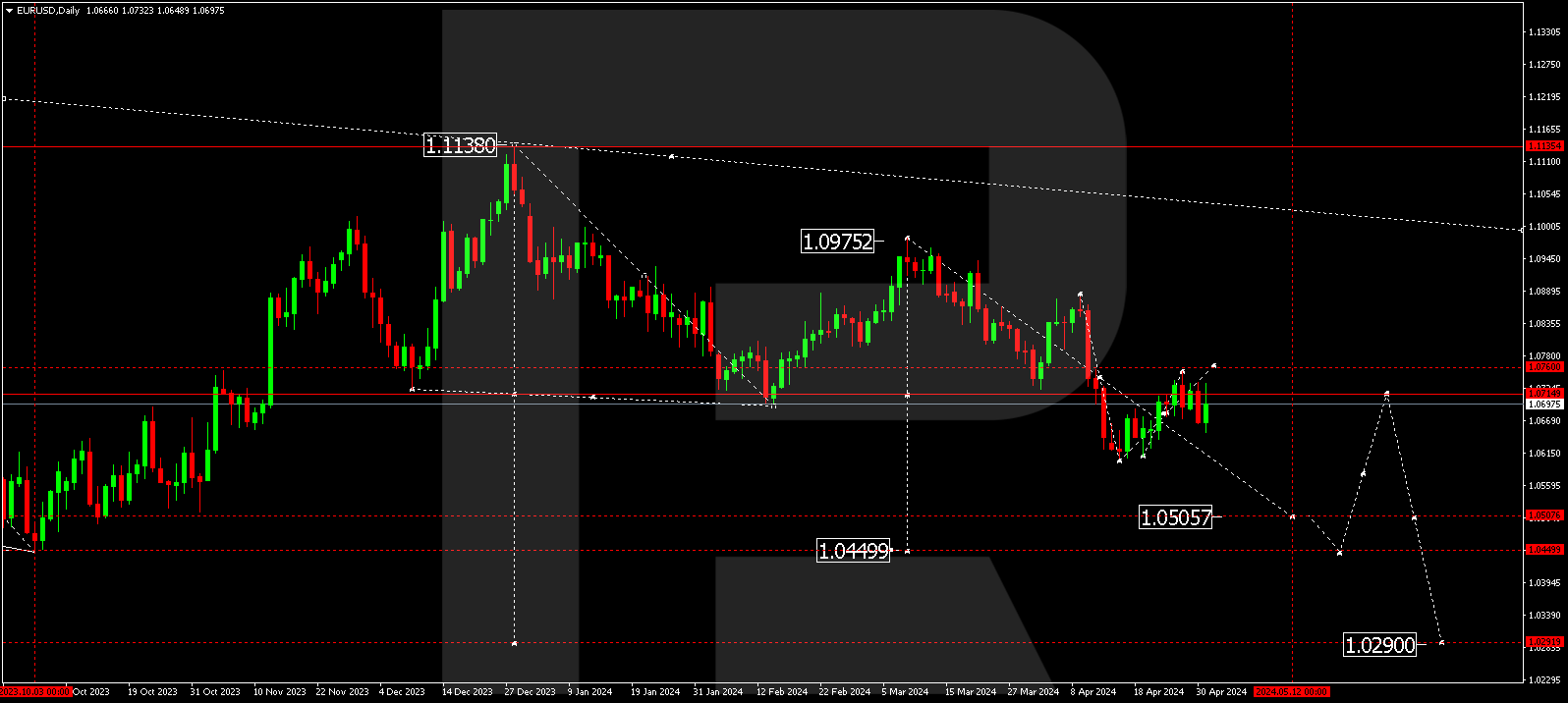

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction, reaching 1.1138. A new decline wave could follow, targeting 1.0763. The market has already completed the first impulse to 1.0940 and is in a consolidation phase around this level today. With an upward breakout, the price could correct to 1.1010. A downward breakout will open the potential for a decline to 1.0763. Next, a correction towards 1.0940 could follow.

