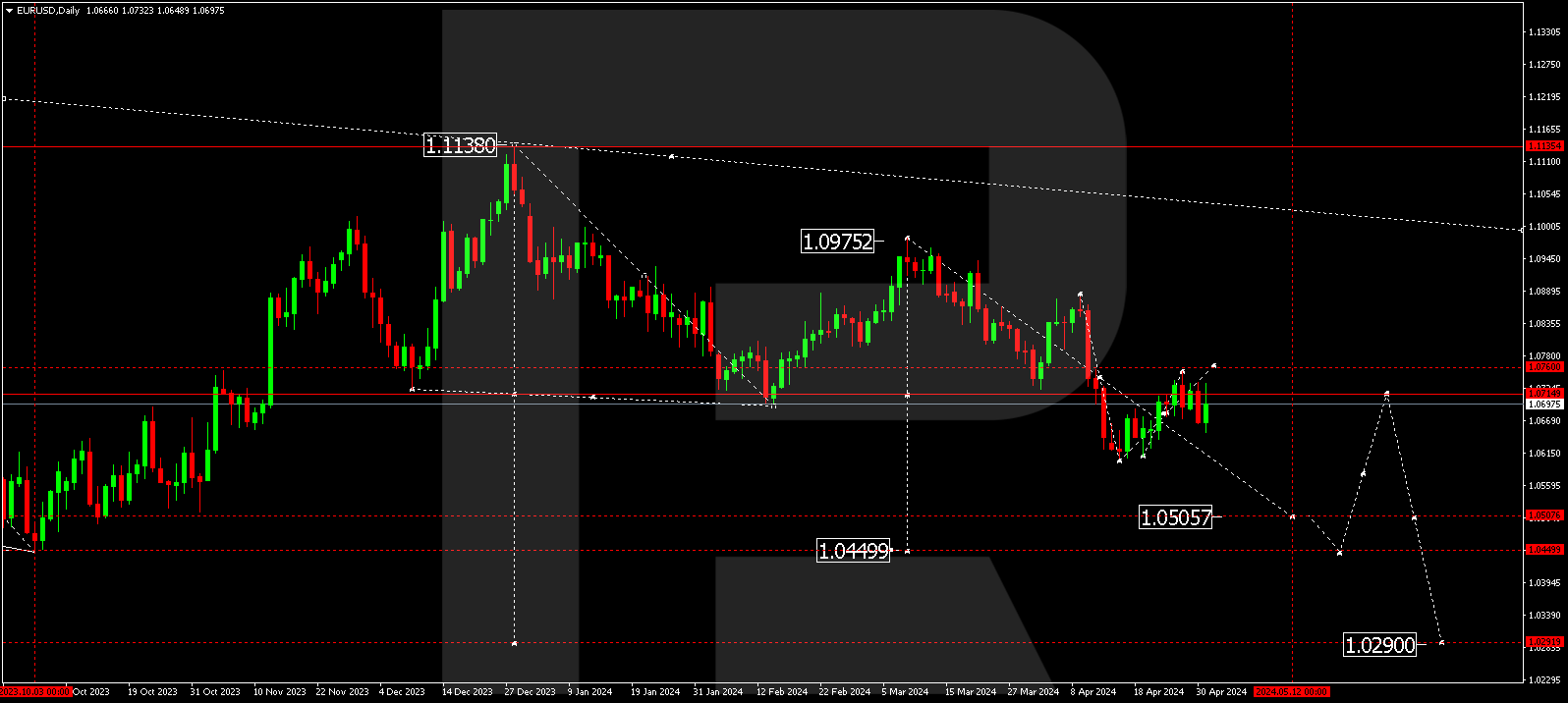

EURUSD, “Euro vs US Dollar”

The EURUSD pair corrected to 1.0886, and today the first structure of the fifth decline wave to 1.0570 is already developing. The target of the first structure is 1.0730. Once this level is reached, the quotes could correct to 1.0807 (testing from below). Next, a decline to 1.0650 might follow. This is a local target.

