Technical Analysis & Forecast for May 2023

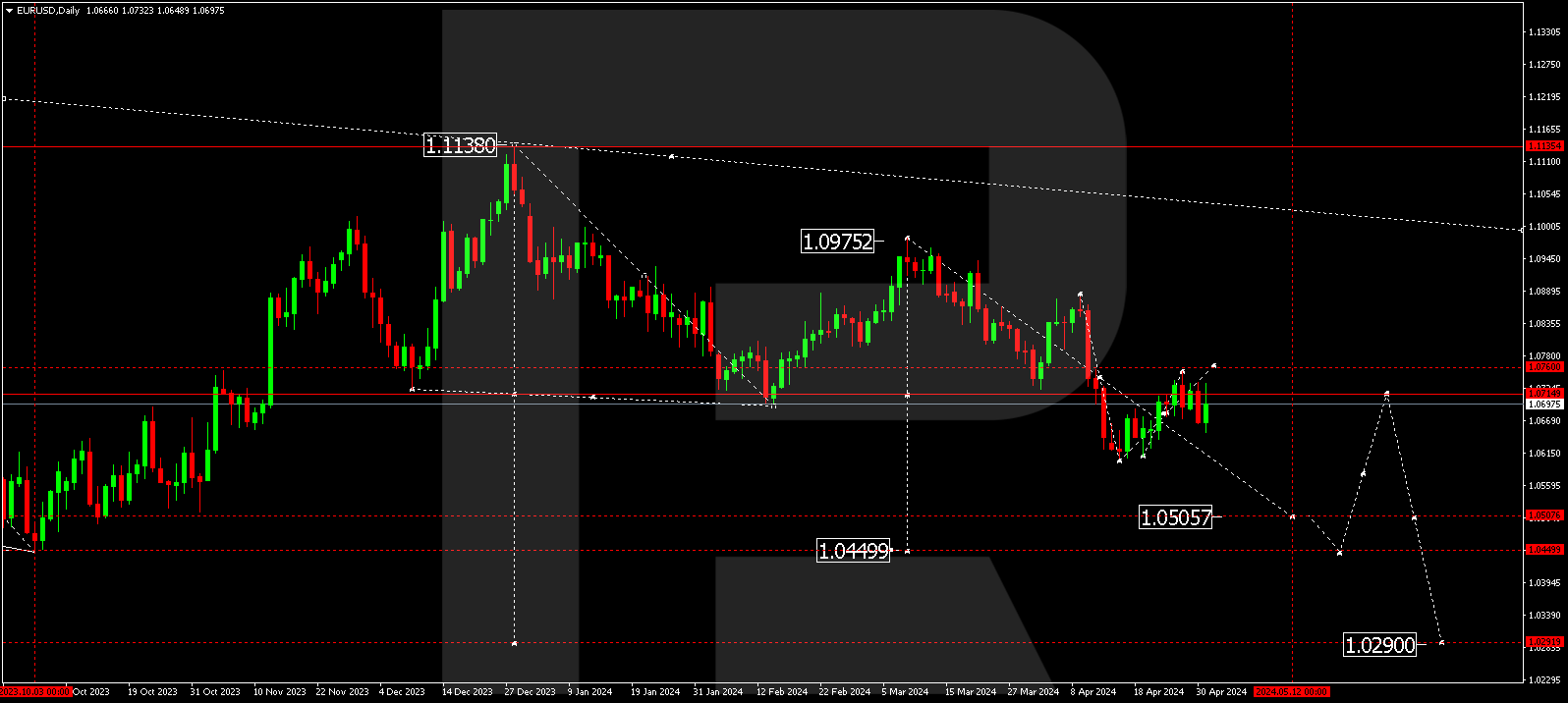

EURUSD, “Euro vs US Dollar”

The currency pair continues to develop a consolidation range around the 1.0880 level. At the moment, the market has extended it upwards to 1.1090. A downward pattern is expected to develop towards 1.0880 (test from above). An upside exit from this range could open up the potential for growth to 1.1250, followed by a correctional decline to 1.0520 on the way down.