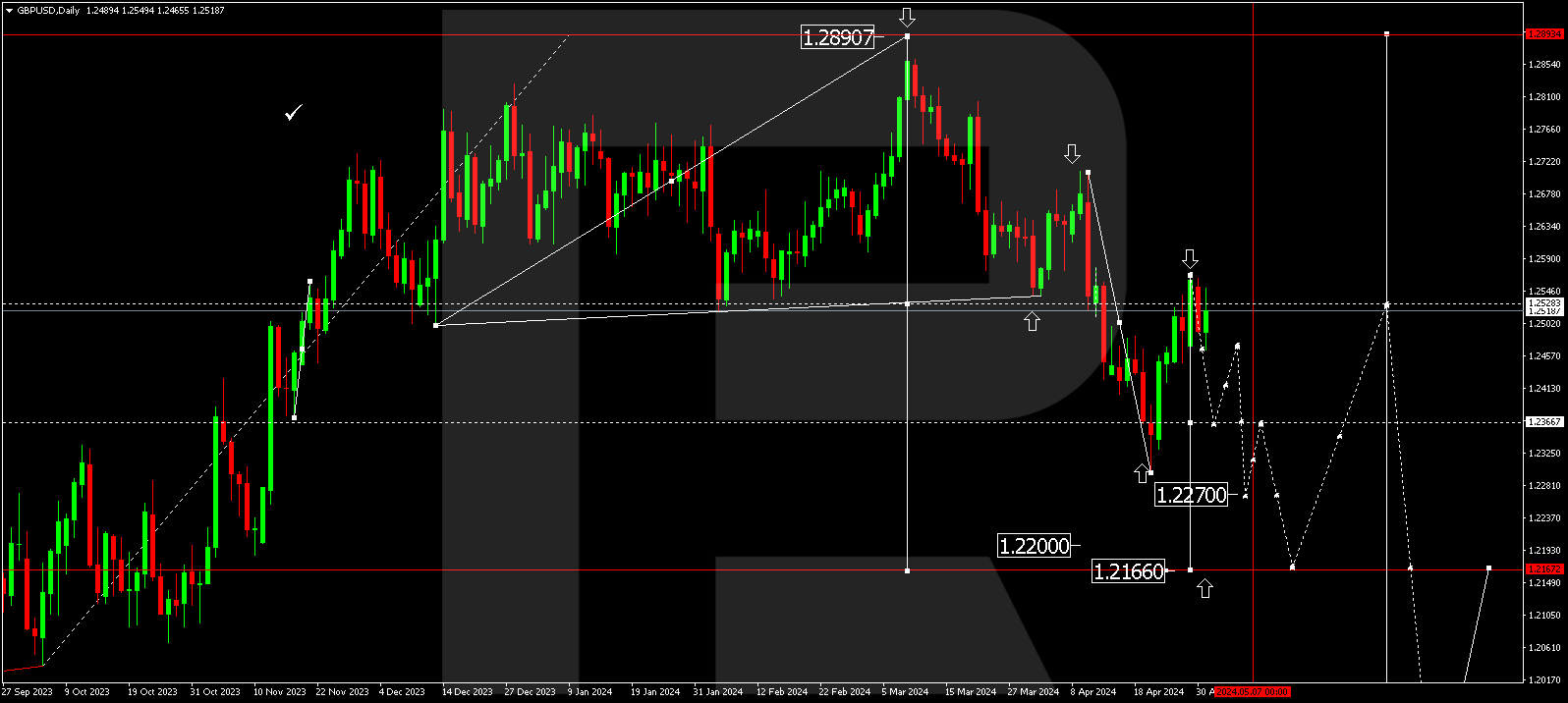

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has corrected to 1.2822, with the market currently forming a consolidation range below this level. With an upward breakout, the correction could extend to 1.2890, while a downward breakout will signal the beginning of a decline wave towards 1.2460. If this level breaks, the trend might continue to 1.2040. This is a local target.

