Technical analysis of the currency market on June 15, 2017

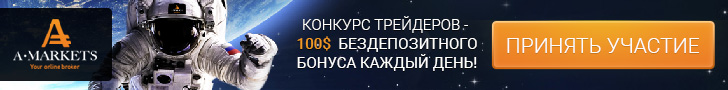

06.15.2017 Technical analysis of the EURUSD : Splash volatility observed twice on the last auction for the pair EURUSD. Frustrated fundamental data on US traders rushed to sell the dollar, because of what the EURUSD exchange rate updated this year to a maximum of 1.1295. The second time - after the Fed meeting, unable to gain a foothold above the resistance 1.1280 the bulls gave the initiative, and the pair fell back to the 12th figure. At today's Asian session there are attempts to WHO update an upward correction, but moving averages Alligator indicate a potential consolidation, MACD volumes again at zero, SMA-line above - there is no clear buy signal. Yesterday load our sell signal with 1.1260, floating profit of which at the moment is 40 points. Cayman indicates that only 17.53% buy EURUSD, the remaining 82.47% are sold, which in turn could trigger the pair in the coming hours.

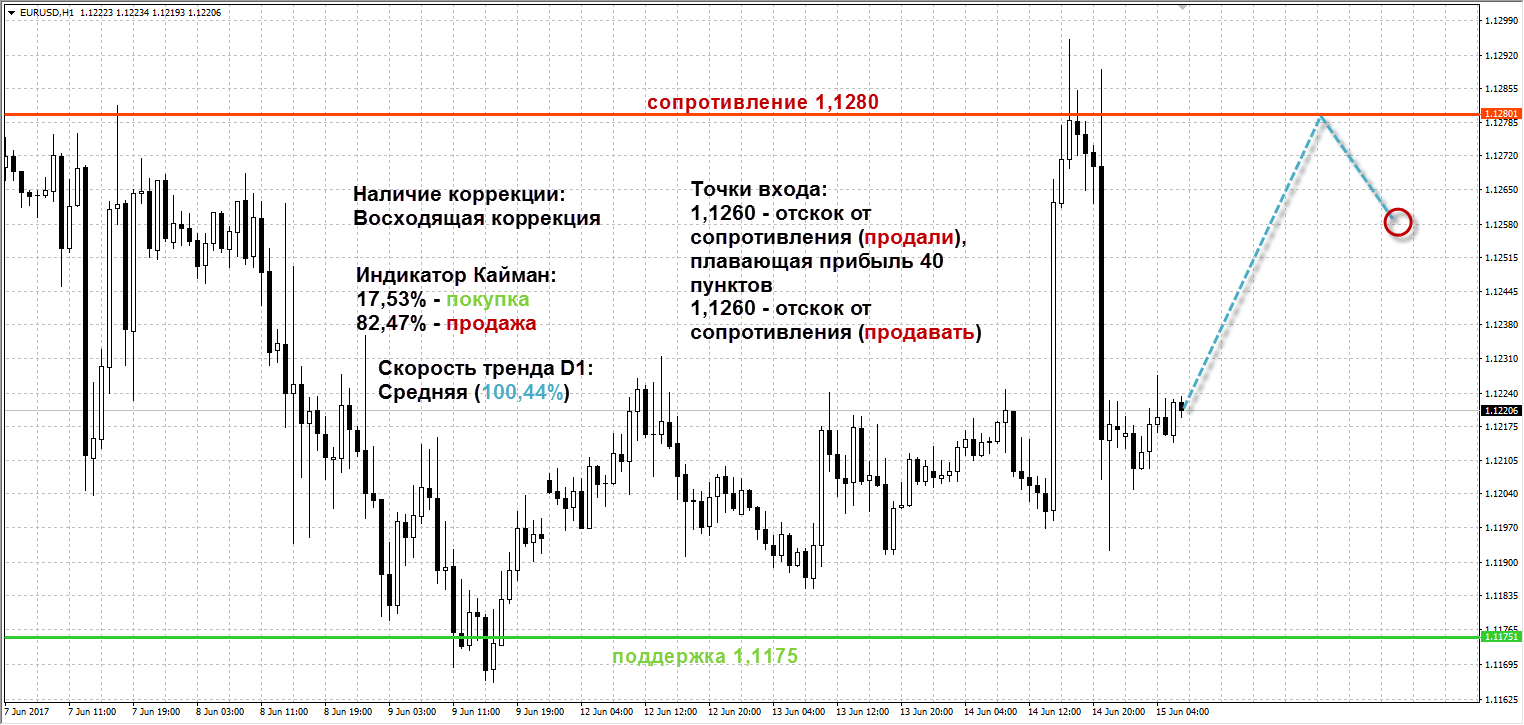

Technical Analysis USDJPY 06.15.2017 : At the end of trading session on Wednesday the USDJPY has lost 48 points to 109.55. The basic movement happened with the release of US players on the market, then the exchange rate sank 136 points, while the bullish momentum at the end of the session was not enough to win back the daily losses. According to previously open the deal to buy with 110.00 at the moment in the loss of 37 points, the growth of 109.30 load another buy signal with 109.50, on which the floating profit of 12 points at the moment. Moving averages do not give explicit Alligator buy signal, indicating a possible consolidation, but the MACD is moving in the negative zone towards zero, SMA-line below - a clear bullish signal. The preponderance of Cayman bulls side (68,30% buy, sell 31.70%), however, now we expect development of ascending correction for the pair.

