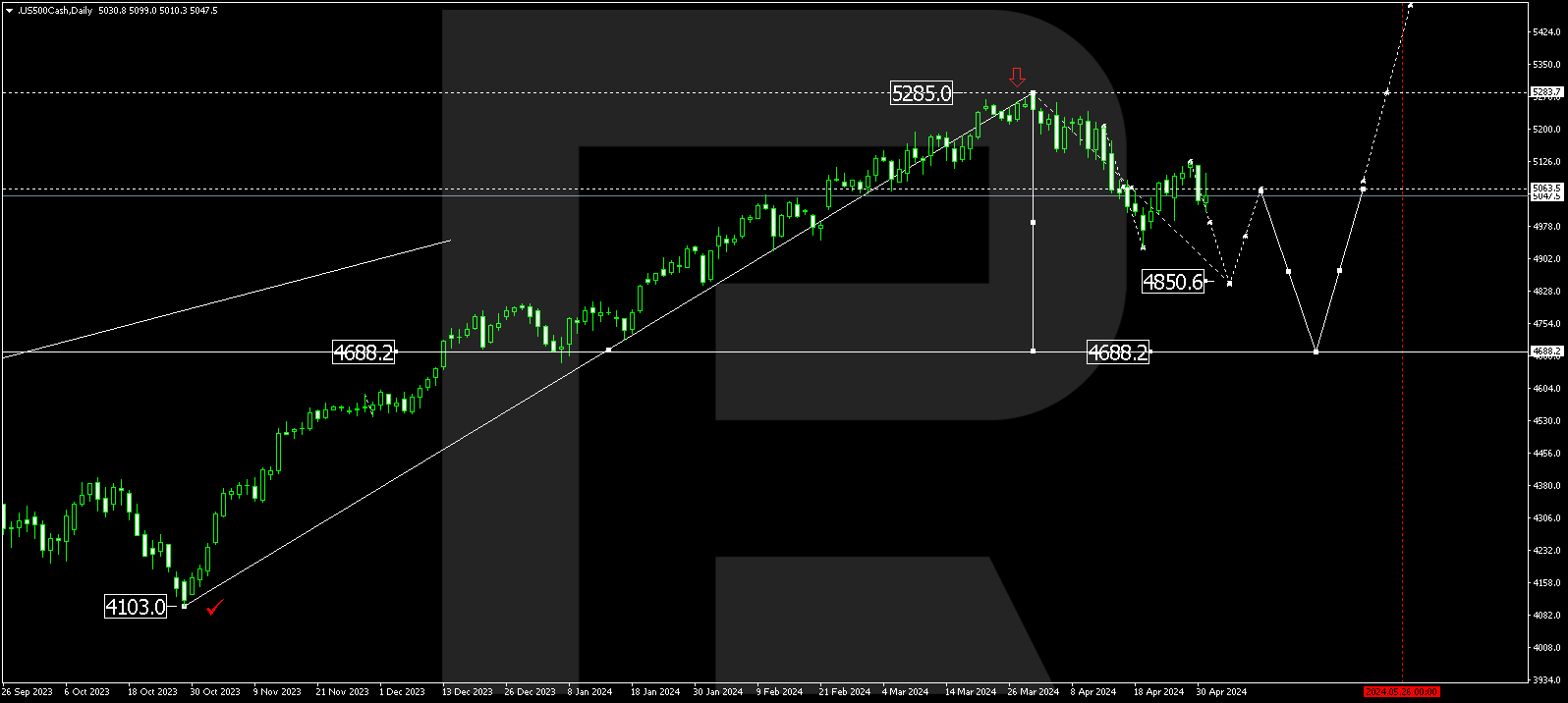

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction to 1.1010. Currently, a decline wave to 1.0860 might form, possibly followed by a correction to 1.0920. Practically, a consolidation range is forming around this level. The main scenario presumes a decline to 1.0713. This is the first target.