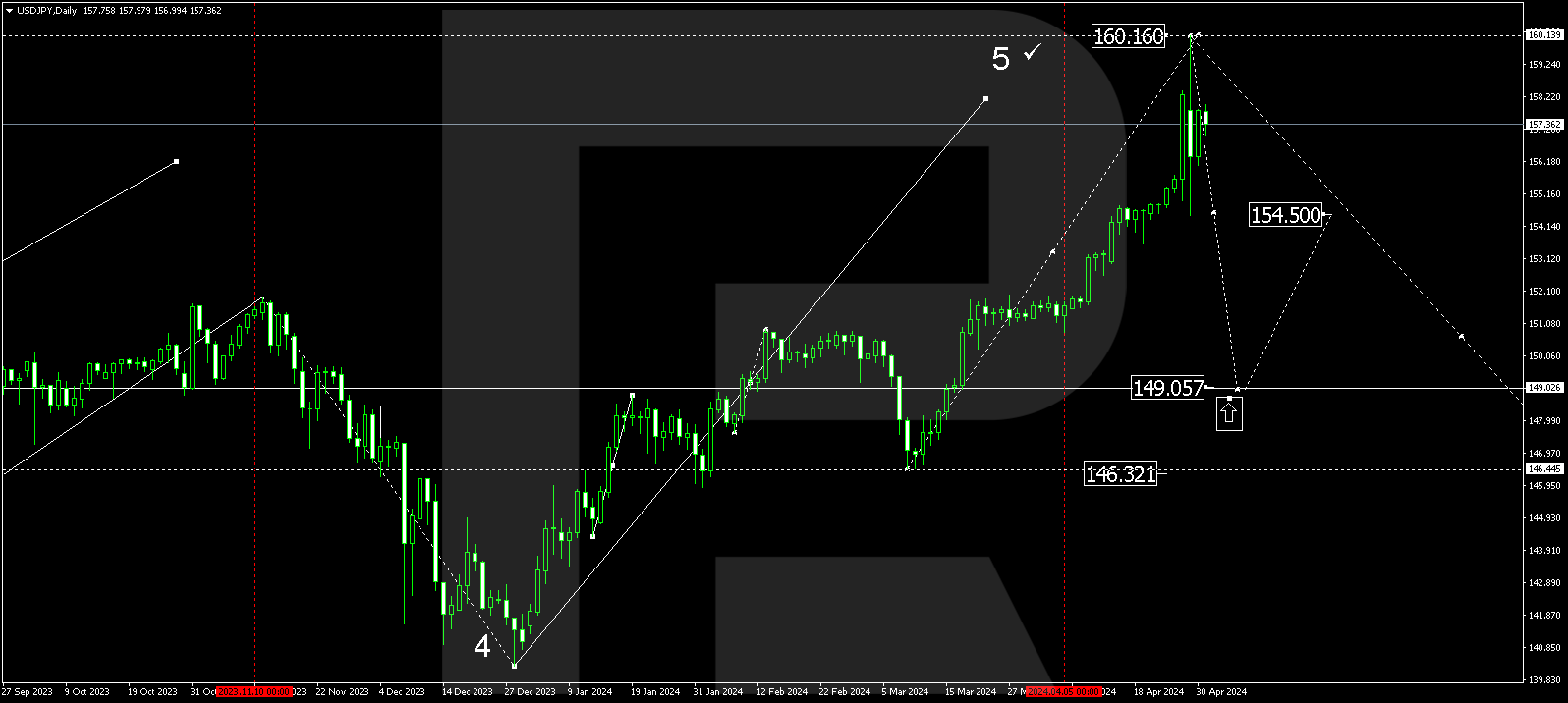

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed the first decline wave to 140.24, with the market developing a correction to 149.40. When the correction is over, another downward movement could start, targeting 139.40. This is a local target.

