The euro continues to decline; the market has come to terms with high pressure

The EURUSD pair remains under pressure due to problems with French politics and weak statistics.

The euro continues to decline; the market has come to terms with high pressure

EURUSD starts the week relatively low and balances around the 1.0693 mark today.

Earlier, statistics supported the US currency. Business activity in the US reached a 26-month high in June amid a rebound in employment. At the same time, price pressures are decreasing, leading to the conclusion that the recent slowdown in inflation will become sustainable.

The political imbalance in Europe remains in force, primarily in France. Ultimately, this can undermine the trust of both businesses and consumers.

Fresh data showed that activity in France's services sector contracted in June. This indicator also has slowed down in Germany. The foreign exchange market seems to remain under pressure and will not dare take any crucial steps before the French elections in late June or early July. This factor remains at the centre of attention of the European currency market.

The new week for EURUSD will be neutral regarding providing critical macroeconomic statistics. Everything has been shifted to Thursday and Friday when reports on the business climate and economic expectations indices for the eurozone will be released, as well as statistical data on orders for durable goods, GDP and Core PCE in the United States.

EURUSD technical analysis

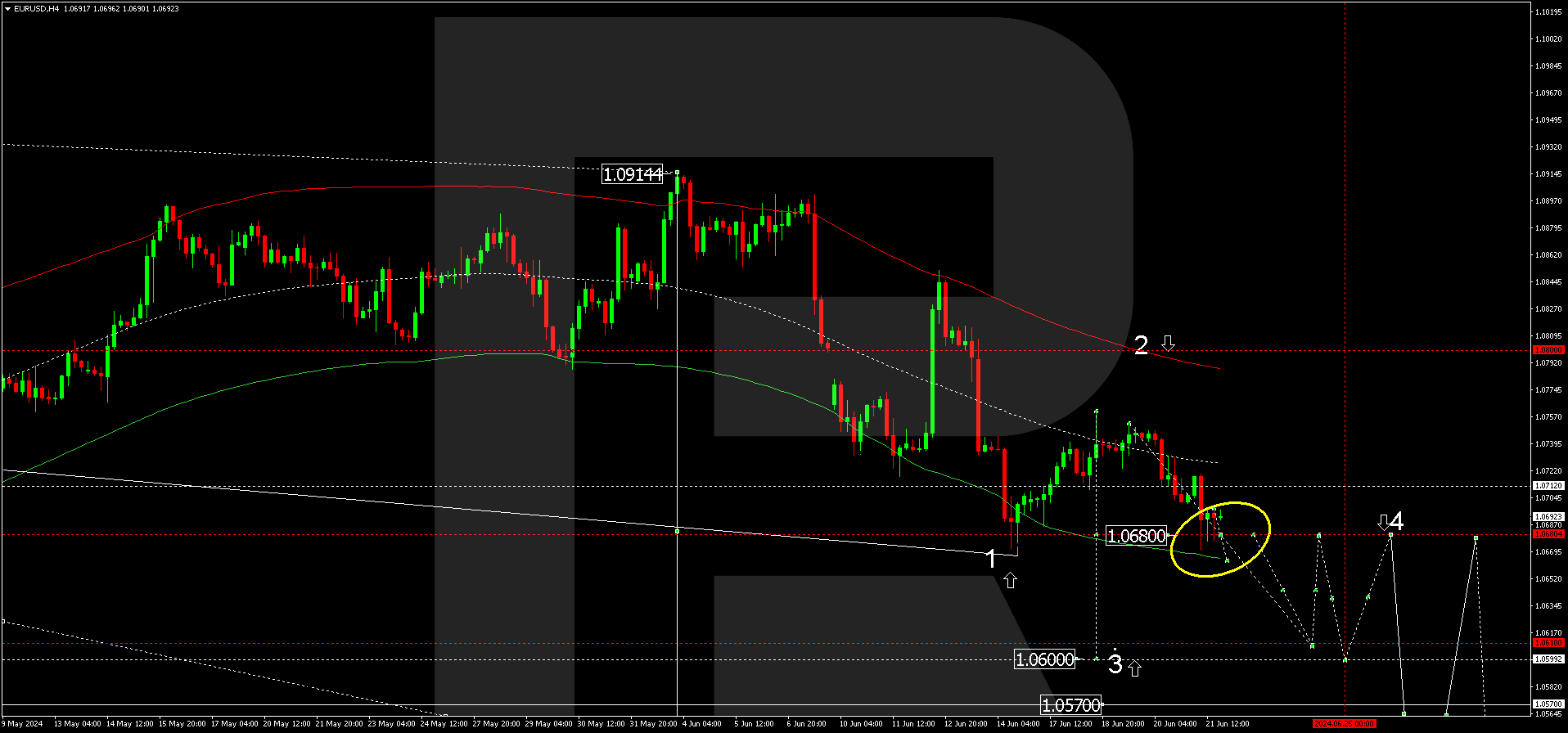

On the EURUSD H4 chart, a wave of decline towards 1.0671 appeared, and the formation of a compact consolidation range around 1.0680 is expected. This level is critical for forecasting the EURUSD exchange rate on 24 June 2024.

With the exit from the range downwards, quotes could decrease to 1.0610 and further increase to 1.0680 (testing from below). After attaining this level, the price could start a new wave of decline towards 1.0600. This trend may continue towards a local calculated target of 1.0570.

EURUSD technical analysis 24.06.2024

This scenario is technically confirmed by the Elliott wave structure and wave matrix with a pivot point at 1.0680. This level is considered crucial for a downward wave in the EURUSD rate. The market has received a downward rebound from the Envelope's centre.

Practically, a further decline to the Envelope's lower boundary could follow. After the price tests this boundary, a growth wave is expected to start, aiming for the Envelope's upper boundary.

Summary

Technical analysis of EURUSD suggests a further decline in quotes towards the targets of 1.0600 and 1.0570. Collectively, the news factor may contribute to this scenario.