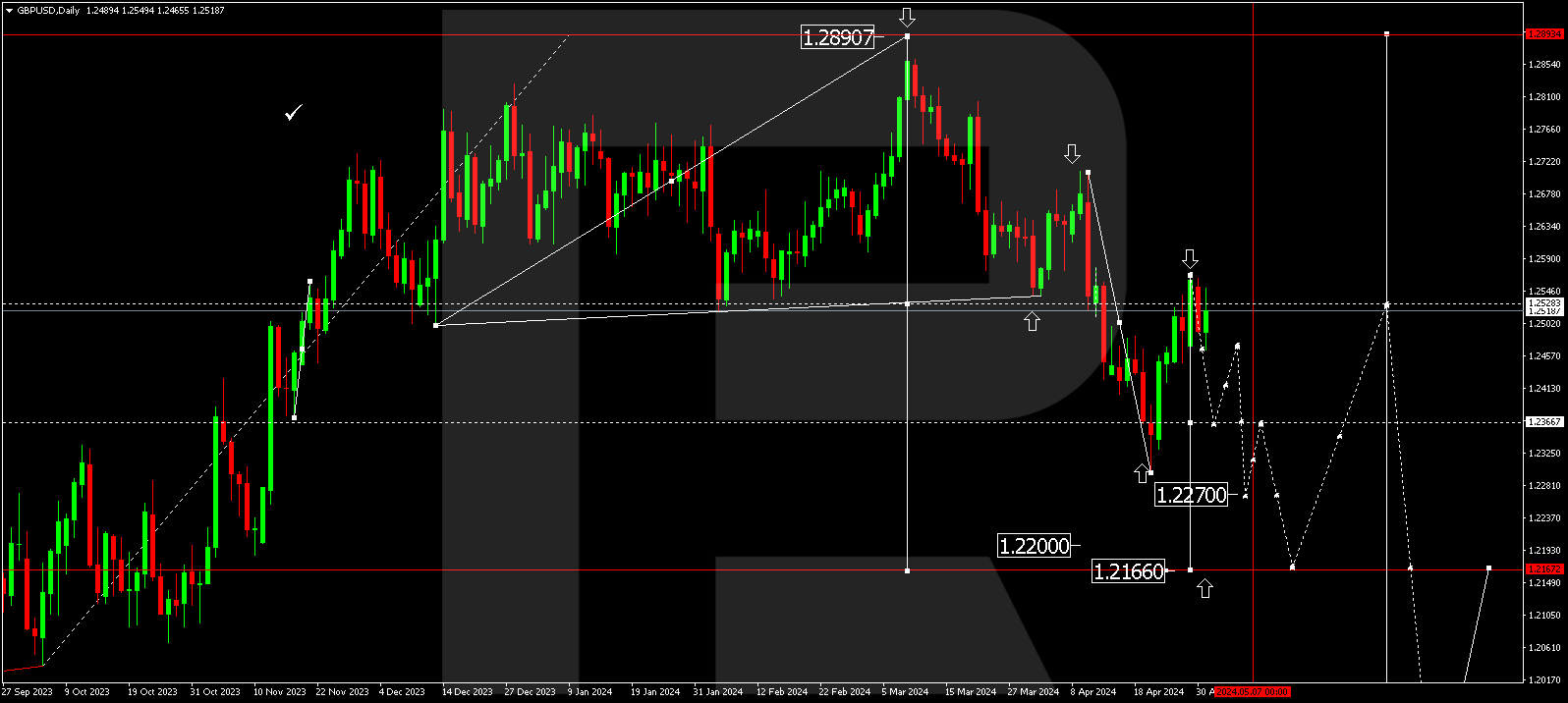

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair continues to develop a consolidation range around the 1.2300 level. At the moment, it could extend upwards to 1.2600. After the level is reached, a structure of decline to 1.2300 could form. Next, a new structure of growth to 1.2777 could follow.