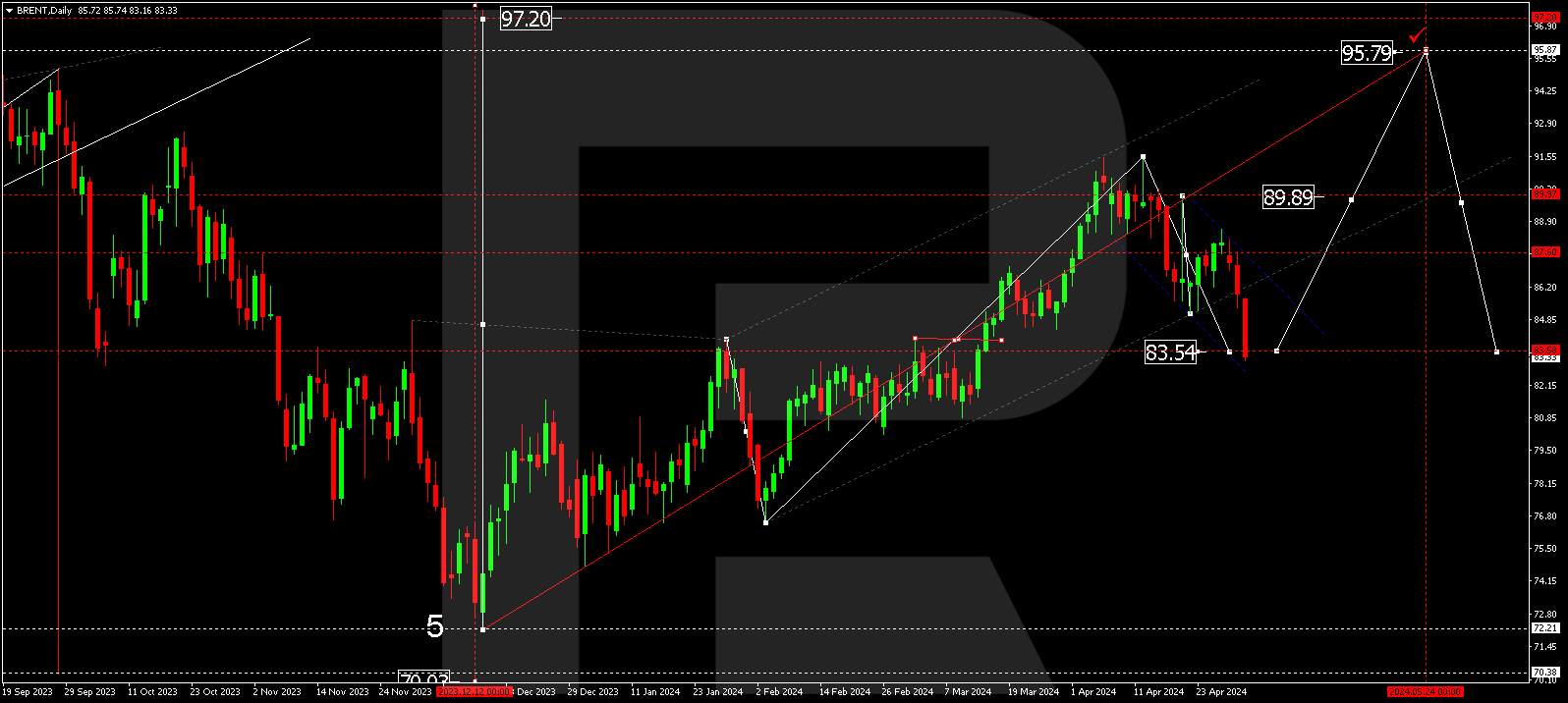

BRENT

Brent has undergone a correction, reaching 74.74. A consolidation range could form above this level now. Breaking above it, the price might maintain its upward trajectory towards 91.30, potentially hitting the 94.00 level.

