Technical Analysis & Forecast for April 2023

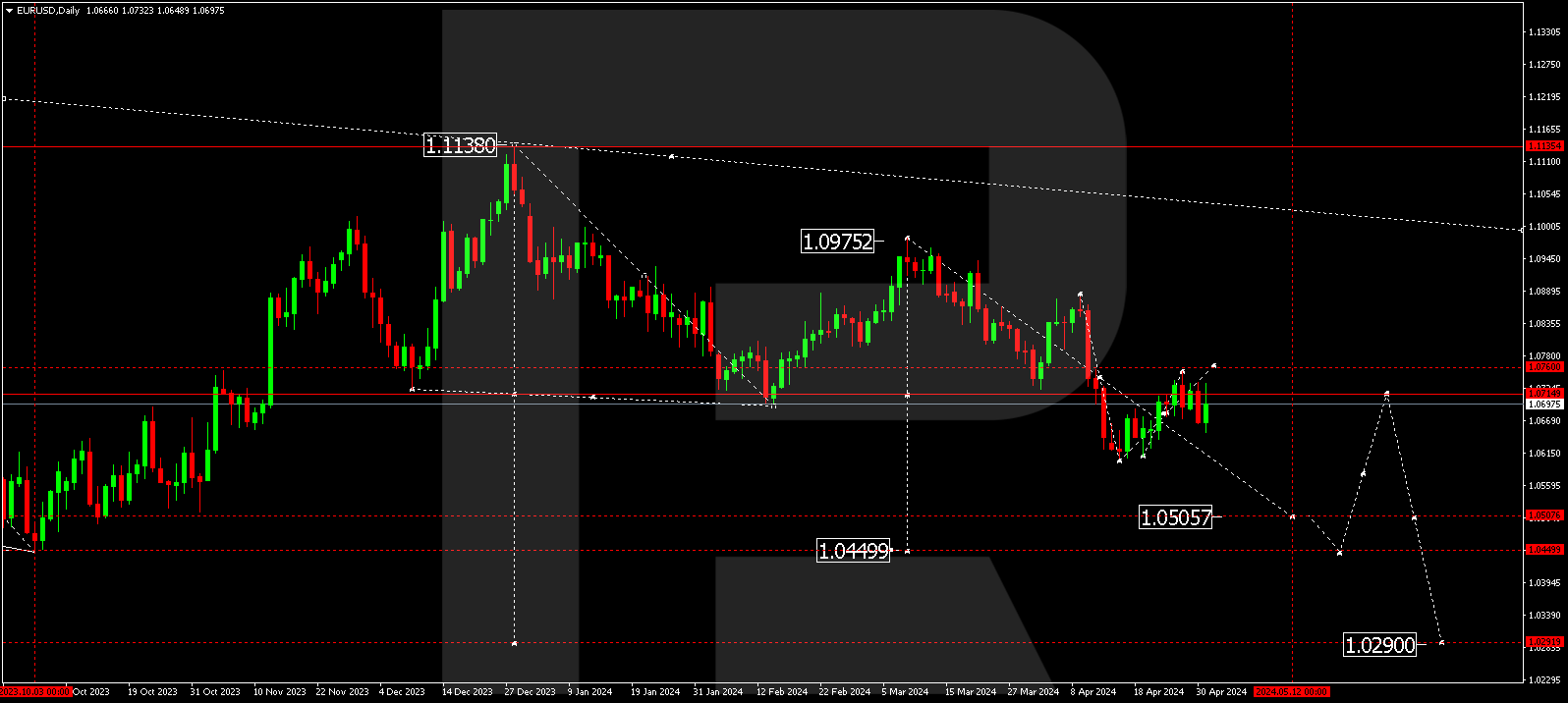

EURUSD, “Euro vs US Dollar”

The currency pair continues developing a consolidation range around 1.0700. At the moment, the market has extended it up to 1.0928. If the price breaks it upwards, a pathway for growth to 1.1080 will open. If the price breaks the range downwards, the structure of decline could continue to 1.0455, from where the wave might extend to 1.0360.