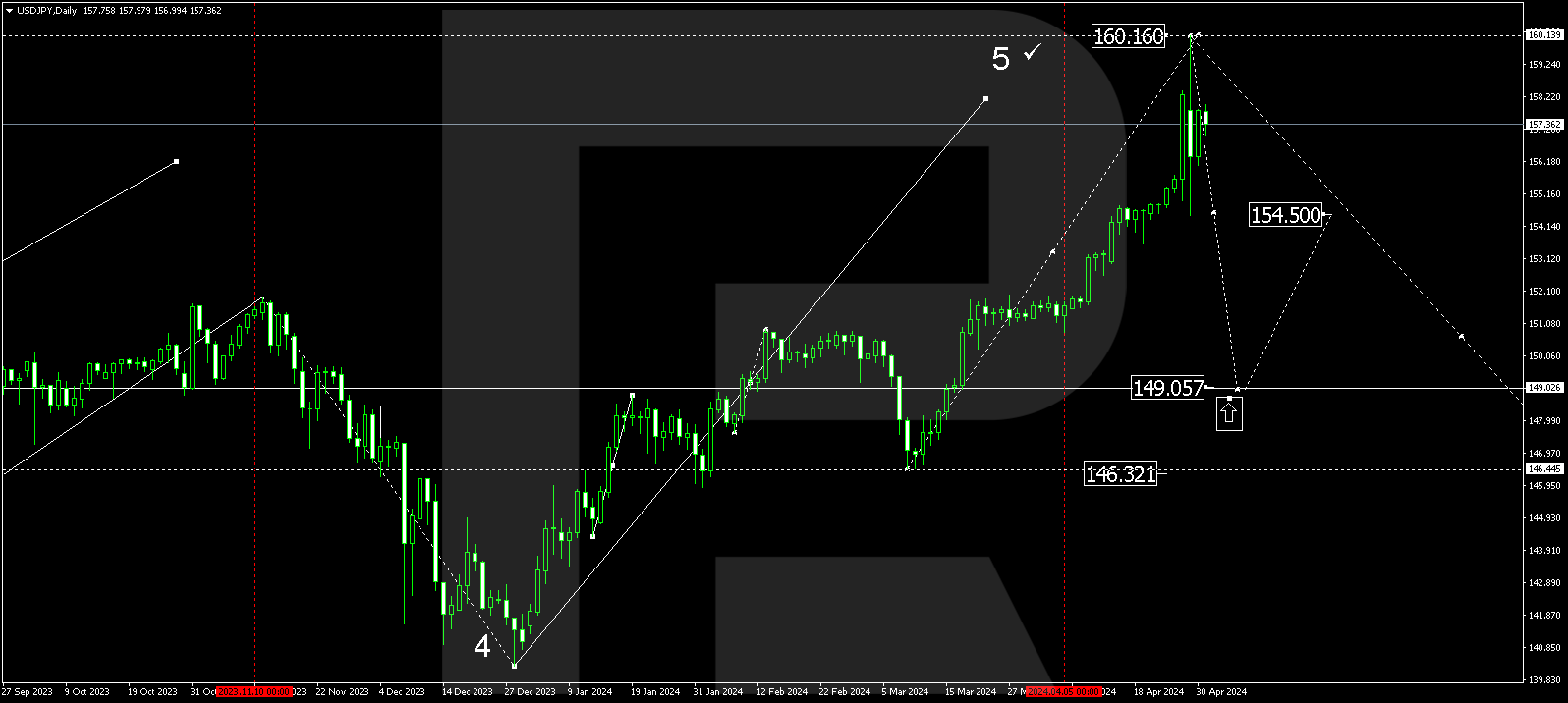

USDJPY, “US Dollar vs Japanese Yen”

The currency pair formed a consolidation range around the 133.55 level, and with exiting upwards today, it worked out a local wave target of 137.70. A new consolidation range could form at the current highs. With an exit from it downwards, a correction to 133.55 could begin (a test from above) followed by growth to 138.77. An exit from the range upwards could open the potential for growth to 138.77, followed by a decline to 133.00.