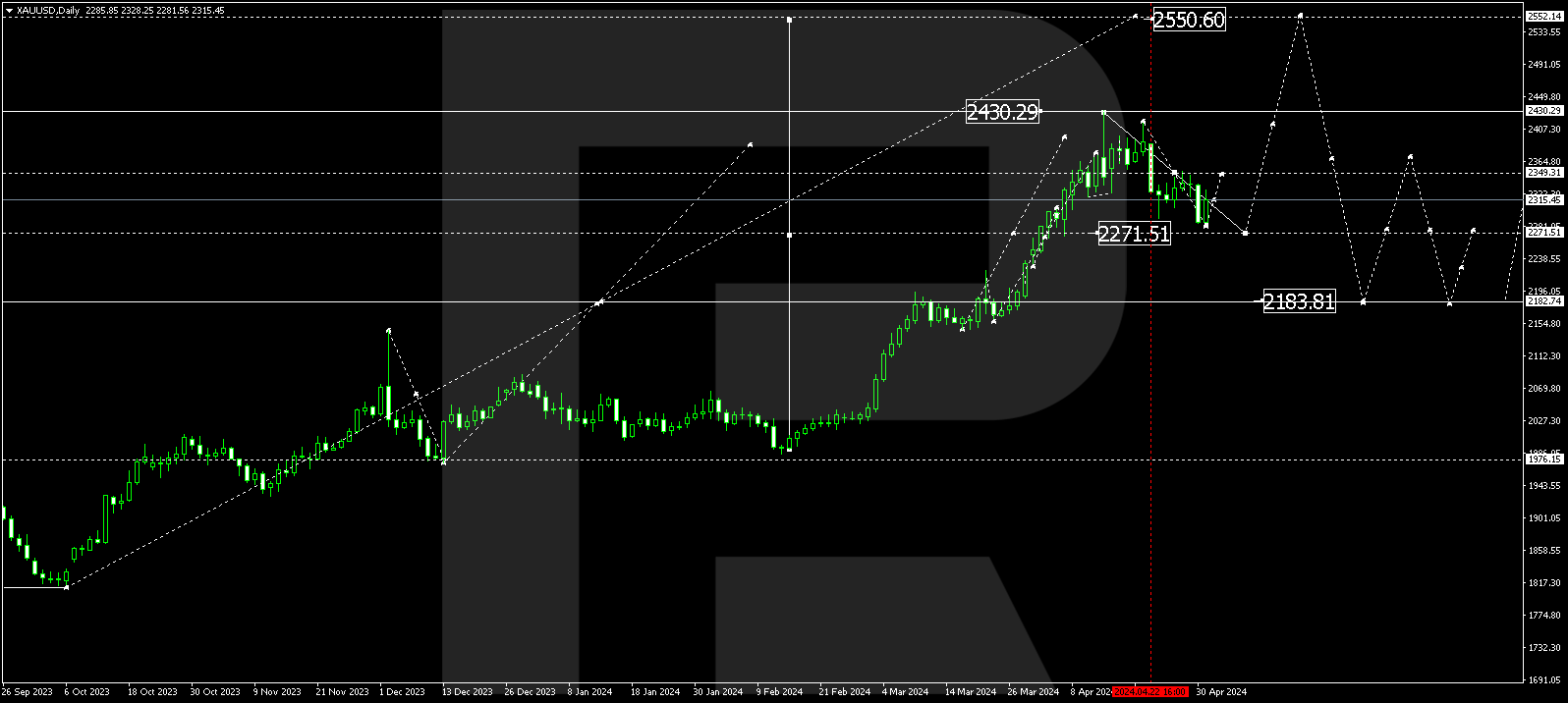

XAUUSD, “Gold vs US Dollar”

Gold continues to form a wide consolidation range around 2036.36, with a growth structure towards 2114.55 expected to develop. After the price reaches this level, another consolidation range could emerge. With an upward breakout of this range, the trend might continue to 2261.60.

