The USDJPY rate is correcting on Thursday following a significant decline amid the BoJ’s decision to raise the interest rate. Find out more in our analysis dated 1 August 2024.

USDJPY trading key points

- The decision to hike the rate was made despite differing opinions and disappointing consumption data

- Weak indicators will not prevent the BoJ from raising interest rates until they reach a neutral level

- Investors expect one more interest rate hike this year

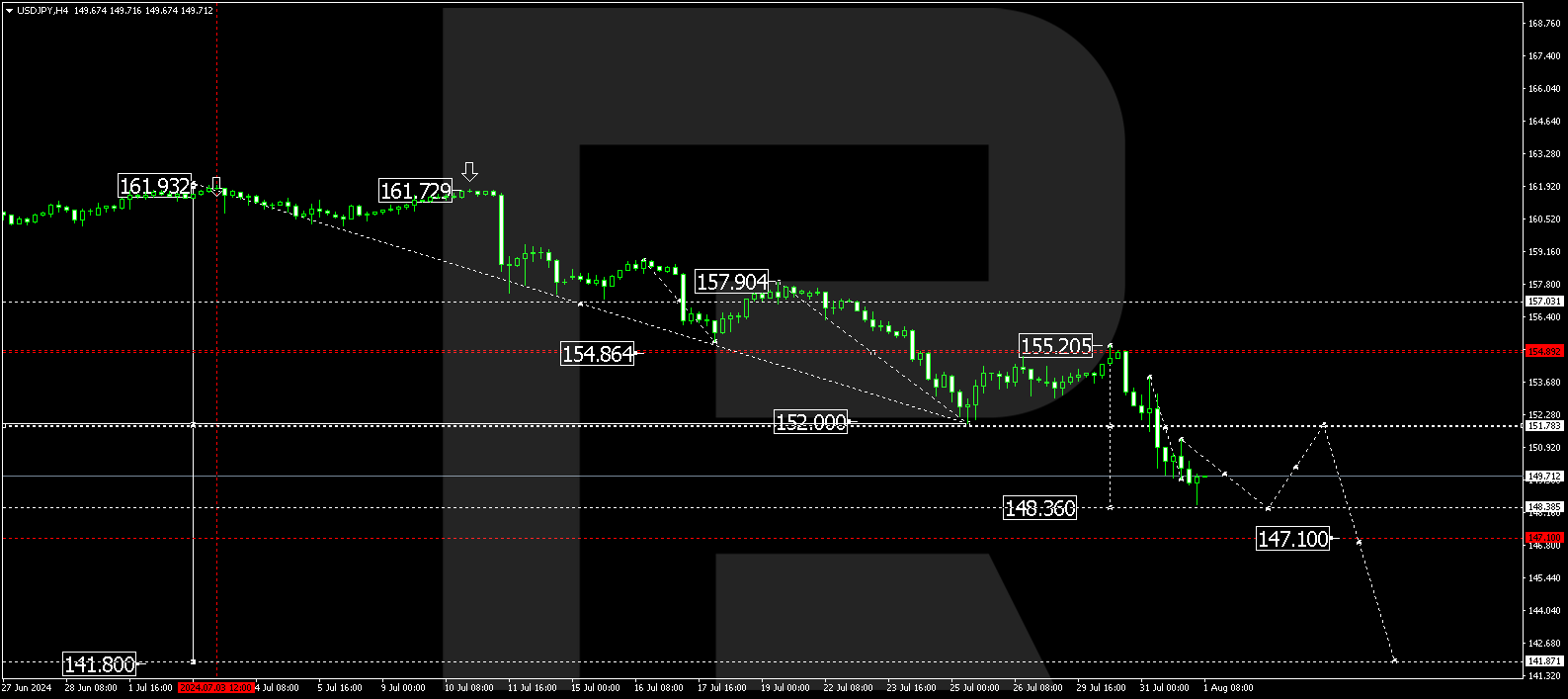

- USDJPY forecast for 1 August 2024: 148.36 and 147.10

Fundamental analysis

The Bank of Japan increased the key interest rate to 0.25%, strengthening the Japanese yen. This is the most significant tightening of monetary policy since 2008, pushing the USDJPY rate down to a four-month low.

Despite sluggish consumer demand and disagreements among Policy Board members, the Bank of Japan proceeded with this crucial decision. The BoJ’s governor, Kazuo Ueda, expressed concerns about the risks associated with a weak yen and a potential rise in inflation.

The BoJ also stated that if economic activity and price forecasts materialise, it will continue to raise the interest rate and adjust monetary policy until the economy and inflation align with its expectations. Markets anticipate two more interest rate hikes in the current fiscal year ending in March 2025, with the next rate increase expected in December. This may lead to further declines in the USDJPY pair as part of the forecast.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a decline wave, reaching 148.50. Today, 1 August 2024, the price is expected to rise to 151.78 (testing from below). After reaching this level, the USDJPY rate could fall to 148.36. Subsequently, a correction towards 151.78 might start, followed by a decline to 147.10.

Summary

The BoJ’s decision to raise the interest rate led to the yen strengthening against the US dollar, driving it to a four-month high. Markets are anticipating two more interest rate hikes by March 2025, which might exert pressure on the USDJPY rate in the mid-term. Technical indicators for today’s USDJPY forecast suggest that a decline wave could continue towards the 148.36 and 147.10 levels.