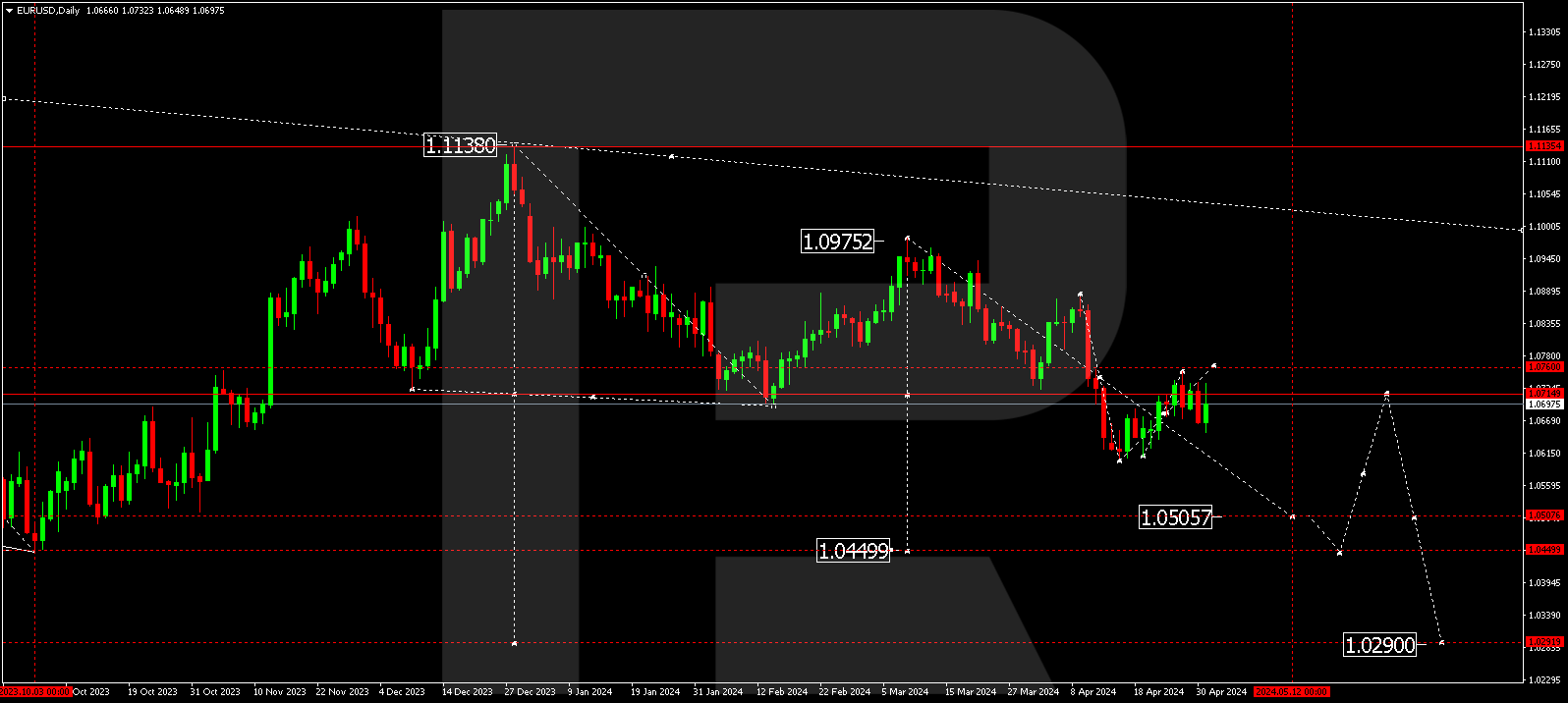

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has performed a correction wave to 1.2680. A consolidation range is now forming under this level. With an escape from this range downwards, a decline wave to 1.2216 could begin. Once this level is breached, the trend might continue to 1.1700. This is a local target.