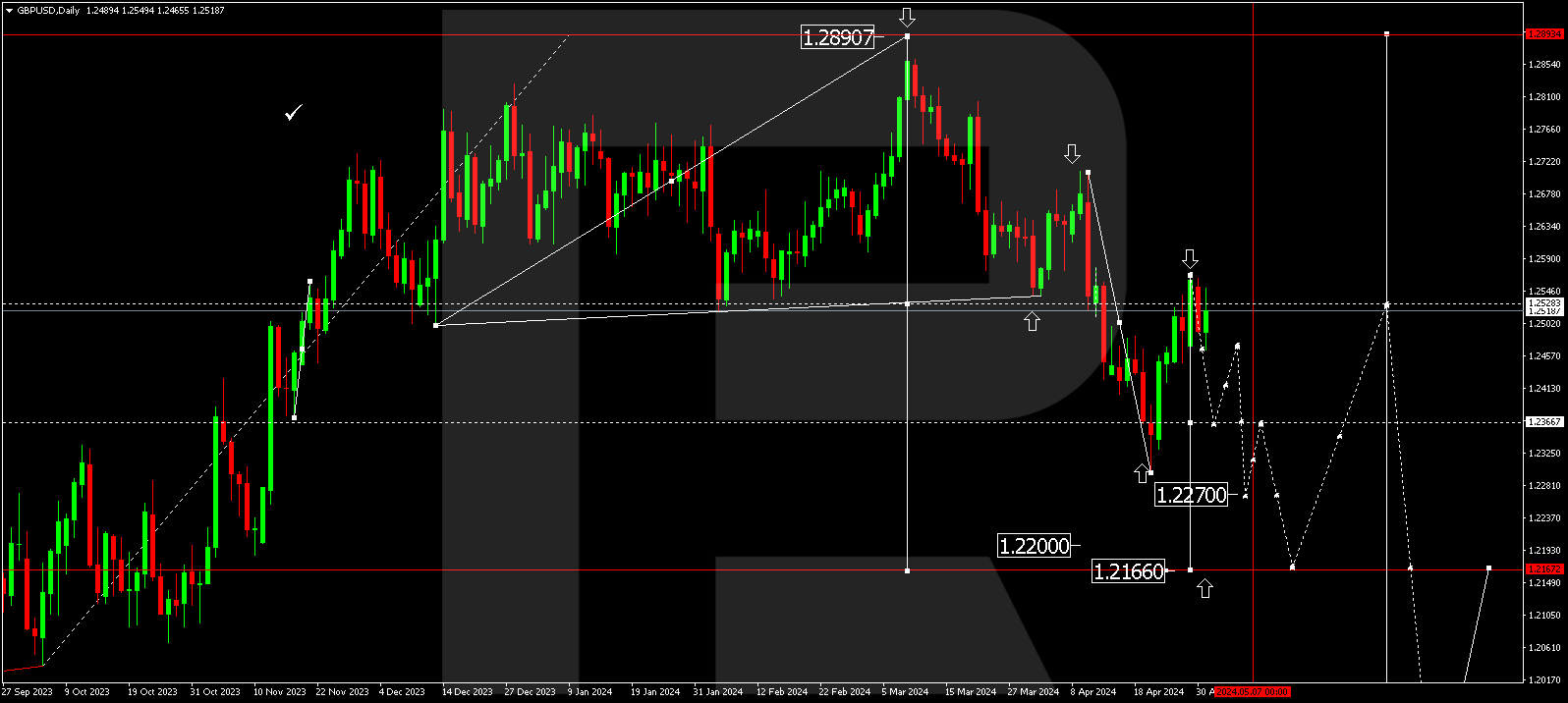

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair continues developing a decline wave to 1.2466, and today the first link of this wave is forming. The target is 1.2588. Once the price reached this level, a correction link to 1.2646 is not excluded. Next, a decline to 1.2525 might follow. This is a local target.