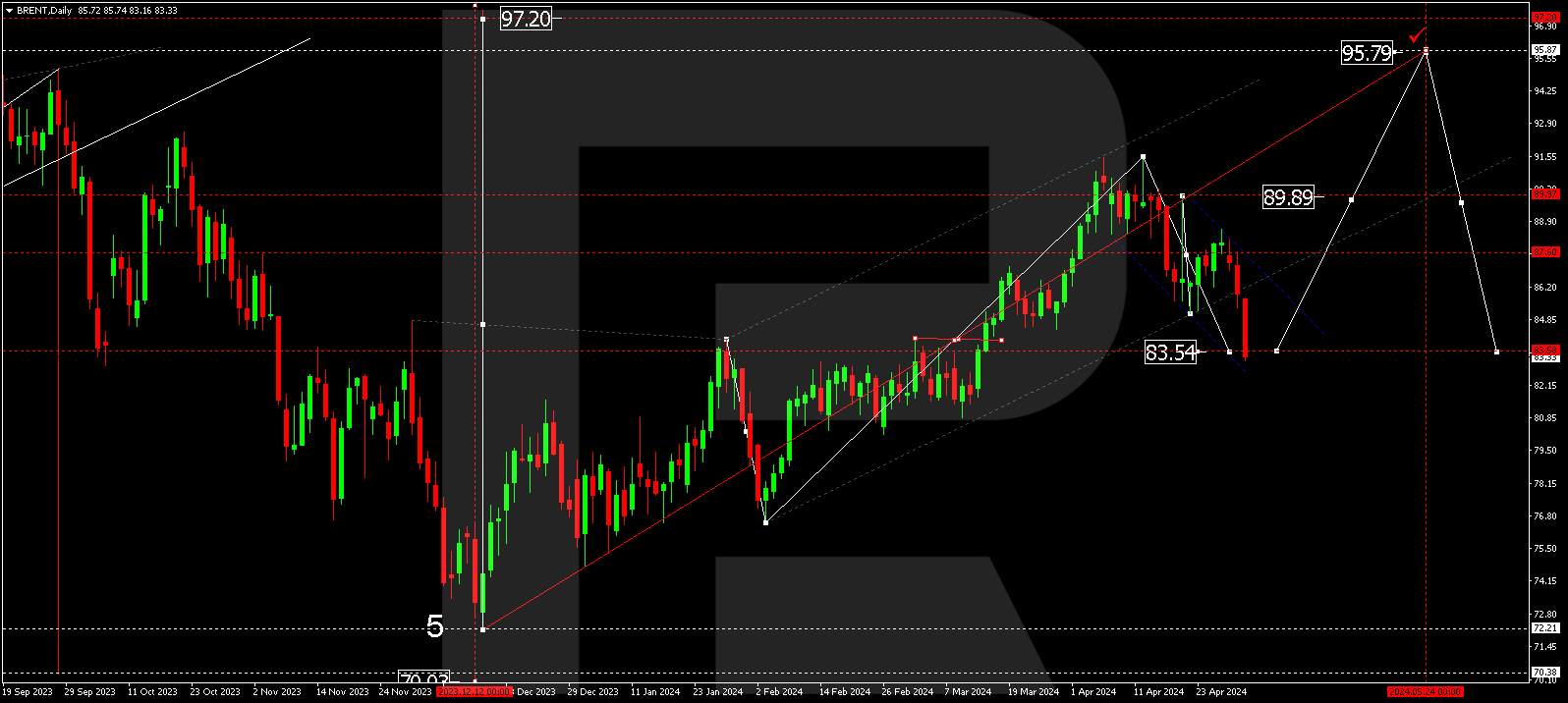

BRENT

Brent has completed a growth impulse to 86.86. At the moment, the market has corrected to 78.47 (test from above). A tie of growth to 82.70 is expected. If this level breaks, the wave could continue to 87.67. And this is only half of the next growth pattern. The trend could practically continue to 97.87. The target is local.