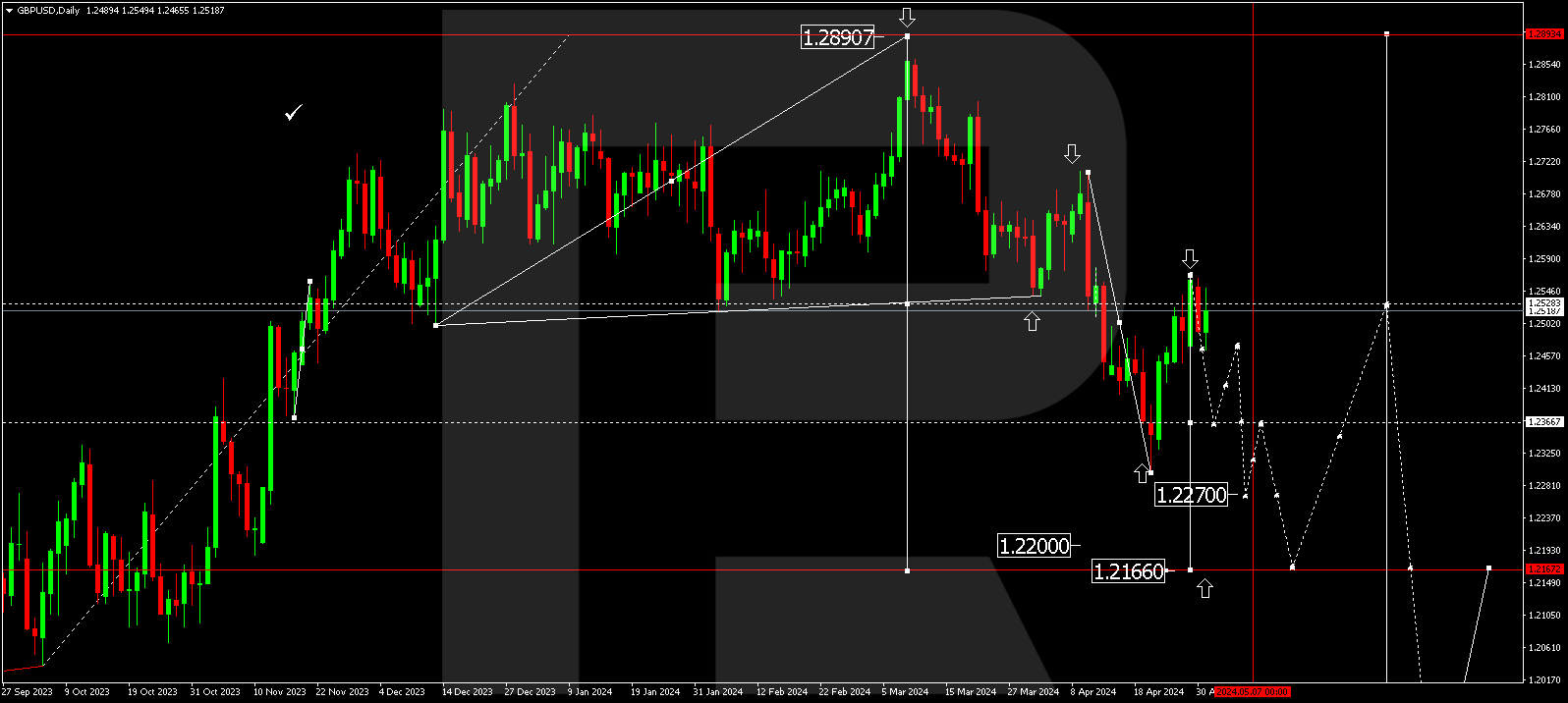

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a movement to 146.80 within the first decline wave. At the moment the market is developing a correction to 149.25. After it is over, a decline wave to 144.44 might follow. This is a local target.