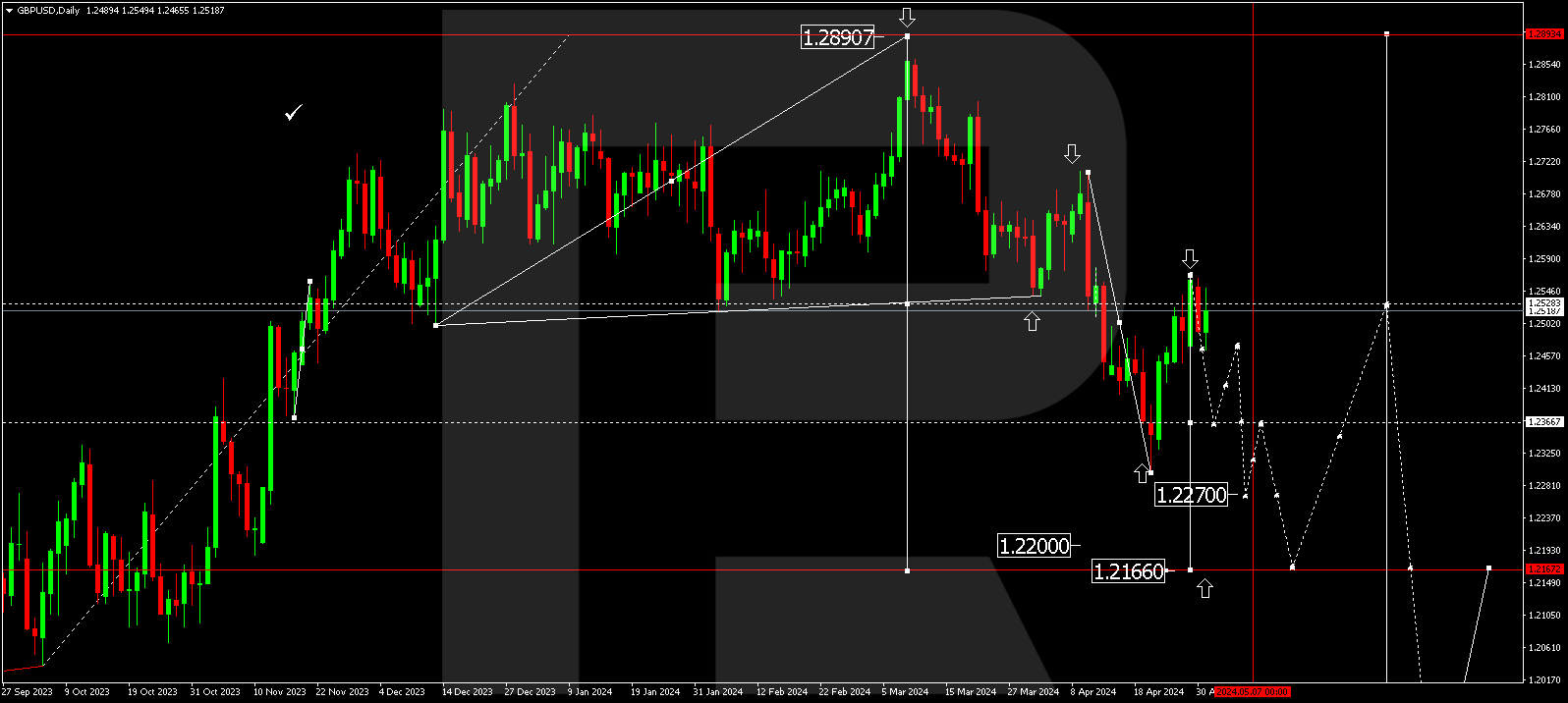

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has completed a link of growth to 1.2252. At the moment, the market has formed a consolidation range around it. A breakout of the range upwards and a link of growth to 1.2490 are not excluded. Later the price could develop the structure further to 1.2700. Then a wave of decline to 1.2120 is expected to begin, and it could continue to 1.1630.

