Gold continues to form a pullback, and prices may fall to 3,338 USD as part of a corrective wave. Discover more in our analysis for 5 June 2025.

XAUUSD forecast: key trading points

- US initial jobless claims: previously at 240 thousand, projected at 236 thousand

- Current trend: moving upwards

- XAUUSD forecast for 5 June 2025: 3,338 and 3,410

Fundamental analysis

The XAUUSD outlook for 5 June 2025 considers gold maintaining resilience, trading near 3,370 USD per troy ounce. Investors remain cautious ahead of the US Non-Farm Payrolls report (NFP), which could shape market direction.

Gold prices are supported by weak US economic data, including a decline in the services PMI to 49.9 and ADP employment growth of just 37 thousand. These figures reinforce expectations of a Federal Reserve rate cut.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment.

The previous reading stood at 240 thousand, with the XAUUSD price forecast suggesting a slight drop to 236 thousand. Although the change is marginal, if the actual figure matches or exceeds expectations, it could affect XAUUSD quotes.

XAUUSD technical analysis

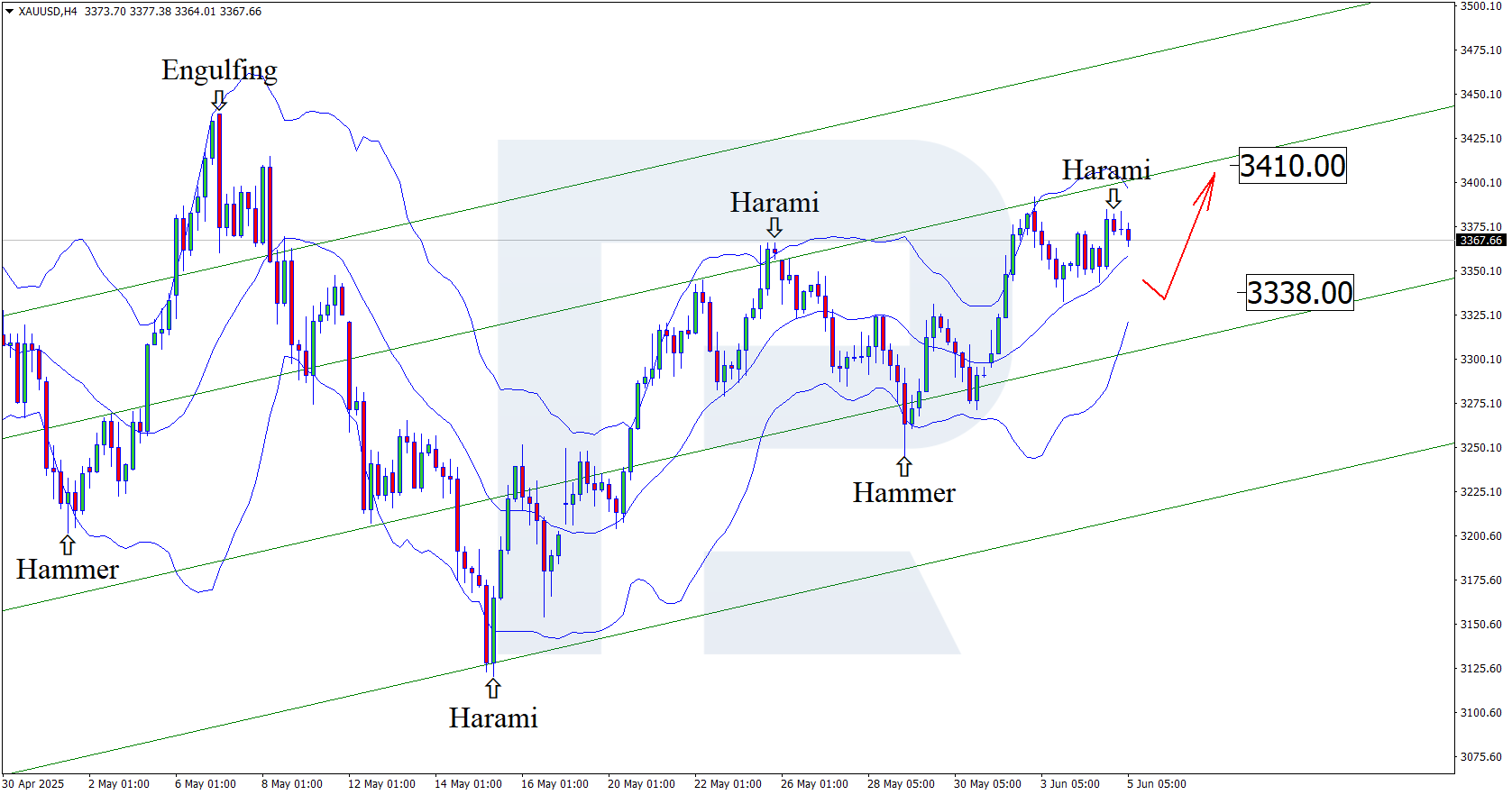

On the H4 chart, XAUUSD prices formed a Harami reversal pattern near the upper Bollinger Band. Currently, quotes are developing a corrective wave following this signal. The uptrend will likely continue as prices remain within an ascending channel, with a possible target for the correction at 3,338 USD.

However, today’s XAUUSD technical analysis also suggests an alternative scenario, where prices may climb directly to 3,410 USD without pulling back to the support level.

With the upward momentum remaining intact, XAUUSD prices could potentially reach a new high and head towards 3,900 USD in the near term.

Summary

A decline in the US initial jobless claims could bolster the USD. Technical analysis suggests XAUUSD may correct towards the 3,338 USD support level before resuming its upward move.