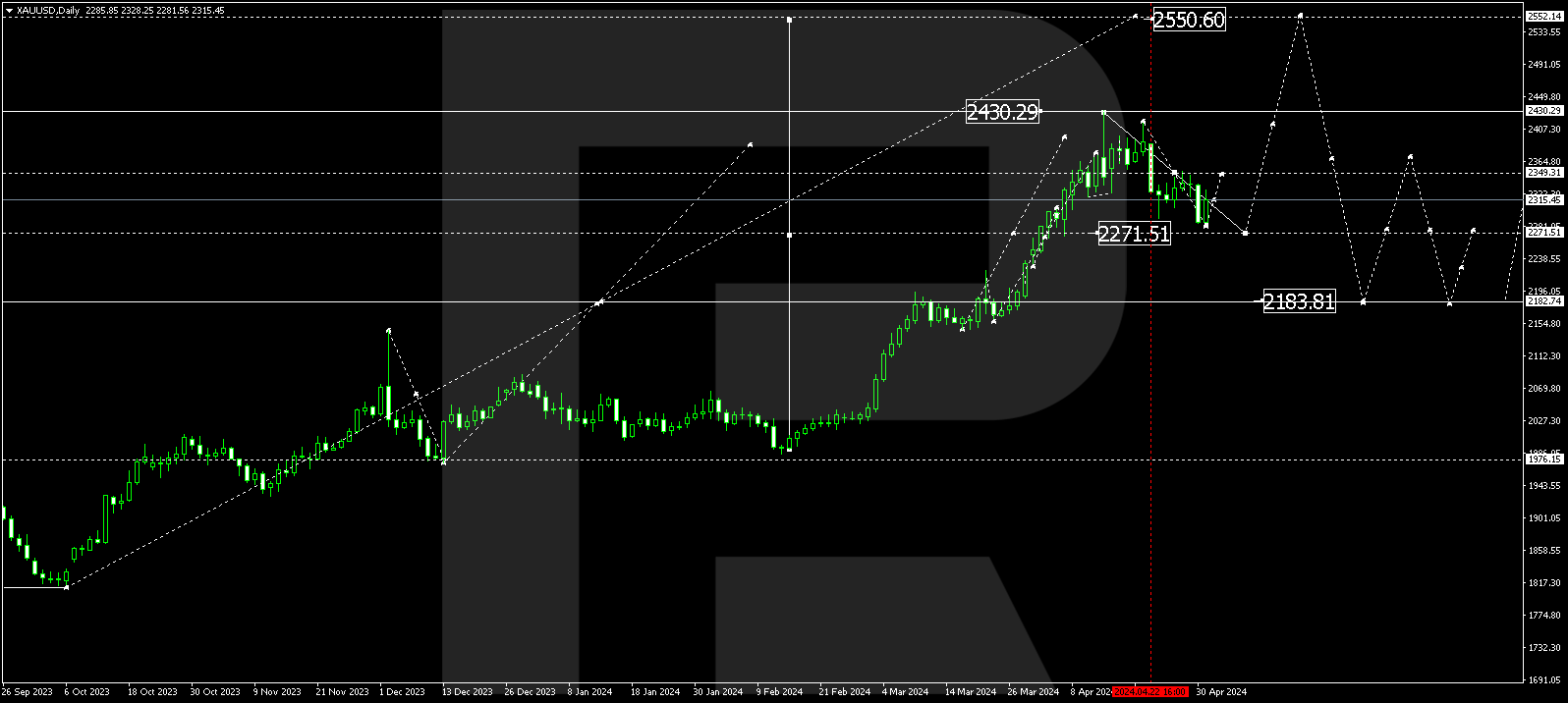

XAUUSD, “Gold vs US Dollar”

Gold continues to develop a consolidation range around the 1980.00 level, momentarily extending to 2047.47 and returning to 1980.00. Today the market is breaking this level down, practically opening the potential for a declining wave to 1914.00. Growth to 1980.00 is expected next (test from below).