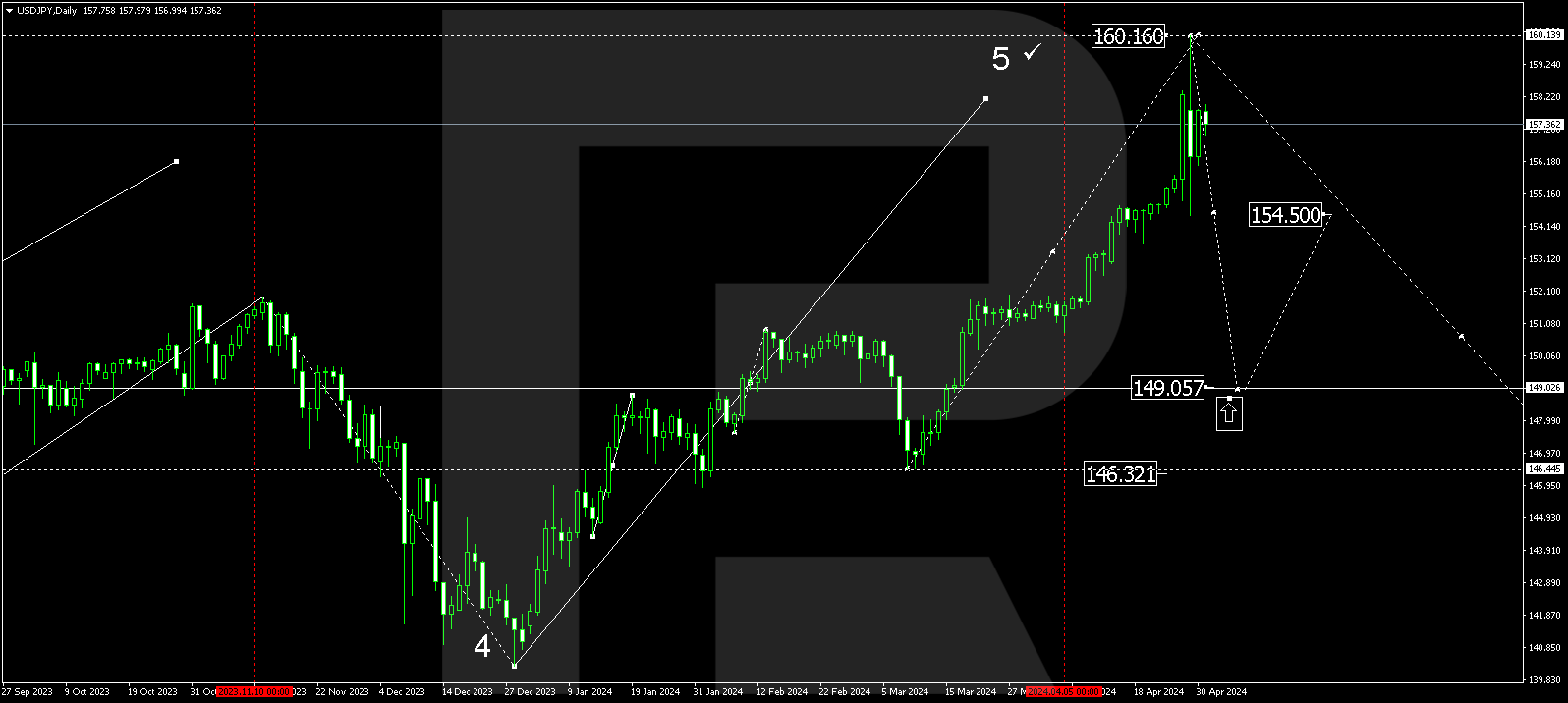

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has broken the level of 132.90 and goes on developing a link of growth to 135.50. The target is local. After the price reaches it, a decline back to 132.90 could follow, and next – growth to 138.02. When this wave of growth is over, a wave of decline to 130.00 could start. Upon breaking this level, the price could form a structure of decline to 124.10.