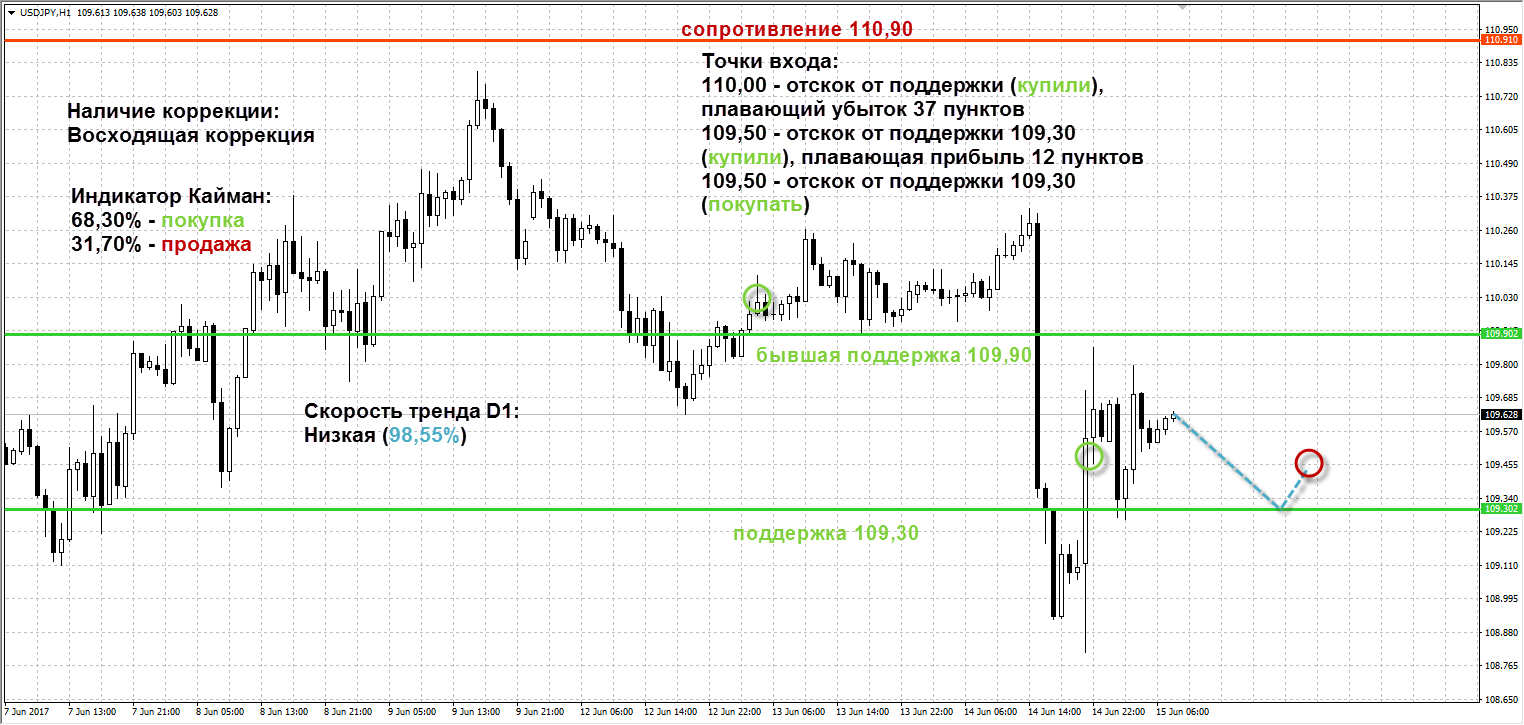

Technical Analysis GBPUSD 15.06.2017: With minimal modifications ended trading Wednesday on the GBPUSD. When volatility in the pair fell 94 points to 2 points on the day to 1.2750. When the pair remained in the channel 1,27-1,2840 and without testing any of its borders. In Asian trading today, there is the lateral dynamics within a narrow range, MACD and moving averages Alligator indicate the probable development of the consolidation. By Cayman buy only 30.15%, the remaining 69.85% sell, and signals to open long position from 1.2625, 1.2725 and 1.2820 long from remain unchanged.

