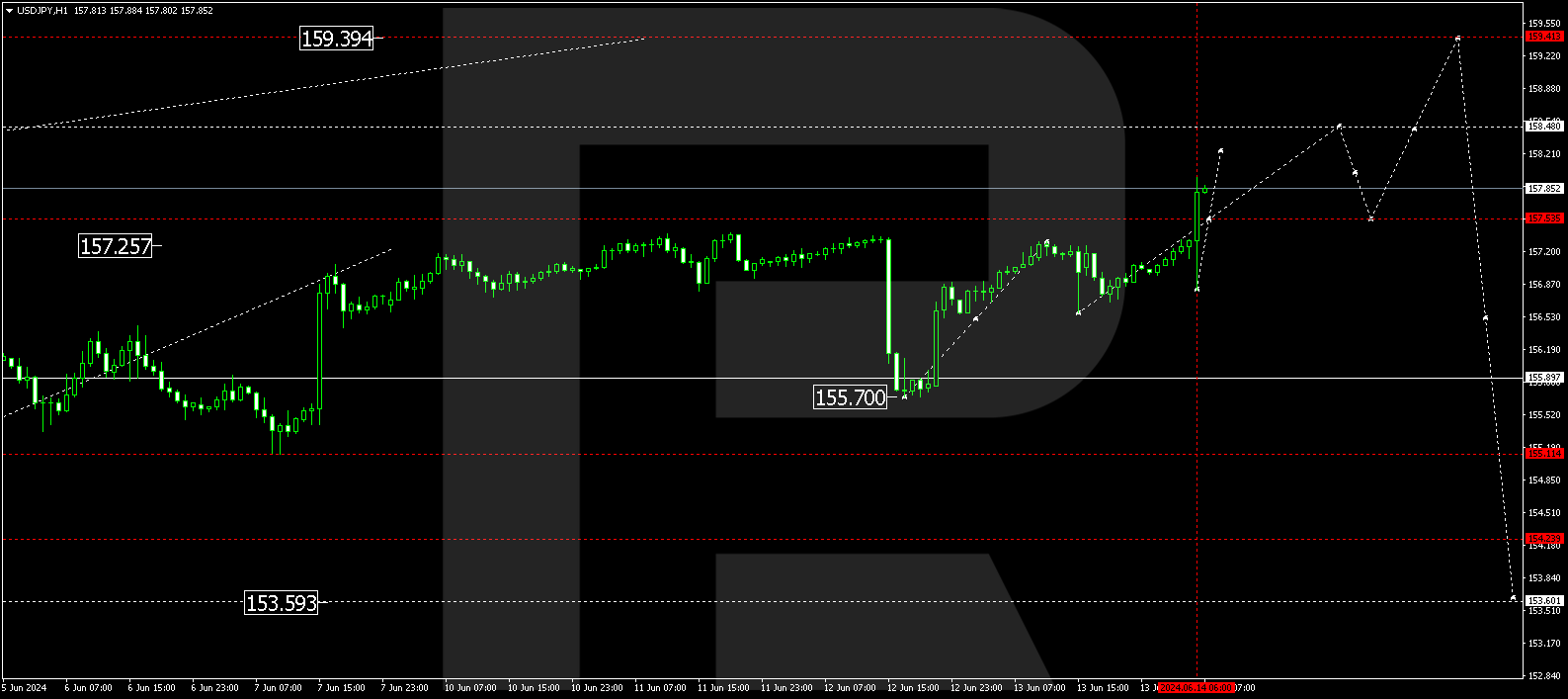

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has broken the 147.90 level upwards and today offers a growth link to 148.48, from where the trend might continue to 149.16. This is a local target.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a growth wave to 0.8684. Today the market might perform a correction link to 0.8605. Once this correction is over, the growth wave is expected to extend to 0.8744, from where the trend could continue to 0.8766.

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD continues forming a consolidation range around 0.6585. A growth link to 0.6598 is forming today. Once this level is reached, a decline wave to 0.6550 could begin. This is a local target.