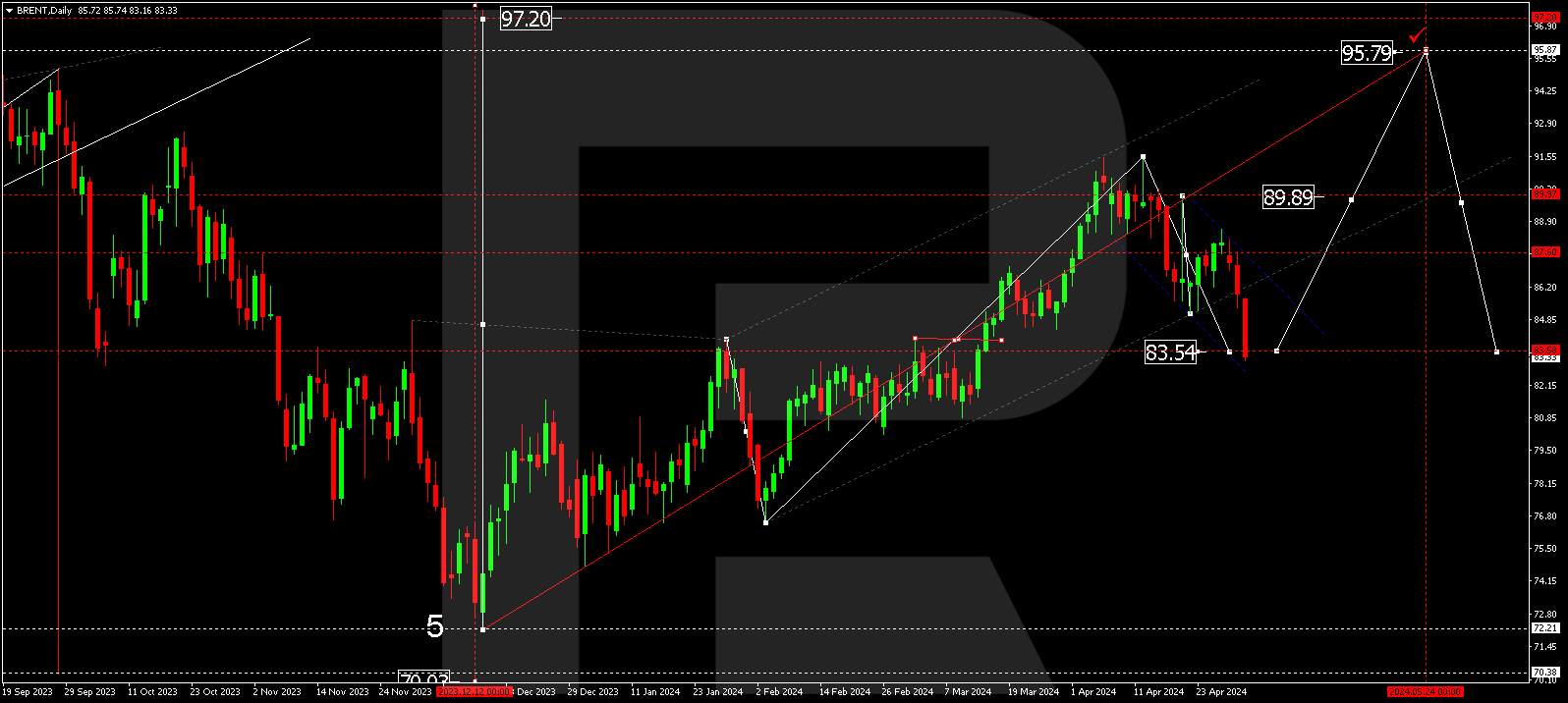

BRENT

Brent has completed an impulse of growth to 78.50. Currently, the market formed a consolidation range around it and today has broken it upwards, reaching the second target of the impulse at 84.84. A link of correction to 80.00 is not excluded. Then we expect a new impulse of growth to 87.00, from where the wave might extend to 94.44. After the price reaches this level, a correction to 78.50 might follow.