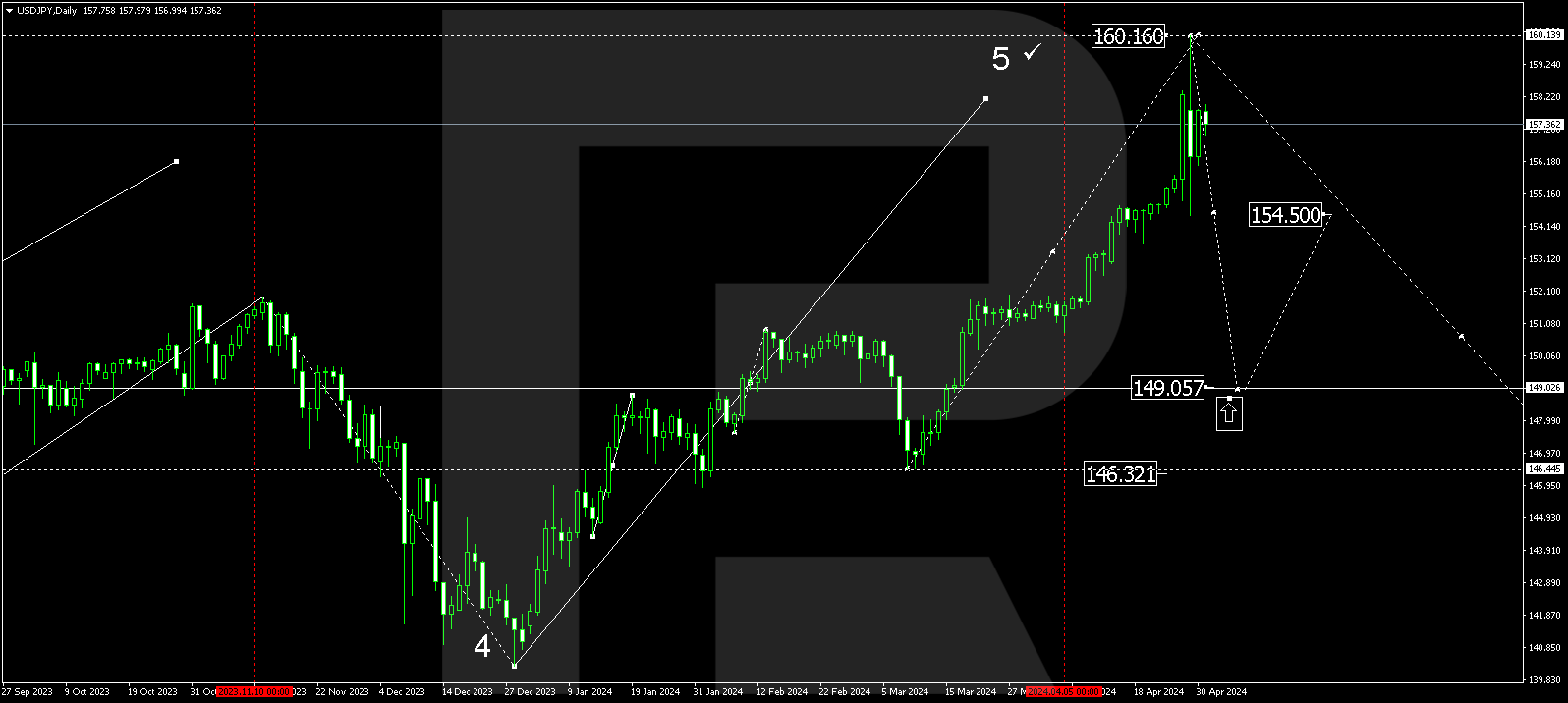

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a correction wave to 149.22. Today the market continues developing a new growth structure to 151.00. Once this target is reached, a consolidation range is expected to form. With an upward breakout from the range, the potential for a growth wave to 152.00 could open, from where the trend might extend to 152.60. This is an estimated target.