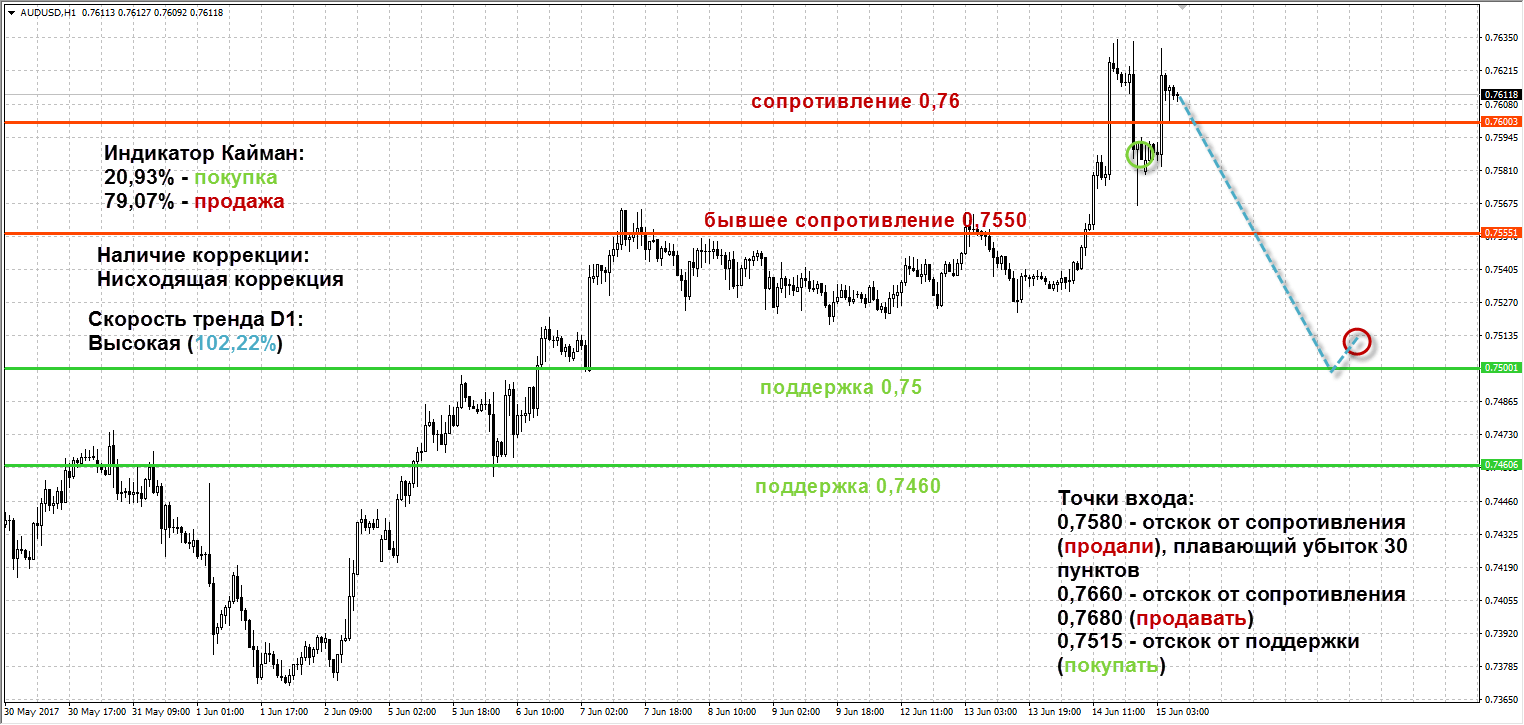

Technical Analysis 06.15.2017 AUDUSD : Australian currency the yen has managed similarly decent rise in price against the background of a weakened dollar day environment. If a trading range of 103 points the pair has risen by 51 points to 0.7585. A sell signal triggered from 0.7580, however, due to the upward correction in today's trading on the transaction floating minus 30 points. MACD indicates bovine deceleration pulse, but the moving averages Alligator still directed upwards. Yesterday the pair has updated the maximum from April 4 to 0.7634, the next resistance level of 0.7680 serves mark. Only 20.93% AUDUSD buying, judging by the Cayman, the remaining 79.07% are sold. Increase the short position is recommended on the rebound from the resistance 0.7680 to 0.7660.

Technical analysts AMarkets currency market

:

Forex Analytics → Forex today. Technical forecasts currency 09/29/2016: Exchange rates EUR / USD, GBP / USD, USD / CHF, USD / JPY, AUD / USD, USD / RUB, GOLD, oil

Forex Analytics → Forex rate forecast USD / JPY 16.09.2016

Форекс прогноз → Форекс на сегодня. Технические прогнозы валют 30.09.2016: Курсы валют EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/RUB, GOLD, нефть

Forex Analytics → Forex today. Technical forecasts currency 09/30/2016: Exchange rates EUR / USD, GBP / USD, USD / CHF, USD / JPY, AUD / USD, USD / RUB, GOLD, oil