The USDJPY pair resumed growth. The market evaluates the possibility of a foreign exchange intervention by the Bank of Japan. Find out more in our analysis for 20 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair resumed its ascent

- Investors anticipate interventions by the Japanese authorities around the 160 JPY per USD level

- USDJPY forecast for 20 November 2024: 156.30

Fundamental analysis

The USDJPY rate rose to 155.08 on Wednesday.

The yen’s recent gains were offset by comments from Japanese officials, specifically their remarks that any future interest rate hikes would be gradual, depending largely on how economic conditions evolve. Notably, no timeline was provided.

Investors now view the 160 JPY per USD level as a trigger for potential financial interventions.

Domestic data showed that Japan’s exports rose 3.1% in October, following a 1.7% decline in September. Imports grew by 0.4%, contrary to expectations of a 0.4% contraction.

The USDJPY forecast appears cautious so far.

USDJPY technical analysis

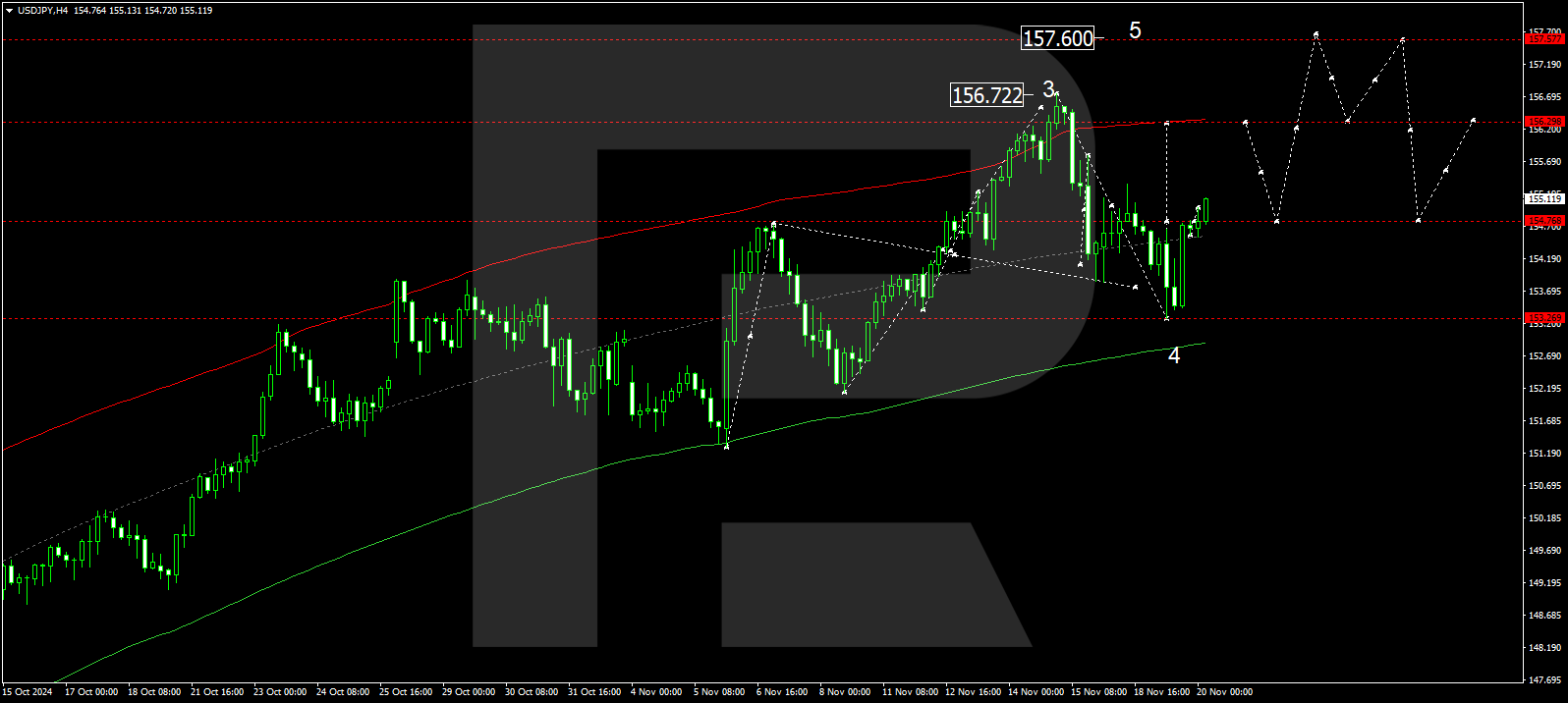

The USDJPY H4 chart shows that the market has completed a corrective wave, reaching 153.30. Today, 20 November 2024, it rose to 154.77, forming a consolidation range around this level. A breakout above the range could lead to the growth wave continuing towards 156.30 and potentially reaching 157.60. Conversely, a downward breakout might lead to another corrective movement towards 153.00 before resuming growth to 157.60.

The Elliott Wave structure and growth wave matrix, with a pivot point at 153.00, technically support this scenario for the USDJPY rate. The market is forming a consolidation range around the central line of a price envelope. A downward breakout may extend the correction to the envelope’s lower boundary at 153.00. Conversely, an upward breakout could drive a growth wave targeting the envelope’s upper boundary at 157.60.

Summary

The USDJPY pair rises while Japanese authorities evaluate the likelihood of further interest rate hikes. Technical indicators for today’s USDJPY forecast suggest that the growth wave could continue towards the 156.30 level.