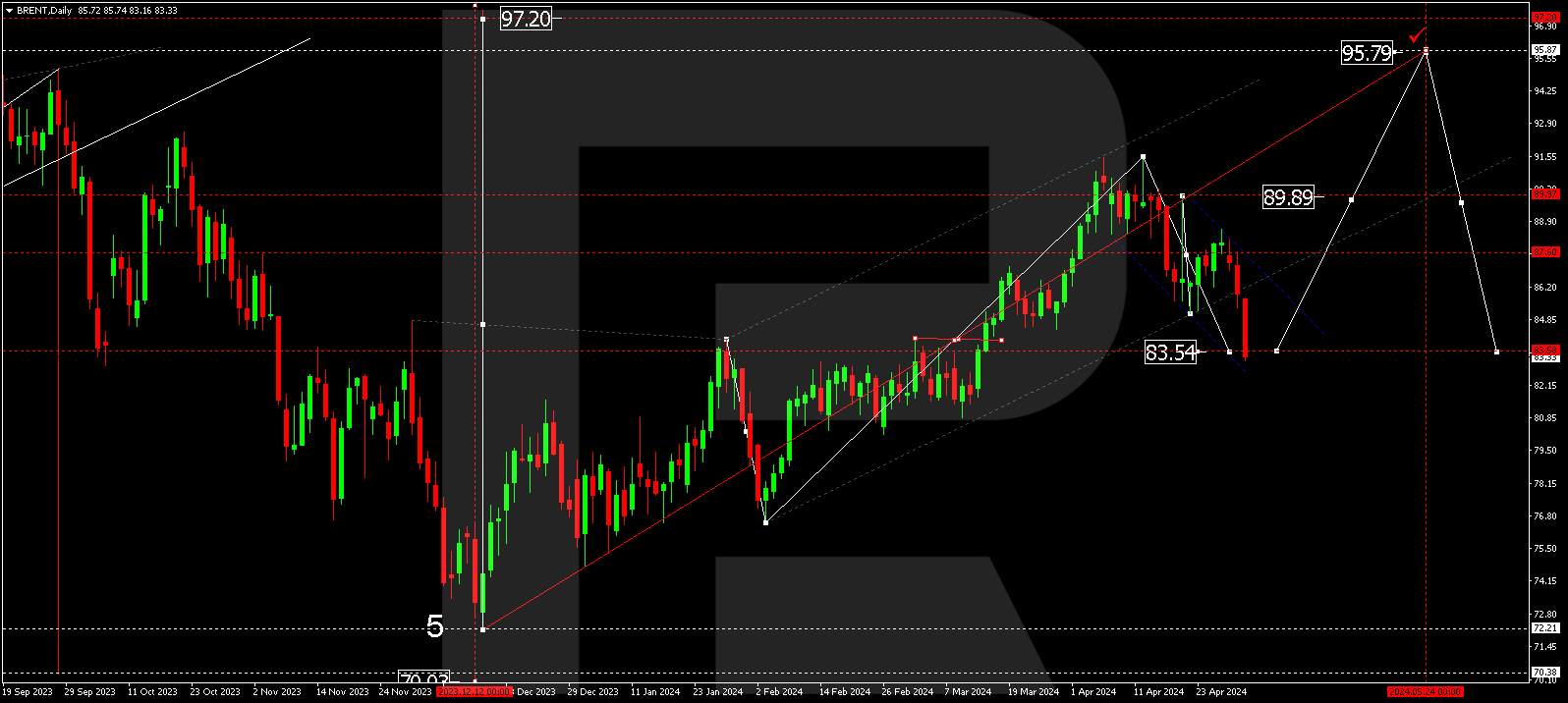

BRENT

Brent continues forming a wide consolidation range around 81.60. An upward breakout from the range towards 85.85 is expected, and this is a local target. Once it is reached, a correction link to 83.55 is not excluded, followed by a rise to 86.55. This is an estimated target.