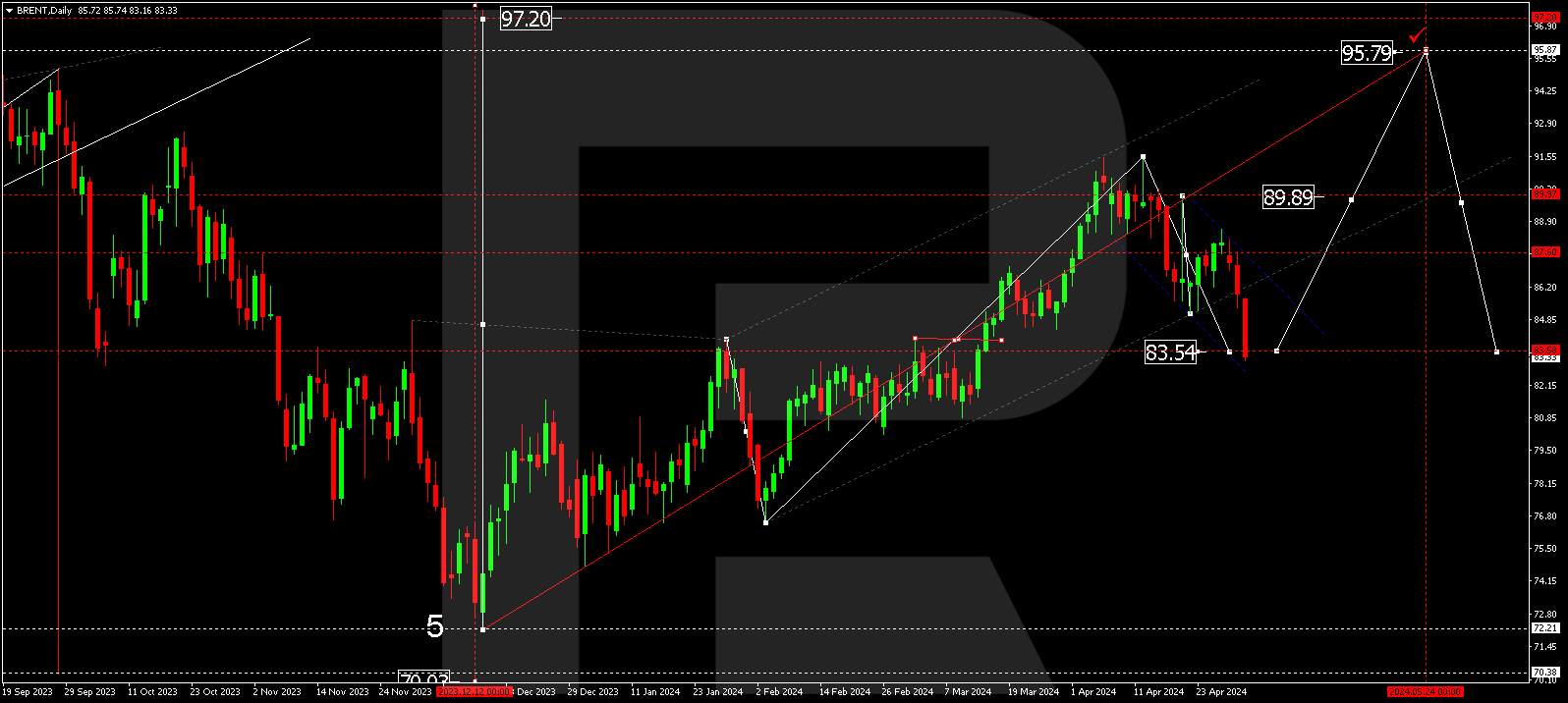

BRENT

Brent has completed a growth wave to 84.80. Next, it might correct to 79.90. After the quotes reach the target, a wave of growth to 88.10 might start, from where the trend could continue to 89.95. This is the first target.