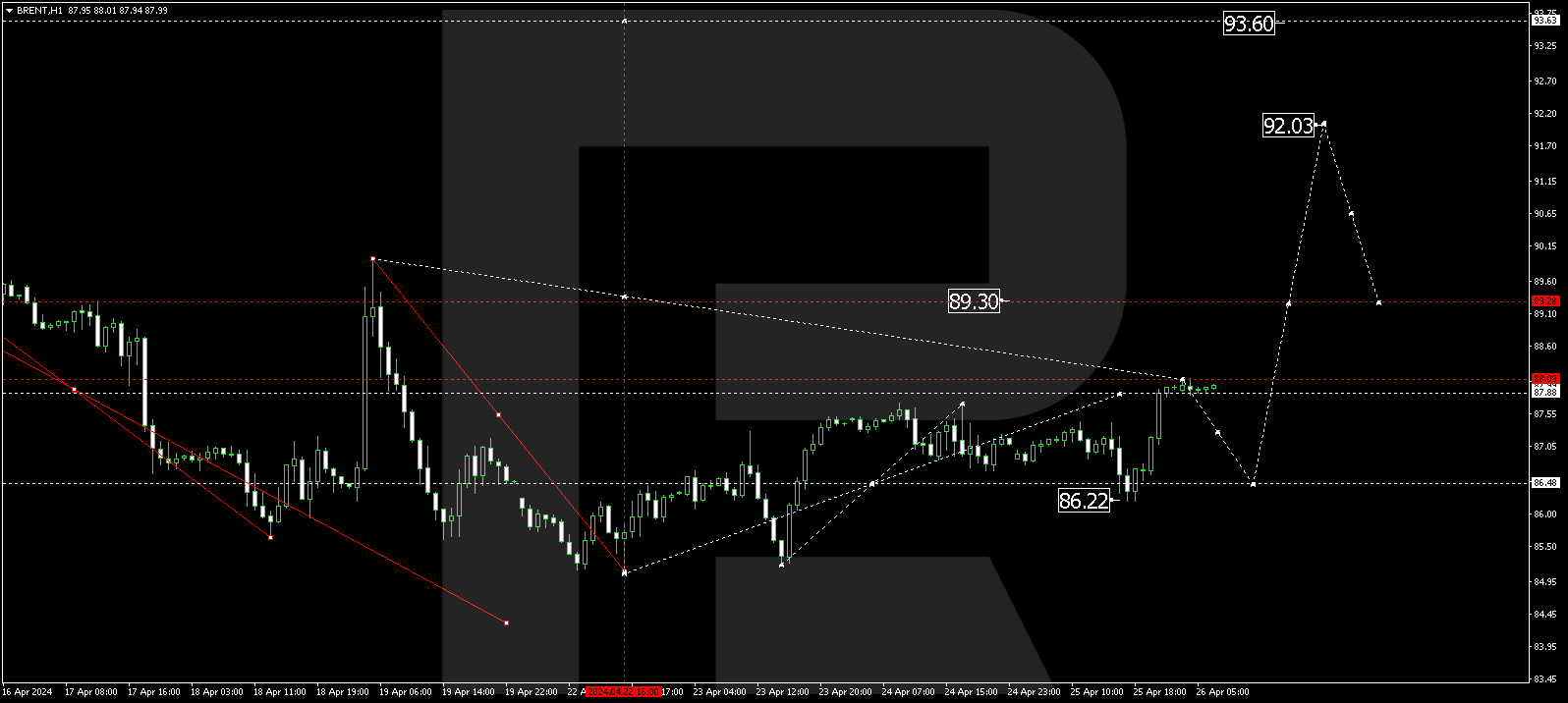

BRENT

Brent has completed a growth structure to 83.40, and today the market has formed a consolidation range around this level, extending the growth wave to 84.22 with an escape from the range upwards. Once this level is reached, a correction link to 83.40 is not excluded. Next, the trend might continue to 85.55. This is a local target.