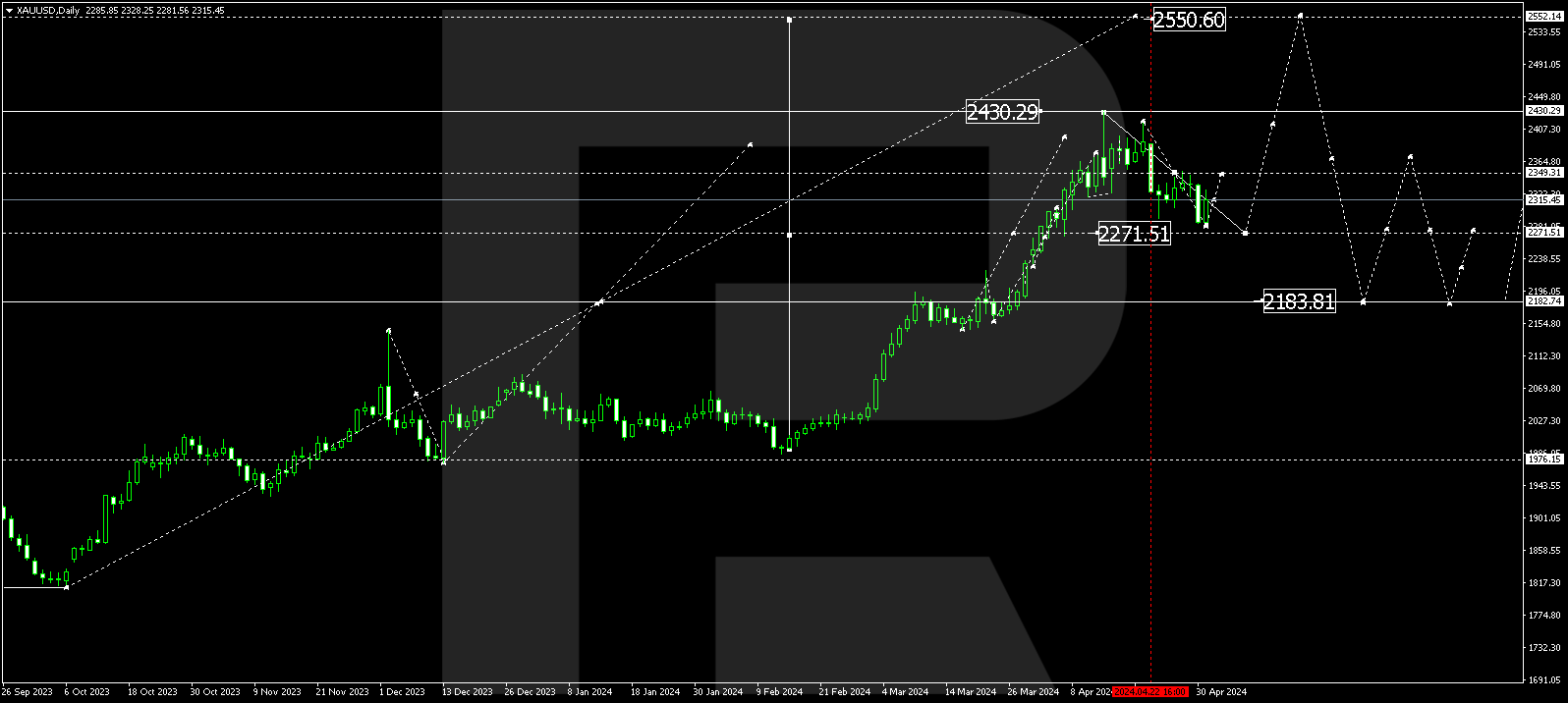

XAUUSD, “Gold vs US Dollar”

Gold has formed a consolidation range around 2028.00 and might continue the growth wave to 2073.00, breaking the range upwards. Once this level is reached, a decline wave to 2028.00 might begin. With a downward breakout of the level, the potential for a further correction to 1978.00 might open.