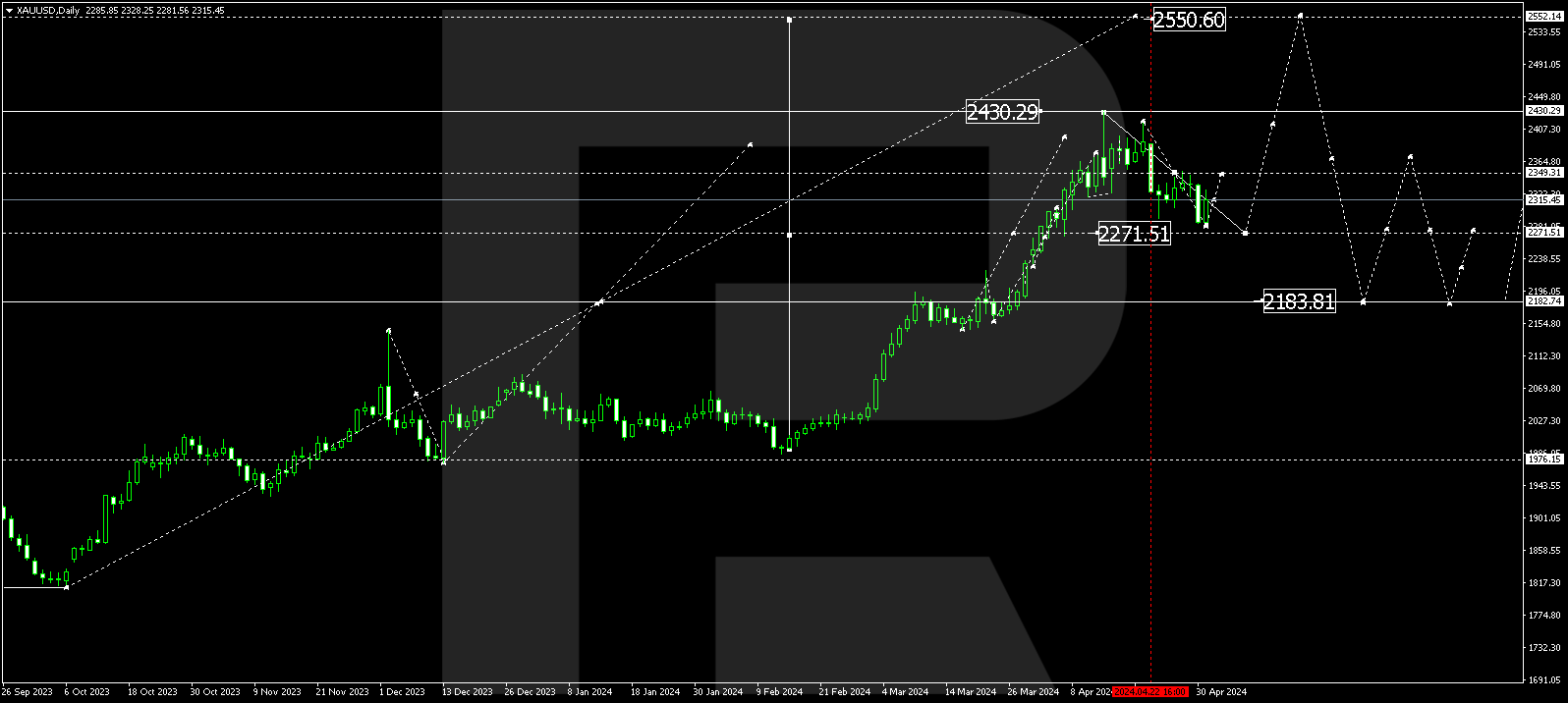

XAUUSD, “Gold vs US Dollar”

Gold has completed a growth wave to 2050.50. A consolidation range is expected to develop under this level. With an escape from the range downwards, a correction wave to 1986.00 might happen. Next, a rise to 2080.00 could follow, from where the trend could continue to 2176.00.