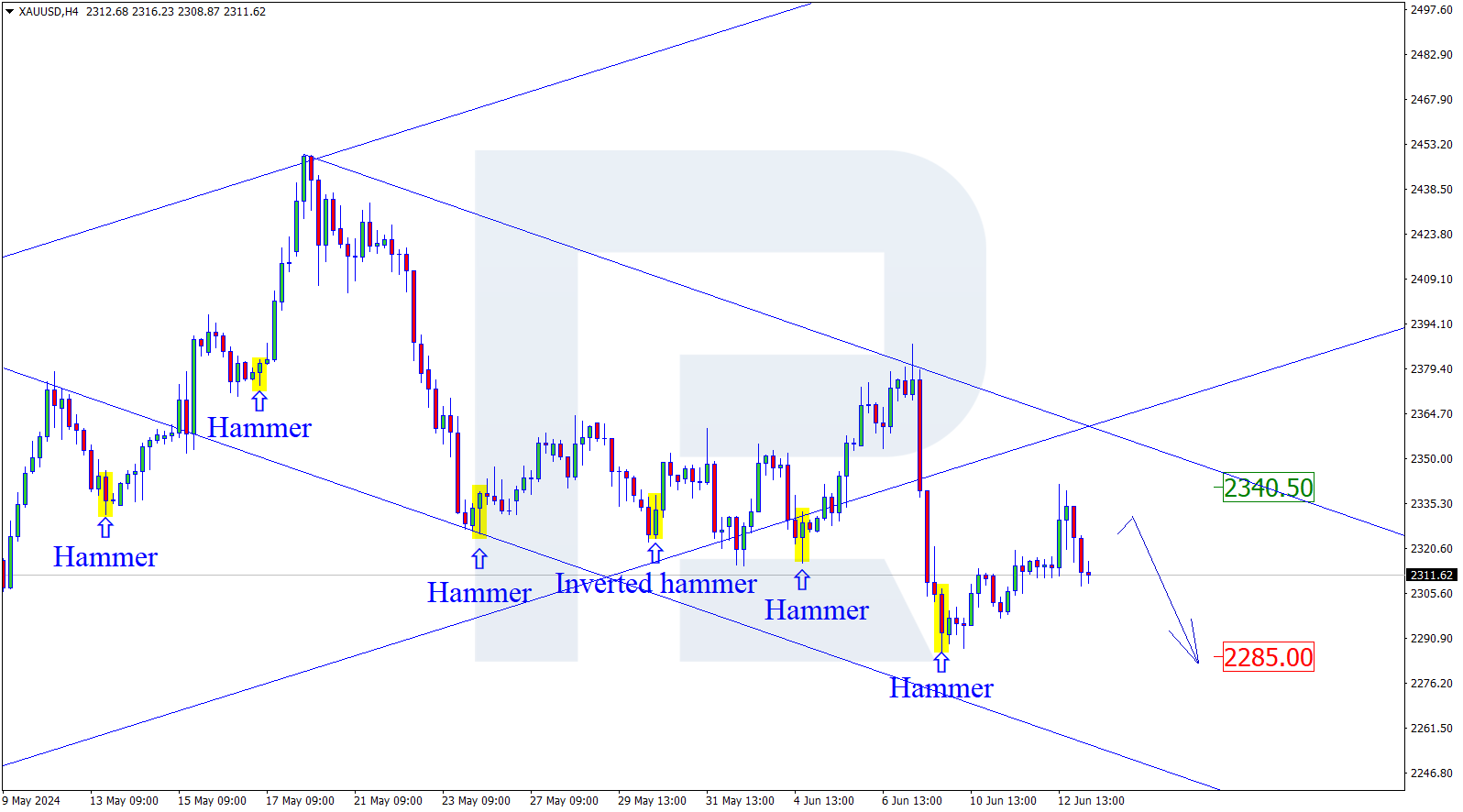

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range under 2023.23. Today the price might decline to 2005.55, later rising to 2023.00. Once this level is reached, a new decline wave to 1991.10 might follow, from where the trend could continue to 1976.50.