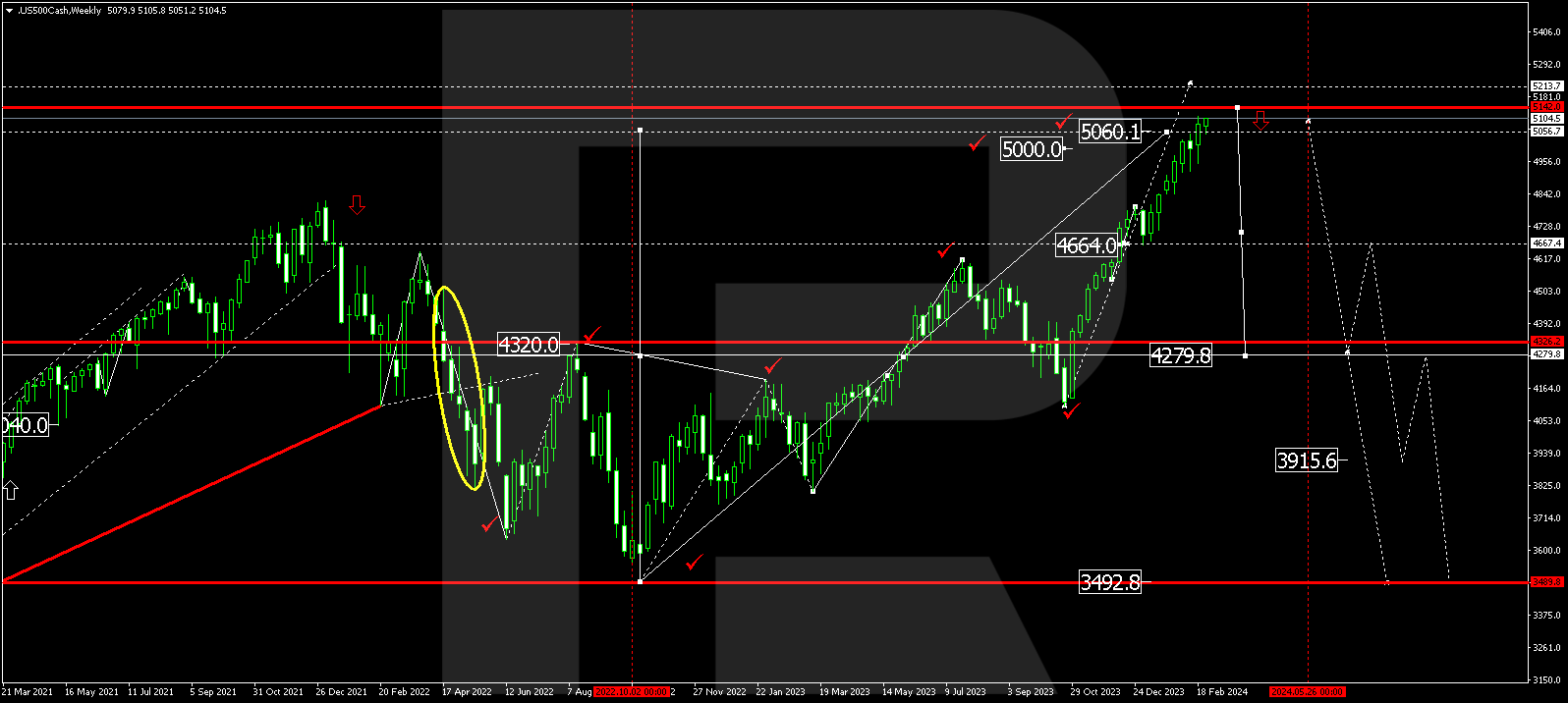

S&P 500

The stock index continues developing the fifth growth wave. The estimated target of this wave has already been reached. Currently, the market could extend this wave towards 5142.0. This structure might even reach 5213.0. It should be noted that these extensions might stop at any moment. The first decline target could be 4280.0.