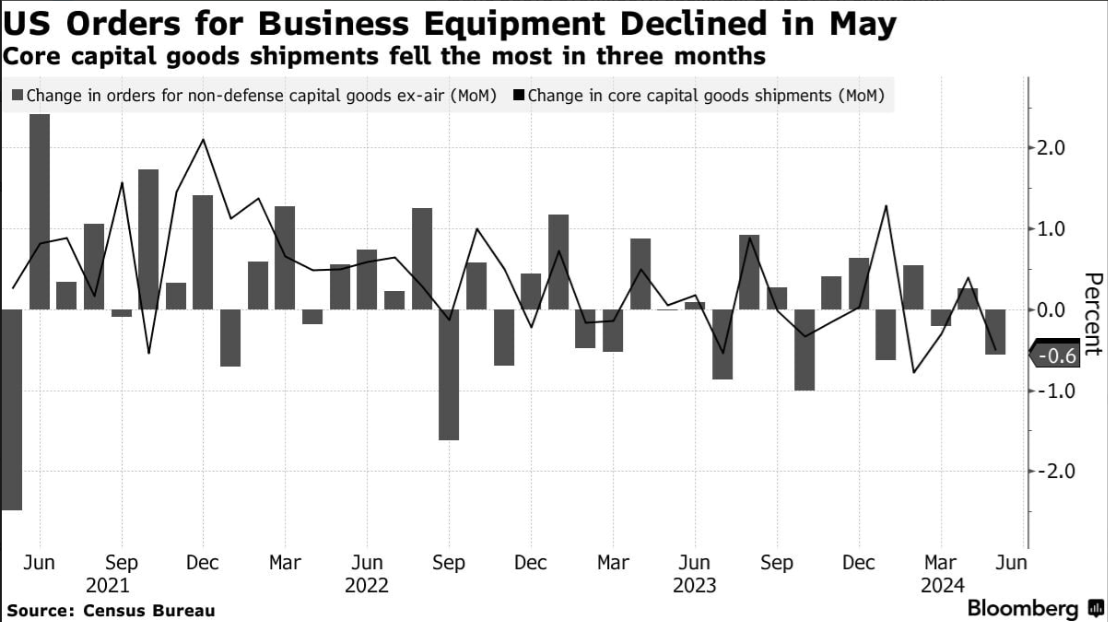

The volume of orders for business equipment at US companies unexpectedly decreased in May, indicating that businesses remain cautious about investments amid rising borrowing costs and shrinking demand.

The decline in equipment orders reflects businesses’ uncertainty about further economic growth

The value of core capital goods orders (investment in equipment excluding aircraft and military hardware) decreased by 0.6% last month, marking this year’s most significant decline. While many companies still seek long-term investments, high borrowing costs and demand challenges force them to scale back their expansion plans.

Orders for US Business Equipment 28.06.2024

Source: https:/bloomberg.com/news/articles/2024-06-27/orders-for-us-business-equipment-match-biggest-drop-this-year

This indicates that factories may encounter production ramp-up challenges in the coming months. Meanwhile, the US manufacturing industry also faces the challenge associated with the strengthening US dollar, which might lead to a decline in export demand. This year, the national currency strengthened on expectations of the Federal Reserve maintaining elevated interest rates for an extended period.

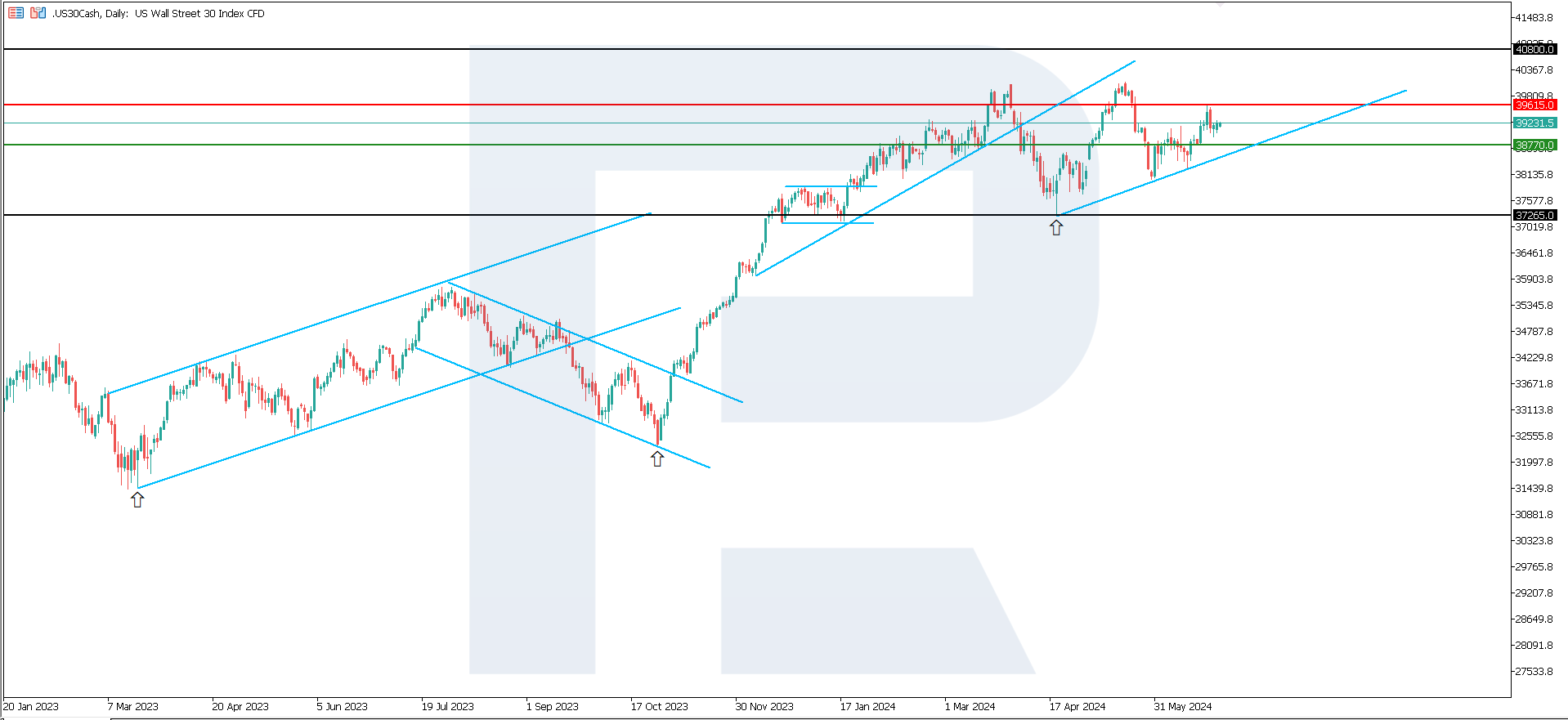

US 30 technical analysis

The US 30 stock index remains in an uptrend that began in late April 2024 and is poised to reach a new high. Still, it is held back by non-technology companies included in the index, which is why investor interest in the AI sector barely impacts the US 30 growth dynamics.

US 30 index (D1) 28.06.2024

A resistance level has formed at 39615.0, with support at 38770.0. The uptrend will likely continue. If the resistance level breaks, the target could be the 40800.0 mark. Alternatively, the price might break below the support level, aiming for 37265.0.

Summary

Core capital goods orders by US businesses decreased by 0.6% in May 2024, indicating that high borrowing costs negatively impact the long-term plans of US manufacturers. However, the US 30 stock index remains in an uptrend with a target at 40800.0, representing a new all-time high.