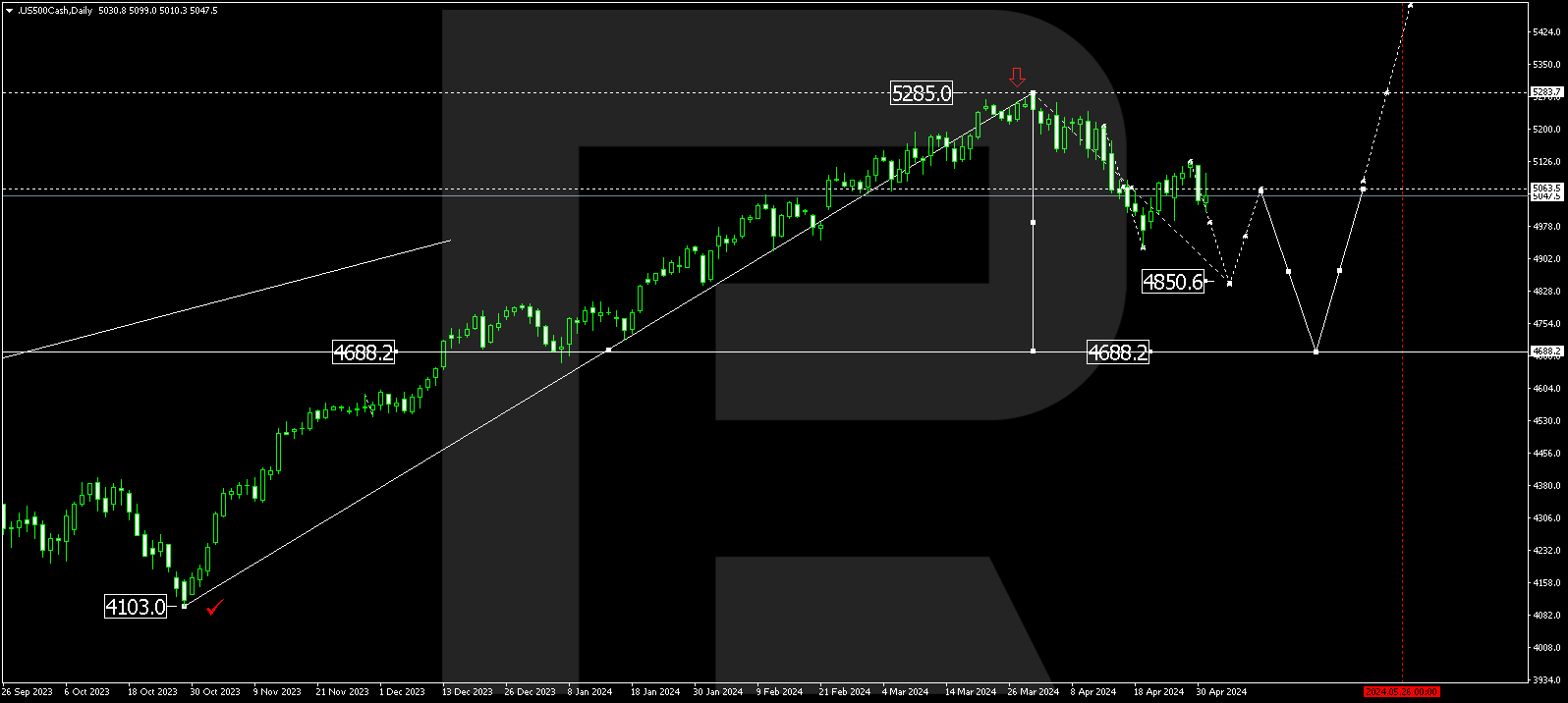

S&P 500

The stock index has completed a growth wave, reaching 4735.5, and is currently in a consolidation phase around this level. A downward breakout could entail a link of correction to 4522.0, followed by another upward movement to 4900.0 and a subsequent decline to 4100.0.