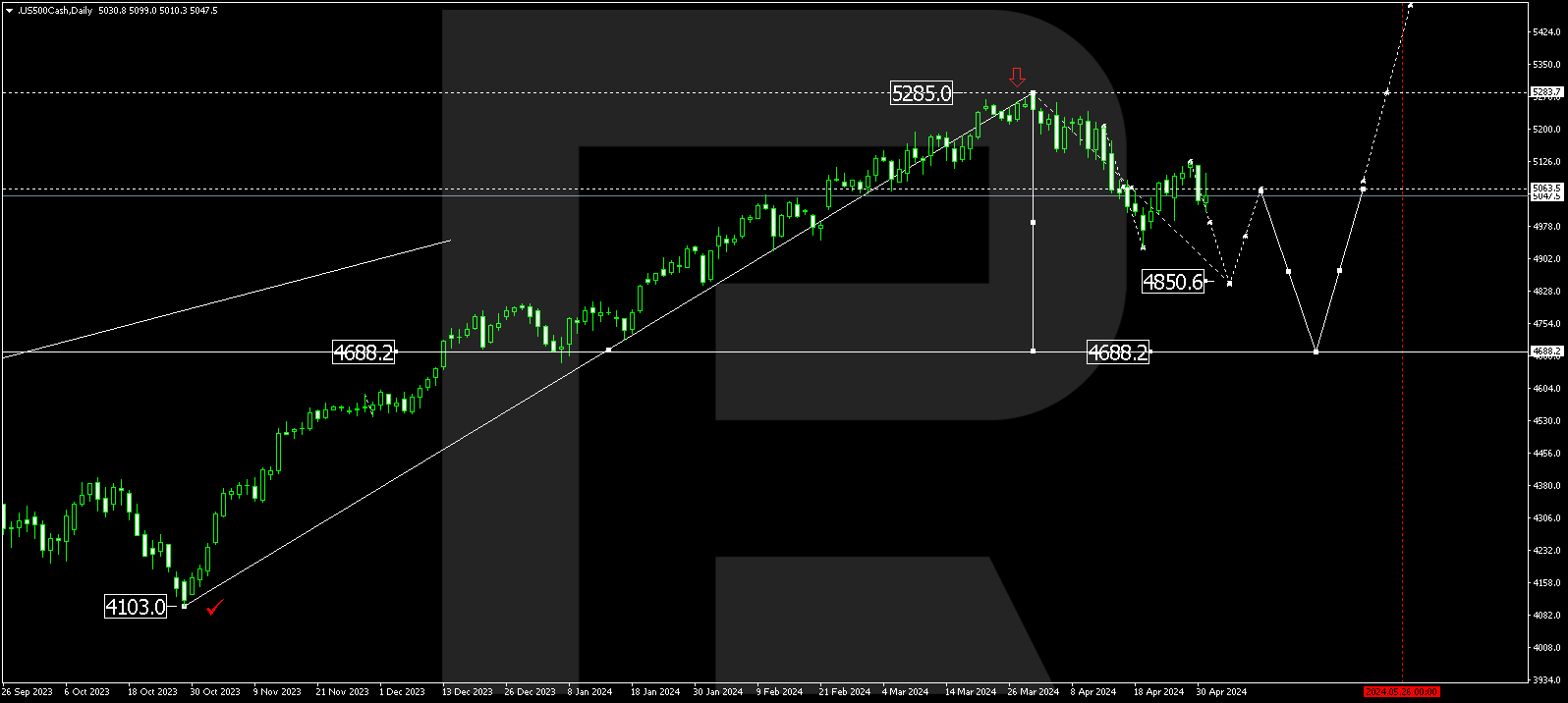

S&P 500

The stock index has formed a consolidation range around the 4050.0 level and with an upside exit has extended it to 4190.0. The local growth structure has been worked out. A wave of decline to 4050.0 could begin next (a test from above), followed by the formation of another new growth structure to 4300.0.