The US 30 stock index hit a new all-time high as part of a strong uptrend. A correction is expected next week, following which the index may again reach another peak.

US 30 trading key points

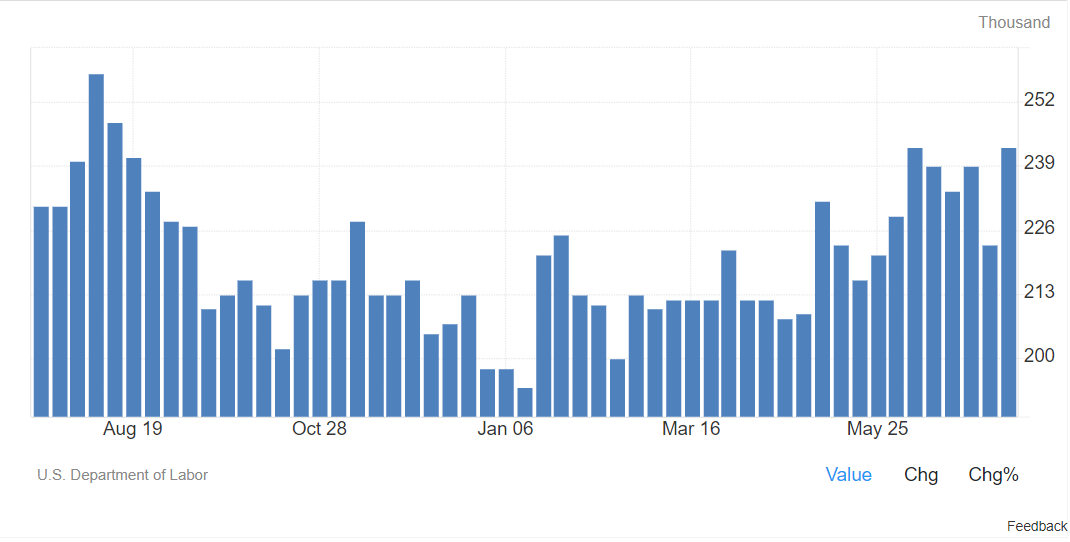

- Recent data: initial jobless claims reached 243,000

- Economic indicators: the US employment market shows increasing weakness, with another rise in unemployment likely in July

- Market impact: negative employment market statistics will serve as an argument for the US Federal Reserve to lower the key rate

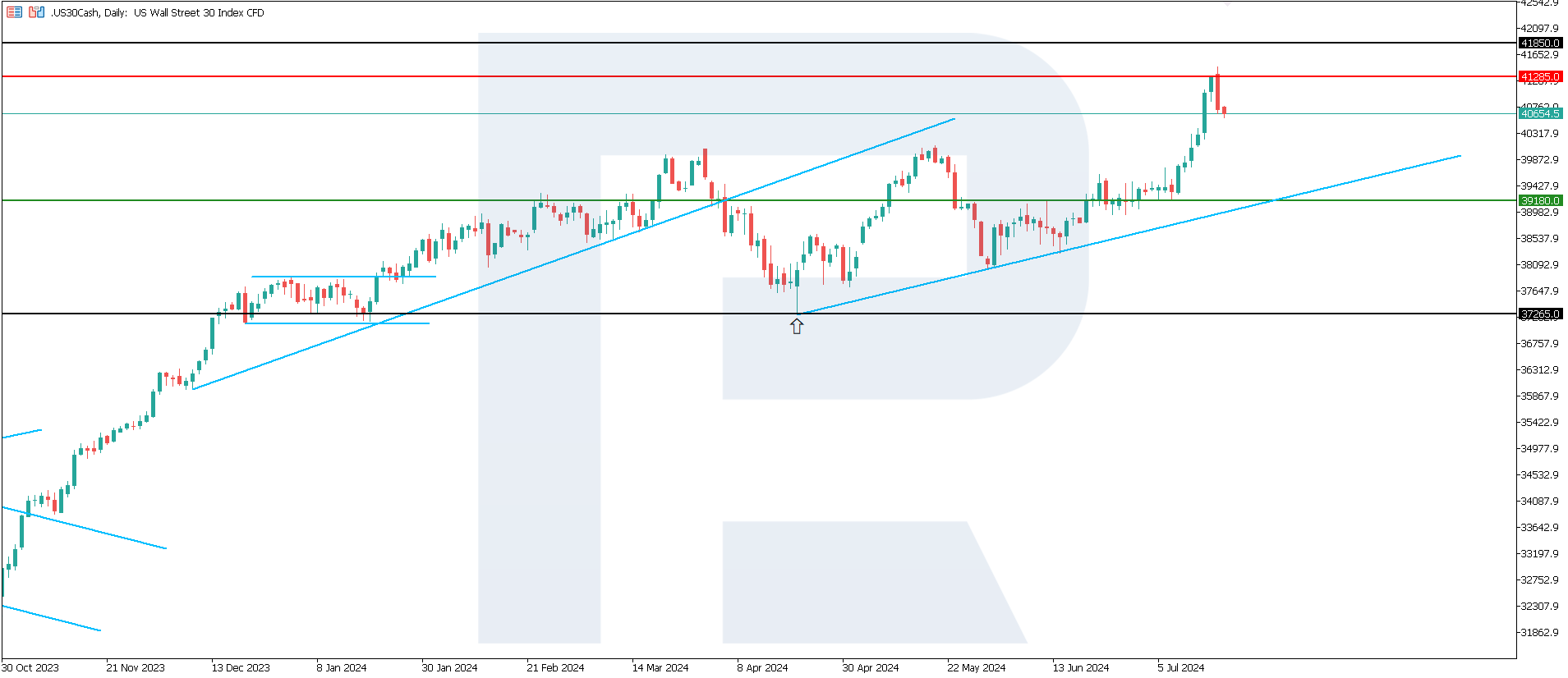

- Resistance: 41,285.0, Support: 39,180.0

- US 30 price target: 41,850.0

Fundamental analysis

Initial jobless claims rose by 21,000 to 243,000 over the last week, reported the US Department of Labor on Thursday, while economists expected 230,000 claims. Their total number increased by 20,000 to 1.867 million.

Source: https://tradingeconomics.com/united-states/jobless-claims

US Federal Reserve officials are increasingly confident that price stability is not far off. Over the past weeks, they have laid a foundation for the forthcoming step in their speeches. Jerome Powell will likely state the intention to reduce the key rate more clearly following a monetary policy meeting on 30-31 July.

US 30 technical analysis

The US 30 stock index has confidently broken above the 39,615.0 resistance level. With the uptrend persisting, a current price decline will likely be a temporary correction. The US 30 index will reach a new all-time high next week.

Key US 30 levels to watch next week include:

- Resistance level: 41,285.0 – if the price breaks above this level, it could rise to 41,850.0

- Support level: 39,180.0 – if the price breaks below this support level, the decline target will be 37,265.0

Summary

The US employment market continues to show weakness. The Federal Reserve’s leadership is increasingly confident that inflation will reach the intended 2.0% target. This increases the likelihood that a September key rate cut will be announced in late July. The current growth target for the US 30 stock index could be 41,850.0.