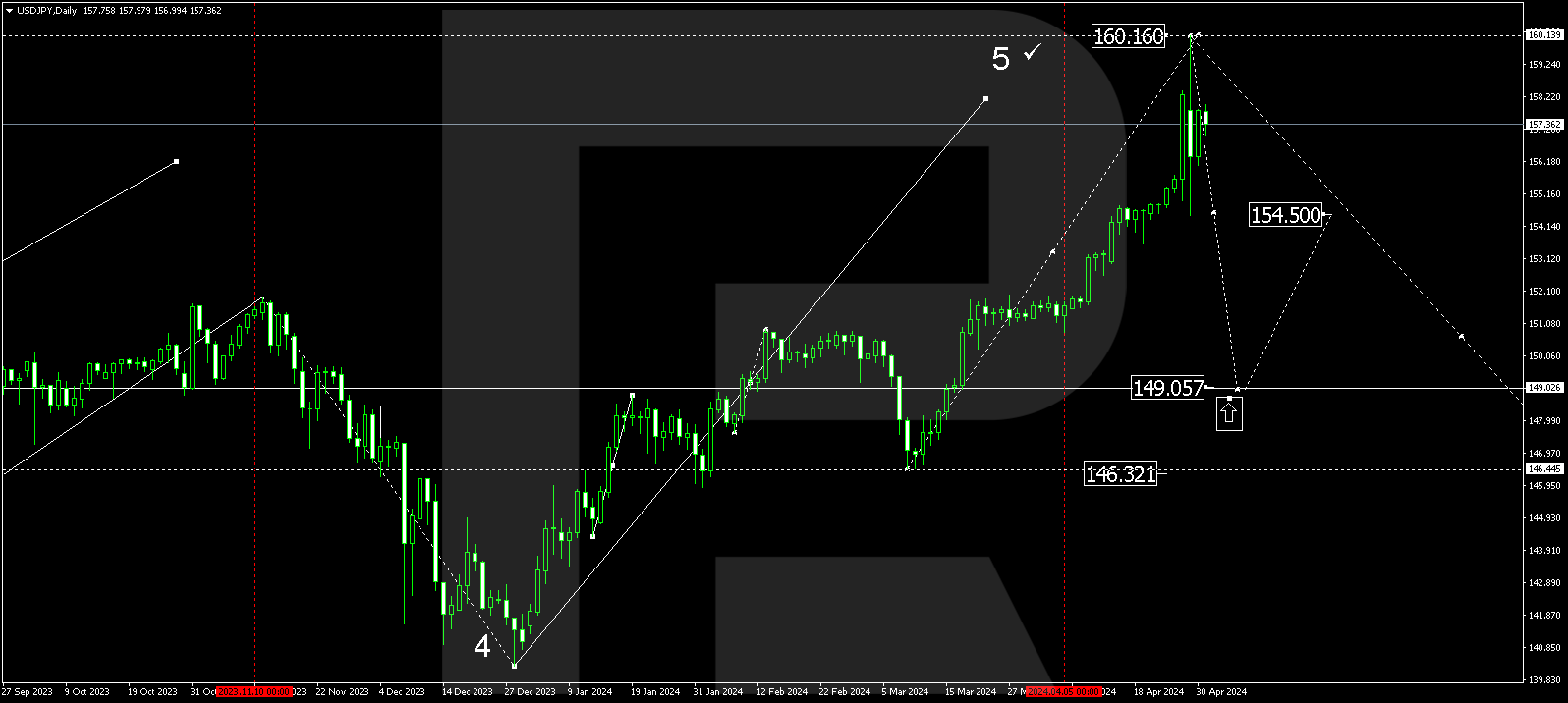

S&P 500

The stock index has formed a consolidation range around 4370.0. With an escape from the range upwards, the second half of the growth wave might develop to 4640.0. After the price reaches this level, a new decline wave to 4486.6 might begin. This is the first target of the decline wave.