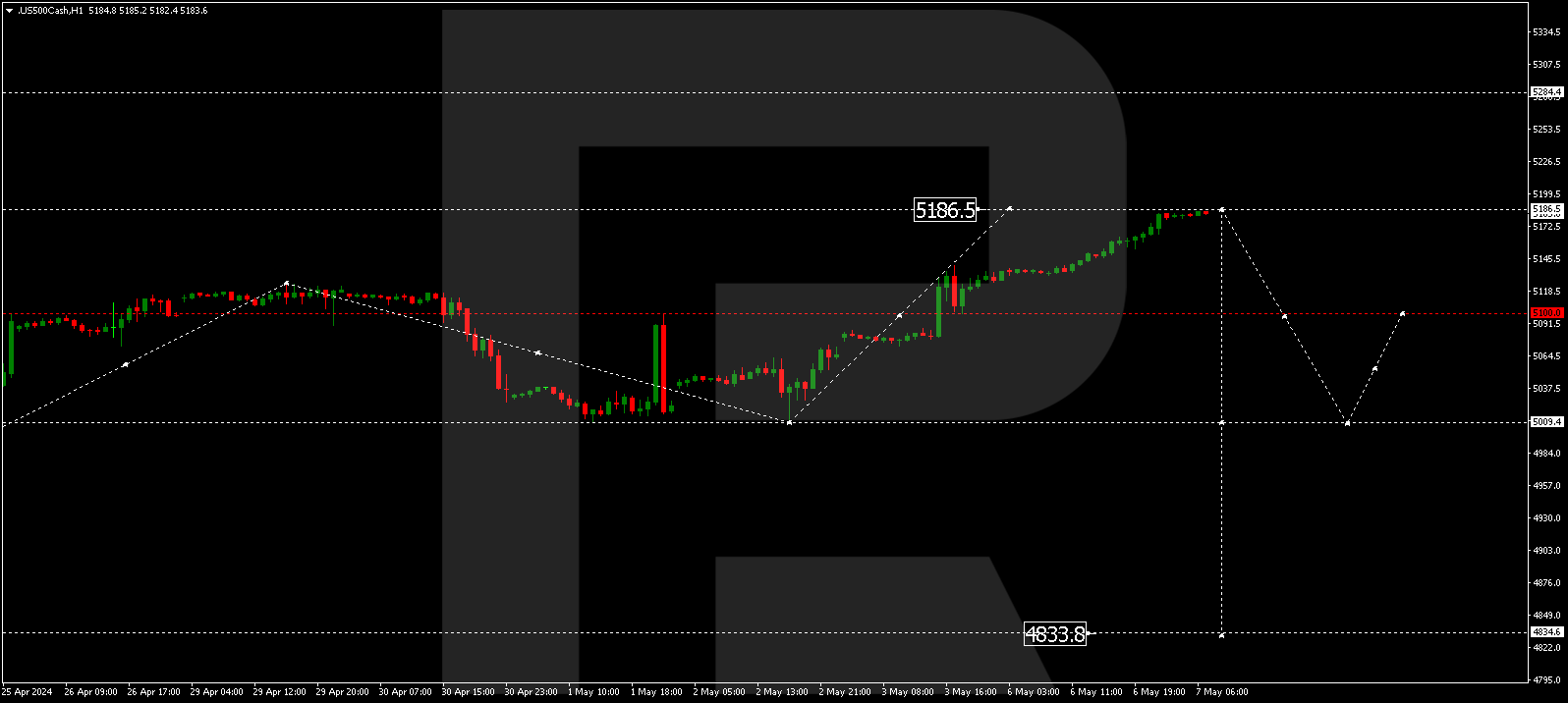

S&P 500

Gold continues developing a consolidation range around 2023.23. A growth link to 2030.00 might form today, followed by a decline wave to 2005.55. And if this level also breaks, a new decline structure to 1991.10 could develop, from where the trend might continue to 1976.50.