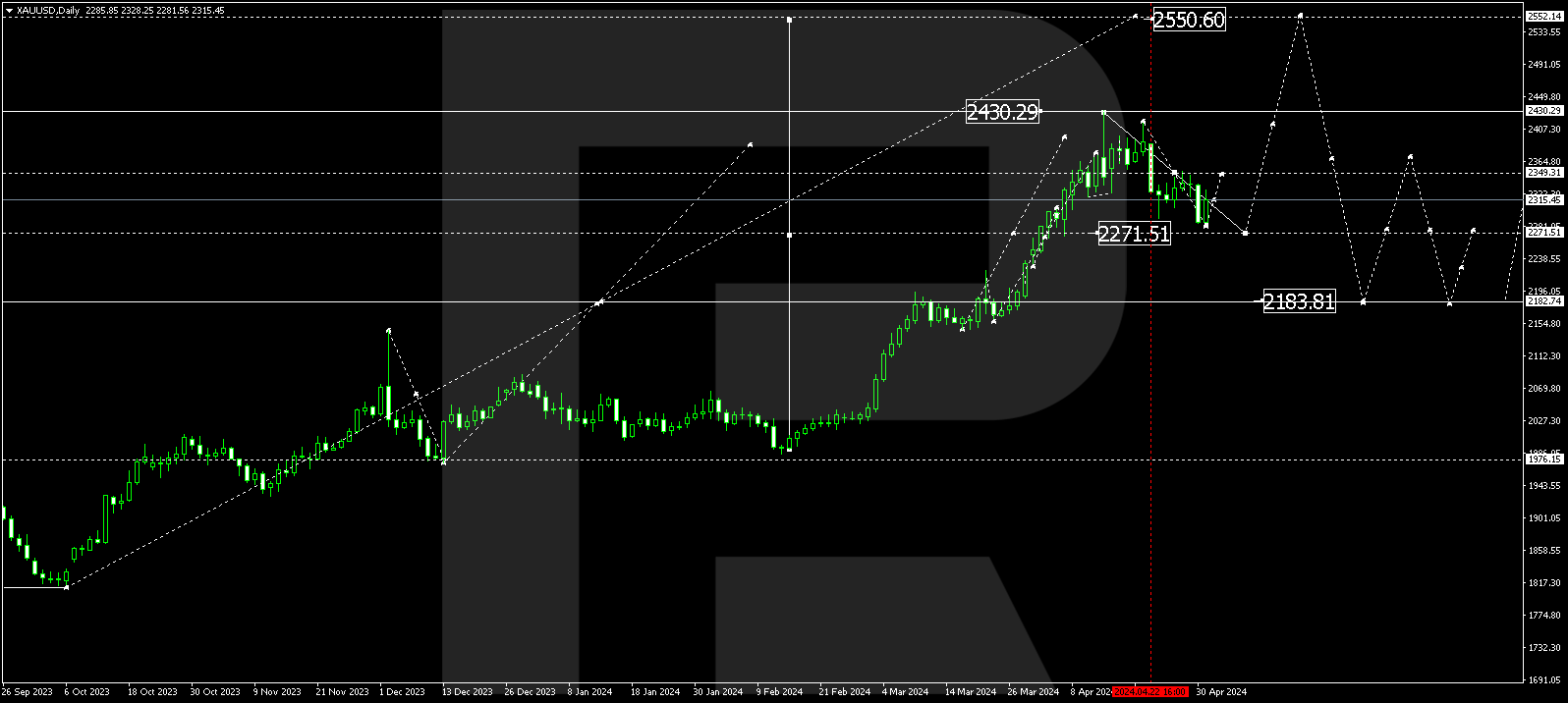

XAUUSD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 1959.00. We expect a structure of decline to 1909.00 to follow. After the price reaches this level, a wave of growth to 2014.50 could develop. Then we expect a decline to 1900.00, from where the wave could continue to 1800.00.

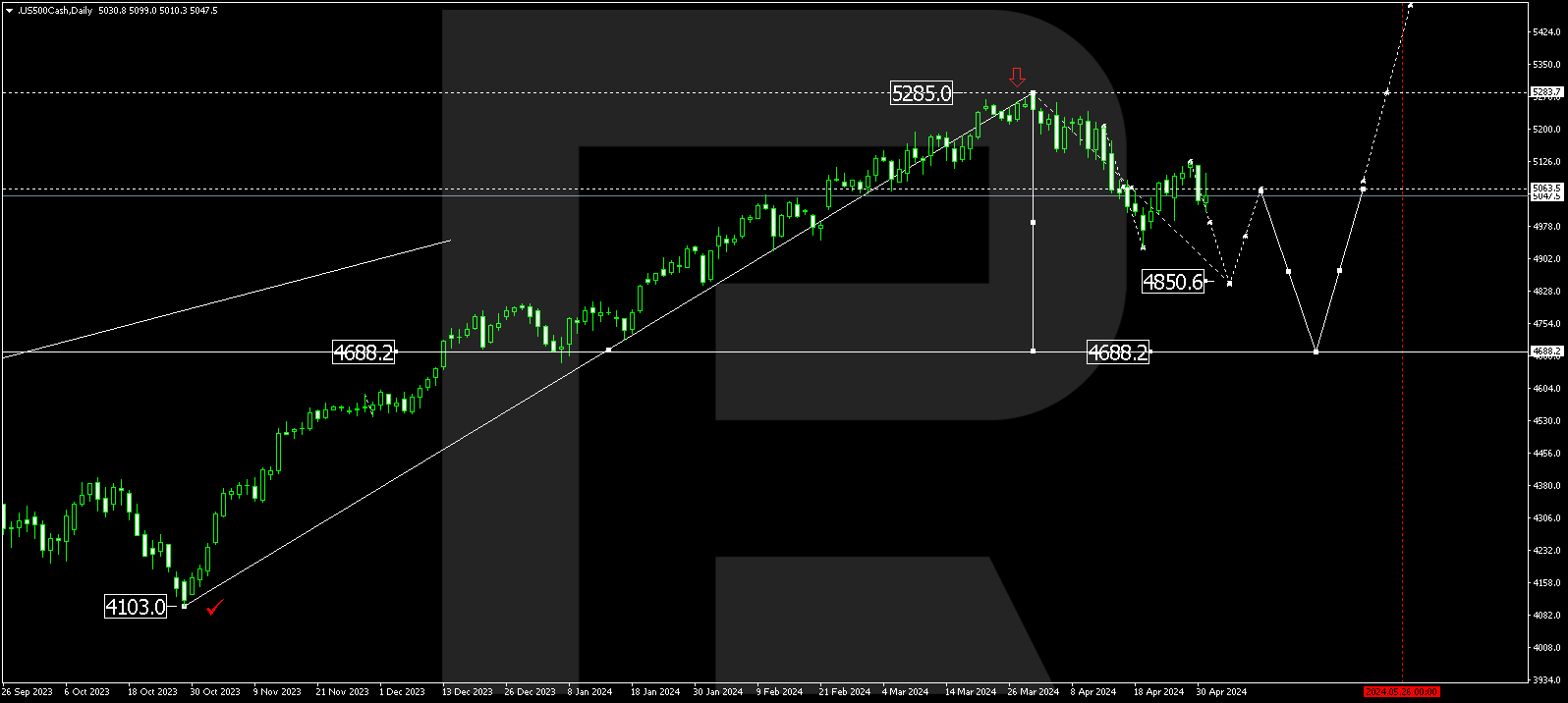

S&P 500

The stock index has completed a link of growth to 4048.0. Today the market has extended the range upwards and suggests developing a link of growth to 4195.0, followed by a decline to 4050.0. After the price reaches this level, the wave of growth could continue to 4290.0, and there it is likely to be over. Then a decline to 3900.0 could start, from where the impulse could develop to 3400.0.